According to the International Energy Agency, nearly two billion air conditioners (AC) are in use worldwide this year. This number will to increase to 5.5 billion by 2050 and China is going to drive the majority of the world’s demand. Indeed, China has boasted the fastest growth in space cooling energy consumption in the last two decades. Until recently, Chinese people just used to purchase cheap fans in the summer but with the rise in their disposable income and the increasing demand for comfort, a growing number of Chinese people can afford air conditioners now.

Therefore, China’s air conditioner manufacturing industry will keep on growing in the future, passing from around $33 billion in 2020 to $42 billion by 2025. In 2018, 60% of Chinese households had AC, since the product availability on e-commerce platforms and the emergence of easier ways to finance it, contributed to the expansion of space cooling systems. China is now accounting for over 40% of the global air conditioner market, but the growth of AC production and sales still shows no sign to slow down.

Segmentation of the air conditioner market

The air conditioner market in China, based on the product type has several segments: Splits, Variable Refrigerant Flow (VRFs), Chillers, Windows, Central and Portable ACs.

Split AC: Split AC has two parts: one is the indoor unit which includes the evaporator and the cooling fan, and the other is the outdoor unit which includes the compressor and the condenser. This type is common for homes as well as in small office spaces.

Window AC: Window-type air conditioners are not centralized units and can produce enough cool air just for a single room. In this type, all the AC components are inside a single casing. This is one of the most popular ones and is for those who are on a budget.

Portable AC: A portable air conditioner is a single self-contained unit that can be wheeled into a room and positioned on the floor. Hot air is discharged by a hose vent through an exterior wall or window. Portable air conditioners tend to be noisy, but they are a good temporary cooling solution.

Central AC: It’s used for cooling big buildings, it has a huge compressor and might be expensive to install, produces warm or cool air in one central place and then distributes it throughout the building by means of ducts.

VRF AC: The mechanism is somewhat similar to that of the Split AC but with one outdoor unit, it can connect multiple indoor units. It’s the best technology in energy conservation so far as it is best to get maximum utilization with less space and less power consumption. VRFs represent another emerging market segment due to increasing workspaces and rising industrialization.

Split type AC and end-use sector

Within the commercial AC sector, Split type air conditioners held the largest share in the China air conditioner market because there is a larger range of offers with the latest technologies, compared to window-type air conditioners. Growth in demand for multi-split units and VRFs, in particular, will be driven by an expanding real estate market and a rebounding construction market. VRFs are increasingly replacing chillers, which continue to face declining manufacturing market shares in the commercial sector. In addition, the increasing need for home improvement and furnishing services, the rise of e-commerce platforms and younger generation’s growing demand are boosting residential demand for small multi-split AC products, as well.

Based on the end-use sector, China’s air conditioner market had two segments: the residential sector and commercial/industrial sector. The residential air conditioner segment holds the largest share in China’s air conditioner market due to the rapidly increasing population and real estate construction for residential purposes. However, VRFs and chiller-type air conditioners are getting popular in large corporate spaces such as factories, offices, and institutions due to the cost efficiency for the large-scale electricity consumption.

Growth of the market and its main consumers

Geographically, the market includes North China, East China, Northeast China, South Central China, Northwest China, and Southwest China. Before 2020, North China held the largest market share in the Chinese air conditioner market because they vaunted a higher GDP and living standards.

In 2016, China accounted for 54% of global VRF sales. The regional distribution of VRF sales in China remained steady, with half of the sales coming from the economically developed Eastern coastal region, which still has significant potential for growth; followed by the tropical Southern region. North and Central China together accounts for another quarter of sales.

In terms of specific end-use sectors, East China dominates in terms of residential, office and commercial AC demand, while North and South China face stronger demand for commercial ACs than residential ACs. As a result of these demand drivers, VRFs have become the largest product category of multi-split AC products in terms of market value, passing from accounting for 11% of the market in 2015 to 50.3% in 2017, with a total market value of 40 billion RMB. After VRFs, chillers and unitary ACs are the second and third largest product categories.

Tech-related to air conditioners

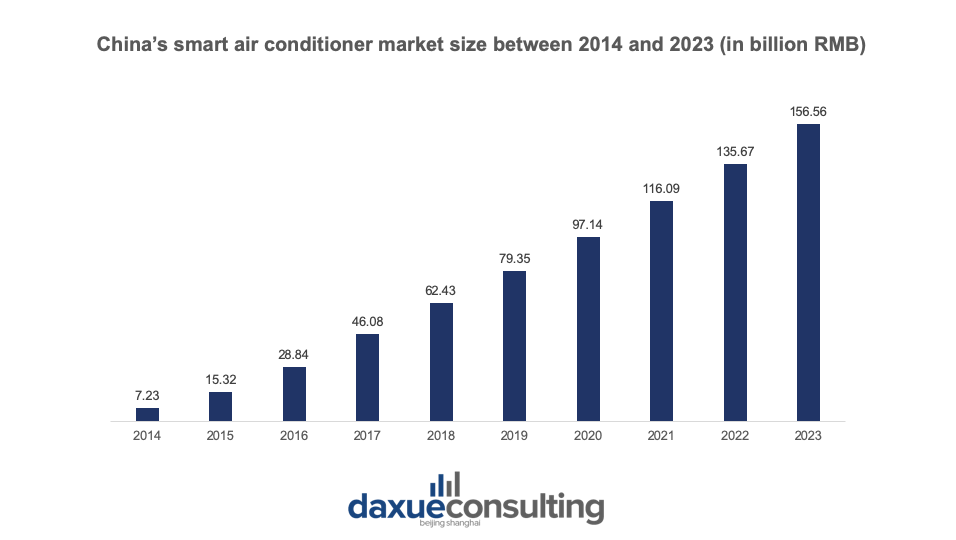

Basic average prices of residential air conditioners in China are on an upward trend because there is a significant shift in consumer demand for high-end, more energy-efficient and consequently more expensive products. The air conditioner manufacturers want to reduce the price competition and increase margins through product and technology upgrading, by introducing interaction with smartphones, IoT, cloud computing, AI technology and other cutting-edge technologies. BSRIA, a UK market intelligence company, sees smart air conditioners benefiting from rapid growth in the smart appliances and smart homes market. The proportions of smart residential air conditioning units exceeds 30%, with the market for these medium and high-end models continuing to increase their share.

Another important trend is that Chinese domestic brands are gaining increasingly more ground, whereas international air conditioner brands are gradually losing their market share in China, even if they can still make more profits by selling core components and spare parts.

Data source: Statista, designed by Daxue Consulting, Market size of the smart air conditioning in China from 2014 to 2018 with a forecast until 2023, in billion RMB

Some points about the air conditioning market in China:

- In recent years, demand for air conditioners grew due to various factors, especially because of changes in weather conditions and rising per capita income.

- Manufacturers are increasing their focus on R&D activities to meet the growing demand for higher-end and more energy-efficient air conditioners in China.

- Smart air conditioners benefit from rapid growth in the smart appliances and smart homes market.

- In 2020, the number of air conditioners sold in the domestic market totaled 51.62 million, a drop of 16.5% year on year, and the total retail sales value decreased by 22% year on year, amounting to 156.8 billion RMB during that period.

- Split type air conditioners held the largest share in the air conditioner market because there is a larger range of offers with the latest technologies. VRFs and chiller-type air conditioners are more popular in factories, offices, and institutions due to the cost efficiency.