According to a report from Pacific Securities, the share of meat snacks in the overall snack market in China increased from 13.5% to 21.5% in 2020, marking a huge jump 10% in 2017. The surge in meat snack consumption in China is partly attributable to a change in consumer eating habits during the COVID-19 pandemic. Due to the sanitary measures in place, a lot of young consumers found it more convenient to eat hardier snacks and less frequent meals. Clearly, the popularity of meat snacks in China is rising, but what is behind this trend?

Compared to other types of snacks, meat snacks provide more energy and nutrition, making them a more satisfying meal-replacement than carb-based snacks. Although now that the the sanitary measures are largely relaxed the new snacking habits have formed. Therefore, the popularity of meat snacks in China is likely to persist, but can be potentially disrupted by other trends such as vegetarianism.

Nuts or meat: favorite categories of snacks in China

During 2020 Q1, nuts, pastries, and biscuits contributed to 5.0, 3.3, and 3.2 billion RMB sales respectively on Taobao and Tmall. Meat-based snacks came as the fourth most sold snacks on the platforms, generating 2.5 billion RMB sales. Although other types of snacks are more popular on offline channels, the overall popularity of meat snacks in China can be higher due to the prevalence of offline sales.

Baidu’s search volume data shows the consumer demand for nuts is stronger in the winter, while the search volume of meat-based snacks such as dried pork and duck tongue are less impacted by seasons. The seasonal fluctuation for nuts is likely the result of people associating nuts, as a “hot food” with cold weather. Compared to nuts which can be preserved longer, the increase of meat snack sales during the shopping festivals such as 11/11 and 12/12 is not as visible. In addition, the Chinese custom of having nuts during the spring festival season also contributes to the increasing demand in the winter.

Duck is Chinese consumers’ favorite meat snack

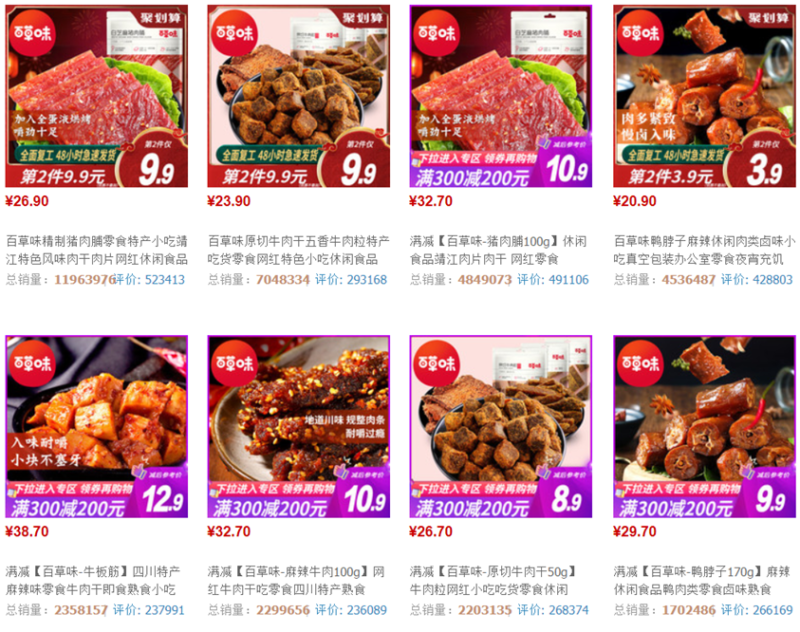

Source: Bestore website, a variety of meat snacks in China, most common are jerky and preserved meat

