Behind Double 11 and 618, Double 12 is the third largest shopping festival in China. Taobao started the first Double 12 on December 12, 2012, with the purpose to promote small and medium C2C and O2O Taobao sellers. Like all of China’s online promotion festivals, Double 12 now includes most Chinese e-commerce platforms, such as Alibaba, JD.com and Pinduoduo. In recent years, more and more Chinese shoppers have shown interest in Black Friday and Christmas sales season, 12.12 rides off this demand. Double 12 2020 was a big year for Pinduoduo, but not all platforms, as it appears Chinese shoppers who shopped-till-they-dropped on Double 11 did not meet December’s festival with the same enthusiasm.

The Double 12 shopping festival is not just designed for C2C but more importantly for the O2O market

How Pinduoduo leverages Double 12 to improve its position in the market

Taobao, the C2C platform from Alibaba, started the Double 12 shopping festival in 2012. The same year, Tmall was officially introduced into the market and Double 11 was also renamed as “Double 11: Tmall shopping carnival”. In order to balance the losses of small and medium-sized Taobao sellers who are easy to be drowned out by large brands during Double 11, Alibaba positions Double 12 as a critical campaign to help them gain exposure and clear their inventories for the end of the year.

In Double 12 2020, not only Taobao but Pinduoduo also takes advantage of the shopping holiday to improve its position in the market. JD.com, on the other hand, focuses on Double 11 (the original shopping holiday) and the 618 Mid-Year Festival.

Compared to the intense competition of the 2020 Double 11 gala on TV channels, with five galas and four major Chinese e-commerce platforms, Pinduoduo’s “Double 12 Super Night Gala” was the only one, which broadcasted on Hunan TV on December 11th.

Source: Weibo.com; Pinduoduo’s “Double 12 Super Night Gala”

During Pinduoudo’s Double 12, more than 1.3 million users viewed the international beauty brands category and product sales increased by 310% compared to last year. The signature product from beauty brand Lancome was sold out as soon as it was on the shelf, with RMB 2 million sales. In addition to the foreign beauty brands, Dyson, Nintendo Switch, and food products from various countries also entered the Pinduoduo’s Double 12 global shopping hot sales list.

Pinduoduo has stated, “Double 12 is a good chance for Pinduoduo to promote its platform value. We presented to consumers at the lowest price across all platforms. In the future, we will continue to carry out the shopping events to meet the 730 million users of good quality products.”

The O2O market makes Double 12 different from any other shopping festival in China

Meanwhile, in addition to the C2C business, the Double 12 shopping festival also focuses on the O2O market. O2O businesses like restaurants, groceries, and local services used to lack opportunities to take part in any online sales event. Thus, Double 12 is also seen as the most important marketing campaign for Chinese O2O platforms like Meituan-Dianping and Alibaba’s Koubei.

Particularly during Double 12 2020, under the impact of COVID-19, online-to-Offline platforms in China had a rapid growth. According to a consumer report from Kantar, in the first quarter of 2020, offline sales were down 13%, while online-offline services grew 19% in the same period. Although COVID-19 infections in China have remained low in the second half of the year, consumers have kept the passion for delivery services.

This trend contributes to a new record for the O2O platforms’ participating in Double 12 2020. On suning.com, over 100,000 local consumption coupons were sent out in 5 minutes and 24,000 movie tickets and 12,000 burgers were sold in 1 hour.

Additionally, Alibaba announced almost 9 million physical merchants partnered with Alipay, and would start promotion during the Double 12, offering billions of yuan of discounts. Alibaba’s top KOL, Li Jiaqi, also gave out coupons for the food delivery platform Ele.me on his live-stream marketing session.

Source: Suning.com; Offline store coupons were offered during the Suning’s Double 12 period.

In the shadow of Double 11, Double 12 struggles to gain momentum

For most consumers, the role of Double 12 is more of a supplement to Double 11. Double 11 is for buying things for themselves, but Double 12 is for their family. Alibaba and Suning.com show, during the Double 12 2020, sales of children’s smart-watches and nutritional supplements for the elderly increased much more than Double 11.

However, there is only one short month between Double 11 and Double 12 and many customers also admit that they often overspend during Double 11, leaving themselves almost no spending budget for Double 12. This year, due to the strong promotion of Double 11 and the long duration of the campaign period, consumer demand has also been fully released, so the demand for shopping during Double 12 2020 was weaker than last year.

With the entry of international brands, the line between Double 11 and Double 12 have blurred on China’s e-commerce platforms. After the mid-year 618 and Double 11, the advertising expenses cannot be as high for Double 12. Therefore, they do not put much effort into Double 12 for the limited rate of return.

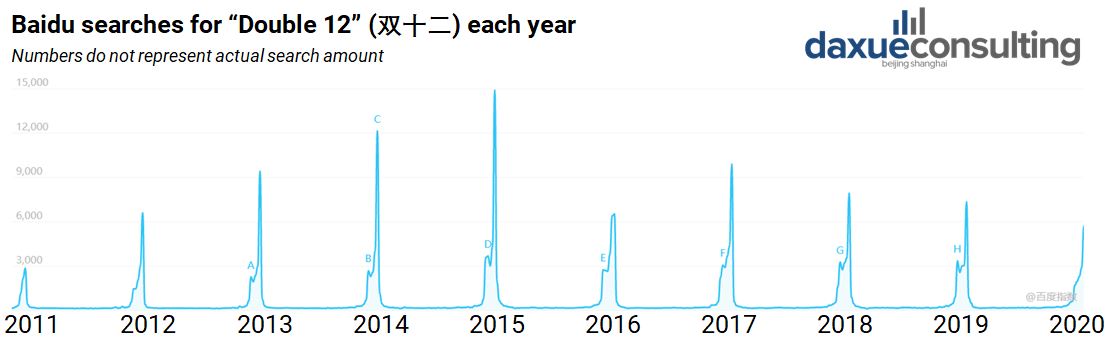

Attention to Double 12 peaked in 2015

In contrast to Double 11 2020’s 498.2 billion yuan in sales, Double 12 2020 was relatively quiet. In fact, most large e-commerce platforms in China had not released sales figures for Double 12 since 2015, probably due to a low engagement rate and insignificant transaction volume.

Source: Baidu Index. The Baidu search frequency of Double 12 peaked in 2015

The highlights of Double 12 2020

- Double 12 is highly focused on O2O marketing and selling, making it different from any other shopping festival. Consumers have the chance to get discounts not only in offline stores but also even in the vending machine through mobile payments like Alipay and WeChat.

- Cross-border overseas-focused e-commerce platforms, like Lazada and Shopee, are included in Double 12. The festival has driven beyond China to South Korea, Japan, and Southeast Asia.

- The shopping festival attracts many economical shoppers, because its prices in Double 12 are often lower than Double 11, and since it is the last campaign for brands to clear the inventory for the year.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn about China’s male beauty market

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast