In recent years, a rational consumption trend has emerged in China’s consumer landscape—a departure from impulsive and excessive spending towards a more thoughtful and considered approach to consumption. In a dynamic Chinese market characterized by an increasing number of promotional events, it becomes imperative for brands to comprehend this shift in consumer behavior. With one of the most renowned promotional events, 11.11 around the corner, the understanding of changing Chinese consumers’ behaviors is vital for establishing meaningful connections and adeptly meeting the discerning needs of Chinese consumers.

Download our report on Gen Z consumers

Exploring the performance of 11.11 in recent years

11.11, referred to as Singles’ Day or Double 11, has evolved into an extraordinary shopping extravaganza, embodying a cultural phenomenon within China. Initially conceived as an anti-Valentine’s Day celebration for singles, this annual event has undergone a remarkable transformation, now standing as the largest online shopping festival worldwide. Occurring on November 11th annually, Double 11 has gained immense popularity among Chinese consumers who eagerly await the arrival of this grand occasion, brimming with enormous discounts, exclusive deals, and captivating promotions presented by e-commerce platforms.

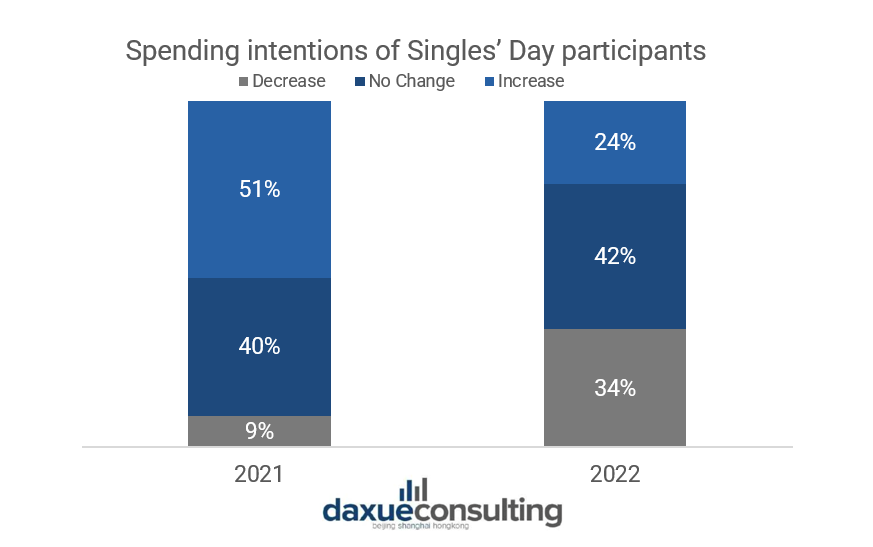

However, the popularity of Double 11 did not appear as a constant growing trend in these years. In 2022, Bain conducted research with 3,000 participants to understand their consumption patterns during Double 11. The findings revealed that for Singles Day 2022, 34% of respondents expressed their intention to decrease their spending compared to the previous year, taking into account both online and offline purchases. In contrast, only 24% of participants planned to increase their spending, indicating a noticeably less optimistic outlook compared to the previous year. As a result, retailers are encountering difficulties in regaining customer spending for the upcoming 2023 event.

The shift in Chinese consumers’ consumption behavior after pandemic

The impact of COVID-19 has led to a simultaneous decrease in both the income and spending of Chinese consumers, prompting significant changes in consumers’ consumption patterns. According to DATA100, an information technology firm, there are five emerging post-COVID consumption habits among Chinese consumers:

- Consumers are exhibiting a growing inclination toward rational consumption. Up to 63% of respondents acknowledged that their consumption habits were becoming more rational. They expressed a tendency to plan their purchases, avoid unnecessary spending, and prioritize cost-effectiveness.

- Consumers are showing a preference for trading down(消费降级). They are inclined to invest time in searching for the most affordable products across various shopping platforms.

- There are more online purchases than offline. The change in purchasing behaviour was caused by the pandemic lockdown which led to a greater shift of the population towards online channels for their shopping needs.

- Consumers are exhibiting a propensity to stockpile goods. The act of accumulating certain essential items provides them with a sense of security and peace of mind.

- There is more health-centered consumption. The pandemic has highlighted the importance of maintaining good health, leading to a surge in demand for health-related products and services among Chinese customers.

The potential effects on Double 11 after the change in consumption habits

In general, Chinese customers are increasingly becoming more rational and discerning in their shopping habits. Participating retailers in the Double 11 sales event are facing the challenges of meeting the expectations of those customers who are actively making comparisons. They are under pressure to offer appealing discounts and competitive prices that not only capture the attention of these savvy shoppers but also provide them with excellent value for their money.

Price war unleashed among e-commerce platforms

For example, Tmall has made the strategic decision to initiate a price war and pose a challenge to Pinduoduo in this year’s Double 11 event. Specifically, Tmall announced that every product available on its platform will undergo extensive price adjustments, ensuring the most competitive prices as compared to other e-commerce platforms. For consumers in Tmall, this year they no longer have to go through the hassle of comparing prices or calculating discounts and minimum purchase requirements. Instead, they can effortlessly identify products through the presence of “lowest price across the network” and “official instant deduction” lightning tags.

To combat Tmall, Pinduoduo also announced its own promotional plans. PDD’s “Ten Billion RMB Subsidy(百亿补贴)” initiative will engage over 100 domestic and international brands across various categories including mobile phones, home appliances, cosmetics, and fashion apparel. When considering specific products, the iPhone 15 Pro will see a generous reduction of up to RMB 2,000.

Retailers’ sales-boosting opportunities by leveraging on rational comsumption

First and foremost, streamlining the customers’ research process may lead to favorable outcomes. Enabling customers to swiftly access pertinent information, compare prices, and rely on trustworthy product reviews enhances their confidence in making purchase decisions. As a result, retailers may experience a surge in sales due to the increased likelihood of customers making confident purchasing choices. As mentioned before, Tmall can set a good example by reducing the complexity of the research process. In the past, Tmall’s primary promotion method during Double 11 has been “cross-store discounts” (跨店满减). However, this year marks the first time that the emphasis has shifted to “lowest prices across the entire network”, which made the comparison process much easier and less time-consuming.

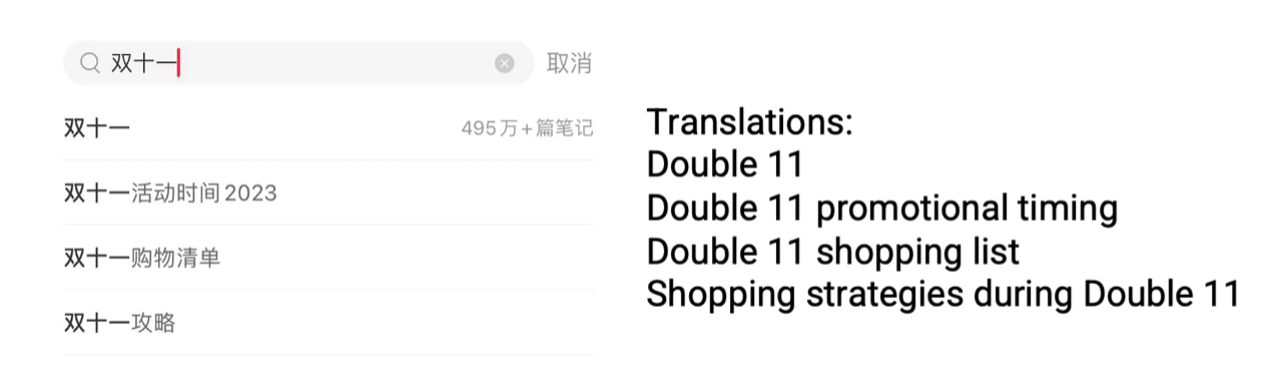

While searching for the best deals, customers practicing rational consumption will also look for some social proof or recommendations from their families, friends, or influencers. For example, when searching about Double 11 in XiaoHongShu, there are approximately five million posts related to topics such as “shopping list,” “shopping strategies,” “live streaming,”, “Best products to purchase” and more. By leveraging the power of online recommendations, Chinese consumers navigate through the vast array of choices during Double 11, ensuring they make well-informed choices and maximize their shopping experience.

Key takeaways from rational consumption and the impacts on the upcoming Double 11

- The impact of COVID-19 has resulted in reduced income and spending, leading to notable shifts in consumer behavior, with five emerging post-COVID consumption habits identified by DATA100.

- Chinese customers’ shopping habits are increasingly discerning as they invest more time in researching and comparing prices across platforms to secure the best deals.

- The more rational consumption habit poses challenges for retailers participating in the Double 11 event to provide competitive prices and appealing discounts while delivering exceptional value.

- While searching for the best deals, these rational customers will also look for some social proof or recommendations from their families, friends, or influencers.

- Retailers can further reduce the complexity of customers’ decision journey by streamlining the promotion mechanism.