Sportswear industry in China. Athleisure combines the words athletics and leisure. This term refers to the global fashion trend of sportswear clothing designed for workouts which can be worn in non-athletic settings like during work, casual or even social occasions. With the athleisure trend gaining popularity worldwide, consumers started to recognize that sportswear can be well-designed and fashionable at the same time. Meanwhile, the rising awareness of health has been a growing consumer market trend in China. This healthy lifestyle trend coincided with the global athleisure fashion trend and rapidly took off among Chinese consumers both females and males, especially the young generation aged between 15 and 35 years old. The Chinese middle class has been increasingly willing to pay more for higher quality, newness and lifestyle products. With the demand for high-quality athletic clothes, a growing number of US companies began to develop products mixing fashion with sportswear for the Chinese market.

Sportswear industry in China: More health conscious, Chinese consumers are embracing the athleisure movement

As the purchasing power of the growing Chinese middle-class increase, more consumers pay attention to their health and want to pursue a fit lifestyle. The Chinese sports industry is still underdeveloped. Sports are 3 percent of GDP in the U.S. but accounted for just 0.7 percent of China’s GDP last year, or 474 billion yuan ($72 billion), according to a January report by ICBC analyst Jianpeng Yu. But the Chinese government invests massively on the domestic sports market and is encouraging the healthy trend, hoping to raise more interest in sports before Beijing hosts the Winter Olympics in 2022. Within its 13th Five-Year Plan, the General Administration of Sport of China has the goal of creating an industry worth 3 trillion yuan, which could contribute around 1 per cent of the national gross domestic product by 2020, compared to 0.7 per cent in 2015. According to statistics, China’s professional sports industry could grow by a compound annual rate of more than 20 per cent to hit 1.6 trillion yuan (US$242 billion) in annual revenue by 2025, a report by venture capital firm China eCapital Corp showed. The fitness industry is growing quickly with sales of 127.2 billion yuan in 2014, an 84 percent increase over 2009, according to China Daily newspaper. There were 3,650 fitness clubs in 2014, up from 2,930 in 2009, reports Bloomberg. Meanwhile, the larger market for amateur recreational sports will grow from the current 1.2 trillion yuan to 3.5 trillion yuan over that period, with a 12 percent compound annual growth rate each year. Also, sport-related app downloads are expected to reach 248 million, including health analysis (activity tracker), competition with friends, and sharing sports pictures. Nearly 60% consumers usually post pictures on different social media when they work out or play other sports. Fuelled by social media and the influence of celebrities, the athleisure wear trend is not only for people who want to get to the gym after work, but also became a fashion trend, especially among Chinese millennials.

As the purchasing power of the growing Chinese middle-class increase, more consumers pay attention to their health and want to pursue a fit lifestyle. The Chinese sports industry is still underdeveloped. Sports are 3 percent of GDP in the U.S. but accounted for just 0.7 percent of China’s GDP last year, or 474 billion yuan ($72 billion), according to a January report by ICBC analyst Jianpeng Yu. But the Chinese government invests massively on the domestic sports market and is encouraging the healthy trend, hoping to raise more interest in sports before Beijing hosts the Winter Olympics in 2022. Within its 13th Five-Year Plan, the General Administration of Sport of China has the goal of creating an industry worth 3 trillion yuan, which could contribute around 1 per cent of the national gross domestic product by 2020, compared to 0.7 per cent in 2015. According to statistics, China’s professional sports industry could grow by a compound annual rate of more than 20 per cent to hit 1.6 trillion yuan (US$242 billion) in annual revenue by 2025, a report by venture capital firm China eCapital Corp showed. The fitness industry is growing quickly with sales of 127.2 billion yuan in 2014, an 84 percent increase over 2009, according to China Daily newspaper. There were 3,650 fitness clubs in 2014, up from 2,930 in 2009, reports Bloomberg. Meanwhile, the larger market for amateur recreational sports will grow from the current 1.2 trillion yuan to 3.5 trillion yuan over that period, with a 12 percent compound annual growth rate each year. Also, sport-related app downloads are expected to reach 248 million, including health analysis (activity tracker), competition with friends, and sharing sports pictures. Nearly 60% consumers usually post pictures on different social media when they work out or play other sports. Fuelled by social media and the influence of celebrities, the athleisure wear trend is not only for people who want to get to the gym after work, but also became a fashion trend, especially among Chinese millennials.

Young wealthy Chinese are spending more on healthy living

“We have seen a great surge of consumers who have started to participate in running and other sports,” said Colin Currie, managing director for Greater China of Adidas, during an interview for Bloomberg. In recent years, the number of different professional athletic games and activities has been growing rapidly, for instance, cycling races and marathons. According to the Chinese Athletics Association (CAA) vice president, Du Zhaocai, the number of marathons and road running races hosted or co-hosted by the CAA in 2015 reached 134, which was a 160% increase compared to the year 2014. “In 2010, there was only a total of 13 marathons, and now it has increased ten times. Now we can say that marathon has become the most popular competition in China which contributes to promoting a healthy lifestyle.” Du Zhaocai said to China Daily. “The running business is booming, golf is gaining a good share, and of course the big price in China is football and training,” founder and chief executive Kevin Plank told South China Morning Post in an interview.

China is now the second largest sneaker market in the world after the US, with Nike as the leader, followed by Adidas. With the rapid growth of the sports sector supported by the corporate investment, the increase in purchase power and the growing awareness of the importance of a healthy lifestyle, sports-related consumption is booming in China, even though China’s global economy is slowing down. According to Fujian Daily News, wealthy Chinese consumers with an average monthly income between ¥16,000 and ¥41,000 spend at least ¥2,000 on their sports equipment annually. In 2014, sporting goods sales amounted to about ¥150 billion (22.49 billion USD) in 2014, and it is expected to reach ¥180 billion (26.99 billion USD) in 2019.

Chinese consumers start to ditch traditional luxury shopping for Western sports brands

Instead of buying prestige luxury brands, Chinese consumers start to shift their spending to more active and lifestyle brands like Nike and Adidas. “I used to buy a lot of luxury brands, but in the last year or so I’ve been purchasing more of the sports brands because they are more comfortable and more fashionable,” said Alex He, Beijing resident interviewed by South China Morning Post. Casualwear now occupies more space in local wardrobes, as luxury loses cultural clout, argues Jerry Clode for BOF. Among other factors, this growing enthusiasm for active lifestyle fashion is undoubtedly contributing as well to China’s luxury slowdown. China’s sportswear market is expected to surpass the luxury goods market by 2020, according to Euromonitor International, with double-digit growth each year to 280.8 billion yuan ($42.6 billion) compared with luxury’s single digit growth to 192.4 billion yuan ($29.2 billion) during the same period.

As Chinese consumers are becoming more global, they turn more and more to the big foreign sports brands, which are dominating China’s market. Increasing competition is hurting many of China’s domestic sports brands like Anta, causing them to partner with other foreign brands to stay on course.

Athleisure sub-brands: a strategy to reconnect with Chinese Millennials

Lululemon was one of the earliest athleisure sports brands in the world, with its iconic active wear line of yoga clothes, recently followed by new brands like Lorna Jane. International sportswear brands such as Nike, Adidas and Under Armour (UA) have already responded to the athleisure trend. Riding the wave, many foreign sports brands, and fashion brands have developed similar products or even sub-brands for athleisure, such as the sub-brand Adidas NEO targeting Chinese born in 90’s/00’s with affordable prices for China.

| Brand | Lifestyle products | Launching time in China |

| Nike | Nike 360 (dedicated retail stores), Nike Air | 2002 |

| Adidas | Adidas Originals, Adidas NEO (dedicated retail stores)

Adidas Y3 | 2002

2006 |

| New Balance | Series products, e.g. classic 999 | 2006 |

| Puma | PUMA Black Label (dedicated retail stores) collaboration with celebrities, e.g. PUMA SOCK X STAMPD | 20013 |

| Under Armour | Under Armour Sportswear (UAS) | Not launched in China yet |

| Asics | Asics Tiger | 2015 |

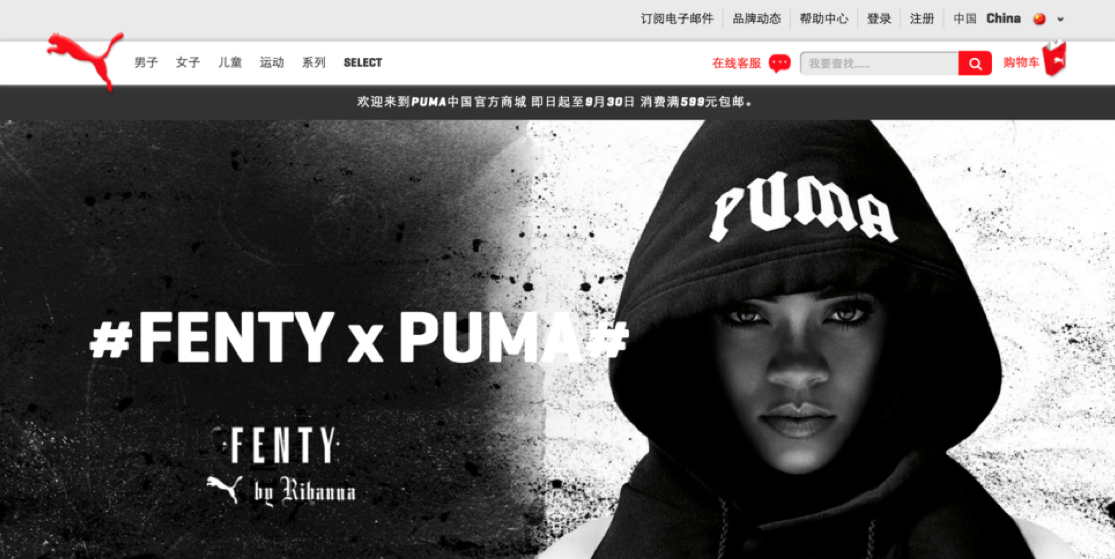

Atleisure products can be a way to connect with China’s next generation. While giants like Nike, Adidas, and New Balance have already cemented their reputation as sportswear labels that have a heavy influence on fashion tastes in athletic gear, some brands like Puma and UA are still in the early stages of a push beyond sports and sweats, writes the South China Morning Post. For instance, Puma, accused of being a boring brand mainly because of its design, successfully repositioned itself and became very popular among the young generation since its collaboration with Rihanna. The pop star recently launched the autumn/winter 2016 Fenty Puma by Rihanna line with a focus on ink and painting style, inspired by Japanese street culture. The campaign, heavily promoted on Weibo and popular online fashion magazines like Elle China and 1626, was a great success. In the same vein, UA chose the award-winning fashion designer Tim Coppens from Adidas to craft a new collection called UAS (Under Armour Sport) to be launched in China this autumn. “UAS will bring a young, fresh and modern voice to sportswear and reflects the insights we’ve gained as a performance brand now applied to the everyday wardrobe. Consumers have the expectation that performance product is not just functional but is fully executed through fit and style.” Said the founder and chef executive Kevin Plank to Retail Info System News.

Atleisure products can be a way to connect with China’s next generation. While giants like Nike, Adidas, and New Balance have already cemented their reputation as sportswear labels that have a heavy influence on fashion tastes in athletic gear, some brands like Puma and UA are still in the early stages of a push beyond sports and sweats, writes the South China Morning Post. For instance, Puma, accused of being a boring brand mainly because of its design, successfully repositioned itself and became very popular among the young generation since its collaboration with Rihanna. The pop star recently launched the autumn/winter 2016 Fenty Puma by Rihanna line with a focus on ink and painting style, inspired by Japanese street culture. The campaign, heavily promoted on Weibo and popular online fashion magazines like Elle China and 1626, was a great success. In the same vein, UA chose the award-winning fashion designer Tim Coppens from Adidas to craft a new collection called UAS (Under Armour Sport) to be launched in China this autumn. “UAS will bring a young, fresh and modern voice to sportswear and reflects the insights we’ve gained as a performance brand now applied to the everyday wardrobe. Consumers have the expectation that performance product is not just functional but is fully executed through fit and style.” Said the founder and chef executive Kevin Plank to Retail Info System News.

UA winning strategy: finding the right balance between an online and offline presence

At the same time, Puma’s transition is also happening in retail shops. The brand has opened three stores dedicated to its collection of luxury lifestyle clothing and shoes Black Label in Beijing and Shanghai. Whereas most luxury brands have been closing their stores in recent years in China, sportswear giants are expanding their store network, to showcase the brand and spread their lifestyle positioning. Similarly, Under Armour, the US sports brand, opened in September 2015 one of its largest international brand house store totaling 15,000 square feet on Shanghai’s busiest high street, Middle Huaihai Road. That outlet is its second largest flagship store in the world, behind the similar one in New York. Plank revealed that UA aims to open 115 stores this year in China, with another 100 planned for 2017, bringing the total number of outlets to more than 300 by 2017. In addition to investment in direct-to-customer channels, the brand is working as well on having a balance of store and online sales. “It is important to have a very deliberate e-commerce strategy to cater for the rapidly changing habits of consumers.” Plank said. UA partnered with the two largest online marketplace operators, Alibaba and JD.com, and its e-commerce business in China had hit last year’s total sales by May, which represented about 20 per cent of its total sales in the country. According to Retail Info System News, UA’s e-commerce presence in the country is experiencing amazing growth, with year-to-date revenues up 157%.