Plant-based milk in China has gained increasing popularity as an alternative to traditional dairy milk. Driven by various factors including increasing health consciousness, environmental concerns, and lactose intolerance among consumers, this trend is expected to grow even more, opening unique opportunities for new brands in the Chinese market.

Increasing demand of milk substitutes, with soy milk leading

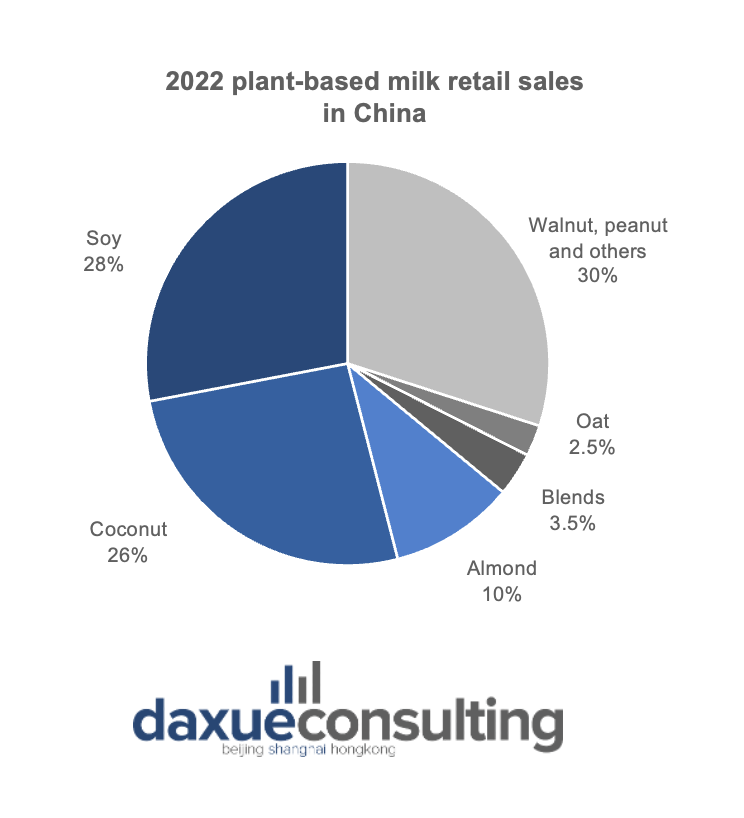

The demand for plant-based food and beverages in China is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.11% from 2022 to 2027. This surge in popularity can be attributed to several factors, including the population’s growing environmental and health concerns, as well as the rising prevalence of lactose intolerance, significantly impacting China’s dairy milk market. According to the data-analytics company Statista, the milk substitutes market in China amounts to around USD 11 billion in 2023, with an expected growth in volume production of 13.6% in 2024. Among the different types of milk alternatives, soy milk is the most popular, followed by coconut and almond milks.

Moreover, the oat milk alternative has experienced significant growth. Although still low in terms of revenue, the oat milk market has been consistently on the rise ever since Oatly’s marketing success in 2018, when it managed to bring oat milk from an unknown product to one of the most popular milk substitutes in the country.

The outstanding marketing move involved promoting the product extensively in Shanghai’s coffee shops, following the so-called “the three ones” approach: one product, one market, one city. Through collaborations with local businesses, they effectively raised awareness of the beverage. By the end of the year, oat milk and coffee became very popular, solidifying Oatly’s position in the Chinese market.

Regulatory ambiguity and its implications for positioning and consumer perception

Compliance with food safety regulations, labeling requirements, and certifications is essential for gaining consumer trust and accessing the market.

For instance, when an ingredient is considered new to the Chinese market, it requires approval from the National Health Commission (NHC). However, since the plant-based food and beverage market is still relatively new in the Chinese landscape, specific regulations for vegan products have yet to be established.

This regulatory ambiguity can create uncertainty at the retail sales level, such as when products are categorized. Milk substitutes cannot be strictly classified as beverages or as dairy milk, and this might lead to confusion for both retailers and consumers. It is thus essential to work on the packaging and advertising strategy to build a precise positioning and dispel any doubts. Communicating the nature of the product can be challenging, but it can be made easier by emphasizing its nutritional profile and providing information on its usage and sustainability as a milk.

From concerns to choices: the influence of health and safety on the growing popularity of plant-based milk in China

The COVID-19 pandemic has deeply impacted Chinese consumption habits, amplifying concerns around health and wellness. Dairy milk is being recognized in China as a valuable source of calcium and proteins. However, factors such as lactose intolerance and lingering food safety concerns, stemming from incidents like the melamine scandal in 2008 when traces of this toxic compound were found in children’s milk powder, have prompted consumers to explore alternative options. In addition, there is a growing awareness among individuals about the importance of managing their calorie intake for fitness and weight loss purposes and an increasing number of people embracing a vegetarian lifestyle.

Among alternatives to the dairy counterparts, plant-based milk in China is perceived as a highly nutritional, with low fat and low cholesterol. Furthermore, certain types like soy milk are as cheap as RMB 3, corresponding to USD 50 cents, making them more affordable and even more convenient.

Key players in the plant-based milk market and their e-commerce dominance

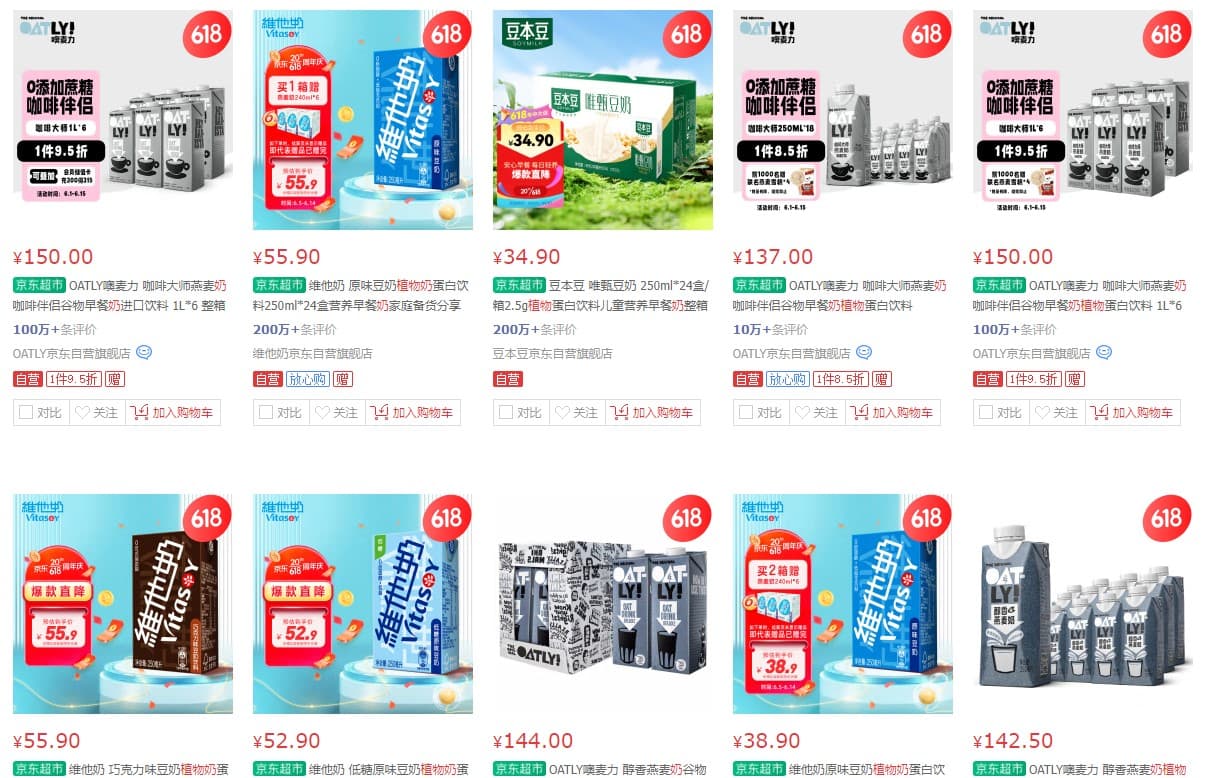

Multiple companies are currently competing for the plant-based milk market in China, including dairy products giants like Mengniu and Yili. Among the key players in this niche sector are Vitasoy and Soymilk (豆本豆, Doubendou), Oatly, Yangyuan, Lulu (露露), and Yeshu, each specializing in a specific type of vegan milk, soy, oat, walnut, almond and coconut milk, respectively.

Many of them use e-commerce platforms in China to appeal to the young consumers. In JD (京东) and Tmall, two top Chinese e-commerce platforms, Oatly, Vitasoy, and Doubendou have emerged as top sellers. As for Tmall in 2021, 69% of the plant-based milk consumers were between the ages 18 and 34 and 40% of them were from first and second tier cities, meaning that many are young and have the ability to buy these products.

These online platforms also allow brands to showcase their products and reach a wider or focused consumer base. They offer popular tools like live-broadcasting and short videos sharing and production to better engage with the young audience. For instance, the brand Six Walnuts (六个核桃), owned by Yangyuan, is known for being well versed in both online and offline marketing channels. They focus on engaging their audience through frequent live-broadcasting and short videos, while also collaborating with celebrities and idols to narrow the distance with the young audience.

Breaking ground: Marketing strategies for entry and growth

With the Chinese plant-based milk market still experiencing growth, there are ample opportunities for new brands to enter the scene. Nevertheless, achieving success in this competitive landscape requires careful planning and the implementation of a comprehensive marketing strategy.

Packaging for success: Harnessing the power of design and product positioning

Due to the newness of the product category and the necessity to build product awareness in the market, packaging plays a crucial role. It needs to be visually appealing and informative and it might want to resonate with the products which are closer in resemblance to it. For example, cardboard packaging can evoke familiarity with dairy milk, and plastic bottles with yogurt, while a smaller format can position the product as an on-the-go beverage. Understanding the desired perception of the product in the consumers’ minds and aligning the packaging accordingly is vital for success.

For instance, Oatly’s packaging implies that the product is not intended to be drunk directly from the cardboard, which aligns with their positioning of oat milk as a beverage to be consumed with coffee. Other brands like Plantag (植物标签) are taking a different approach by targeting the direct-to-drink sector. They offer a kind of packaging that facilitates easy consumption directly from a bottle.

Leveraging digital platforms, with health, taste, and sustainability

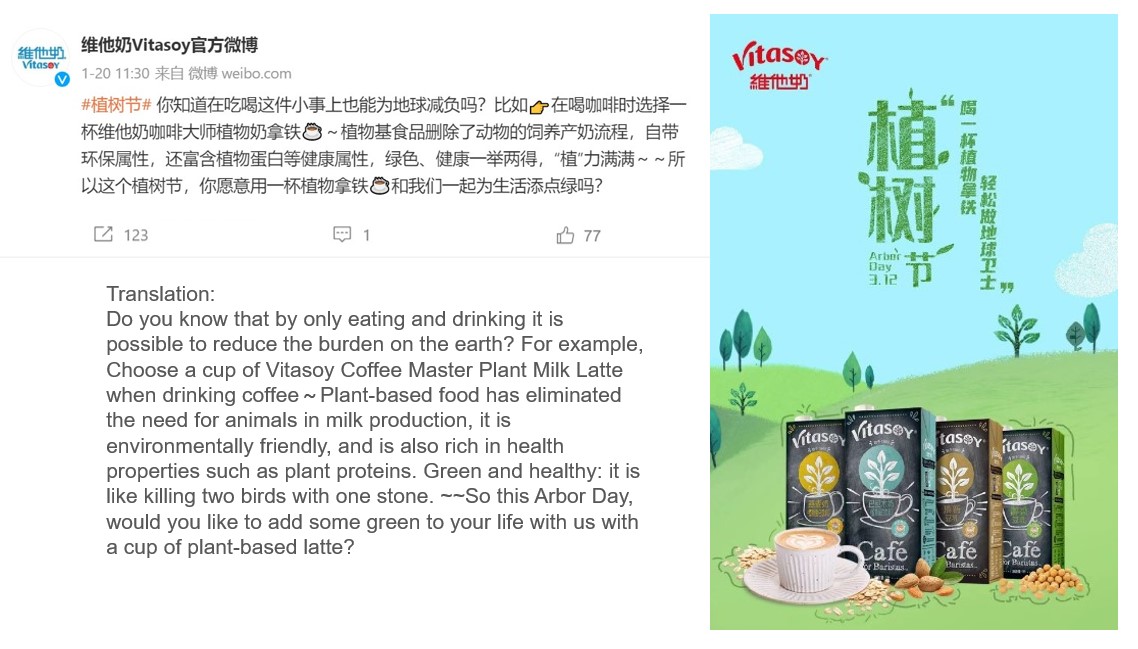

Well-executed advertising campaigns play a vital role in the promotion of plant-based milk in China. Utilizing digital platforms and social media is particularly effective in reaching and engaging with the audience, especially with the tech-savvy Gen Z and Millennials.

Highlighting the product’s health benefits, taste, protein content and eco-friendliness may help build a favorable brand image and appeal to Chinese consumers. Hence, incorporating these elements in the adverting strategy can be advantageous. For instance, during 2023 Arbor Day, Vitasoy made a post on Weibo emphasizing the good qualities and benefits of its products for both the consumers and the environment, generating a positive response in the community and creating more buzz online than usual.

Partnerships with coffee shops

Many plant-based milk brands have been collaborating with coffee shops in China as a way to expand their application of their products, similar to the aforementioned case involving Oatly. Through these collaborations, brands can communicate the versatility and taste of their products in coffee-based beverages.

However, it is also important to note that not all milk alternatives are equally appreciated when mixed with coffee. Dairy milk remains the most favored, while oat milk and coconut milk are gaining popularity. Nut and soy milk are not typically recommended with coffee, because they do not blend harmoniously together, resulting in a taste which is not as much appreciated as the other alternatives. Moreover, in addition to coffee shops, brands can explore other collaborations with tea shops, restaurants, and bakeries.

A glance in the competitive soy milk market: Doubendou

Doubendou, a brand owned by Dali Group, has established a leading position in the soy milk market. Its success is not only to be attributed to the increasing popularity of soy milk, but also to its innovations in milk processing techniques. Bearing in mind consumers’ health concerns, Doubendou launched the organic soy milk, produced from carefully selected raw material. The beans are cultivated in the Songnen plains, in north-east China, and they are known for their strong flavor and high nutritional content. To ensure transparency and quality, each carton of Doubendou organic milk is equipped with a unique code that serves as an “ID card”, approved by a certification agency.

By addressing consumers’ demand for a superior product and effectively promoting their commitment to quality, Doubendou has successfully reshaped people’s perception of soy milk, turning it from a beverage once seen as filled with additives into a highly nutritious drink.

The ambiguous yet promising plant-based food market in China:

- The demand for plant-based food and beverages in China is projected to grow at a CAGR of 5.11% from 2022 to 2027. The milk substitutes market in China is valued at USD 11.05 billion in 2023, with an expected volume growth of 13.6% in 2024.

- Soy milk is the most popular variant of plant-based milk in China, followed by coconut and almond milks.

- Key players in the Chinese plant-based milk market include Vitasoy, Soymilk, Oatly, Yangyuan, Lolo, and Yeshu.

- Packaging plays a crucial role in product positioning and building awareness in the market.

- Leveraging e-commerce platforms including JD and Tmall is essential for market expansion and reaching a wider consumer base.

- Marketing strategies should focus on highlighting the product’s health benefits, taste, eco-friendliness and protein content.

- Collaborations with coffee shops can be highly beneficial for promoting plant-based milk. Dairy milk remains the most popular option in coffee shops, followed by oat and coconut milk.

- Doubendou is an example of effective marketing strategy, as it successfully developed a product addressing consumers’ health concerns and changed the perception of soymilk in China.

Author: Chiara M. Barbera

Read about the 10 Mistakes Chinese Brands Make when Going Abroad