The wine market in China is growing as consumers develop wine drinking habits, however, consumption remains low compared to developed Western nations. From 2014 to 2018, the Chinese wine market grew by 28%. Yet, by 2019, China’s per-capita wine consumption at only 1.5 liters a person, paling in comparison to Portugal’s 62.1 liters, France’s 50.2 liters and the Canada’s 16 liters. Industry analysts are very optimistic that the appetite for wine in China is only going to increase in the future, driving up wine imports in China.

Surprisingly, despite being the world leader in grape production, China imports more wine than it produces. 84% of the grapes grown in China are table grapes.

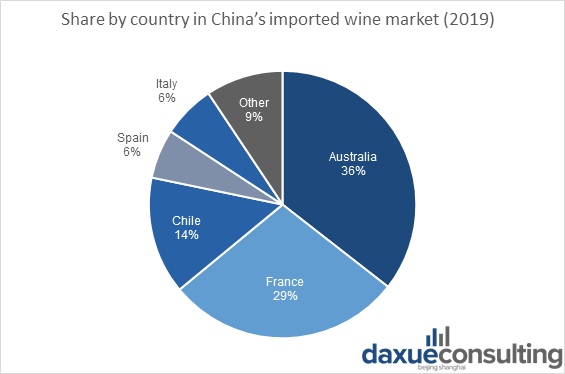

When it comes to import origin, China’s preference is largely in line with developed countries. While there has been much movement by other countries up (Argentina, Moldova, and Georgia) and down (US, South Africa, and Germany) the list of wine exporting countries to China, the five biggest sources are Australia, France, Chile, Italy, and Spain.

Source: Statista, China’s wine imports by origin

Snapshot of China’s imported wine market

France

In terms of quality, France is considered the premium country of origin. This is in line with globally held perceptions. In China, France has an advantage in terms of brand prestige over its rivals. French wine imports in China are also the most expensive on average which adds to the prestige image. However, France has been losing market share in China over the past 5 years. This is due to the innovative techniques and strategies of New World wine producing countries. According to Chinese consumers, French wines are hamstrung by the rigid confines of what French wine should be. Despite a 14% tariff on French wines in China, French wine imports in China are in a good position to adopt some of the marketing strategies of New-World wine brands and take back the number one spot in the Chinese wine market.

Australia

Australian wine brands have been the most innovative in terms of sales and marketing strategies. Because they lack the prestige of Old World wine brands in China, they are unable to charge as high a price. Despite this setback, there are zero tariffs on Australian wines in China and the shipping distance is shorter. They are the dominant country in terms of market share in China. This has been put down to the excellent marketing performance of brands such as Penfolds and Yellow Tail. A trade disagreement involving wine may hamper Australian brands in China.

Chile

Chilean wine imports in China also benefits from zero tariffs. Despite lacking the prestige of Old World brands, Chile actually has older vines than any of the major Old World producers, thanks to the phylloxera bug which decimated vines across the world in the 1800s but has yet to properly hit Chile. Being a very long and narrow country means Chile covers many climatic zones and as such can grow many varieties of grapes. Other favorable geographical conditions mean Chilean vineyards use much less pesticides than their competitors. This means they have more organic wines which will be a key competitive advantage in the sustainably produced/ environmentally friendly market in the future. 75% of exports are pesticide free. Chilean wines are also cheaper than French and Australian wines.

Italy

Italy is the biggest producer of wine in the world. Italian wine brands have been classified since the 1960s and strict guidelines cover all aspects of production.

This makes it easier for Chinese consumers to identify quality wines. Italian wine imports in China are relatively cheap despite the high diversity and strong potential to sell the brand messages of regions such as Veneto, Apulia, Tuscany etc. (20 regions in total). Idyllic production landscapes make wine tours and/or promotion another key competitive advantage for Italy. A long-term decline in domestic consumption has led to brands innovating to stay relevant. There has been strong growth in the organic wine sector and these brands have achieved premiumization. Italian wines must also pay a 14% tariff.

Spain:

Spain is the cheapest of the top 5 regions and this is because it lacks the production capabilities of its rivals. Most Spanish wine is sold in bulk which means it is more likely to be mixed with other wines before being bottled and sold. This lowers the price Spanish producers can charge. To broadly categorize an entire market group, it is said that Chinese wine drinkers prefer fruity flavors and Spanish wine is perceived to have a fruitier aroma than the wines of its competitors. Investment in production and distribution methods as well as marketing could see Spanish wine take a bigger slice of the market share. The tariff on Spanish wine imports in China is also 14%.

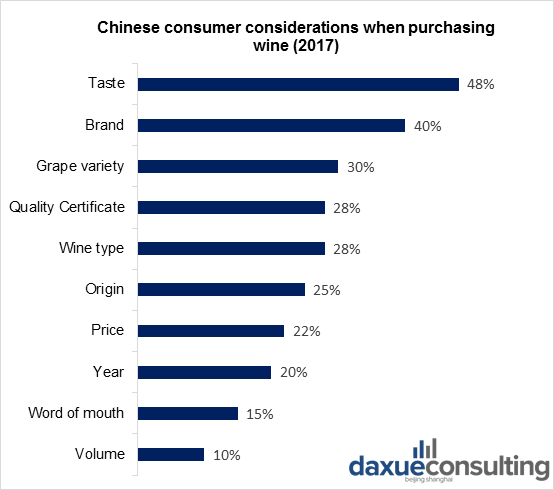

What do Chinese customers pay attention to when purchasing wine?

Source: Exactdata, 2018

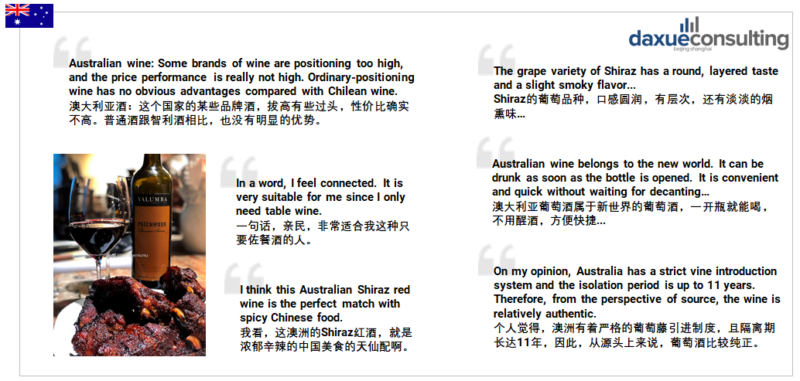

Social Listening: What do Chinese consumers have to say about imported wine?

Australia: Consumers of Australian wine feel that the wine is of medium quality. They would be less willing to pay a high price for an Australian wine.

Source: Zhihu, daxue consulting analysis, consumer perceptions of Australian wine imports in China

France: French wines are considered the highest in terms of quality, the high price is justifiable. Some consumers would prefer to buy French wines but turn to more affordably priced New World wines for approximate quality.

Source: Zhihu, daxue consulting analysis, consumer perceptions of French wine imports in China

Chile: High price performance wines. Not as good as French wines but perceived to be much cheaper. One of the best on the market in terms of quality-price.

Source: Zhihu, daxue consulting analysis, consumer perceptions of Chilean wine imports in China

Italy: Chinese consumers recognize the great diversity in Italian wine. Italian wine is considered easier to drink although its quality is not as high as French wines.

Source: Zhihu, daxue consulting analysis, consumer perceptions of Italian wine imports in China

Spain: Spanish wine is considered to be the most affordable of the big, Old World producers. Performs well for its lower price.

Source: Zhihu, daxue consulting analysis, consumer perceptions of Spanish wine imports in China

Case studies of imported wine brands in China

As an example of how a wine brand can be innovative and gain market share, we will have a look at 2 highly innovative Australian wine brands.

Yellow Tail

Yellow Tail became #1 brand in the US within 2 years of entering the market. The New World brand didn’t try to challenge the major players of the wine market and adopted a blue ocean strategy whereby they targeted the 88% of the population who weren’t already familiar with drinking wine. The brand successfully made wine seem more like an everyday pleasure rather than a special occasion indulgence. By focusing less on enological terminology/ complexity, above-the-line marketing, and vineyard legacy/ prestige,and focusing more on making selecting a wine easier (having a smaller range), having easy to drink wines, and making drinking wine seem like a fun and adventurous thing to do, rather than a more serious activity They managed to make wine seem more approachable and accessible to the average person.

Source:Alibaba.com, Yellow Tail Wine in China

By reducing the factors that the competition had long competed on and by creating new factors the competition had never offered, the Australian wine brand had made the competition irrelevant.

There are lessons to be taken for any brand thinking about entering China. The market for wine in China shares similarities with that of the US in the early 2000s.

Penfolds

Penfolds adopted a specific name and color tailored towards the Chinese market. They relocated their Eurasian office to Shanghai to be closer to and capitalize on the large, affluent market. They have opened several Penfolds stores in China.

Penfolds is translated into 奔富 in Chinese, which means ‘Towards prosperity’. It fits the Chinese mindset of pursuing ‘good omen’.

The outer package and bottle package of Penfolds are red in color, with is seen as a lucky color in China. Thus, making it suitable for many occasions like festivals and weddings.

In 2014, Penfolds moved its Eurasian office to Shanghai. In the following years, Penfolds made a lot of promotional activities tailored for the market, such as luxury wine tastings. Also, Australian winery tours were offered targeting high-end Chinese consumers.

Since 2017, Penfolds Winery has successively opened direct-sale stores in several cities in China to directly approach the consumers.

Takeaways of China’s wine import market

- Wine imports in China come mostly from Australia, France, Chile, Italy, and Spain.

- Wine imports from Europe face a 14% tariff and have been losing market share to New World brands

- New World wine brands in China have often have a 0% tariff and have gained considerable market share. This trend is set to continue.

Learn how a Swiss entrepreneur sold started a wine business in China

Read the transcript of China Paradigms 41 to learn how to start a wine chain in China.

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast