In 2024, China’s winter apparel market held the largest share in the Asia Pacific region, which accounted for 35.4% of the global market revenue. Drivers for winter apparel purchases include the growing popularity of winter tourism and winter sports. Around 313 million people have participated in ice and snow sports or other winter-related leisure activities since the 2022 Beijing Winter Olympics. Another factor is that in the wet-cold southern China, where there is no centralized heating and people rely on electric heaters, people wear their winter clothes for daily wear, even wearing down jackets inside.

Download our 2024 China Summer Sports Market report

What’s driving the demand for winter apparel in China

The winter sports market in China, a relatively immature market, is gaining momentum, especially after the 2022 Beijing Winter Olympics. To illustrate, from November 1st to December 20th, 2024, ski resort bookings in Heilongjiang, Jilin, Liaoning, and Xinjiang, increased by 50.49% year-over-year. Moreover, JD.com data shows that the sales of ski jackets saw a year-over-year growth exceeding 50%.

Meanwhile, enthusiasm for winter tourism continues to rise. Harbin, a top winter destination, recorded a 50% year-over-year surge in hotel bookings in November 2024. The average winter temperature in Harbin, around -15°C to -20°C, makes it necessary for these tourists to invest in winter apparel, even if only worn once. Nearly 80% of travelers planning ice and snow trips to Northeast China this winter are from southern China.

