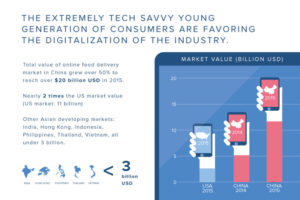

The online food delivery in China has witnessed explosive growth during the past two years. Online food ordering is the fastest growing sector of all mobile applications in China, and competition in this market has become tougher and tougher. Here is an infographic realized by Daxue’s team with key figures and information you need to know about this booming industry in China.

Online food delivery in China: Ordering and delivery services

The online food delivery industry in China is booming: in only six months, the number of users has grown by 32% from 114 million to 150 million between December 2015 and June 2016. Among the Chinese users, the largest consumer group is the white collars users, aged 27.7 on average. They account for 63% of online food delivery app users. Many of them are Chinese millennials who spend a decreasing time cooking for themselves. Students are the second largest consumer group and account for 30.5% of these service users (Chinese Millennials Behavior)

A high-potential market in which competition grows fierce

The online food delivery industry has a bright future. The number of Chinese mobile internet users keeps increasing: according to the China National Network Information Centre (CNNIC), 656 million Chinese people use cellphones to go online, accounting for 92.5% of all Chinese internet users. This is 37 million more than at the end of 2015. Undoubtedly, the online food delivery market that relies on mobile ordering has high growth prospects. Also, the significant ease of paying for food through mobile payment systems such as WeChat Wallet and Alibaba’s Alipay can only push the market in this direction.

However, the market has already become a brutal battleground. The three leading players are Ele.me, Meituan Waimai, and Baidu Waimai that represent respectively 37.5%, 30.5%, and 15% of the total market in May 2016. Launched earlier than its competitors in 2009, Ele.me is still ahead but its advantage over Meituan Waimai and Baidu Waimai is narrowing, especially since they all offer quite similar services.

How can Daxue help its clients: End-consumer survey in China

A client who wanted to test a new smartphone application contacted Daxue Consulting team. The application would provide a service that allows people to order and to sell homemade dishes. To meet the client’s demand, Daxue Consulting selected 500 qualified respondents, administrated a face to face survey to them, and delivered recommendations about possible improvements and market acceptance of the mobile application.

See our service: China Market Entry