Evergrande Real Estate Group was established in 1997 in Guangzhou, China. In 2016 it had more than 500 real estate projects in China in more than 180 cities, which made it the world’s largest real estate company. The group is also engaged in investment in sports parks, electric vehicles, and has stakes in food and beverage, bottled water, grocery, dairy and other business across China. In 2010, Evergrande even bought the football team now known as Guangzhou Evergrande. The team has since built the largest football school in the world, at a cost to Evergrande of $185 million.

By 2021, Evergrande already had 1,300 projects in over 280 cities across China. However, things were not as rosy as they might seem. In 2020, Evergrande’s debt problem surfaced, and the company struggled to solve the issue. One year later, this potential debt crisis intensified as the company started to accumulate dangerous amounts of debt to fund its operations. By 2021, the company became China’s most debt-laden real estate developer with over $300 billion in liabilities. In September 2021, the company warned investors about problems with cash earnings, and about the possibility of defaulting if it could not quickly raise money. So, what was the reason behind the fall of Evergrande?

How the Evergrande empire started

The financial situation in Asia was difficult during the formation of Evergrande and the company decided to create a strategy of “short, stable and fast”. The first Evergrande project was called Jinbi Garden and had an eco-friendly concept. From this project, Evergrande earned 100 million RMB in one day.

Since then, Evergrande had entered the market in over 20 major cities such as Guangzhou, Tianjin, Chongqing, Shenyang, Wuhan, Chengdu, and Nanjing, with over 50 projects. The real estate enterprise had made a significant leap in scale and brand. Evergrande’s first-class management team and successful development model have also helped the company attract the attention of international giants. Evergrande has raised over US $1 billion on international capital markets and had become a model for Chinese real estate companies to move towards internationalization. From Chinese investors, Evergrande managed to build an empire and attract the attention of such investors as Suning, Sequoia, Didi and AliBaba.

Was a radical expansion strategy a mistake?

After the 2008 financial crisis Evergrande received equity and debt financing and took advantage of China’s urbanization opportunity to continue its growth. The company even had set itself an ambitious 2013 target of “sales of 550 billion yuan by 2020.” For this reason, the head of the company, Xu Jiayin, chose a radical expansion path.

This consisted of raising funds through large-scale debt and capital transactions, and then buying land, building houses and selling those houses later. This famous Evergrande “three highs and one low” strategy was based on “high debt, high leverage, high turnover, and low cost”. As a result, in 2016, Evergrande, which took out an expansion loan, achieved annual sales of 373.3 billion yuan, surpassing Vanke and Country Garden, and took the lead in the industry. However, this strategy was quite risky, and the debt started to accumulate.

Was an expansion to 3-4 tier cities a mistake?

Since 2016, Evergrande has invested a lot in Tier 3 and Tier 4 cities on projects with low liquidity. Although house prices are lower in Tier 3 and Tier 4 cities, net talent inflows tend to be insufficient. This made it difficult to implement Evergrande’s projects in third and fourth tier cities in terms of analyzing local real estate resources. This is why many Evergrande real estate projects have been on sale with no willing buyers.

How “Three Red Lines” influenced the debt

Behind the potential Evergrande debt crisis are also the “Three Red Lines“ of the asset-to-liability ratio, the net debt to equity ratio, and the cash to short-term debt ratio. In August 2020, they directly forced Evergrande to pay back by cutting land foreclosures, lowering prices, and dividing quality assets. While these tactics helped ease Evergrande’s debt, they sacrificed mid- and short-term profits and weakened the company’s future solvency.

The fall of Evergrande in 2021

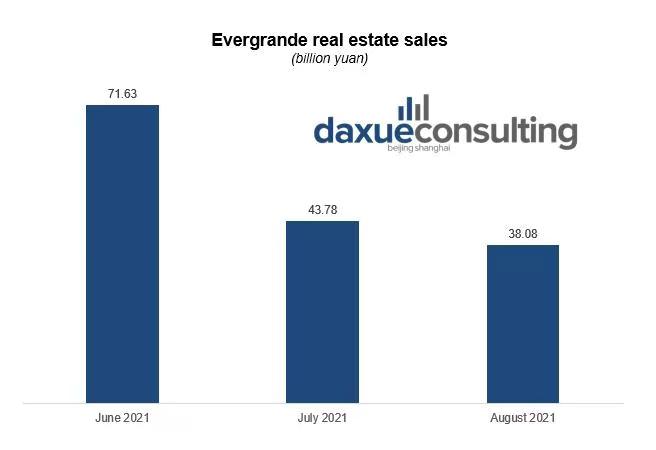

China Evergrande real estate contract sales from June to August 2021 totaled 71.63 billion yuan, 43.78 billion yuan and 38.08 billion yuan respectively according to the company’s official statements, indicating a downward trend.

September is usually a hot period for real estate contracts in China. However, as of September 14, 2021, the total market value of Evergrande was only HK $148 billion. Furthermore, constant negative news about the company have seriously affected the confidence of potential buyers as sales continued to fall sharply in September. It led to a continuing deterioration in the company’s sales, which further put pressure on cash flow and liquidity.

China Evergrande is currently in active contact with some potential investors to discuss the sale of certain shares of Evergrande Auto and Evergrande Real Estate. At the same time, the Evergrande Group is also considering attracting new investors for the Evergrande Group and other subsidiaries.

Who will be affected by the fall of Evergrande?

There are several reasons why the fall of Evergrande can be a serious problem for many people. Being a giant, the company has many people depending on it, including supplier, customers and even financial institutions.

Chinese financial institutions

The People’s Bank of China has decided to inject 100 billion yuan of cash into the financial system to stabilize the market. The Chinese government has also advised the financial sector to focus on stabilizing land and housing prices.

Since the company has borrowed funds from 170 national banks and 121 financial institutions, the potential bankruptcy of Evergrande would lead to financial problems in a number of financial institutions in China. This can create so-called credit crunch, where companies struggle to borrow money at affordable rates. This, in turn, will have a negative impact on business development, as it will be more difficult for companies to borrow money from banks for expansion. Moreover, it could make the Chinese economy unattractive to foreign investors, at least in the short term.

Suppliers and contractors

The fall of Evergrande also impacts the companies with which the company worked. This includes construction and design firms as well as material suppliers. All of them are also at risk of losing huge funds in the event of bankruptcy of Evergrande. In addition, the financial system as a whole could be in trouble if Evergrande collapses. Indeed, Evergrande will have over 240 billion yuan of trade payables from contractors over the next year, according to the S&P report.

Clients

Many clients bought properties from Evergrande even before construction began. They made deposits and currently can potentially lose the money if the company goes bankrupt.

Key takeaways about Evergrande’s collapse

- The fall of Evergrande may have potential negative influence on Chinese economy in general, as well create financial problems for many companies related to its business.

- The Chinese government is trying to stabilize the situation by injecting money into economy, but Evergrande’s stocks keep falling.

- The current crisis comes from several mistakes made by the company during its development, including radical expansion, focus on low tier cities and three red lines situation.