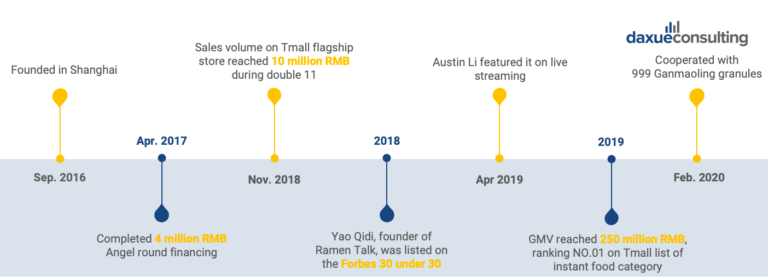

Ramen Talk, founded in Shanghai in September 2016, is an instant noodle company that aims to make restaurant quality comparable noodles. In April 2017, the Chinese instant noodle brand completed a 4 million RMB angel financing. Its GMV reached 250 million RMB in 2019, ranking first on Tmall list of instant food category.

Download our report on Ramen Talk’s strategy

Source: Daxue Consulting and Double V. Training & Consultancy; F&B market in China report, timeline of Ramen Talk’s major achievements

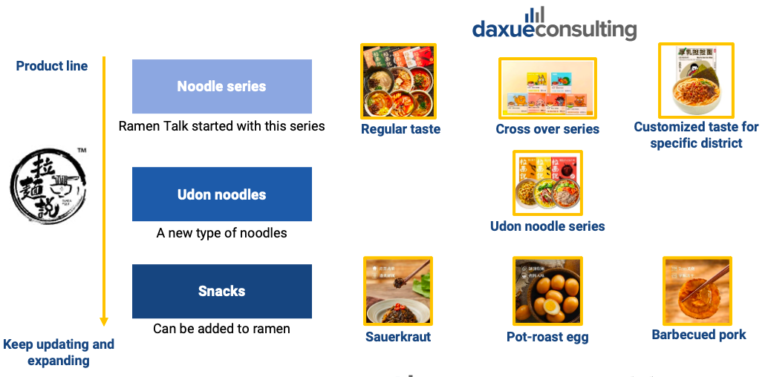

Ramen Talk is keen on developing new flavours

Following the brand concept of “Taste of home”, Ramen Talk is committed to only use high quality ingredients. In addition to the traditional instant noodle recipes, the Chinese instant noodle brandalso provides Udon noodles and snacks. As Udon used to be only eaten in restaurants, instant Udon is a brand-new market. Besides noodles, Ramen Talk is also working on expanding into peripheral food that can be added into noodles to bring more flavours. The time in between each new product launch is a bit over a month, which is much faster than product launch of other brands.

Source: Daxue Consulting and Double V. Training & Consultancy; F&B market in China report, Ramen Talk’s product line

Strategy 1: Fill the market gap between convenient and premium food

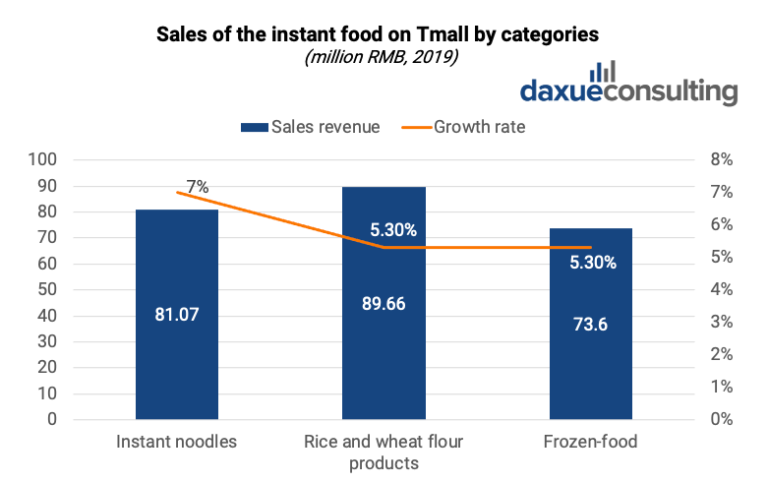

Source: Ipsos, designed by daxue consulting; F&B market in China report, sales of the instant food on Tmall by categories and their growth rates

In the last decade, China’s instant food market has been focusing more closely on health. Non-fried instant noodles rank first among all categories of instant noodle, including frozen dried noodle, Konjac noodle, oat noodle, low fat buckwheat noodle and so on. From 2018 to 2020, the market size of instant noodles grew rapidly with a 7% increase. This growth is even more eye-catching in the COVID-19 lockdown period.

Something that makes Ramen Talk stands out from all its competitors is that it not only focuses on innovation of noodle types, but also in taste and healthy ingredients in order to stay aligned with its premium brand image. In terms of types of noodles, Ramen Talk has come up with non-fried noodles with a shelf life of 60 days, that contains less preservatives. In terms of taste, the Chinese instant noodle brand has new flavours such as Tom Yum Goong and pork tripe with chicken, both of which make noodles more “restaurant-like”.

Strategy 2: Mass promotion on live streaming

Compared to other instant noodle brands, Ramen Talk relies heavily on live streaming promotion, with a monthly frequency. In April 2019, the Chinese instant noodle brand was featured on Li Jiaqi (李加琦)’s livestreaming show for the first time. Sales volume hit 600,000 RMB in 1 second. Customers can now get 8 packages for 81 RMB in the livestream, whereas if they buy it from Tmall, they have to pay almost 60 RMB for 3 packages. In the entire year, Ramen Talk had been featured by Li Jiaqi for 7 times, worked with over 450 KOLs and held around 2,000 livestreams in 30 days – these records go on.

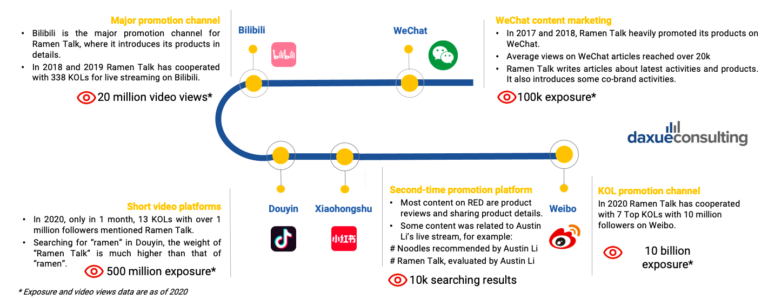

Source: Daxue Consulting and Double V. Training & Consultancy; F&B market in China report, Ramen Talk’s various social media platforms promotion strategies

Aside from livestreaming, Ramen Talk also focuses on social media platforms, aiming to cover consumer groups in different channels by using intensive circle-level marketing. WeChat is the platform that Ramen Talk started off with, publishing articles about newest products and promotions that normally gain about 20,000 views per article. In 2018 and 2019, Ramen Talk worked with 338 KOLs for livestreaming on Bilibili, a platform that serves as the main promotion channel for Ramen Talk. In 2020, Ramen Talk expanded to Douyin, Xiaohongshu and Weibo, all of which heavily focus on KOL marketing and livestreaming. Ramen Talk has built its brand in a wider consumer market with the success of 500 million exposure on Douyin, 10,000 searching results in Xiaohongshu and 10 billion exposure on Weibo.

Strategy 3: Right content and KOLs on social platforms

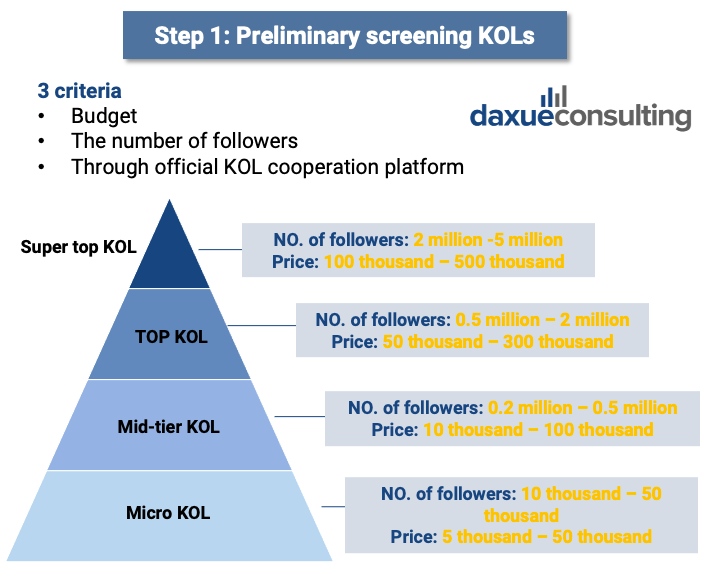

In terms of choosing KOLs, Ramen Talk has its own strategy: strictly screen the KOLs’ content, qualities and engagements with their followers, with more detailed criteria outlined in each step below.

Step 1 – Preliminary screening KOLs

The 3 basic criteria that Ramen Talk keeps in mind are budget, the number of followers and the social media platform that the KOL uses. The tiers of KOLs are outlined in the pyramid graph below.

Source: Daxue Consulting and Double V. Training & Consultancy; F&B market in China report, Ramen Talk’s various KOL marketing strategy

Step 2 – Further screening

After coming up with a list of potential KOLs that fit Ramen Talk’s criteria in the first step, the elimination continues. The KOLs’ video views should be twice as much as the number of followers; likes and comments should outnumber shares; the demographic of the KOL’s target audience should fit Ramen Talk’s target consumers; lastly, a degree of fit between the KOL’s style and Ramen Talk’s brand image is required.

