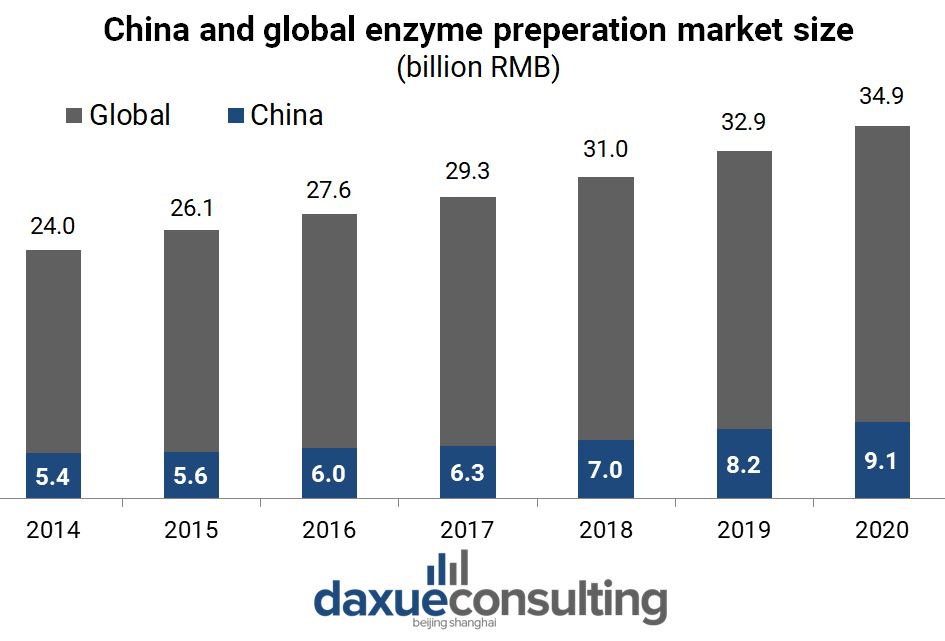

In recent years, the scale of global enzyme market has been gradually increasing. The value of the enzyme market in China reached 35 billion RMB in 2020, increased from 24 billion RMB in 2014. China’s enzyme market is growing with the global trend and gaining competitiveness in the international market. After 50 years’ development, China has become one of the largest producers of enzymes.

Enzymes are a type of protein that is naturally found in the human body, along with other living organisms. As they help create chemical reactions, they are commonly used in the food, agriculture, cosmetics and pharmaceutical industries. For example, enzymes (or rather, the yeast that contain them) are crucial in brewing beer, creating cheese and extracting fruit juice. Today, enzymes are even making their way into the development of green technology.

Overview of China’s enzyme industry

Market size: the enzyme market in China is growing with the global trend

With the improvement of industrial technology and the expansion of application fields, the enzyme industry in China has developed rapidly. According to data from Pacific Securities, from 2008 to 2017, the domestic production of enzyme preparations increased from 615 thousand tons to 1.34 million tons, with an average CARG (Compound Annual Growth Rate) of 9.03%.

The revenue of the enzyme market in China is also growing with the global trend. In 2014, the market value of enzyme preparations in Chinese market was 5.4 billion RMB, and it has increased to 9.1 billion RMB in 2020.

Data source: Pacific Securities, designed by daxue consulting, China’s enzyme preparation market size

Import and export: Chinese enzyme industry is becoming more competitive

In the 1990s, the enzyme market in China highly relied on imports. However, steeping into the 21st century, the dynamic has changed. The research and development level in China’s enzyme market has improved. As a result, many enzyme preparation manufacturers have formed independent brands. Those domestic brands and products are gaining recognition in the international market, and the overall export volume of enzyme products in China is on the rise. According to China customs data, in 2018, China exported $424 million US worth of enzymes and only imported $244 million US. The top export destination is the United States, and the top enzyme producing region in China is Jiangsu province. The top import origin for emzymes in China is Denmark.

The food enzyme market in China

With the continuous development of China’s food industry, including the creation of new snacks and the further introduction of beer, cheese and fresh baked goods, the marketplace for food enzyme preparations in China is also developing. Food enzymes are the largest segment in the enzyme market in China, with a proportion of 36%, followed by 23% of detergent enzyme and 20% of feed enzyme.

The applications of food enzymes preparations are expanding

The three major uses of enzyme preparation in the food industry are: fruit and vegetable processing, baked goods, and dairy products. Enzyme preparations are newly developed multifunctional pasta additives, which can be used to whiten flour, strengthen gluten, increase flavor and other special needs of different pasta, mainly including amylase, oxidase, protease, and catalase complex enzymes.

Enzyme plays an important part in the development of food and beverage products. Some customized enzyme solvents can be used for the processing of fruits, vegetables, cheese, protein, grain and fat.

Baked goods drive the enzyme market in China – learn more about the market for baked goods

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast