Xiaomi Inc. (小米) is a mobile internet company founded by Lei Jun and seven co-founders in 2010. In 2013, Xiaomi grew into China’s largest e-commerce company with its e-commerce platform Mi Market. By 2014, the company had grown into the world’s fourth-largest consumer electronics company. In the same year, the company expanded into several foreign Southeast Asian markets, most notably India. The successful expansion into India lead Xiaomi to take 29.4% market share of India’s smartphone market.

Xiaomi is more than just a Chinese smartphone brand, it is a global consumer electronics brand.

The company refers to itself as an internet and software company and not just a smartphone and hardware company. However, Xiaomi has been accused of imitating Apple’s marketing strategies, and currently operates a business model that is similar to that of Amazon.

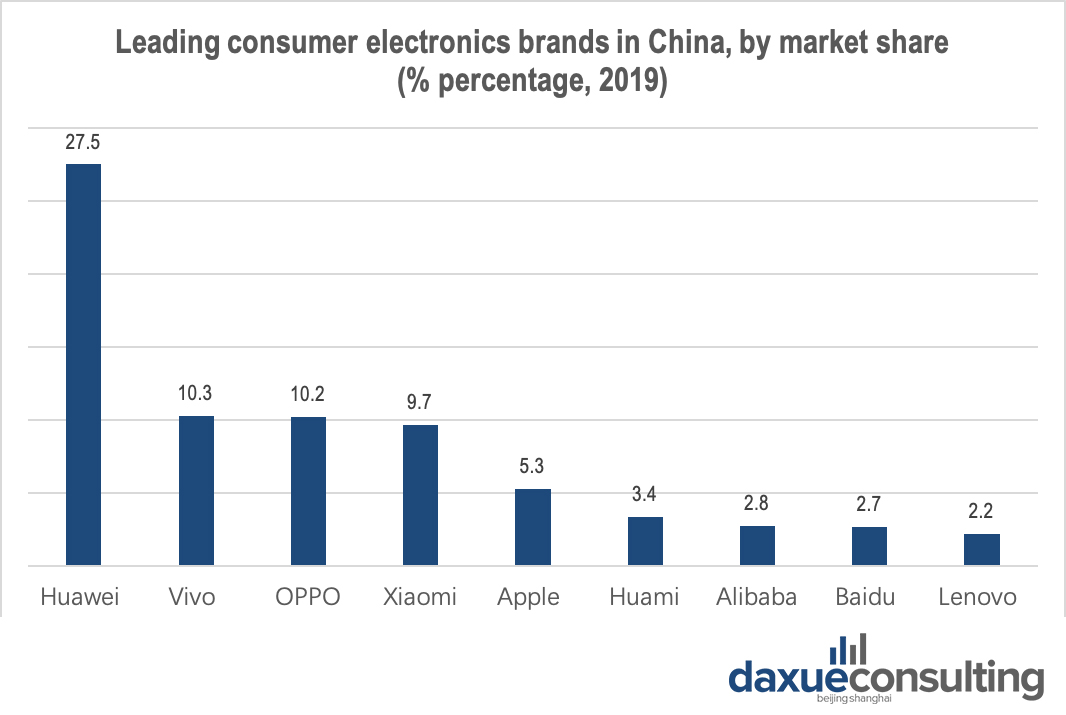

Image Source: Euromonitor, Xiaomi surpassed Apple in market share in China’s consumer electronics market, thanks in part to its grassroots approach.

Rapid product turnaround based on engineer-customer co-creation

Xiaomi offers a diverse profile of products including smartphones, laptops, TVs, internet media streaming devices for TVs, wearables, speakers, and lifestyle products. Its signature products are smartphones and televisions. The company has recently tapped into the IoT (Internet of Things) and smart home concept with the manufacture of smart appliances. By “connecting” products and services and strengthening their interoperability, Xiaomi is able to spur bundle sales.

Image Source: Mi.com, Xiaomi unveils $10,000 transparent TV this August 2020, made it a trending topic on Weibo.

Most of Xiaomi’s products present a minimalistic style with black and white colors, except its smartphones and smartwatches. The minimalistic aesthetics contributes to its alias of “the Apple of China”. Besides, simplicity also reduces the customers’ efforts put into finalizing their purchase decisions.

Image Source: Mi.com, Two kinds of branding

Xiaomi’s incredibly agile strategy in China’s smartphone market

What’s unique to Xiaomi is its product release strategy for its smartphones. Xiaomi releases new generation phones once a year, however, throughout that year its phones are consistently improved by the company’s engineers on a weekly basis. Engineers collect user feedback through speaking directly to them via Xiaomi’s online forums. The consumer feedback will be taken into consideration in the following batch of smartphones manufactured. After the initial launch of a limited number of smartphones, the company will release the improved versions throughout the year in weekly batches.

It’s said that each batch contains not only the latest software built as suggested by the users, but also minor hardware upgrades and changes. With this market strategy, Xiaomi can accomplish in one week what takes rivals a whole year to do. It’s worth noting that, however, as the software stabilizes, the company will cease the improvement process. Additionally, not all models follow the test-and-improve path.

Xiaomi’s unique product strategy is not without problems. Such a product development strategy requires a talented array of engineers, also adding long-term strain to engineers. From the customers’ point of view, it’s two sides of a coin. Some consumers feel the strategy is user-oriented, while are frustrated due to many bugs in the technlogy.

By doing this, it is the products that are selecting (tech-savvy) users rather than users selecting products. For the company, it potentially costs lost phone sales as customers purchase from rivals due to the unavailability of phones or perceived loss of value because of the updates.

The ”razor-razorblade” pricing strategy makes Xiaomi both a successful hardware and Internet company

The razor-razor blade pricing strategy is when a product is sold at a loss (razor), but is often bought along with another product which is profitable (razorblade).

Xiaomi entered the market with low price at medium to high quality, making the smartphone the ‘razor’ of the pricing strategy. This aims to entice as many customers as possible to drive traffic to its e-commerce site where customers spend time in purchasing Xiaomi’s other products, which play the role of ‘razorblades’.

The cheapest model of Xiaomi phones is only CNY549, targeting students and the elderly. Most of Xiaomi’s smartphones are priced under CNY5,000. Devices are seen as conduits to their e-commerce ecosystems. According to the CEO, Xiaomi make profits through content and services. Such a business model shares a lot of similarities with that of Amazon.

Image Source: Xiaomi Tmall store, Xiaomi took a grassroots approach to gain a large customer base.

Xiaomi CEO’s promotional intelligence has been instrumental to the company’s success in the consumer market

CEO Lei Jun plays a crucial role in Xiaomi’s success in the consumer market. The way Lei Jun promote and market himself and the company is believed to takes his cues from Steve Jobs. From the top-down view, he managed to not only establish a strong personal brand but also foster a cult-like following of the Xiaomi brand, drawing parallels with Steve Jobs and Apple. Lei Jun has 23 million followers on Weibo, he is, without a doubt, a KOL if not a celebrity.

Left: Xiaomi Inc. and BBC, Lei Jun’s style is reminiscent of Steve Job’s. Right: Mi.com, Xiaomi’s product launches are reminiscent of Apple’s.

From a bottom-up view, Xiaomi plays a great emphasis on customer intimacy as a source of value. The company did it through cultivating its fan base, namely Mi Fans (米粉), to help promote its products. Customer’s WOM are highly valued over advertising. It explains why Xiaomi managed to spread its reputation of “the King of cost-effectiveness” in China.

Focus on online presence to boost its e-commerce business

Xiaomi was once China’s third-largest e-commerce companies by 2013. This is partly because the company sells a majority of its phones online via its own platform, Mi Market. It also makes profits through on its own e-commerce platform. It’s worth pointing out that the Mi Market mobile application is preinstalled on Xiaomi phones with the company’s online forums and is available to download on other branded smartphones.

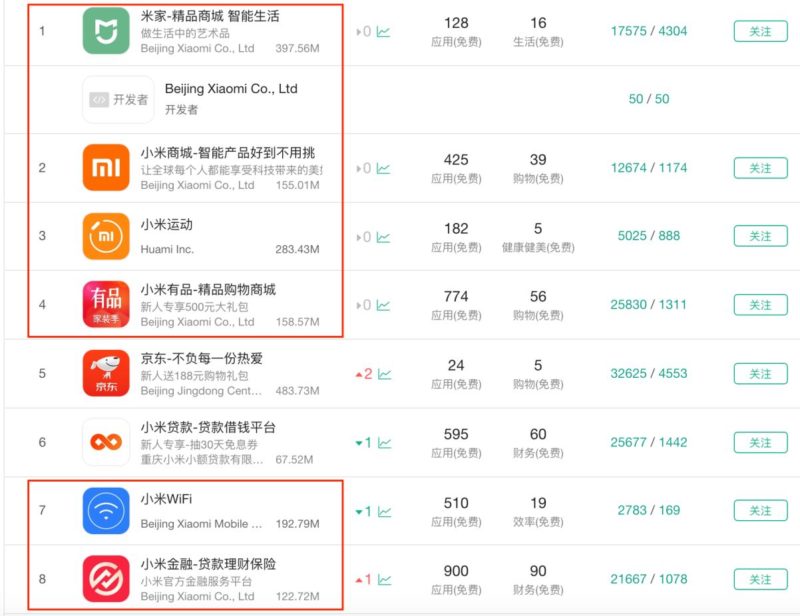

Although Xiaomi also sells its products via major e-commerce channels, Tmall, and JD.com, it’s clear that Xiaomi aims at promoting its owned media. When searching “Xiaomi” on Baidu, Xiaomi’s Tmall and JD stores did not appear on the first three pages. Besides the Mi Market, Xiaomi also launched various mobile applications specializing in Xiaomi’s lifestyle products, premium products, sports, as well as financial products.

Image Source: Qimai.com, Xiaomi offers diverse mobile-apps to connect with consumers.

Content and services as revenue streams

Considering that the sales volumes of smartphones, TVs, and laptops are constrained by deep penetration levels, plus the repurchase rates of household appliances are relatively low, Xiaomi aims to generate revenue from content and services.

However, its content has not yet spoken for the brand, and neither had it generated revenues comparable to that of Kindle to Amazon. At least so far Xiaomi’s value proposition remains to be the cost-effectiveness of its products. As leading tech companies like Alibaba and Baidu also branch out into consumer electronics to gain further share, the market is deemed to be increasingly competitive. While Xiaomi steps up its R&D, we will look for a comparable improvement of its content and services.

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast