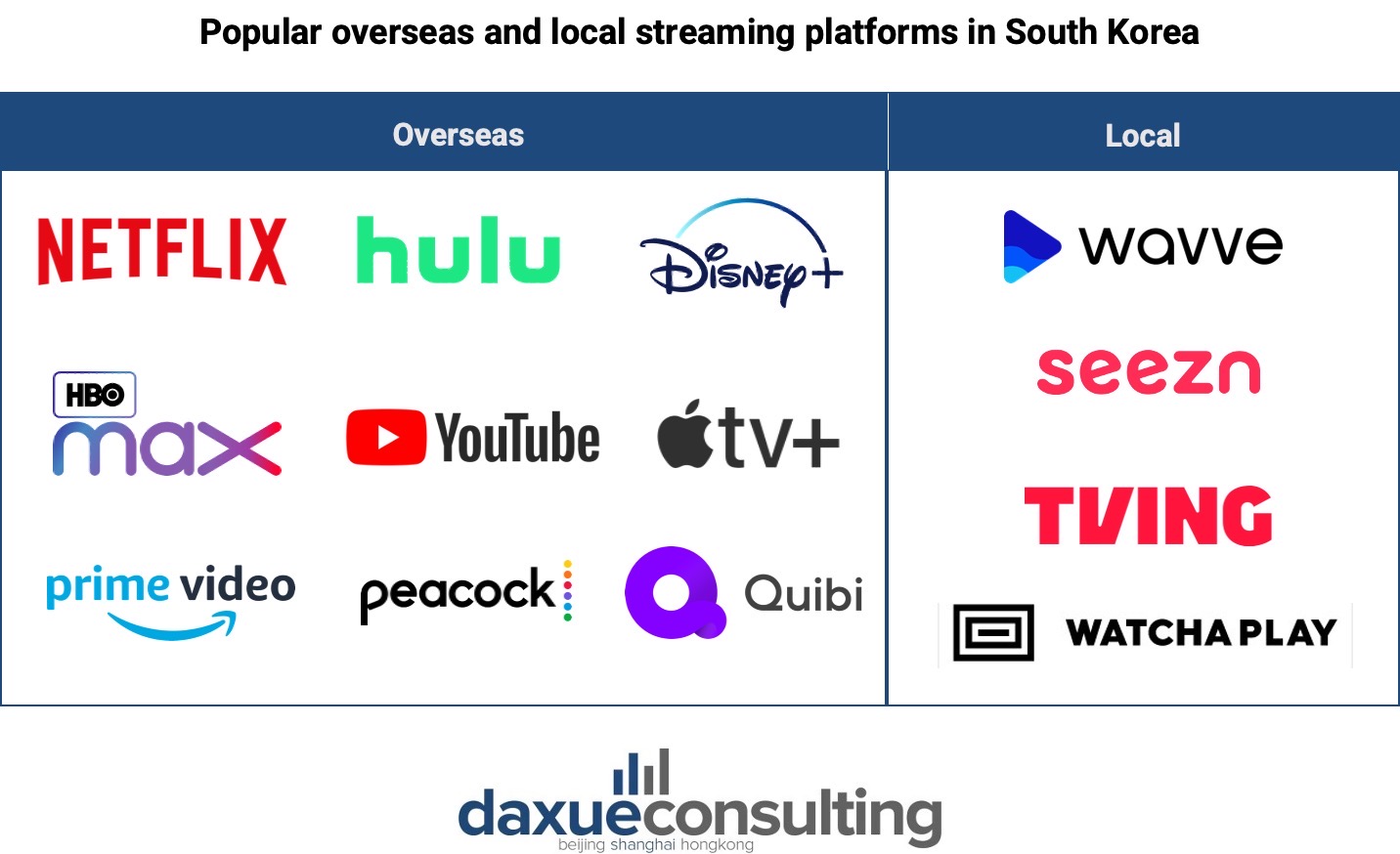

South Korea has emerged as a major player in the global entertainment industry, with its unique K-pop, K-drama, and other K-culture content gaining immense popularity worldwide. As a result, the streaming platforms in South Korea have become increasingly important in the global market. With more and more international streaming services launching their platforms in Korea and domestic OTT services expanding internationally, it is crucial to understand the dynamics of this market.

Global streaming platforms: an industry worth billions of subscribers

Over-the-Top (OTT) services have revolutionized the way viewers access movies and TV shows. Instead of relying on traditional cable, broadcast, or satellite TV platforms, viewers can now access their favorite content directly over the internet. This has made it easier and more convenient for people to watch their favorite shows and movies from anywhere and at any time. In the OTT video market specifically, the revenue can be classified into several smaller markets:

- Video Streaming (SVoD): streaming on a subscription basis

- Pay-per-View (TVoD): paying for digital video content to watch it online

- Video Downloads (EST): downloading digital video content

- Video Advertising: advertising in video streaming

The booming future of the global OTT market

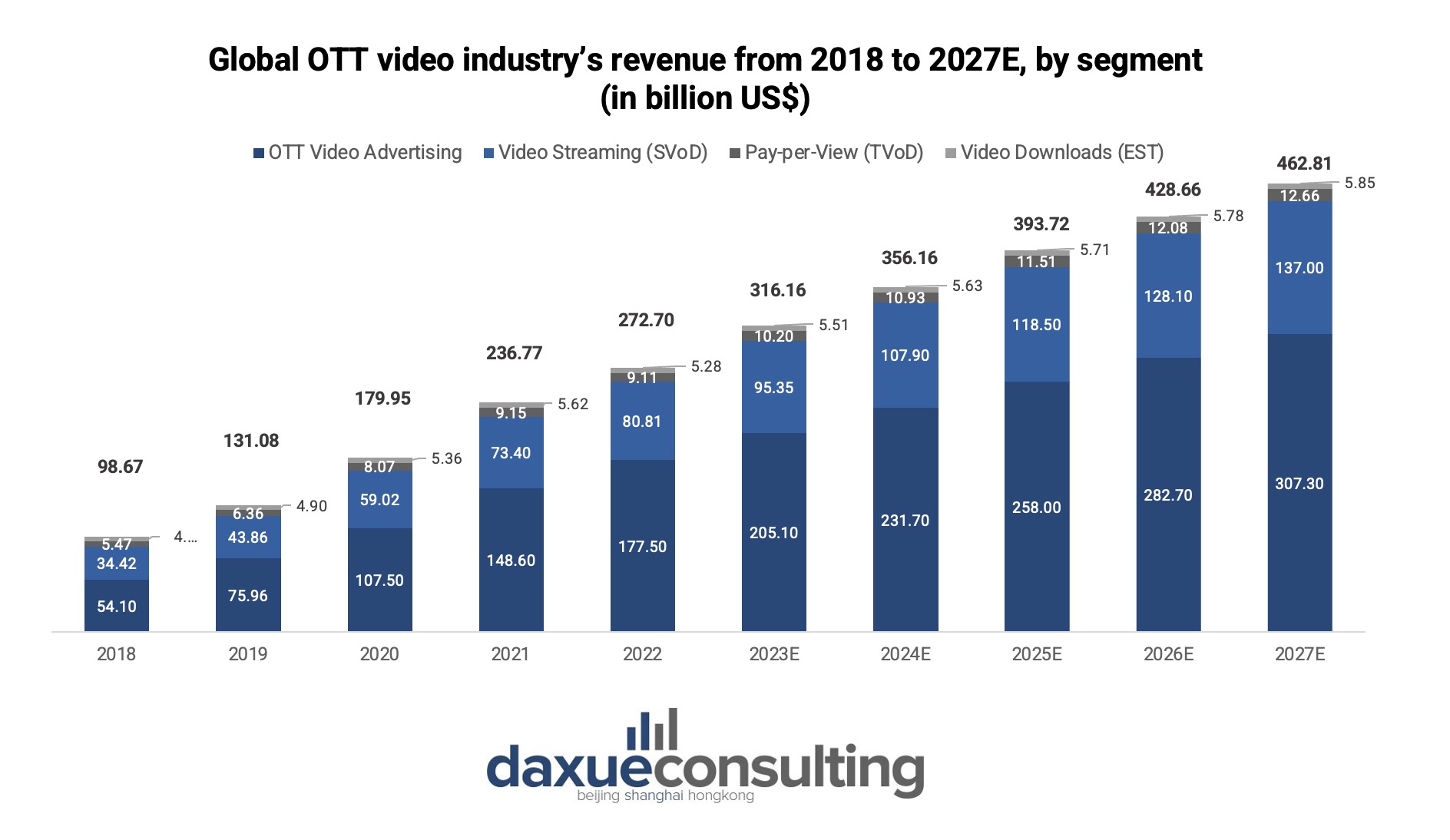

The global OTT market is expected to continue growing. The market is expected to be worth USD 316.10 billion in 2023, with an annual growth rate of 10.01% until 2027, reaching a total of USD 462.9 billion. The largest revenue in this market is being generated by OTT video advertising. Moreover, despite the slowing growth of new subscribers, by 2025, it is predicted that almost 50% of internet users around the globe would subscribe to an OTT video service platform.

The industry of streaming platforms in South Korea is growing by 8.25% yearly

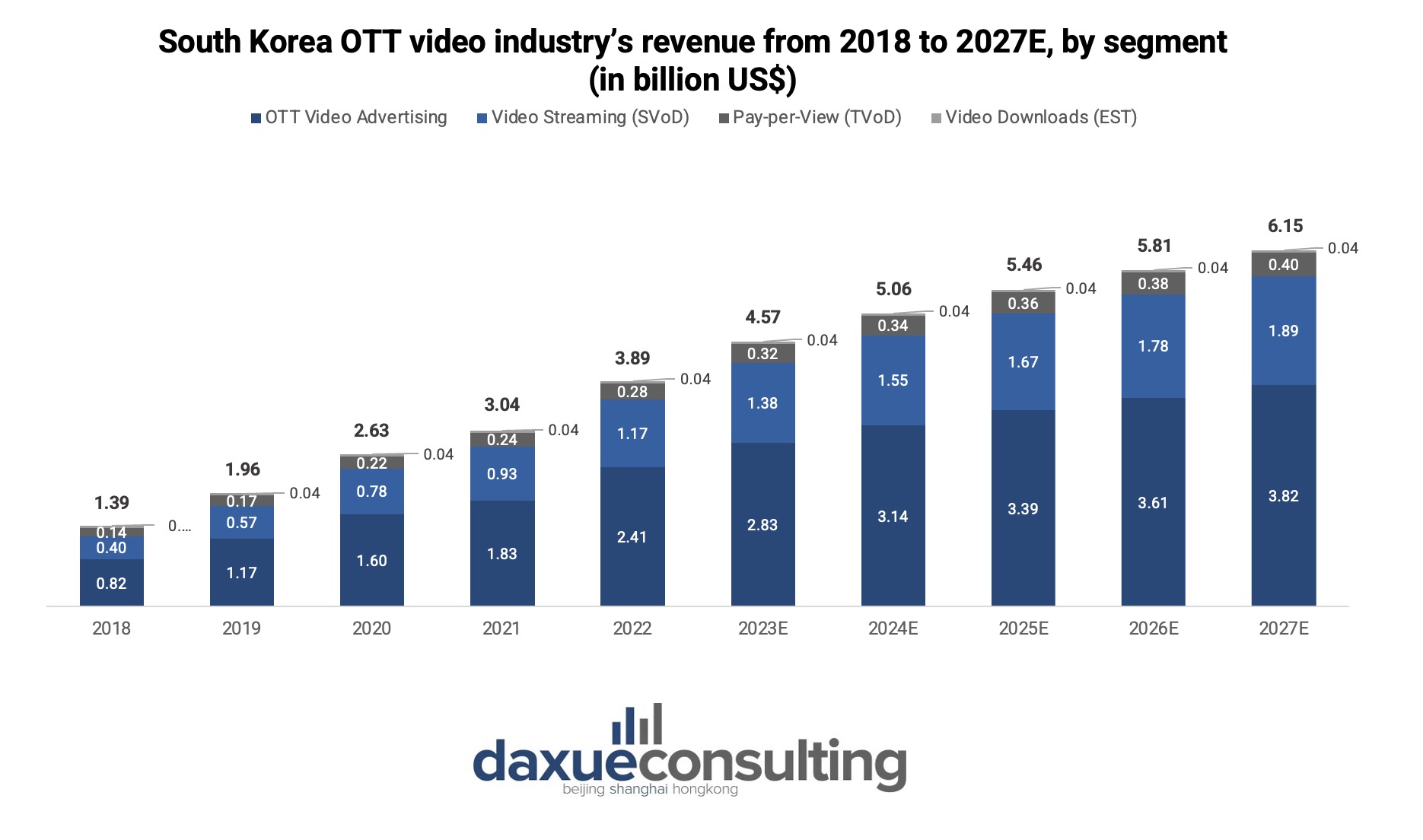

South Korea’s OTT video market revenue is predicted to reach US$4.57 billion in 2023 and grow by 8.25% annually, reaching US$6.28 billion in 2027. Excluding OTT Video advertising, subscription-based video streaming platforms (SVoD) generated the most revenue in South Korea.

Most streaming platforms in South Korea follow an subscription-based model

Most streaming platforms in the country follow an SVoD business model. However, YouTube is one of the exceptions. The platform operates as a free Advertisement-Video-on-Demand (AVOD) platform, while also offering an SVoD known as YouTube premium. This allows users to access premium content without ads, while still having the option to use the free version with advertisements.

COVID-19 supported the growth streaming platforms in South Korea

When the pandemic hit in 2019, it drastically changed people’s habits in South Korea, with many people staying at home. As a result, there was a surge in content consumption and OTT popularity. Binge-watching has also become more convenient with the introduction of online streaming services. Although restrictions lifted, people in South Korea still retain some of the habits shaped by the pandemic.

There is also an increase in single-person households in Korea. Young adults in their 20s and 30s account for the majority of this group. Since purchasing a television is a significant financial burden, young adults are turning to OTT platforms where they can watch shows on their phones and laptops.

Content diversity is crucial for streaming platforms in South Korea

Content diversity plays a massive role in the popularity of international OTT streaming platforms in South Korea. In particular, platforms that feature popular domestic content, such as reality shows or TV series, tend to be high in demand. This is why purchasers in South Korea prefer to use OTT platforms such as Netflix, Tving, and Wavve compared to other platforms such as Disney+ and Apple TV+. By offering a range of local and international content, these platforms cater to a wide variety of viewing preferences and tastes, making them a top choice among South Korean consumers.

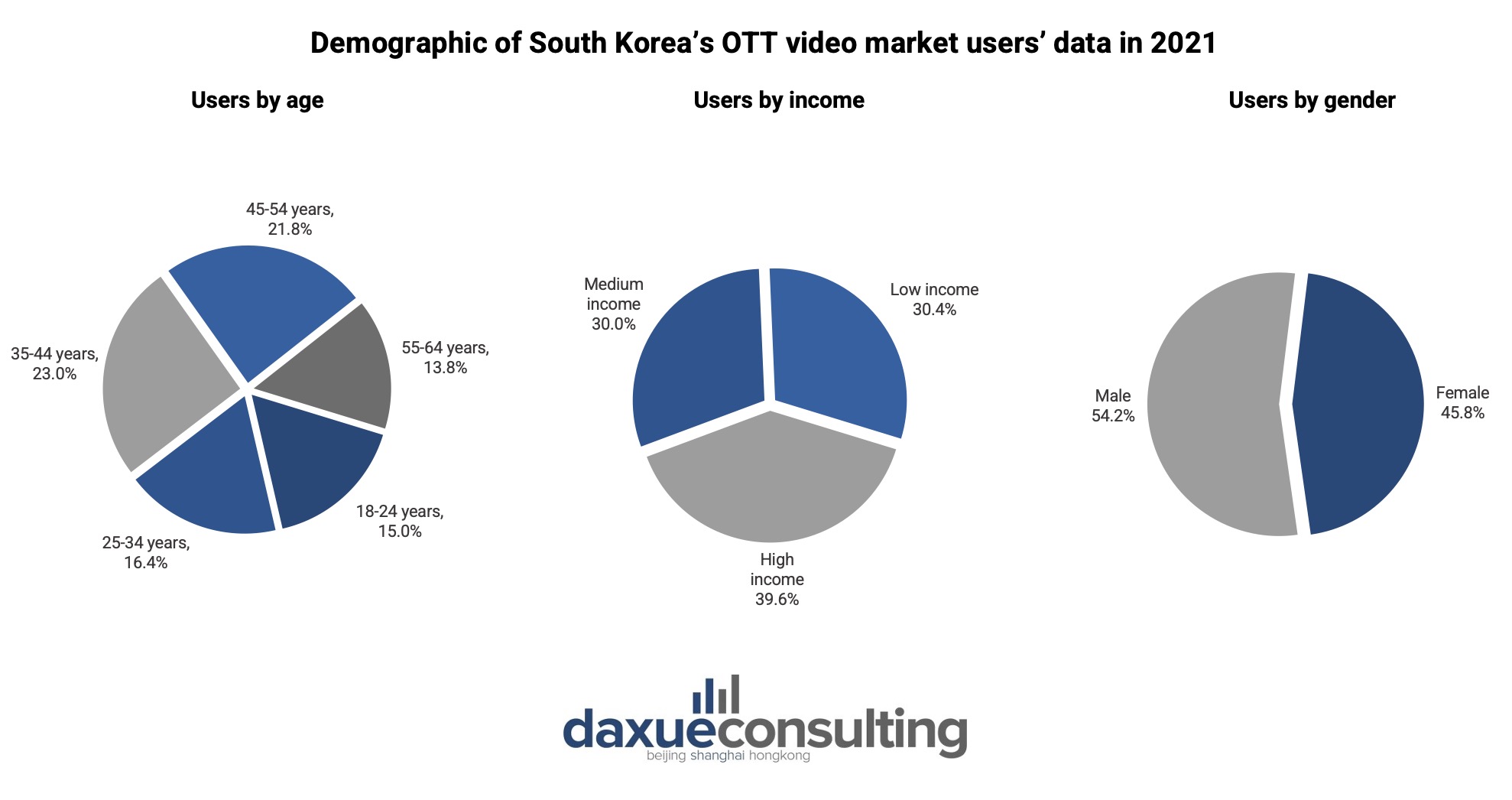

Understanding the demographics of OTT platform users in South Korea

Free OTT video platforms are the most preferred among South Koreans

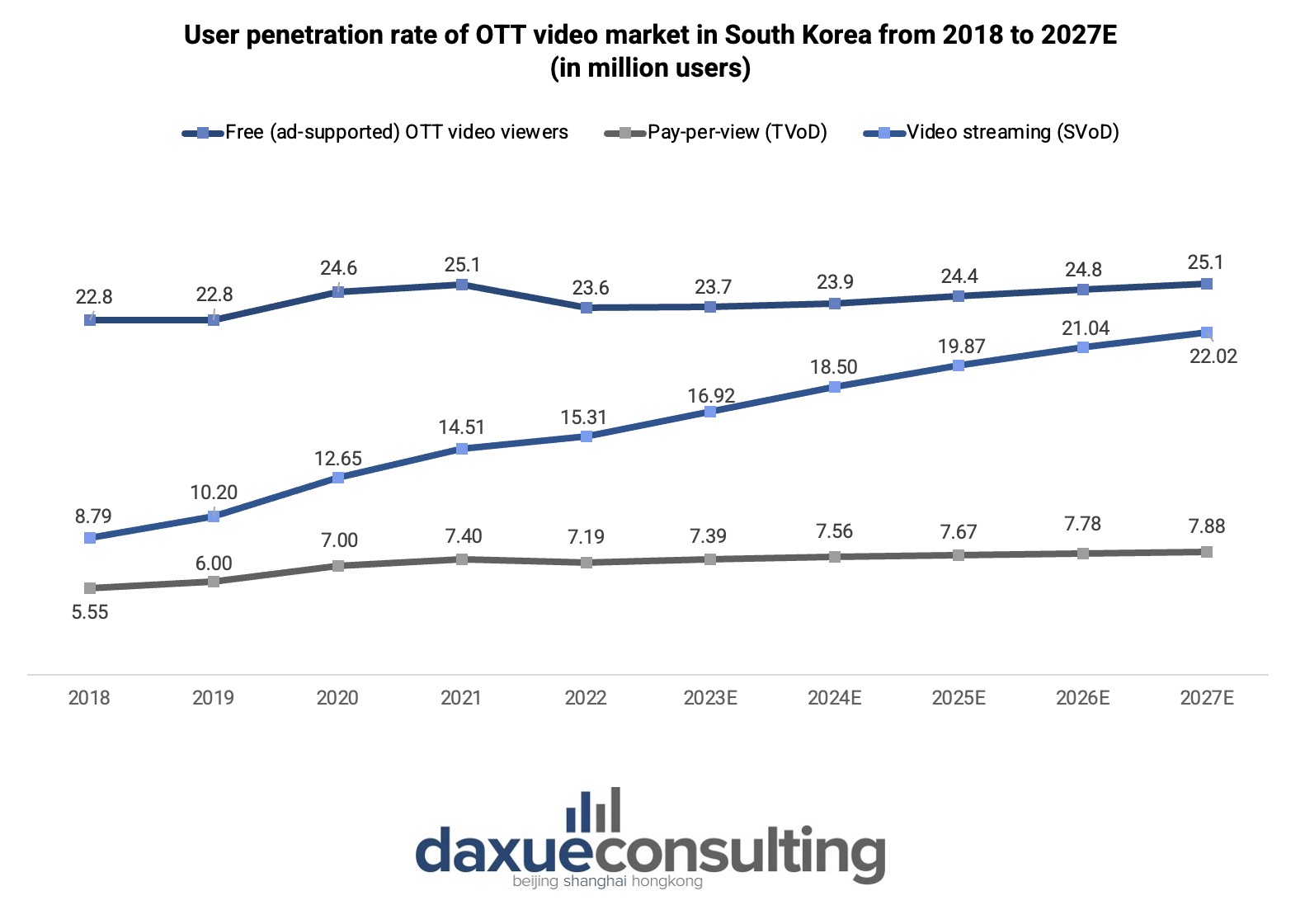

By 2027, 61.93 million people in South Korea are expected to be OTT video market users. Most Koreans prefer free (advertisement-supported) OTT video platforms. This segment has the highest penetration rate in South Korea. The number of subscription-based streaming platforms (SVoD) users is also catching up.

The largest user group of OTT platforms in South Korea is aged 35-44 years old

Categorizing the OTT video platform users in South Korea based on age, people aged 35-44 years make up the largest percentage at 23% followed by 45-54 years old with 21.8%. 39.6% of OTT platform consumers are also categorized in the high-income group. Compared to their female counterparts, males are taking a slightly larger share, 54.2%.

Despite high-income accounting as the largest group, South Koreans are still price sensitive. For example, Coupang lost a number of its paid-membership program users when the company decided to increase its OTT service’s membership price. Its relatively low quality and quantity of original content also did not help the company to retain its clients.

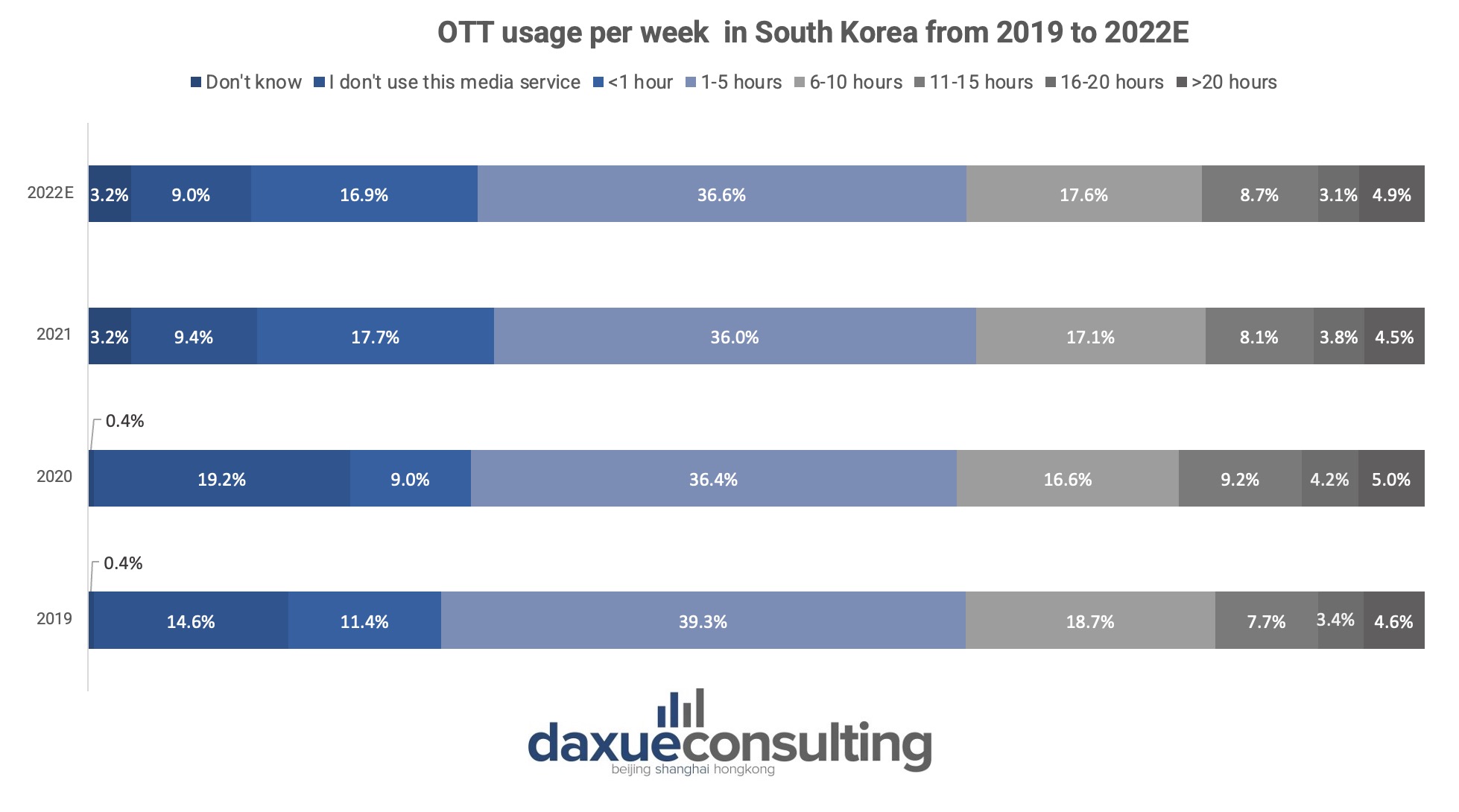

More South Koreans are using OTT media service and for longer hours

Most Koreans watch digital videos for 1 to 5 hours each week, and more and more people are increasing their screen time for OTT platforms. Moreover, the number of people using OTT services is predicted to increase throughout the years.

