Shein is the largest Chinese cross-border fast fashion e-commerce company, with presence in over 150 countries and 235 million downloads across in the world. Its largest markets are the United States and some European countries, including Germany, the United Kingdom, and France.

In the United States, the Trump administration announced on February 1st, 2025, that it would revoke the de minimis exemption, which had allowed Shein to import products from China and sell them at low prices. Although the exemption was temporarily paused on February 7th due to implementation issues, it is likely to be reinstated. This poses challenges for Shein, urging the company to diversify its markets and manufacturing hubs to ultimately “make the beauty of fashion accessible to all.”

Download our report on the future of sustainable fashion in China

For Westerners, the app’s obsession seems to have appeared out of nowhere. However, this type of explosive growth is increasingly common among new Chinese companies that prioritize revenue and growth before profits.

What is Shein?

Founded in 2008, Shein is a B2C Chinese online clothing and accessories retailer selling globally, but not in China. It offers women’s clothing for all occasions and sizes, with additional categories for men, children, and also home life products. With a global warehouse network that allows it to ship to over 220 countries and regions worldwide, the Singapore-based e-commerce is one of the fastest-growing fast fashion brands.

What is the secret behind Shein’s business model?

Shein’s business model is all in its Chinese DNA. Its true advantage is “real-time fashion”, a business model that takes the “fast-fashion” model to its extreme by identifying fashion trends quickly and minimizing manufacturing cycles.

To shorten the time it takes to identify trends, design, manufacture, and ship, Shein uses an in-house design team and comprehensive analysis of fashion trend data. With this, this Chinese company can design, prototype, and ship products substantially faster than its fast fashion competitors. In 2020, it introduced 150,000 new items, averaging over 10,000 per month, surpassing Zara’s annual volume in just one to two months.

The Chinese e-commerce offers similar dresses as other fast fashion brands at half the price, with more diverse styles, varied colors, and patterns. The brand’s mission is to make fashion accessible to all consumers, irrespective of their economic status.

Inside Shein’s successful marketing strategy

Its curated collections, meticulously selected by its team of stylists, offer a catalog with user-friendly navigation. The products are categorized based on gender, body type, promotions, fashion trends, seasonal collections, and styles for a seamless shopping experience. With a vast product range and frequent catalog updates, the app appeals to young, price-conscious consumers seeking trendy selections rather than a lasting wardrobe.

1. Targeting Gen Z consumers

Shein’s main target audience is price-driven customers who love online shopping from all over the world. It sees frequent purchases from Gen Z consumers, predominantly women, as well as parents with children aged 1 to 15 years old.

Therefore, Shein aims to desirable, unique, and socially acceptable for young people. It provides an omnichannel experience with its website, app, and social media, as well as a wide network of fashion influencers. Compared to other generations, Generation Z relies more on social media and targeted mobile advertising to discover fashion brands.

Moreover, it collaborates with Western celebrities adored by young people, including but not limited to Katy Perry, Lil Nas X, Rita Ora, Nick Jonas, and Hailey Bieber to further engage with its target audience. In addition to these collaborations, Shein expanded its partnerships in other segments and regions. In 2021, it collaborated with fashion brand Sarah Kes for a new spring collection and in 2022, the Chinese e-tailer collaborated with Omani celebrity and actress Buthaina Al Raisi.

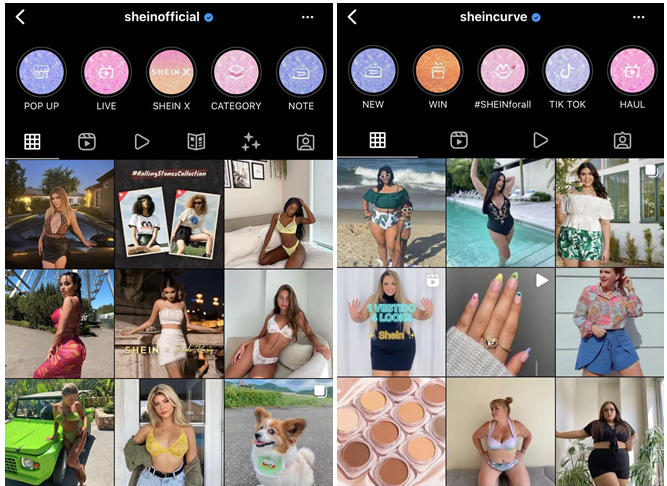

2. Micro-influencer marketing strategy

Partnering with micro-influencers, often individuals with a modest following on Instagram, YouTube, or TikTok, the fashion retailer has established a unique collaboration approach. In exchange for their posts, these influencers receive complimentary product deliveries every month. Some of them can also get up to 10 to 20% commission from the app’s referral sales. This referral strategy is indeed effective, as it helps to spread awareness about the brand.

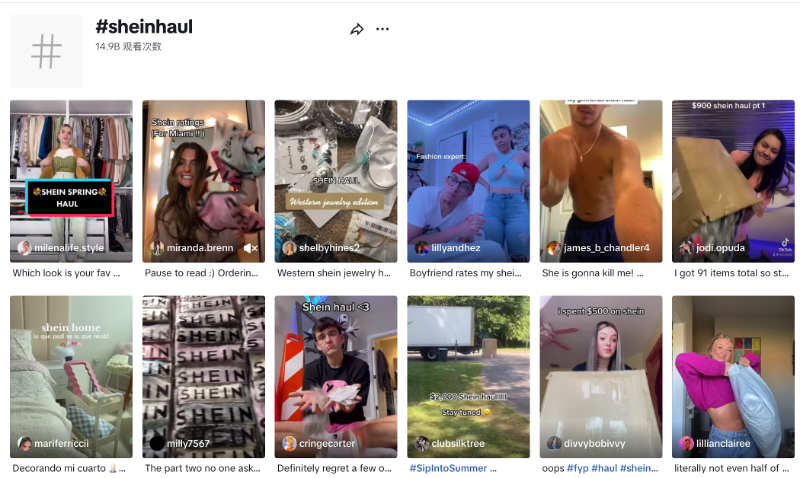

2.1 Shein’s presence on TikTok

It has created armies of fashion bloggers supporting the brand with haul videos of their purchases under the hashtag “#shein”. Shopping purchases are driven by a constant stream of coupons and discount codes. Influencers get free merchandise every month for their posts on TikTok. Others earn commissions on sales directed to Shein.com, above the average affiliate rates that other small stores cannot compete with. Many bloggers, influencers, and YouTubers alike enjoy working with this platform due to the flat rate per video profit made rather than a “brand exclusivity” contract. This creates an easy and convenient working experience for both parties.

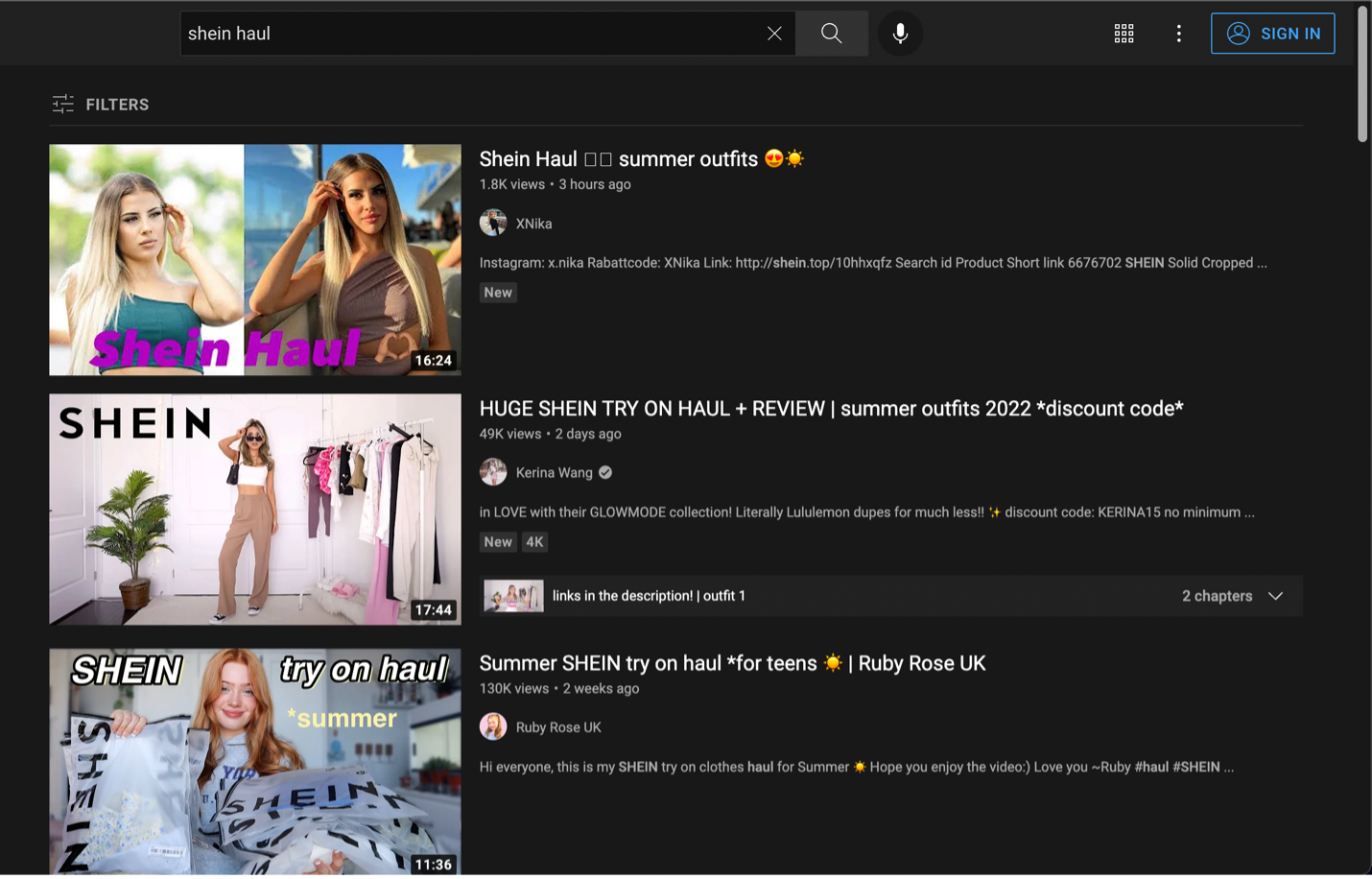

2.2. Shein’s marketing strategy on YouTube

The e-tailing platform has created an environment that allows shoppers to feel smart and savvy to find the perfect outfit in style. The sheer range of items sold through the store and the fact that not everything is always in stock create a somewhat gamified experience. Customers are happy to film themselves unpacking their clothes to try them on and show how they found these inexpensive goods. Sometimes, these products may not be the right size or look cheaper than they appear to be on the Internet, but this risk adds to the fun of a customer’s experience.

Moreover, the app offers customers the opportunity to join its affiliate program. Participants can earn commissions by promoting Shein on social media, where followers place orders through referral links. This program includes options like the Shein Official Affiliate and Partner Affiliate Platforms.

3. No permanent stores but pop-up stores to transform digital focus into in-person engagement

Even though it has no permanent brick-and-mortar stores, Shein has opened pop-up stores in many cities since 2018, such as Las Vegas, Milan, and Seoul. It has also opened a permanent brick-and-mortar space in Japan, where people can make scan the QR codes on the tags and get their products to delivered.

In 2023, Maxine Silva, senior director of brand PR, told Chain Store Age that Shein doesn’t intend to open permanent stores for the moment. However, as a global online retailer, they aim to target cities with a high concentration of online shoppers, offering customers a unique and enjoyable in-person shopping experience. In line with the company’s digital focus, their temporary stores feature social-friendly spots for customers to capture Instagram-worthy photos while shopping.

Shein, Amazon, and Temu: similarities and differences of the three e-tailing giants

Currently, Amazon, Shein, and Temu are three key players in the global e-commerce landscape. Understanding the quirks and differences among the three platforms is key to figuring out what makes Shein stand out, especially when stacked against the more traditional Amazon and the other Chinese platform Temu.

What makes Shein different from Amazon

Amazon taught Western consumers to shop online and build their shopping habits through data collection from search optimization. This app adopted Amazon’s strategy when entering the US, competing head-to-head and asserting dominance with USD 10.3 billion in online net sales in 2022. Amazon stands out with a broader product range and established brands, compared to Shein, which adopts a budget-friendly approach. Both platforms provide flexible exchange and return policies, but Amazon’s delivery, especially with Prime, is notably faster than Shein, which may experience longer delivery times, particularly for products shipped from China. For urgent needs, consumers may prefer Amazon despite potentially higher prices.

A rising Nemesis: Temu

Unlike Amazon, which offers stable product quality, Shein and Temu require careful selection. Initially concentrating on apparel and accessories, Shein has expanded its product range to include sewing and textile, home décor, car decoration, beauty items, small appliances, and toys. In contrast, Temu, a marketplace affiliated with Pinduoduo, offers a wide array of goods, distinguished by its budget-friendly prices, faster shipping, and a distinctive group-buying feature that allows customers to secure lower prices when purchasing items in bulk with others.

What Chinese companies can learn from the app’s success in the West

In a way, this fast fashion retailer helped test the waters for Chinese brands looking to expand abroad, to see what market strategies they can take abroad, and what won’t work. Here’s a look at what Shein’s market strategies worked in the West.

1. Agility and high responsiveness to trends

Shein’s success underscores the importance of swift adaptation to fashion trends. Prioritizing agility in the supply chain, production, and decision-making processes to quickly respond to evolving consumer preferences can provide Chinese companies abroad with a great competitive edge, especially when targeting Gen-Z.

2. Diverse and affordable offerings

Drawing inspiration from Taobao, Shein offers lower prices than any Western fast fashion brand. The brand’s ability to produce large quantities of each item in bulk further reduces costs, facilitating its swift growth.

3. Hunger marketing

The e-tailing platform’s mastery of hunger marketing tactics is evident through its frequent catalog updates, flash sales, and exclusive discount codes. The brand’s IP collaborations and pop-up stores further fuel consumer anticipation, emphasizing the effectiveness of scarcity and exclusivity in driving sales.

4. Omnichannel and social media presence

Shein has a large social media presence, 34.5 million followers on Instagram and 9.9 million followers on TikTok as of February 2025. It regularly uploads content, facilitating product discovery and audience engagement. Their robust digital presence, intertwined with influencer marketing targeting younger shoppers, strengthens the brand’s reputation through clothing hauls and reviews.

5. Micro-influencer marketing

This app’s strategy mirrors KOC marketing in China, fostering mutually beneficial partnerships. This approach exposes the brand to new audiences through fashion-forward clothing, offering smaller influencers free clothes in exchange for opinions and social media exposure. Leveraging lesser-known influencers minimizes marketing costs and adds credibility, as smaller influencers are often perceived as more relatable.

What to avoid when going abroad

Despite its success in the global market, it is not without controversies. One issue involves imperfectly implemented body positivity, where heavily photoshopped images contradict the brand’s inclusive stance.

Shein has also faced criticism for poor social responsibility, with allegations of unsustainable practices, poor working conditions, and data breaches.

Cultural insensitivity, excessive ads, and notifications contribute to negative user experiences.

Additionally, the fast fashion retailer is entangled in numerous lawsuits for design theft and copyright infringement, raising ethical concerns despite its substantial valuation.

How revoking the de minimis exemption can affect Shein

On February 1st, 2025, the Trump administration revoked the de minimis exemption, which allowed imports under USD 800 to enter the U.S. duty-free and with minimal inspections. It also announced an additional 10% tariff on Chinese imports. However, the sudden announcement left custom officials, postal services, and companies unprepared. Therefore, soon on February 7th, the Trump administration paused the policy change to develop a more structured and feasible implementation plan.

If the de minimis exemption is removed, it can significant challenges to Shein, which has relied on the policy to import products from China and sell them at a cheap price. This change may lead them to raise their prices, potentially weakening its competitive edge as an affordable e-commerce fast fashion brand. Additionally, Shein may face supply chain and logistics challenges, including product delays.

To reduce its reliance on the U.S. market as its main audience and China as the main manufacturing hub, Shein has been diversifying its audience and manufacturing centers to provide its global consumers with more locally made products.

Shein’s marketing strategy: how the Chinese fast-fashion brand is conquering the West

- Shein is a Chinese B2C fast fashion e-commerce giant targeting women, Gen Z consumers, and young parents worldwide in over 150 countries. Its success lies in its “real-time fashion” business model, emphasizing rapid trend identification, in-house design teams, and quick manufacturing cycles, enabling the release new pieces daily.

- The e-commerce targets Gen Z consumers globally through an omnichannel approach, collaborating with Western celebrities, employing micro-influencers on platforms like TikTok and YouTube, and offering an affiliate program for user-generated content promotion.

- Despite being an online retailer, the app engages consumers through pop-up stores in various cities, enhancing the in-person shopping experience and aligning with its digital focus.

- Shein’s success proves that some marketing tactics used in China are also effective in the West. The utilization of strategies like micro-influencer marketing, frequent discounts, and low pricing inspired by Chinese platforms like Taobao, along with a strong social media presence, has been particularly fruitful.

- The global expansion also highlights the crucial significance of steering clear of controversies tied to body positivity, social responsibility, cultural insensitivity, and legal issues.

- In the U.S., Shein faces a significant obstacle: the potential end of the de minimis exemption, which has allowed it to bypass duties and inspections. Therefore, it continues to reduce its reliance on the U.S. as its main market and China as its main manufacturing hub.