Step 3 – content control

Ramen Talk requires the KOLs to not only discuss the product itself, but also highlight the brand culture and concept. In the meantime, the Chinese instant noodle brand looks for KOLs who present their genuine selves on social media: the more natural, the closer to life, the better the feedback, the better fit for Ramen Talk’s KOL.

Step 4 – campaign monitoring

Lastly, Ramen Talk closely monitors each campaign after they are published. It uses bullet comments to advertise in KOLs’ partnership videos, checks if comments and bullet comments are positive, and 72 hours after posting, Ramen Talk also checks of the number of views has achieved the recent posts’ results.

Strategy 4: Seize the opportunity in crises to gain more exposure

Since COVID-19 period started, the Chinese instant noodle brand has been making decisions rapidly to cater to customers’ new needs. For example, 999 Ganmaoling granules (999感冒灵) has become very popular during COVID-19, and Ramen Talk co-branded with this brand in February 2020 to gain more traffic in a short period of time.

Source: Tmall; Ramen Talk’s co-branding campaign with 999 Ganmaoling

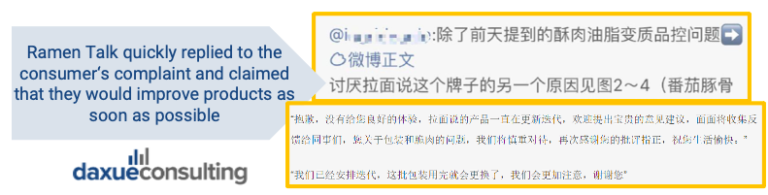

Additionally, Ramen Talk also closely monitors customers’ complaints. They have always replied to complaints or feedback in a timely manner and promised that they would improve products as soon as possible.

Source: Daxue Consulting and Double V. Training & Consultancy; F&B market in China report, Ramen Talk’s prompt response to consumer complaints

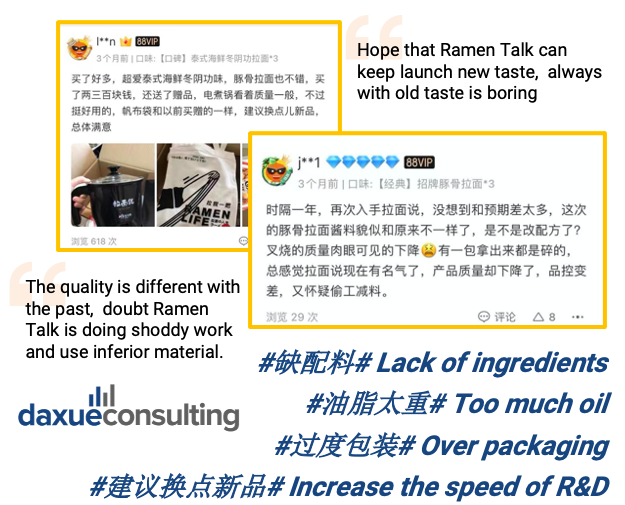

Obstacles: Low margin, pressure on R&D and quality guarantee

- The retail price is 57.9 RMB for 3 bags while it is 81.2 RMB for 8 bags in livestreams. Live streaming sales provide discounts to consumers that is large enough to compare with factory price. This results in low margins for Ramen Talk as the selling price isn’t much higher than the manufacturing cost.

- The outsourcing production makes it difficult for Ramen Talk to guarantee the quality of its products, which may have been reflected in the increasing consumer complaints.

- As Ramen Talk ranks first in the instant noodle category, customers have high expectation of its products. Ramen Talk also faces stress on Research & Development in terms of meeting consumer demands.

Source: Daxue Consulting and Double V. Training & Consultancy; F&B market in China report, Ramen Talk receives complaints while not meeting customer expectation

What brands can learn from Ramen Talk’s marketing strategies

Thanks to its outstanding brand positioning, leveraging livestreaming sales and KOL collaborations, Ramen Talk continues to rank first in instant food category on multiple shopping platforms. Out of all food & beverage brands, Ramen Talk stands out by having a very detailed KOL selection/elimination 4-step process like no other. Though it faces threat of low margin by participating in livestreaming sales, it is beneficial in the long run as it provides the brand with more exposure and a greater sales volume. The threat that requires Ramen Talk’s immediate attention would be quality control: this is also a long-term improvement as making changes in packaging and ingredients takes time and effort. Overall, Ramen Talk has set a great example for new F&B brands who want to establish themselves in the competitive market.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about Chinese F&B brands’ market strategies

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast