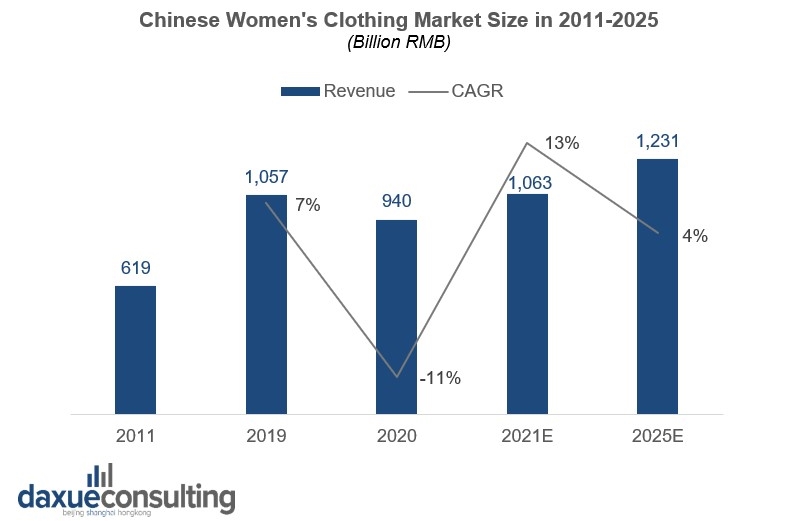

Chinese women’s clothing market accounts for half of the overall domestic clothing market. According to Euromonitor, the Chinese women’s clothing market jumped from RMB 619 billion in 2011 to RMB 1,057 billion in 2019, with a CAGR of 6.9%. It boasted a higher growth rate than men’s clothing (5.41%), yet lower than children’s clothing did (12.03%). Affected by the pandemic, the women’s clothing market size narrowed slightly to RMB 940 billion in 2020. However, it is expected to maintain a steady growth rate of 4% by 2025, reaching a scale of RMB 1,231 billion by that time.

Breaking down the Chinese women’s clothing market, two major groups can be identified: the middle-to-high-end and the low-to-middle-end women’s clothing segment. The former targets consumers with higher purchasing power who value quality. According to Euromonitor, the middle-to-high-end women’s clothing segment accounted for 14% of the total women’s clothing market in 2020. The average growth rate for the past 5 years was 7.5%, this exceeded the overall women’s clothing market growth rate of 5.2% It reflects that the potential of mid-to-high-end women’s clothing is gradually being tapped, the demand of clothing’s quality and brand awareness of women is increasing.

On the other hand, the latter targets the mass market which is mainly young consumers. Brands are usually fast fashion and provide affordable and trendy clothes. According to Qianzhan, Chinese women under 30 living in first and second tier cities are the main consumers of fast fashion. Yet, since people’s consumption needs are changing continuously, the attractiveness of fast fashion brands has gradually declined. Indeed, in the past two years, the number of stores of fast fashion brands in China has shown a downward trend.

New trends in the Chinese Women’s Clothing Market

1. Fashion as a tool for expressing Chinese women’s personalities

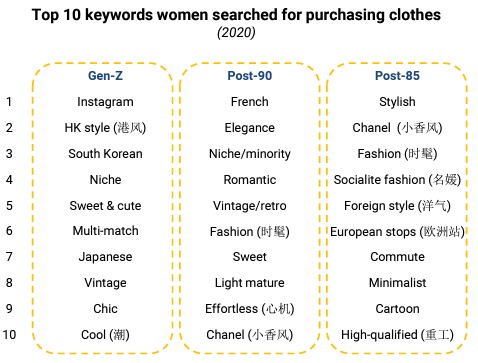

With the rising education level and disposable income of Chinese women (55.9% have a bachelor’s degree or above), modern women in China pursue stylish and high-quality clothing. According to our report about emerging Chinese fashion brands, Generation Z women are willing to try new styles, while the post-90s prefer elegant French style and the post-85s prefer the fashion style of Western socialites.

2. Chasing sustainable fashion

The increasing environmental awareness and higher disposable income in China, especially in the aftermath of Covid-19, are inducing more and more people to embrace sustainable fashion. According to our report on sustainable consumption in China, Chinese consumers display a relatively high willingness to pay more for environmental and climate-friendly products. Moreover, 83% of respondents in China Sustainability Consumption Report 2019 claimed choosing eco-friendly fabrics when buying clothes, expressing a preference for fabrics such as linen and regenerated nylon.

Therefore, Chinese consumers are looking for eco-friendly and sustainable brands. Below are two examples of homegrown green brands:

- NEEMIC is a Beijing-based high fashion brand that addresses both ethical and environmental issues. Its garments are completely made from organic materials;

- ICICLE is a Shanghai-based high-end eco-friendly clothing brand for women and men. It owns a vertical and integrated supply chain covering original design, manufacture, logistics, retail and franchise. It uses 100% organic or recycled materials to make its collections.

3. The Guochao (国潮) wave boosts the demand for local brands

The popularity of Guochao has pushed up the demand for domestically produced clothing. Chinese consumers are increasingly embracing products incorporating revitalized elements of Chinese culture. Thus, the “Made in China” label becomes a symbol of pride and cultural resonance.

For example, Fancy Youth Protectionism (FYP) is a Chinese streetwear brand. Based on young Chinese consumers’ strong cultural confidence, FYP’s style is full of vitality. It integrates rebelliousness into high street fashion to create a new urban style. In one of its collections, FYP makes extensive use of Chinese characters, differentiating itself from ordinary streetwear brands using English quotes.

4. “Live-streaming sales backed by production” as the new business model

Since 2020, the growth of live-stream ecommerce has skyrocketed due to the pandemic. As of March 2020, live-stream shoppers were about 265 million, accounting for 29.3% of the total Chinese netizens. The sales conversion rate is huge. For example, in 2020 Taobao Live boasted a Gross Merchandise Value of over RMB 400 billion according to Alibaba’s financial report. Under the new business model of “live-streaming sales backed by production”, KOLs work directly with manufacturers to sell clothes. The most famous example is Viya, who is recognized as the “Queen of live-streaming”.

Among all the product categories, clothing is the most popular live-stream ecommerce option. In 2019, the KOLs selling clothes accounted for 14% of the total. In particular, women’s clothing was the most popular item category among Chinese live-stream shoppers according to Taobao Live. Regarding women’s fashion trends in China, it is found that the transaction value of Hanfu 汉服 in 2020 increased by 753% compared with 2019, in line with the Guochao wave.

Severe competition in the Chinese women’s clothing market: Who are the leading players?

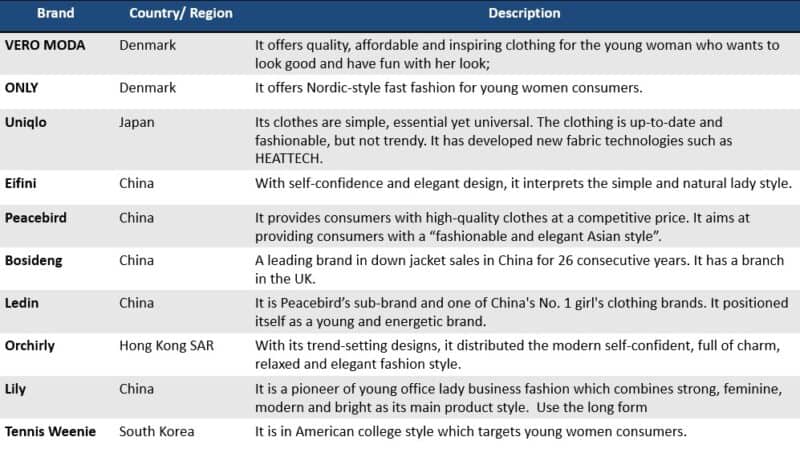

According to HKTDC, Chinese high-end women’s clothing market currently consists mainly of brands from France, Germany, Italy, Japan, the US, the UK and South Korea. As for the mid-end market, it is mainly dominated by Hong Kong and Taiwanese brands, while domestic brands are mostly found in the mid- and low-end markets. Yet, domestic brands are gradually moving up the chain. By introducing bespoke services, focusing on innovation and upgrading in response to the changes in the market, Chinese brands are driving the development of domestic apparel.

Trends redefining Chinese women’s clothing market

- As Chinese women witness a rise in their education level and disposable income, high-quality clothing imposes itself as a key driver of purchase in Chinese women’s clothing market.

- Chinese women are more and more environmentally conscious, thus sustainable clothing is bound to turn into a more popular choice, especially after the pandemic.

- With the rising trend of Guochao, local brands have become Chinese women’s preferred option. Thus, in order to attract Chinese consumers, foreign brands should consider adding more Chinese elements to women’s clothing.

- KOLs have replaced retailers and serve as a bridge between factories and consumers. Hence the importance for brands to enhance their ties with KOLs to win over Chinese women’s clothing market.

Author: Lydia Choi