According to the World Health Organization (WHO), 38% of China’s population was overweight and 8% was obese in 2022. While the obesity rate is much lower than many western countries including the United States, the growth rate is outpacing its eastern neighbors South Korea, Japan, and Singapore. This has not only captured the attention of authorities, but netizens as well. It has lead to the rise of commercial weight loss camps and buzz around Ozempic, the most famous weight loss drug in the GLP-1 category. The recent approval of GLP-1 drugs like Ozempic in China marks a significant shift in the country’s regulatory stance toward weight-management medications. However, challenges remain. Patients are concerned over side effects and high costs, amid mixed reactions on social media.

Download our China’s samples economy report

GLP-1 drugs and their applications in weight control

Ozempic is becoming widely embraced in the West, with celebrities endorsements from Hollywood stars like Amy Schumer and tech billionaire Elon Musk. Introduced for type 2 diabetes in the diabetes treatment market in China, Ozempic is a brand name of semaglutide, a member of the GLP-1 drug class. GLP-1 drugs mimic a natural hormone that stimulates insulin production, reduces glucagon release, and helps regulate blood glucose levels. Side effects of these drugs —such as delayed gastric emptying and appetite suppression— turn out to be the desired effect for another type of users: those seeking weight loss. Currently, although other GLP-1 drugs have demonstrated significant potential for weight management, Ozempic remains a leading name in the market for obesity treatment.

Ozempic in China: the regulatory breakthrough

In June 2024, China’s National Medical Products Administration (NMPA) marked a major regulatory milestone. Following the completion of a dedicated China pivotal trial, it approved the scope extension of Novo Nordisk’s Ozempic’s market authorization – branded as NovoCare in China –, adding the long-term weight management indication to its previous T2DM scope of use.

This decision marked the first time a GLP-1 drug received approval for weight control in China. Prior to this, GLP-1 drugs in the Chinese market were limited to diabetes treatment, despite their well-documented effects on weight reduction.

More importantly, market players have viewed the decision as a regulatory breakthrough that opens a window of opportunities rather than a singular event. Just a month later, tirzepatide, another GLP-1 drug with best-in-class potential developed by Novo Nordisk’s main competitor Eli Lilly and Co., was also approved for entry into China’s weight loss market.

Rising obesity rates in China to drive long-term demand

A key consideration behind the Chinese regulator’s shift to a more open stance towards GLP-1 therapies might be their concerns over the country’s surging obesity rate. Indeed, the government publicly recognises obesity as a public health crisis. This is reflected through the official framing of Xinhua, the largest state media, which deliberately reported a more staggering estimate of overweight population in China, 50%, as opposed to the more optimistic figure from the WHO.

Childhood obesity in China is also an issue and could get worse. Chinese younger generations are adopting lifestyles more sedentary compared to their global peers due to factors such as urbanisation and long studying/working hours, with fewer space given to sport activities at schools and universities compared to, for example, the USA. They hence face increased risks of getting diabetes or becoming overweight, fuelling the longer-term demand for effective medical treatments.

Indeed, industry estimates underscore the significant growth potential of China’s GLP-1 drug market. Experts estimate that China’s GLP-1 market could grow at 23% a year — faster than the 21% global average — to USD 11.4 billion in 2033.

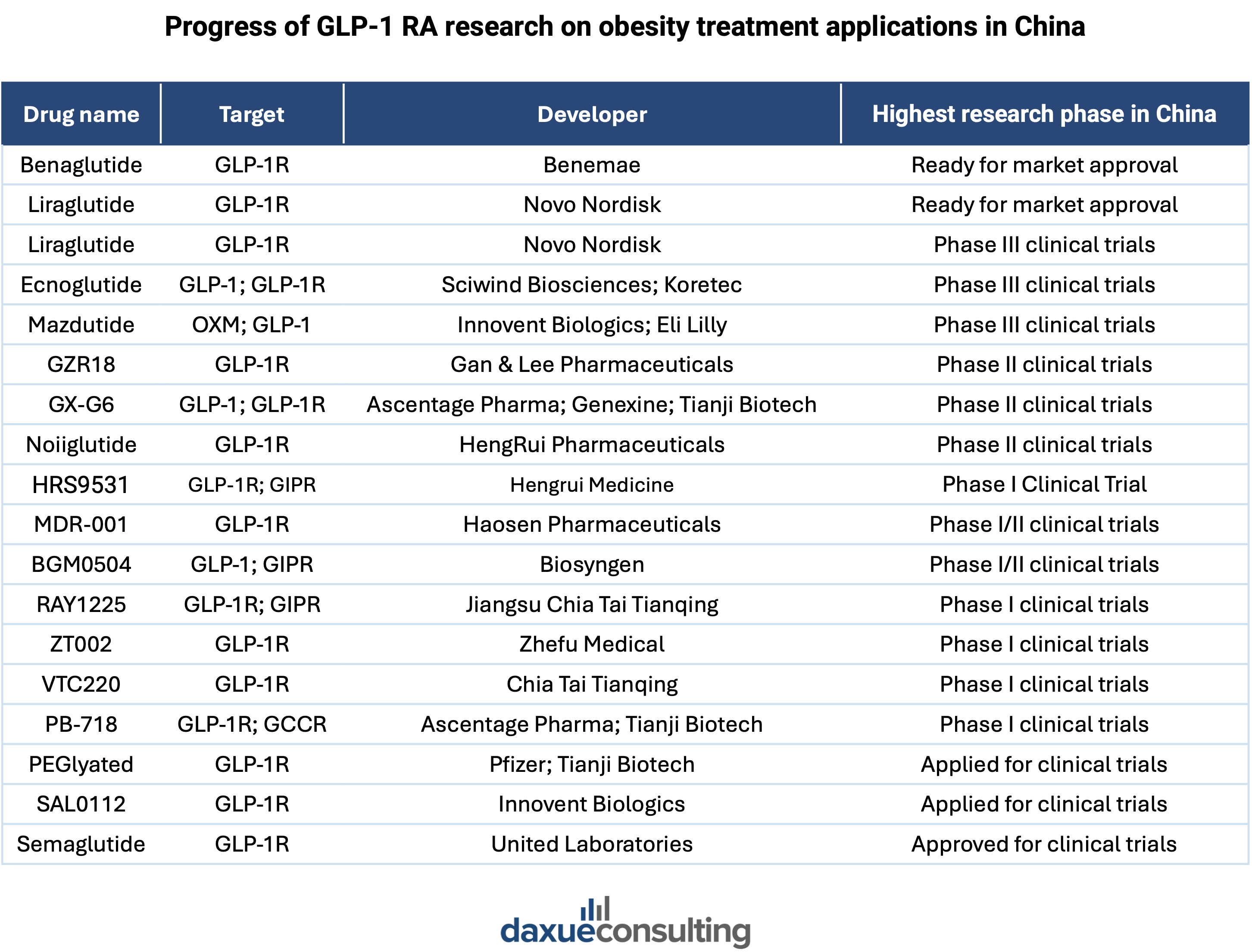

The competitive landscape of GLP-1 drugs in China: pressure from local players

Two foreign giants—Novo Nordisk and Eli Lilly—dominate the Chinese GLP-1 drug market. Having gained nearly exclusive entries to the new and expansive weight management market of China, the two firms together account for approximately 94% of total GLP-1 drug sales in the country.

However, this status quo is projected to witness profound changes in the future. Sensing the potential of the market, China’s domestic pharma firms are now ramping up their efforts to develop and commercialize their own GLP-1 products. Notable players include Huadong Medicine, Gan & Lee Pharmaceuticals, and East Sunshine, all of which are investing in research and development to bring GLP-1 treatments to market. Shanghai Benemae’s beinaglutide, China’s first domestically developed GLP-1 drug, is undergoing clinical trials for weight-loss treatment, with potential approval expected soon.

A 2021 incident reflects the determination of local competitors to gain market share. Huadong Medicine filed a petition for the invalidation of Novo Nordisk’s core patent over semaglutide in China, which was to last until 2026. Novo Nordisk successfully defended its patent protection period through a series of dramatic legal battles. According to Nomura’s estimation, with fiercely ramped-up investments, China’s domestic competitors may take over 20% of the total market share by 2033.

Chinese consumer perceptions of GLP-1 drugs

On social media platforms such as Little Red Book, netizens expressed mixed receptions towards weight loss drugs.

Even before the official approval, Chinese patients in search of weight reduction solutions have noticed the use of GLP-1 drugs and observed their widespread popularity overseas. On Chinese social media, Ozempic has gained a reputation among netizens as the “magic drug for weight loss” and the “secret of Hollywood stars.” Then the belated approval for GLP-1 drugs’ usage for weight reduction in China were met with curiosity and excitement.

However, after a few months since the initial NMPA approvals, concerns have risen. Searches of “injected slimming drugs” are filled with posts expressing concerns over or claiming to “unveil” the negative health effects of GLP-1 drugs. The comment sections generally feature heated arguments between netizens over the safety of GLP-1 weight treatments. Consensus aside, debates generate a real hesitation: many tempted users of GLP-1 injections were frightened off by the negative experiences shared by some of the patients. Building trust is still a major challenge in front of GLP-1 drugs in China.

Barriers to purchasing GLP-1 drugs in China

Besides side-effects, NovoCare’s injectable-only dosage form makes it difficult for patients to sustain this treatment.

“NovoCare’s dosage form (injectable only) also constitutes an obstacle to patient compliance – even though the Chinese are more used to going to the hospital for a “drip” than in other countries, due to the quite uniquely widespread use of injectable antibiotics throughout the country for decades. Indeed, while going to the hospital for a few hours for a cephalosporine drip to quickly alleviate infectious fever and flu-like symptoms is considered normal, carving out a similar amount of time every week for semaglutide treatment may be difficult to sustain, especially for those patients with a very busy professional schedule.”

– Irénée Robin, Managing Partner at VVR Medical

Unsurprisingly, cost is a another key concern for prospective users. The weight of this concern is evident from the calls for the inclusion of semaglutide into the state insurance system, which were strong enough to attract a direct response from the National Healthcare Security Administration. Yet, a firmly negative response from the latter indicate to prospective buyers the disappointing fact that GLP-1 weight loss drugs are unlikely to become much more affordable in the short term. However, Robin says that this could change over time.

“As soon as Chinese alternates reach the market – presumably at a lower price point than Novo Nordisk’s and Lilly’s products – this situation may well change, as the NHSA may elect to grant at least partial reimbursement to said home-grown alternates.”

– Irénée Robin, Managing Partner at VVR Medical

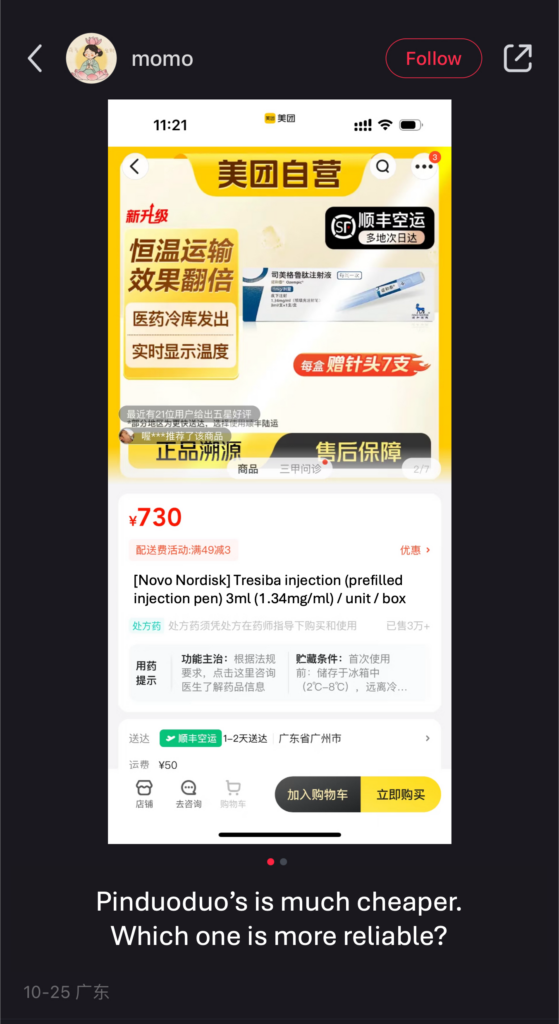

Additionally, the prescription-only status of the drug makes in inaccessible to individuals who do not meet the strict requirements of obesity, leading to the emergence of unreliable purchasing channels and surging prices.

Social media posts show that e-commerce platforms rather than public hospitals, are often the top purchasing channels of GLP-1 drugs in China. Due to the grey nature of these sales channels, buyers are uncertain of the quality and safety of their purchases. Online discussions comparing prices on Taobao, Meituan, and Pinduoduo question the validity of cheaper offers.

Despite the permeating distrust, prices continued surging. On Chinese e-commerce platforms like Taobao, for example, the price of NovoCare has risen as high as RMB 1,000. This is twice the cost of the same drug at a public hospital.

What to know about GLP-1s and the weight loss drug market in China

- In 2024, China’s National Medical Products Administration authorized the commercialization of Novo Nordisk’s Ozempic for long-term weight management.

- Obesity is a growing national concern and fuels the demand for the weight loss drug market in China.

- Novo Nordisk and Eli Lilly are leading the market of GLP-1 drugs in China. However, Chinese pharmaceutical companies are already developing their own versions as Nordisk’s patent is set to expire in 2026.

- Chinese consumers praise GLP-1s in China as a weight loss solution. However, there are growing concerns about their affordability, ease of use, and safety.

- As domestic manufacturers bring new GLP-1 products to market, increased competition is likely to drive prices down. This will potentially make these treatments more affordable and accessible in the longer term.

- Transparency regarding side effects and long-term outcomes will be essential for establishing a loyal consumer base. Also, improved regulations over sales channels would be auxiliary in ramping up consumers’ trusts in the GLP-1 market.