Growing demand for a blizzard of winter apparel choices

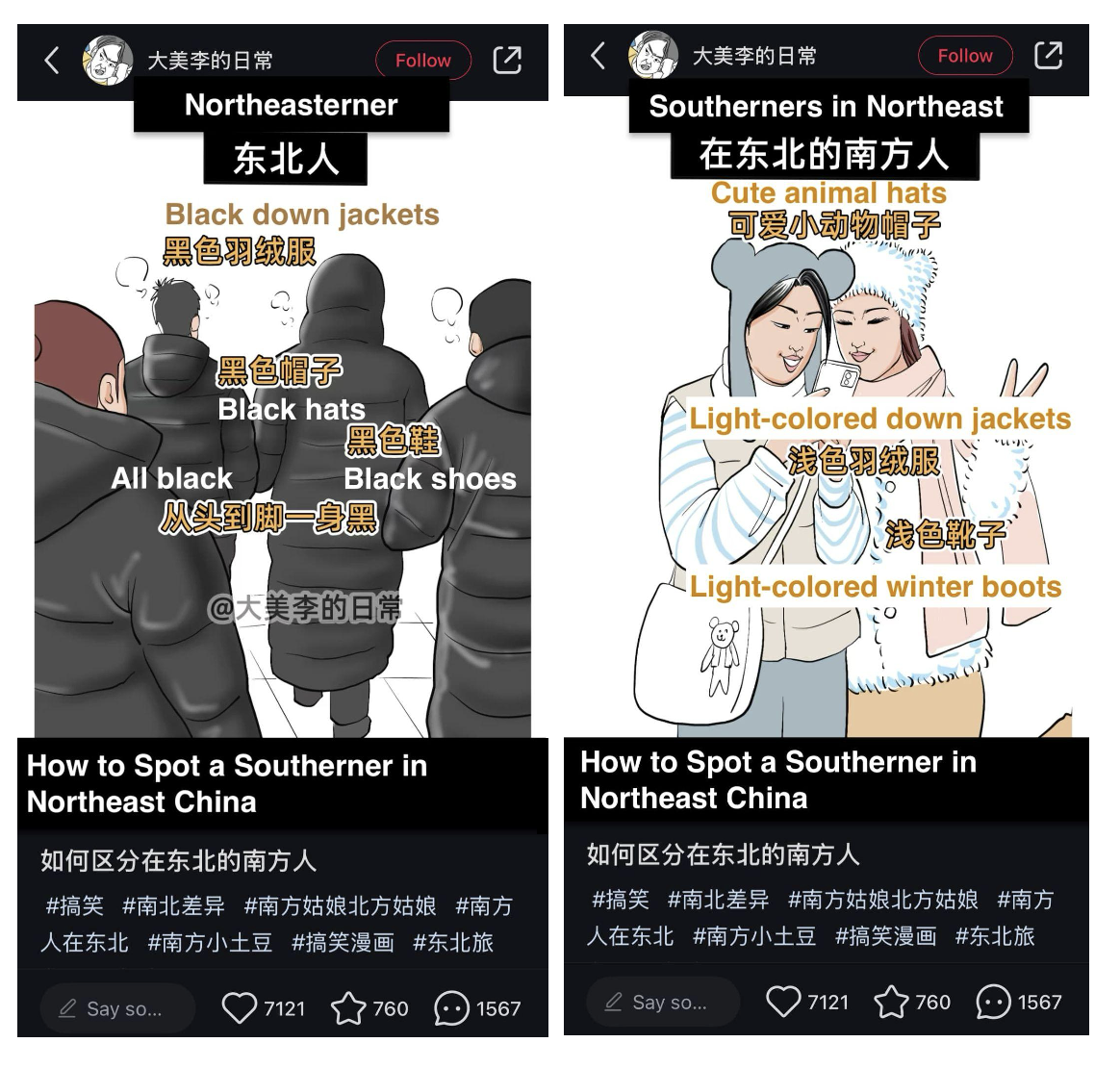

Chinese consumers are showing interest in a wider range of product categories and higher levels of sophistication. In addition to down jackets, thermal underwear and thick pajamas have become staples. They are not only prioritizing functionality, such as comfort and warmth, but also seeking more fashionable designs. Unlike the northwest locals, southern tourists buy warm apparel with distinct styles. Xiaohongshu travel posts reveal that while locals prefer practical black jackets and durable shoes, tourists favor light-colored down jackets, stylish boots, and fluffy hats that look cute in pictures.

Thermal underwear is no longer old-fashioned

Once regarded as an essential yet outdated household item for staying warm, thermal underwear—form-fitting, long-sleeved—was dismissed as old-fashioned by Chinese young people for years. However, as thermal sets have undergone significant innovation in both functionality and design, younger generations are now embracing them. During the 2024 Double 11 shopping festival, thermal underwear sets sales saw a robust increase by over 100% year-over-year.

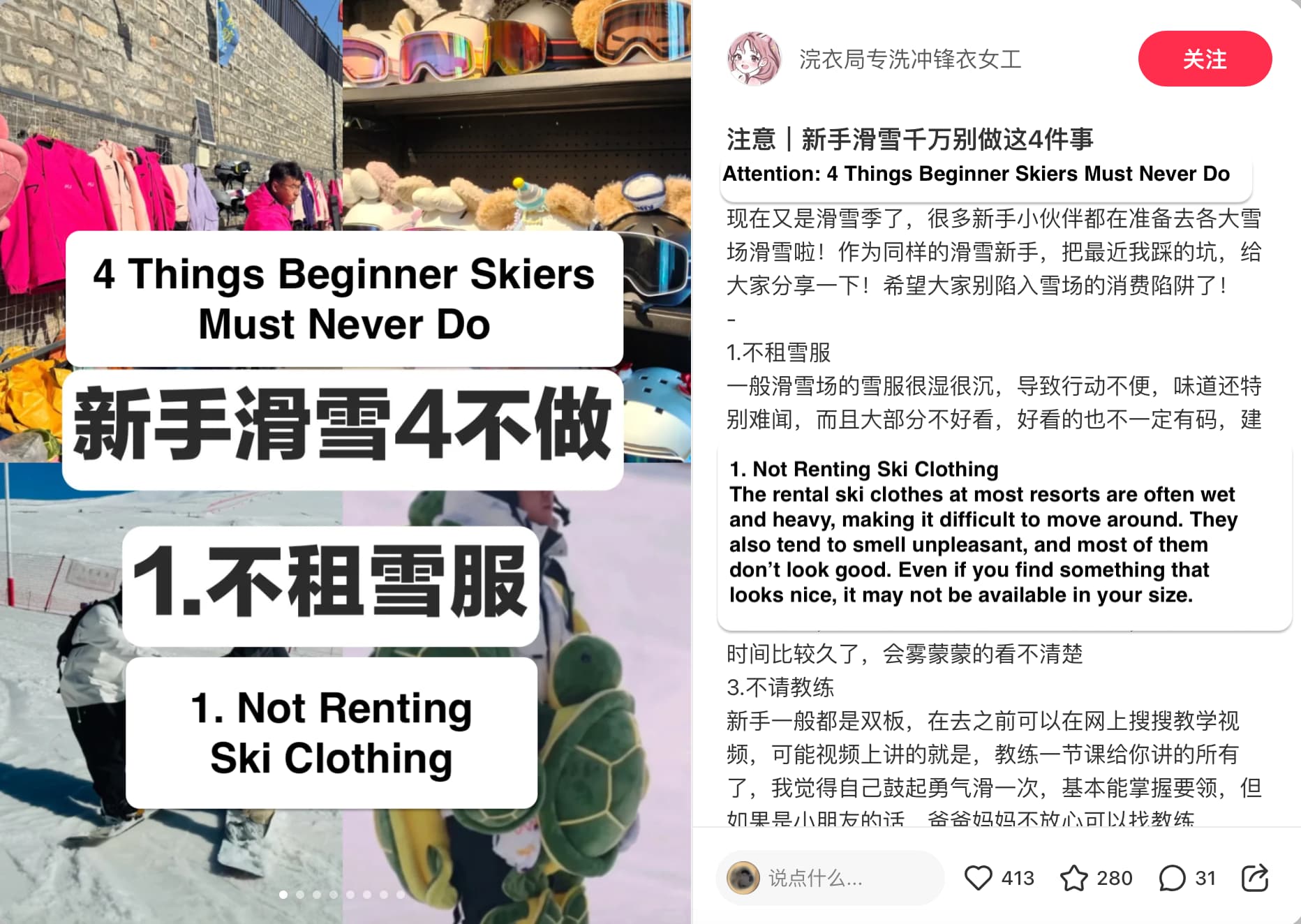

Even though many are new to winter sports, renting apparel and equipment is not a popular choice

Even though many are still new to winter sports, Chinese consumers choose to purchase their own clothing and equipment instead of renting them. Rental gear at many ski resorts, for example, tends to be outdated and poorly maintained. Also, as people do winter sports more often, owning personal gear has become a more practical choice.

“New Year Battle Outfits”: Winning with new clothes in the new year

Wearing new clothes during the Chinese New Year, a tradition dating back to the Han Dynasty, symbolizes a fresh start. The term “New Year Battle Outfits” (新年战袍), coined on social media, describes the clothes people wear for New Year social occasions, such as family reunions and reunions with old classmates.

Compared to their everyday attire, Chinese people pay more attention to high-quality and luxury clothing in their New Years attire. Some seek clothes that look more expensive (显贵), while others prefer well-known brands. At the end of the day, it’s about showing “face” (面子). They want outfits that are not only stylish but also representative of their achievements. Designer brands, premium materials, and custom-made pieces, as well down jackets, cashmere coats, and fur, are sought. Also, when it comes to the color, red is an extra touch for good luck, but it’s not a must-have.

The MaMian skirt (马面裙) , one of most popular items of new Chinese style, has become a top choice for “New Year battle outfits.” Rising Guochao (国潮) has reignited interest in the “new Chinese style” (新中式), which combines traditional Chinese aesthetics with modern fashion, among the Gen Z in China. In January 2024, sales of MaMian skirts on JD.com increased by 300% year-over-year.

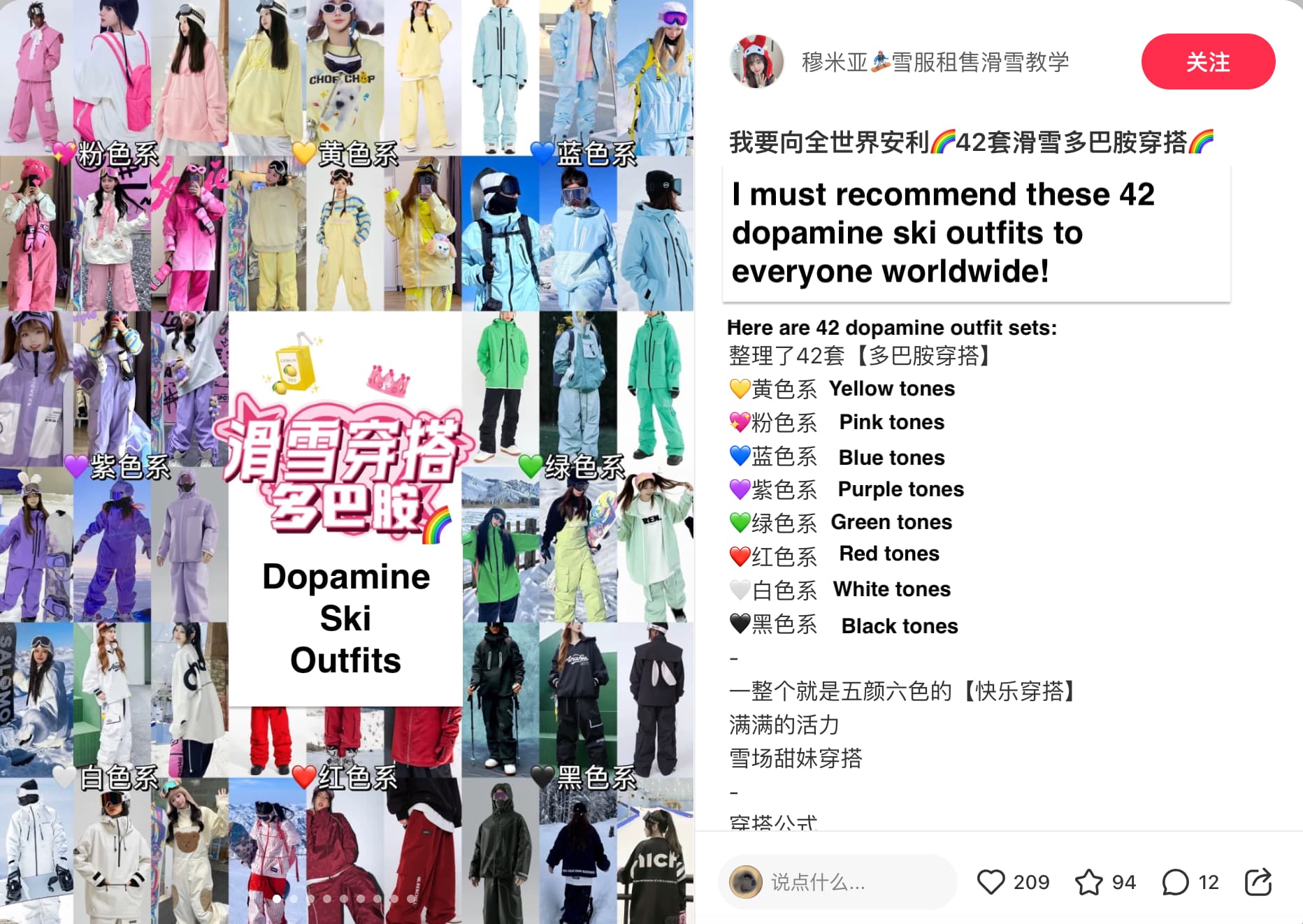

“Dopamine ski wear” (多巴胺色系雪服): bright colors for a bright winter sports experience

The dopamine dressing trend, which involves using bright and bold colors, extends to ski apparel. To add more emotional value to their winter sports experiences, people are wearing clothes that make them feel positive emotions, such as joy and relaxation. They also coordinate their outfits with their friends, wearing matching or complementary colors for a shared exciting experience. During the year-end shopping season (“双旦”礼遇季), from December 15th to December 25th, 2024, dopamine-colored ski wear brand ISEE MIGGA’s sales increased by over 500%.

Wearing pajamas outdoors and outdoor clothes indoors

China’s Qinling-Huaihe line divides regions with and without centralized heating, leaving southern areas to face bone-chilling winters without it. To stay warm, people wear thick coats indoors. In the southern province of Hunan, many locals are often seen wearing cotton pajamas both at home and even outside. This widespread practice has even earned them the nickname “Hunan Provincial Uniform (湖南省服)” on social media.

During COVID-19, as people spent more time at home and ran quick errands they sought more versatile clothing. Bananain, originally known for basic underwear, started in 2022 to introduce winter loungewear suitable for outdoor wear, focusing on both warmth and fashion.

China’s millennial retro fur-fashion based on Hong Kong’s pop culture

China’s millennial retro fashion incorporates classic symbols of Hong Kong pop culture, reflecting a longing for the “golden era” of economic prosperity and cultural confidence. Drawing from the urban aesthetics of the 1980s and 1990s, this style highlights items like fur, fur-collared coats, plaid wool suits, gloves, berets, and scarves.

“Colorful mountain” style: meeting the demand for versatile outdoor apparel

Consumers are incorporating outdoor clothing into their daily wear, with lightweight outdoor apparel appearing in scenarios such as commuting, going to school, and social gatherings. The sales of lightweight outdoor clothing on JD.com during the 23/24 autumn/winter season increased by 42% year-over-year.

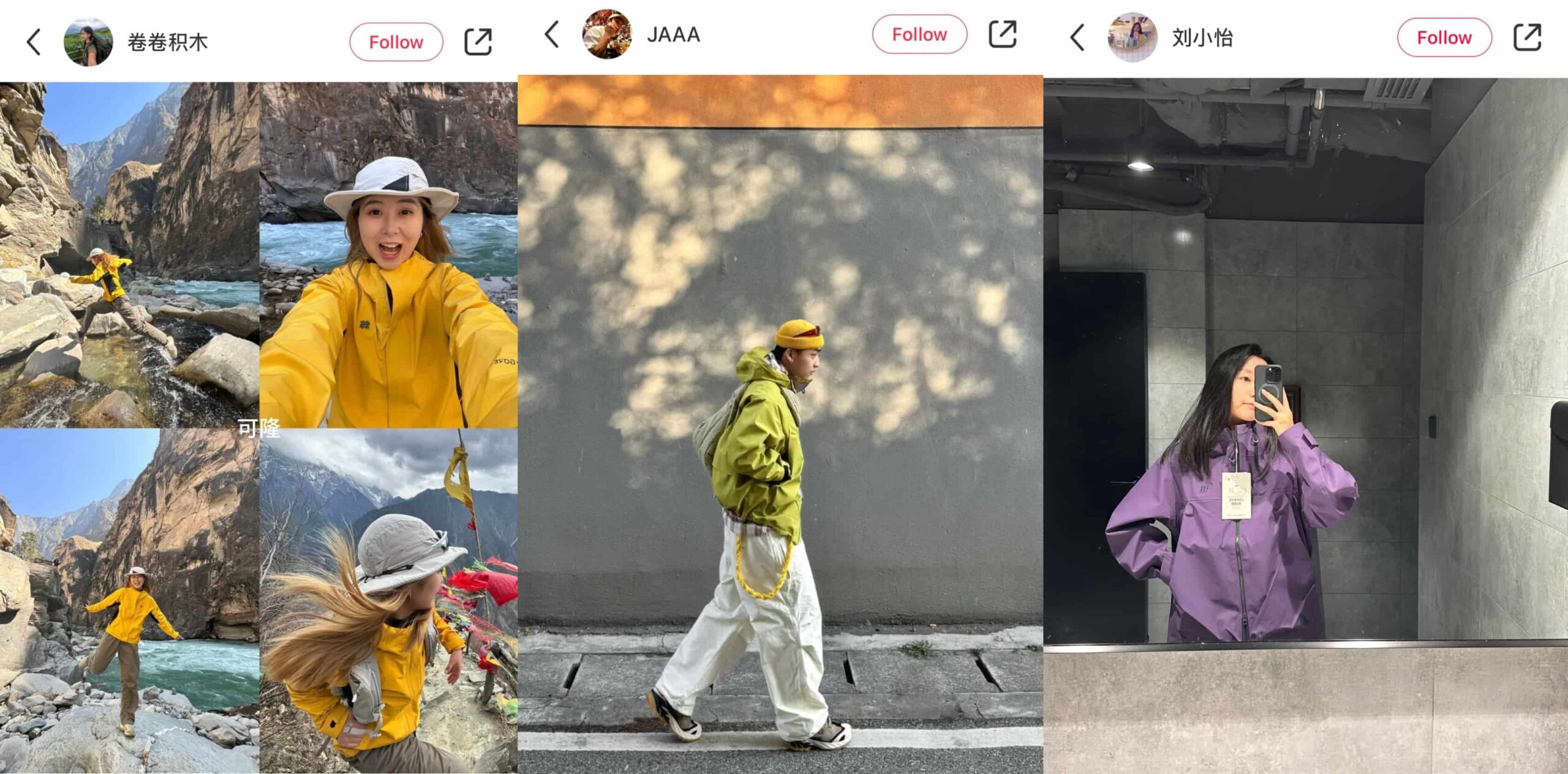

The “colorful mountain” (多彩山系) style blends the functionality of outdoor gear and the sophisticated aesthetics of urban fashion. It features nature-inspired neutral tones, such as as khaki and brown, allowing the clothes to “blend” with the natural surrounding. It can also be combined with vibrant tones, like orange and pink, to make it stand out. Made from technical materials, it offers breathability, water resistance, and durability, making it suitable for urban and outdoor wear.

The winning winterwear branding strategies in China

Bosideng: The fashionable “down jacket expert”

Bosideng, recognizing the serious issue of brand aging, is committed to becoming a “down jacket expert.” Targeting the mid-to-high-end market, the brand creates unique, hard-to-copy products with its expertise in premium down jackets and strives overturn the notion of not being “fashionable”.

Whether partnering with the former creative director of Hermès, Jean-Paul Gaultier, to introduce an exclusive limited-edition series, or collaborating with the Chinese Antarctic Expedition Team to highlight the exceptional cold-resistant features of its products, Bosideng’s ultimate goal is to become the preferred choice for young local shoppers in the luxury segment.

Arc’teryx: A sports luxury leader redefining retail spaces

In early 2024, Arc’teryx unveiled a 2,400-square-meter eco-experience space—the Arc’teryx Museum in Shanghai–marking a pioneering step in immersive retail models. In December 2024, it launched an exhibition titled “Arc’teryx Genesis and Evolution Exhibition” at this museum. Co-curated with the Chinese Academy of Sciences, the exhibition recreates the excavation process of the “Berlin Specimen,” the most complete Archaeopteryx fossil. By merging the narrative of natural evolution with its own brand evolution, Arc’teryx gives consumers a deeper appreciation of its heritage and innovation.

Outdoor down jackets go sexy: The North Face x SKIMS collaboration

Once having wide presence in China’s down jacket market, The North Face has experienced limited growth in recent years. In China, its 1996 edition down jacket, popular among male college students, earned the nickname “male college student uniform” (男大校服) due to its ubiquity. To counter this stereotype, the brand is now expanding into the female consumer market. In December 2024, The North Face and SKIMS collaboration, was launched and became an internet sensation. The collaboration series includes 56 items, such as down jackets, bodysuits, and gloves, which cater to both the fashion needs of snow sports gear and SKIMS’ signature high-end, sexy style.

The partnership represents a reshuffling of target demographics: SKIMS aims to tap into the outdoor market, while The North Face appeals to SKIMS’ female consumer base. It also serves as a trial run for SKIMS in the Chinese market, where the brand has yet to establish official stores. This co-branding effort was a success. The collection sold out on launch day despite being available in only two offline stores with limited quantities.

China’s winter apparel market is becoming more mature as winter sports and travel continue to develop

- The growing popularity of winter tourism and sports is injecting new momentum into China’s winter apparel market. People in the wet and cold south are traveling to the snowy and cold north for snow and ice experiences, increasing the demand for winter clothing.

- Winter apparel is diversifying, with rising demand for down jackets, thermal underwear, and thick pajamas, among other items. China’s millennial retro fashion style, incorporating Hong Kong’s cultural influences and featuring fur, is making a comeback.

- Chinese consumers are also seeking more versatile clothing, such as pajamas that can be worn outdoors for quick errands and the “colorful mountain” style, which blends outdoor functionality with aesthetics.

- The Chinese New Year is a time to showcase winter fashion. In 2025, the MaMian skirt was a top choice, reflecting the growing desire to incorporate traditional elements into modern styles.

Download the full report on China’s summer sports market by daxue consulting here: https://daxueconsulting.com/china-summer-sports-market-report/