OTT usage in South Korea from 2019 to 2022E

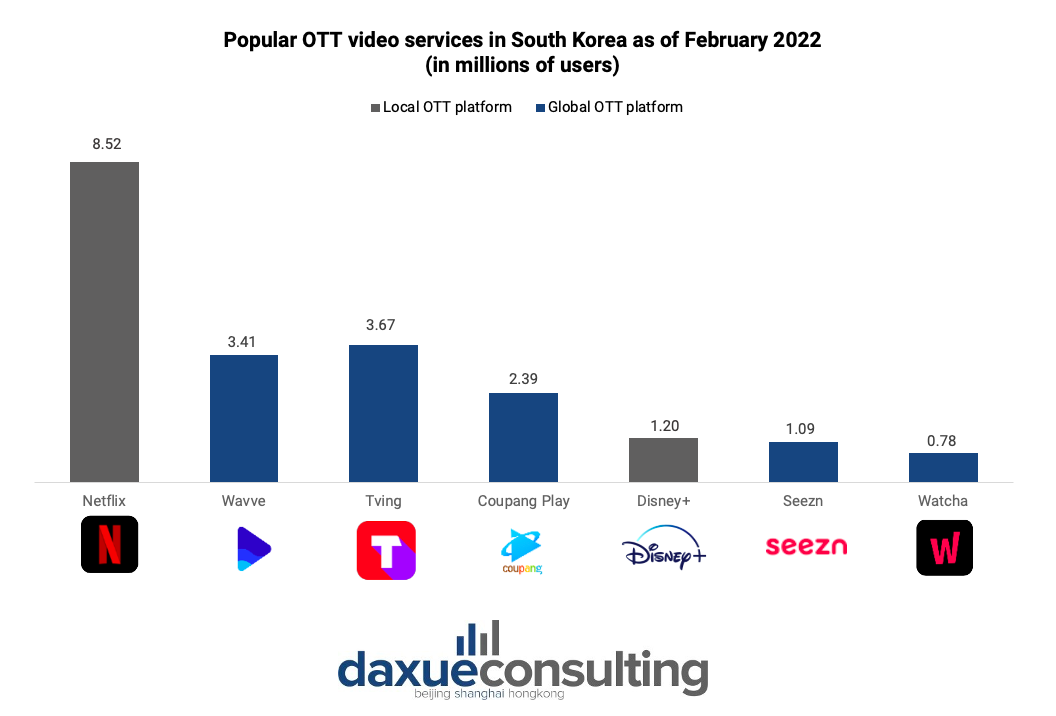

Foreign companies are leading players, globally and locally

Netflix, a top subscription-based platform

Netflix is proving to be a powerhouse on the global stage. According to Forbes, in the year the pandemic hits, Netflix was the top-downloaded streaming application worldwide, recording 59.1 million downloads in 2020. Netflix’s leading position can also be seen in South Korea. Among Subscription-Video-on-Demand (SVoD) segment, Netflix is by far the most used SVoD platform in South Korea.

How Netflix is winning over South Korean audiences with user satisfaction and localization

There are several factors contributing to Netflix’s success in South Korea. Although a it is a foreign company, it has been great at localization. It doesn’t only provide high-quality subtitles but also tailored and even original content for the Korean market. This is not an easy feat as they would have to compete with local players such as Tving and Wavve.

In addition to the quality of content, content diversity is important, especially for South Korea’s Gen Z, according to a National Research Foundation of Korea study. Content diversity together with social relations (recommendations from friends and acquaintances) and active participation (taking part in Netflix’s community both online and offline), positively affect the continuation of user intent.

YouTube, the app that over four-fifths of the population uses

YouTube is the most popular app used in South Korea. In fact, as of 2022, about 81% of the population used YouTube. Although more individuals in South Korea use Netflix’s subscription-based services compared to YouTube Premium, the majority of Koreans access YouTube for free with advertisements.

The competition in the OTT market in South Korea is intensifying, and it’s challenging to predict future winners when the market is still not aligned. Although Netflix and Youtube are strong companies globally and is anticipated to continue thriving, local services like Wavve are also robust, and thus, should not be underestimated.

What to know about streaming platforms in South Korea:

- The global OTT platforms market is expected to continue growing and will be valued at USD 316.10 billion in 2023, with annual growth rate of 10.01% until 2027.

- The revenue from the OTT video market in South Korea is anticipated to reach USD 4.57 billion in 2023 with subscription-based OTT streaming platforms producing the most revenue, after OTT Video advertising.

- COVID-19 supported the growth of streaming platforms in South Korea, with a surge in content consumption and OTT popularity.

- Content diversity plays a significant role in the popularity of international OTT streaming platforms in South Korea, particularly platforms that feature popular domestic content. Free OTT video platforms are the most preferred among South Koreans, and the largest user group of OTT platforms in the country is aged 35-44 years old.

- Both homegrown and international OTT streaming platforms exist in Korea. As more global streaming platforms are entering the nation, the competition became even more heated. Therefore, despite taking first place when compared to other SVoD, Netflix might lose its position as the market is settling down.