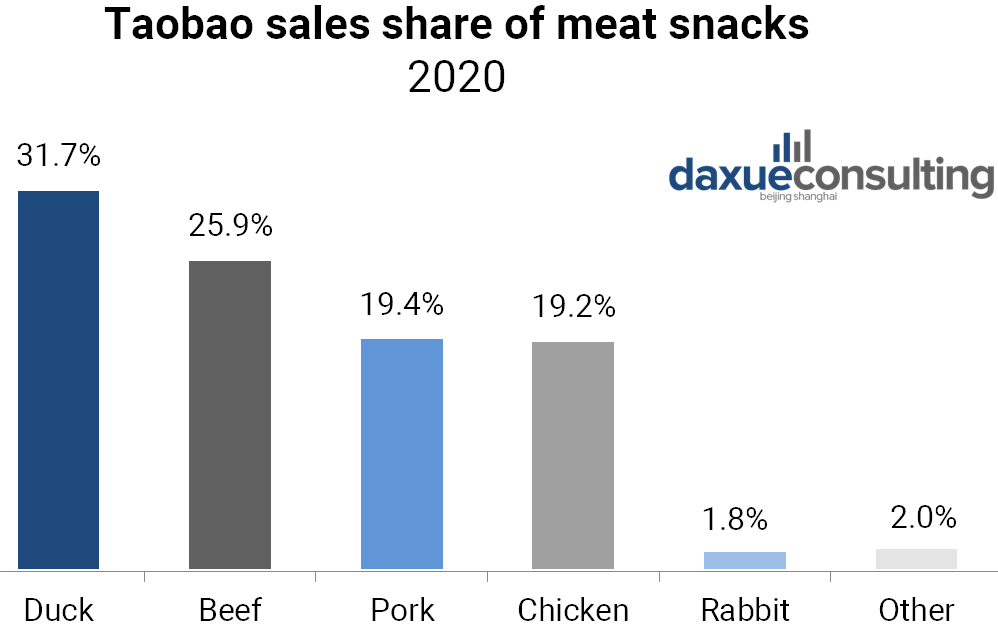

Based on e-commerce data, duck is the clear winner of the Chinese meat snack market, because of the popularity of braised meat in China. On Taobao and Tmall, duck-based meat snacks contributed to 31.7% percent of the sales value in 2020. Following duck, beef –mainly in the form of jerky – came in second at 25.9%. However, in the overall Chinese meat snack market, Beef is possibly less popular than what the data represents, because of the high percentage of offline purchases for braised food, which are usually duck and chicken. Pork and chicken each contributes to 19.4% and 19.3% of online sales in 2020.

Data source: Taoshuju (2020), designed by Daxue, China meat snack market share by meat type

Portrait of meat snack consumers in China

Region

According to Baidu Index, most searches for meat-based snacks are by people in non-first-tiered cities, especially those in the Southern and Eastern China. Searches for “dried pork” are highest among users in Guangdong province, with Jiangsu, Shandong, Zhejiang and Henan also in the top 5. This is likely due to the emerging trend of healthy diet among the urban population, especially those in the most developed cities.

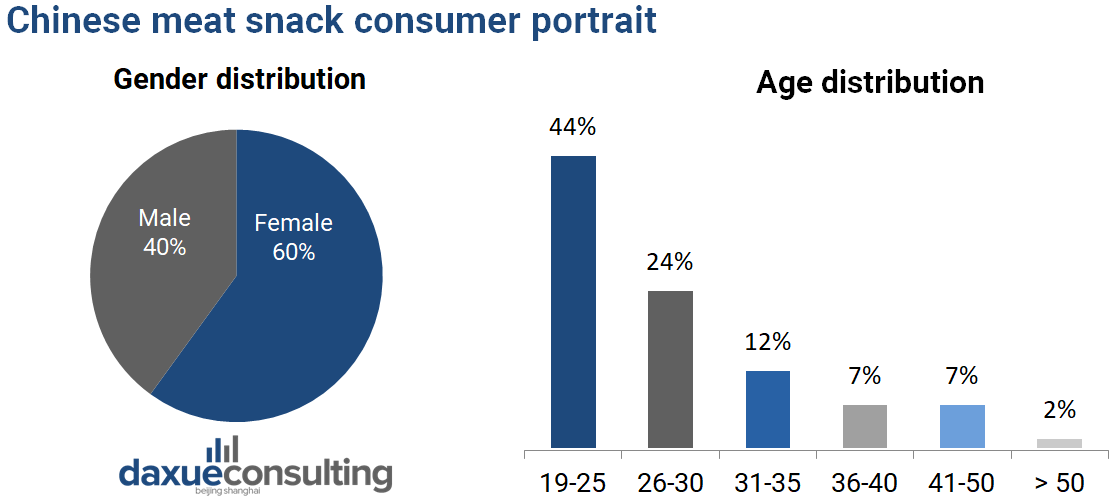

Age and gender

More online searches for meat-based snacks are from women, contributing to 60% of the search volume on Baidu. In terms of age groups, most of search volume comes from younger generations, such as those between 18 and 30 years old; the largest share, 44% the total search volume comes from 18–25-year-olds.

Considering the trends of healthy diets and light diets that are especially visible among female consumers, brands should consider the transformation of product types and brand images to appeal more to those demographics. For example, one of the major players in the market, Bestore (良品铺子) has launched its fitness light snack sub-brand — “Bestore Flying” series products, marketed towards 18-35 year old women, according to their annual report. Additionally, the popularization of sports and fitness has increased demand for more nutritious food.

Data source: Baidu index, designed by daxue consulting, Chinese meat snack consumer portrait

Late night snacks: the consumption pattern of meat snacks in China

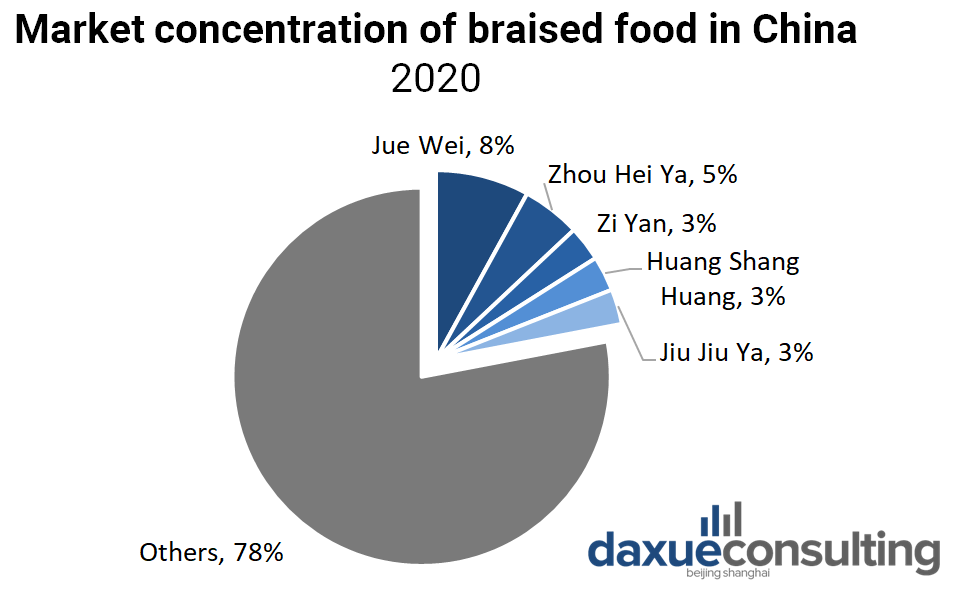

Among different types of meat snacks in China, braised (卤制) meat, such as duck tongues, duck necks, and pork intestines, is the most popular category. According to a survey conducted by MobTech, the majority of purchases of braised meat snacks in China are offline due to the short preservation period. 58% of respondents indicate that their most frequent reason of purchases is impulsive buying, as 41% of the purchases are after 7pm. Only 26% indicated that they purchase braised meat regularly.

According to a report by MobTech, the market segment of braised meat is relatively decentralized. Small individual shops have most of the market share. The five biggest brands that specialize in the category – Jue Wei, Zhou Hei Ya, Zi Yan, Huang Shang Huang, and Jiu Jiu Ya – only have 21% market share. However, a greater degree of industrial integration is expected in the following years alongside the trend of consumption upgrade which causes consumers to attach more value to quality.

Data source: MobTech, designed by daxue consulting, Market Concentration of braised food in China

Domestic brands know Chinese consumers’ tastes best

Domestic brands dominate China’s meat snack market. For the online channels, Chinese brands continuously dominate the top 10 best-selling snacks on Taobao and Tmall. This is mainly because of the dominance of Chinese local snacks in the category. People have a stronger preference of local snacks, such as duck necks and duck tongues over foreign snacks like western-styled beef jerky. In addition, it is uncommon for foreign brands to create these types of snacks because people usually have already established their preferred brands that best suits their taste.

Bestore (良品铺子) and Be & Cheery (百草味) are the leading snack food brands that focus on online channels with significant presence in the meat snacks segment in China.

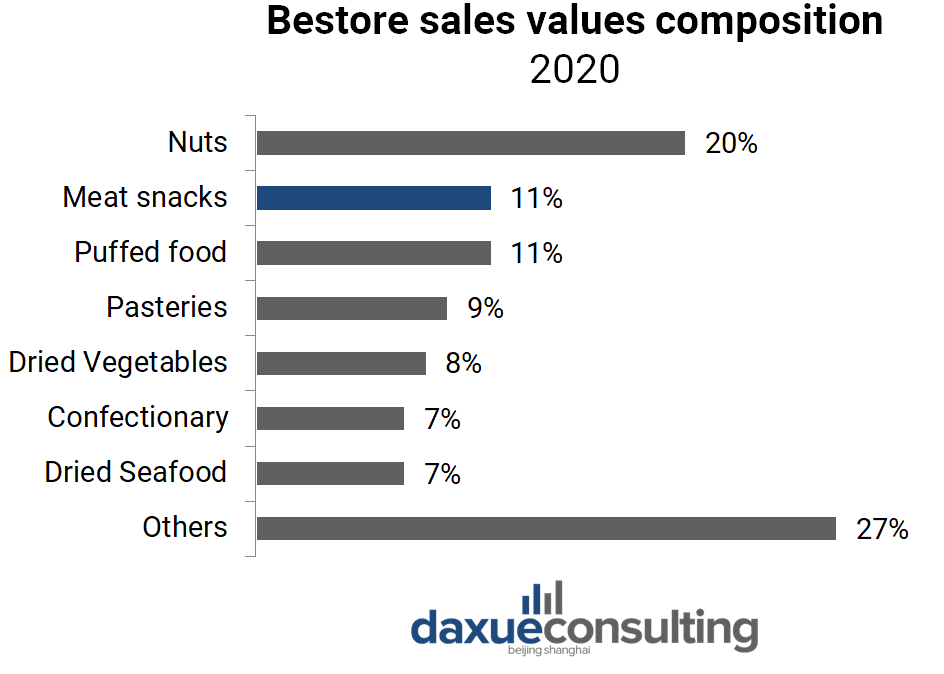

Bestore

The Chinese snack store was founded in 2006 as a small offline snack shop. It entered the online channels in 2012 and has since rapidly expanded both online and offline. According to its website, it had more than 2,100 stores across 95 cities in 13 provinces as of August 2018. Its 90 products lines produce more than 1,200 products cover 12 categories. Nuts are their most popular product category, contributing 20% of its sales volume in 2020, while both meat snacks and puffed food contributed 11% each.

Source: Bestore Tmall store, popular meat snacks for Bestore

Data source: Bestore annual report, designed by daxue consulting, Bestore’s sales volume composition by categories, 2020

In China’s snack market, Bestore has successfully differentiated itself by offering high-quality products. It had undergone strategic transformation to build a high-end brand image. From the perspective of the development trend of the leisure and snack industry, consumption upgrading is still a major trend, high quality and good consumption experience is the core competitiveness, and the high-end strategy of good quality shops is in line with the development trend of the industry.

Be & Cheery

Founded in 2003, Be & Cheery started its expansion on e-commerce platforms in 2010. In July 2017, Be & Cheery officially cooperated with Ali Retail Channel. In 2019, it opens the Tmall store alliance empowerment plan, and announces to build 2,500 upgraded model stores in 2020 to deepen channel penetration and scene touch.

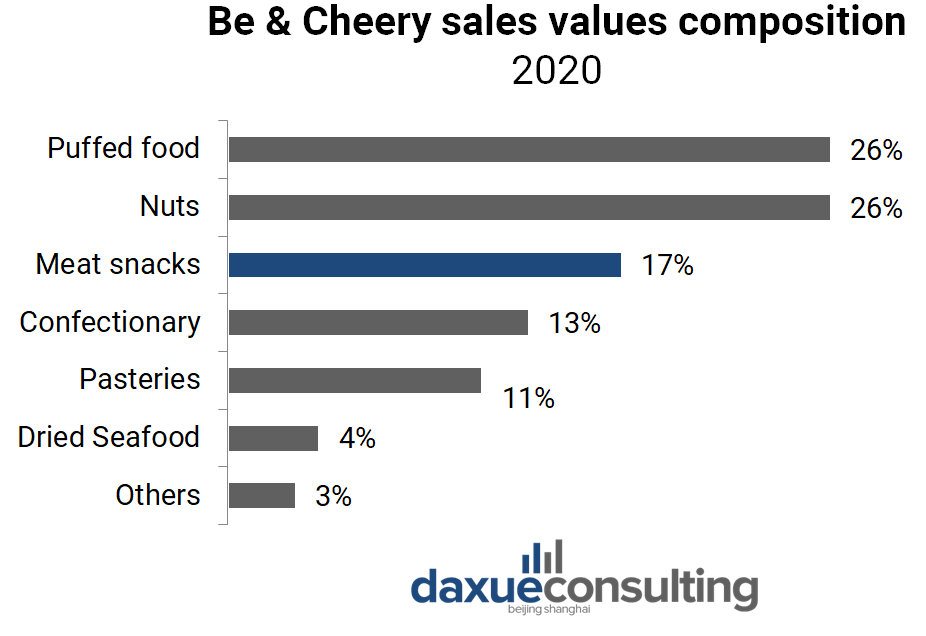

At present, Be & Cheery has been successfully stationed with 500,000 stores, covering 20 provinces and nearly 200 cities in China, to meet the consumer demand of “anytime, anywhere “. Similar to Bestore, Be & Cheery also offers a wide range of selections of snacks. Puffed food and nuts are its most popular categories, contributing to 26% of sales each, followed by 17% from meat snacks.

Source: Be & Cheery Tmall store, popular meat snacks for Be & Cheery

Data source: Be & Cheery annual report, designed by daxue consulting, Be & Cheery sales volume composition by categories, 2020

In April 2017, Be & Cheery announced its brand transformation and return to offline channels. In 2018, the company set up a new retail team and continuously deepened channel penetration and scene touchdown through the mode of “direct sales + franchise”.

Be & Cheery was acquired by Pepsi in 2020. After The acquisition, Pepsi will make use of the excellent online operation ability of the Chinese snack brand to expand the online snack market. At the same time, the offline layout is expected to speed up, Be & Cheery is expected to become one of the new offline channels of Pepsi, expand their brand influence.

What we can learn from Bestore and Be & Cheery

Although two brands focus on online sales, both have been expanding their offline presence aggressively in recent years. As observed, even though the online shopping culture in China is strong, a significant portion of sales in the snack food market is still offline. With leading brands’ rapid integration of their online and offline presences, the competition among Internet snack companies has been intensified. China’s snack food market is bound to become a multi-channel competition battlefield integrating online and offline.

Secondly, both brands can be categorized as integrated platform companies. Compared with single product companies (focusing on a certain class or a certain single product), these companies operate a variety of leisure snack products such as dried pork slices, duck meat snacks, and sliced beef jerky, and so forth, spanning multiple categories. For example, when observing the sales volume of both Bestore (良品铺子) and Baicaowei (百草味), their sales come from different categories of snacks, from meat-based snacks to pastries to nuts. Consumers have better experience if they can buy different categories of snacks just from a single store.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about the ready-to-eat market in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast