The health supplement and vitamin market in China has been growing rapidly in recent years. From 2019 to 2022, this market witnessed an impressive 45% increase in revenue in China, with sales reaching US$4.7 million in 2022, which surpasses every other country. The function consumers are seeking the most is immunity-boosting and among vitamins, the demand is the highest for vitamins B, C and E. While Chinese brands like By-health are popular, products from foreign brands like Swisse are even more in demand on e-commerce platforms. Trends like rising health awareness and the aging population predict a promising future for the health supplement and vitamin market in China.

Download our report on the She economy in China

The development of the dietary supplement market in China

China’s dietary supplement product market has grown significantly in the past few years expected to continue in this trajectory. From US$31.18 billion in 2019, it reached US$37.19 billion in 2021, a 19% increase. By the end of 2023, it is expected to reach US$45.08 billion and US$58.19 billion in 2027. China has now surpassed the U.S. in terms of dietary supplement market size.

Rising health awareness as the main factor of this growth (COVID-19)

Rising health awareness among Chinese consumers, resulting from the COVID-19 pandemic and changing lifestyles, has largely contributed to the growth of the healthcare products industry in China, including vitamins and health supplements. Netizens showed more interest in improving their health during the Coronavirus outbreak and looked for ways to improve their immune system, a trend that still prevailed in 2022.

As Chinese consumers are becoming more health-aware, the consumption of healthcare products is gradually switching from ‘optional’ to ‘must-have’. Most Chinese consumers now regard healthcare products as nutritional supplements. Hence, this trend is promoting the growth of the overall market for healthcare products in China.

Aging population trends in China encourages this growth

China has one of the most rapidly aging populations in the world. In 2022, the death rate was 7.37% and the birth rate 6.77%, which represents a population decrease of 0.6%. It is estimated that the proportion of individuals over the age of 60 will reach 42% by 2040. The rising share of over 60 is an important driver of growth for the healthcare product market in China.

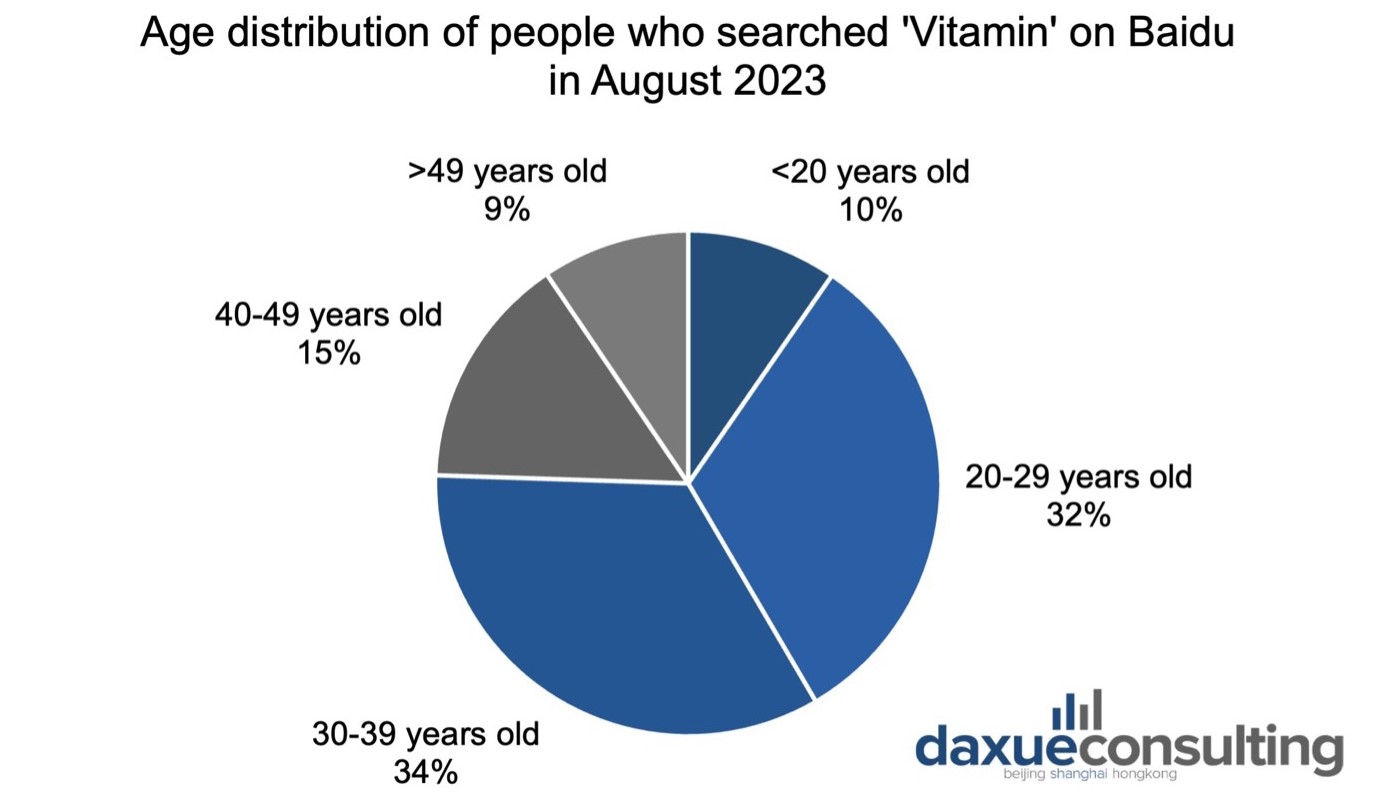

Millennials are the main consumers of health supplements and vitamins in China

Millennials and Gen-Zs primarily drive the growth of the health supplement and vitamin market in China. This demographic group is particularly seeking products that increase energy, reduce stress, and improve sleep quality. This can be attributed to the often hectic schedules and limited rest time of young people.

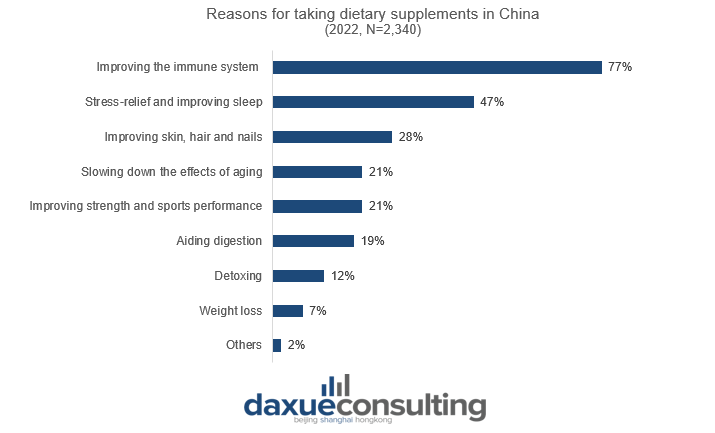

Strengthening immunity is the core driver for health supplement purchases in China

According to a survey of 2,340 people conducted by Rakuten Insights in 2022, 77% of Chinese consumers who bought healthcare products were looking to strengthen their immune systems. The following reason for consuming supplements is to reduce stress and improve sleep quality (44% of respondents). Finally, 35% were looking to improve their hair, nails and skin. These results reflect the issues consumers are prioritising nowadays.

The products Chinese consumers purchased the most in 2023 reflect the focus on these issues. Concentrated supplements (calcium, iron, zinc) were the most popular, followed by immunity-boosting products (fish oil, colostrum, probiotics) and nutritional supplements (protein powder, honey, glucose).

When purchasing healthcare products like vitamins and supplements, consumers prioritise function (91.7%), ingredients (91.2%) and product qualifications (88.1%).

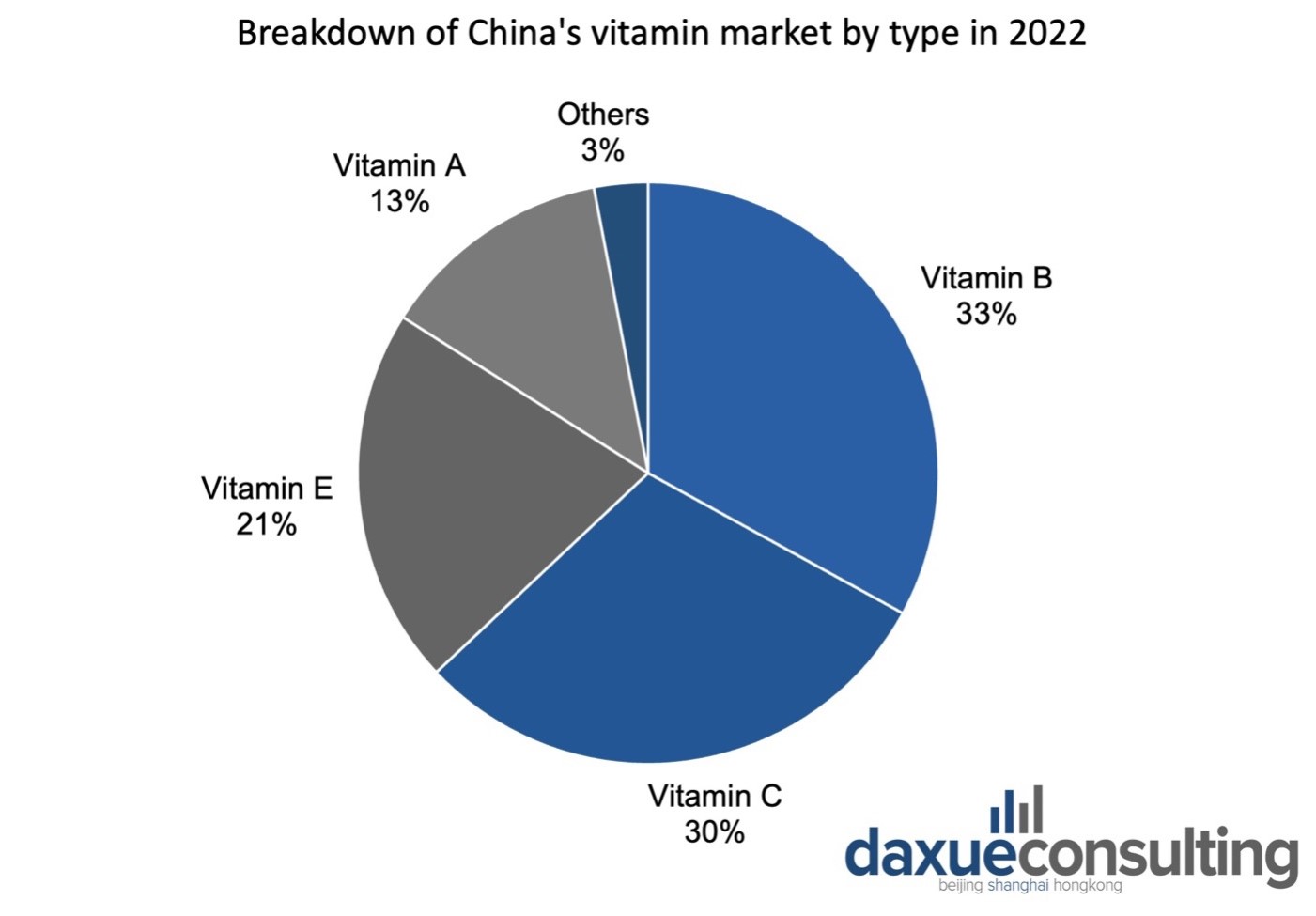

Vitamin B: the most popular vitamin in China

In 2022, the most popular vitamin sold in China was vitamin B, representing almost a third of the market. It is necessary to help the body release energy from food and keep the nervous and immune systems healthy. It was closely followed by vitamin C, which is needed to form blood vessels, muscle and collagen. The third top-selling vitamin in China was vitamin E, which contributes to the health of the brain, skin and blood.

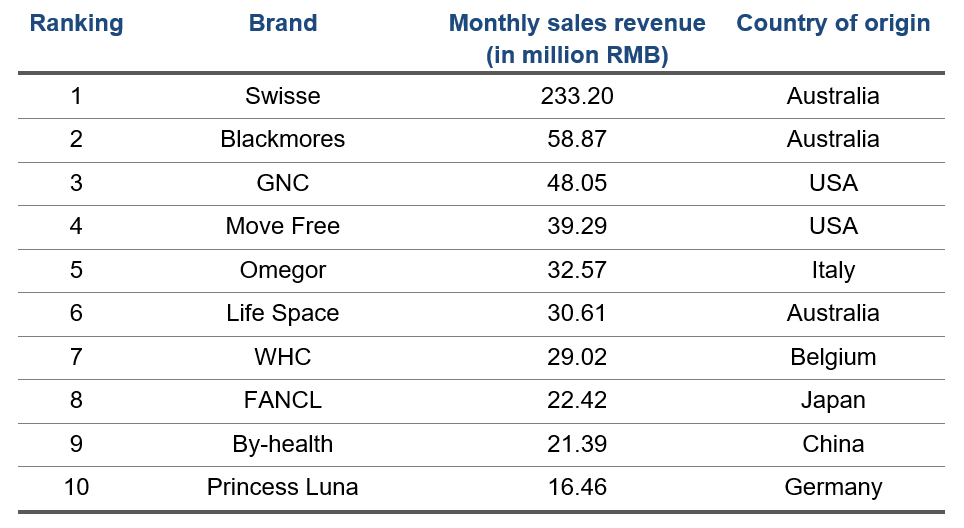

Swisse: the Australian brand dominating the Chinese market

According to iiMedia, the healthcare products industry in China is still in its early stages, and the country still has a long way to go when it comes to health supplements and vitamins production and market supervision. This explains why international brands currently occupy most of the market share. The products primarily originate from Australia and the U.S.

The most popular vitamin and health supplement brand in China is the Australian brand Swisse which was the best-selling brand on e-commerce platforms in May 2023. Consumers praise the products for being ‘effective’, for having a high ‘cost-performance’ and ‘good quality’. Among their top-selling products on JD.com, liver detox supplements are particularly popular, followed by multivitamins and fish oil capsules.

Towards the development of online retail for health supplements and vitamins

In China, vitamins and health supplements can be purchased offline, in supermarkets, drugstores, and health food stores, as well as online. Various marketing strategies exist to engage consumers and educate them about the consumption of these products. For instance, pop-up stores and sports events are a popular way of marketing them and increasing consumer awareness. Local brand By-health has even built a discovery center to educate people about nutrition and provide them with health examinations. Using AI and hologram technology, they can engage the public better and get them more familiar with their products.

With the growth of e-commerce platforms, the share of healthcare products sold online has increased. On social media platforms, health product sales have skyrocketed as well. Australian brand Swiss currently has 123,000 subscribers on Douyin, where it publishes content to promote its product. As many health product companies do, Swisse partners with celebrities, such as famous actress Qin Lan, to appeal to customers.

Stricter regulations for the sale of health products

Companies aiming to sell vitamins and health supplements in China need to obtain a ‘Blue Hat’ certification. The regulation of health supplements is governed by the State Administration for Market Regulation (SAMR) and the National Health Commission (NHC). Then, all supplements that promise health benefits and that are sold in the Chinese market must apply for the “blue hat logo” (蓝帽子) which indicates that a product has been approved by the State Food and Drug Administration (SFDA).

In 2019, the sale of health food, including health supplements, has been banned in pharmacies in over 20 cities across China. The reasoning for this is that pharmacies are required to provide products that meet the criteria for insurance reimbursement, which health supplements do not satisfy. This regulation has caused pharmacies’ sales revenue to decline. As a result, some companies have focused their efforts on developing their online retail channels. For instance, By-health, which previously used pharmacies as its main distribution channel, accelerated its online transformation. Moreover, the brand is now particularly popular on e-commerce platforms and has even ranked first in nutrition-products sales during the 2022 ‘Double 11’ (双十一) shopping festival, with total online sales exceeding USD$96.14 million.

A small market focused on product effectiveness

Chinese consumers increasingly prefer organic, natural products for health. While herbal supplements are in demand, the growth of this market is hindered by insufficient research and product quality. China’s rising GDP per capita and health literacy is driving the demand for effective health supplements and vitamins.

While the health supplements and vitamins market has witnessed tremendous growth in China, the overall market size is still small compared to foreign countries. Increasing health awareness among the population will slowly contribute to the growth of the industry and the proportion of per capita spending on healthcare products is expected to rise.

What we should know about China’s health supplement and vitamin market

- China’s healthcare product market has experienced remarkable growth, projected to rise to US$58.19 billion by 2027. Heightened health awareness following the COVID-19 outbreak and the aging population are fueling this expansion.

- Health supplements and vitamins find their main consumer base in Millennials and Gen-Zs. Consumers’ focus revolves around enhancing immunity, sleep quality, and skin, hair, and nail health.

- Key purchases encompass concentrated, immune-boosting, and dietary supplements. Attention is directed towards product function, ingredients, and qualifications. Vitamins B, C and E currently dominate the sales.

- Foreign brands dominate China’s health supplement and vitamin market due to perceived reliability. These brands market their products through offline and online engagement.

- The ‘blue hat logo’ remains a prerequisite for health supplement sales, and pharmacy sales bans have accelerated the shift to online retail. Despite its growth, the health supplement and vitamin market in China remains comparatively modest compared to other countries.