Embracing the thrill of motor travel and motocross has evolved into a cultural phenomenon. On popular platforms such as Xiaohongshu, “motorcycle” yields over 3.93 million notes, while on Weibo, the motorcycle topic boasts 28,000 posts and 387,000 followers, securing the sixth position in the automotive category. Douyin further amplifies this trend, with motorcycle-related videos garnering nearly 60 billion views.

Amidst this cultural wave, the China Motorcycle Chamber of Commerce’s statistics from January to August 2023 reveal a robust growth in the nation’s motorcycle industry. The production of fuel motorcycles surged to 9.52 million units, marking a 2.53% year-on-year increase, with sales closely matching at 9.54 million units, representing a 1.18% year-on-year growth.

Download our report on Gen Z consumers

Who are the main players in China’s motorcycle market

China’s motorcycle market encompasses both domestic and foreign brands, characterized showcasing a relatively low market concentration. Domestic brands appeal to local consumers through attractive pricing and unique product features. In contrast, global heavyweights rely on cutting-edge technology and quality assurances to uphold their standing in the market. Currently, prominent Japanese manufacturers such as Honda, Suzuki, Yamaha, and Kawasaki, alongside European and American companies like BMW, Ducati, Piaggio, and Harley, enjoy substantial recognition within the country. In 2022, Dachangjiang (大长江) secured the top spot in China’s domestic fuel motorcycle sales with an impressive 2.3 million units. Following closely, Loncin (隆鑫) claimed second place with 1.3 million units, and Zongshen (宗申) rounded out the top three at 988,300 units.

Yadea’s leadership in China’s electric motorcycle boom

In contrast to the fuel motorcycle sector, China’s electric motorcycle industry, specifically those operating at speeds equal to or below 50 km/h, demonstrates a notably higher degree of market concentration. Key players in the Chinese electric motorcycle market include Yadea (雅迪), Aima (爱玛), Xinri (新日), Segway-Ninebot (九号), and NIU (小牛). Notably, Yadea stands out as the industry leader, selling over 14 million vehicles in 2022, capturing a market share of 28%. Aima secures the second position with a total sales volume of 11 million vehicles in 2022 and a market share of 18.5%.

Transformative shifts in China’s motorcycle policies

Many major cities, including Beijing, Shanghai, Guangzhou, Shenzhen, as well as second-tier cities like Kunming, Shenyang, Wuhan, and Shijiazhuang, have imposed various restrictions or outright bans on fuel motorcycles in certain areas or during specific times.

Some cities have tried to change their motorcycle ban policies in recent years. For example, Xi’an lifted its ban on motorcycles in 2017, allowing them to operate within certain areas or under specific regulations. Guangdong province began permitting motorcycle registration in 2018, indicating a relaxation of the previous strict ban on motorcycles in some areas. Instead,Harbin introduced license plate registration for motorcycles in 2021 through a lottery management system.

Only a few cities do not prohibit motorcycles. For example, Chongqing is known for its more relaxed regulations regarding motorcycles compared to many other cities in China. While certain expressways and restricted areas might still be off-limits for motorcycles due to safety and traffic management reasons, they are generally allowed to travel on most urban roads in Chongqing.

JD.com’s comprehensive upgrade in online motorcycle retail for enhanced shopping experience

Historically, traditional brick-and-mortar stores have been the backbone of the industry, but the emergence of e-commerce platforms has supplemented the existing retail landscape. Alongside this evolution, innovative marketing strategies like live shopping are gaining traction and altering the dynamics of motorcycle sales. Notably, major industry players such as CFMOTO, YAMAHA, and BMW are adapting to these changes by establishing official flagship stores on JD and Dewu. This shift underscores the industry’s recognition of the importance of embracing digital channels to meet evolving consumer preferences and stay competitive in the market.

JD made headlines in August 2022 with an initiative aimed at revolutionizing the purchasing experience. Launched as a pilot project in Beijing, this innovative approach introduced three key benefits: eliminating wait times for existing cars, providing free registration, and offering convenient door-to-door delivery.

As part of this initiative, JD Motorcycles proudly showcases an inventory of 50 popular models, encompassing both domestic and imported brands. The platform allows consumers to reserve their preferred time and location for picking up their ordered vehicle, significantly enhancing convenience and flexibility in the purchasing process.

Moreover, JD.com offers a “free license registration” service for eligible consumers meeting the Beijing Vehicle Management Bureau’s qualification criteria for the coveted Beijing B license plate. Additionally, residents within the Sixth Ring in Beijing can enjoy a complimentary door-to-door delivery service. This comprehensive and customer-centric approach by JD.com aims to elevate the overall purchasing experience in the motorcycle market, setting new standards for convenience and service excellence.

Growing commuter demand and the rise of Generation Z consumers

With the changes in motorcycle restriction policies, there has been a rapid surge in demand from commuters, becoming a key factor in the growth of the number of motorcycle users. Particularly in high-tier cities, an increasing number of individuals are opting for motorcycles, including electric ones, drawn by the allure of hassle-free commuting with minimal traffic congestion and convenient parking facilities.

The “2021 JD.com Generation Z Automobile Consumption Trend Report” shows that although people aged 26-35 are still the main buyers, the consumer group represented by Generation Z shows an obvious consumption desire for consumption. In the first half of 2021, Gen Z female consumers purchased more motorcycles than men of the same age, and among people under the age of 35, the growth rate of female buyers is generally higher than that of men.

Simultaneously, the surge in leisure activities has propelled a rapid expansion of the market share of medium and large-displacement motorcycles. China’s motorcycle sales are expected to reach 21.4 million units in 2022. Among them, the sales volume of leisure motorcycles above 250cc reached 553,400 units, marking a significant year-on-year increase of 44.7%. The primary consumers interested in medium and large-displacement motorcycles are mainly young people aged 20-29. According to Baidu Index, more than half of the users who search for keywords for mid-to-large-displacement motorcycle brands such as Benelli, Harley, and KTM are in this age group.

The soaring demand for motorcycle riding accessories

In recent years, the demand for high-quality helmets and decorative motorcycle accessories has surged, driven by the rapid growth in motorcycle sales and an increasing number of female consumers.

During the 2022 JD.com 618 shopping festival, the motorcycle category experienced a notable 106% year-on-year increase in transactions. Notably, motorcycle helmet sales grew by 202%, and motorcycle equipment saw an impressive 280% year-on-year growth. Among motorcycle accessories, helmets, racing suits, gloves, protective gear, rider bags, dashcams, and phone mounts showed robust sales performance.

In the first four hours of Tmall Double 11 in 2023, motorcycle equipment sales increased by 57%, including motorcycle GPS, helmets, riding clothes and other 25 equipment categories. Motorcycle GPS experienced an explosive growth of 1,272%, while motorcycle dashcams increased by 245%, rider gloves increased by 290%, riding pants increased by 563%, and riding shoes by 296%.

Beyond safety to style

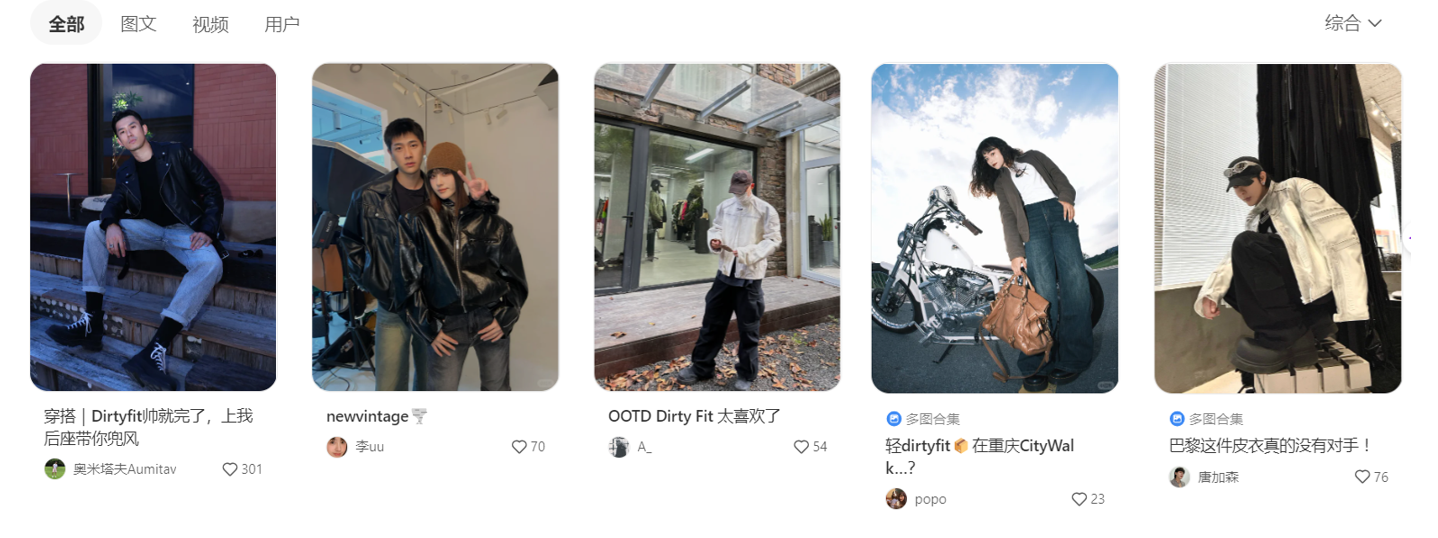

The growing demand for top-notch helmets and stylish motorcycle accessories marks a significant shift beyond mere safety considerations. It’s not merely a matter of adhering to safety standards; rather, it’s about expressing individuality and adopting a unique lifestyle.

This trend is evident on social platforms like Xiaohongshu, where searches for “motorcycle outfit” yield over 170,000 posts, and “motorcycle style” boasts more than 30,000 posts. These numbers underscore an enthusiastic embrace of diverse and trendy aesthetics, highlighting a growing passion for stylish and personalized expressions within the motorcycle community. This evolving interest showcases how riders are increasingly looking beyond functionality to integrate fashion and personal flair into their riding experiences.

Remarkably, this style has transcended the boundaries of the motorcycle community, making its way into the mainstream. Drawing inspiration from both streetwear and motorcycle aesthetics, the “Dirty Fit” style embraces distressed aesthetics with craft techniques like abrasion and fading. Despite its seemingly “dirty” vibe, it incorporates high-quality materials such as denim and leather, often processed to achieve a worn-out look. This style defies conventional fashion norms, acting as a canvas for individual expression and embodying an alternative lifestyle. Iconic items, including distressed leather jackets and well-worn denim, reflect a fusion of high-end fashion and streetwear.

Exploring China’s motorcycle market, dominant players, and innovative retail trends

- Motor travel and motocross have evolved into a cultural phenomenon, dominating social interactions on platforms like Xiaohongshu, Weibo, and Douyin, reflecting a vibrant interest beyond the motorcycle community.

- China’s motorcycle industry experienced robust growth, with fuel motorcycles production and sales showing year-on-year increases, as reported by the China Motorcycle Chamber of Commerce.

- The motorcycle market features both domestic and foreign brands, with notable players including Honda, Suzuki, Yamaha, Kawasaki, BMW, Ducati, and others, each enjoying recognition within the country.

- In the electric motorcycle sector, Yadea emerges as a leader, capturing a significant market share. The electric motorcycle market shows a higher degree of concentration compared to fuel motorcycles.

- Several Chinese cities are lifting their restrictions or bans on fuel motorcycles.

- JD.com’s initiative in online motorcycle retail, including a comprehensive upgrade and innovative purchasing experiences, reflects the industry’s adaptation to evolving consumer preferences.