Since the introduction of the two-wheel pedal bicycle from France to China in 1868, bicycles have been establishing a significant presence within Chinese society. This enduring popularity of bicycles persists to this day. In 2022, the sales manager of Giant’s bicycle shop in Beijing said that the sales of bicycles increased by about 30%. This heightened interest even created widespread shortages, particularly for popular models such as road bikes.

Download our report on how young Chinese Consumers are Finding Themselves

Pedaling through centuries: The evolution of bicycles in China

China’s bicycle history reflects the nation’s societal and economic shifts. In the late 1800s, bicycles arrived in China and gained favor among urban elites. However, it was not until 1949 that they became a symbol of working-class advancement with the rise of the Chinese Communist Party. The initial Five-Year Plan (1953-1957) established ambitious targets for bicycle manufacturing of a 60% increase which led China’s bicycle stock to reach one million by 1958. Bicycles even became part of an elite “marriage package.” The 1980s and 1990s marked a bicycle boom, earning China the moniker “kingdom of bicycles“. Yet, as incomes and urbanization increased, cars took over, making China a global automobile giant. However, in the 2010s, bike-sharing startups addressed urban congestion and environmental issues, heralding a bicycle resurgence.

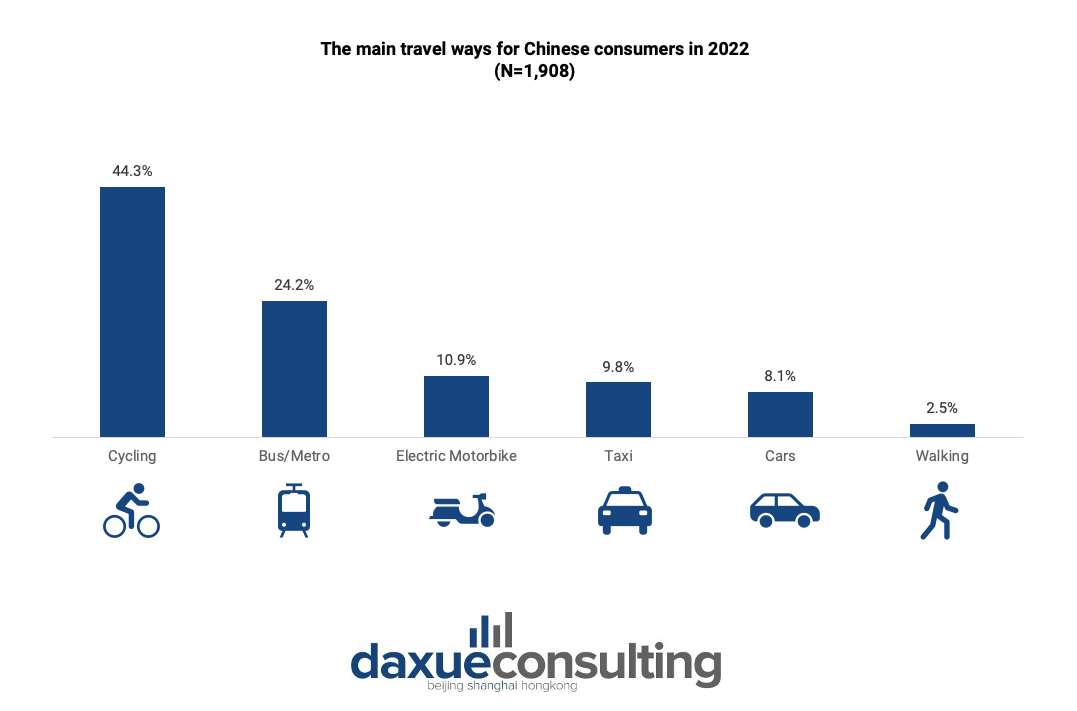

Today, cycling has emerged as the dominant mode of transportation for Chinese consumers. When survey respondents were asked about their preferred mode of transportation, cycling emerged as the top choice among commuters, with an impressive 44.3% of survey respondents opting for cycling.

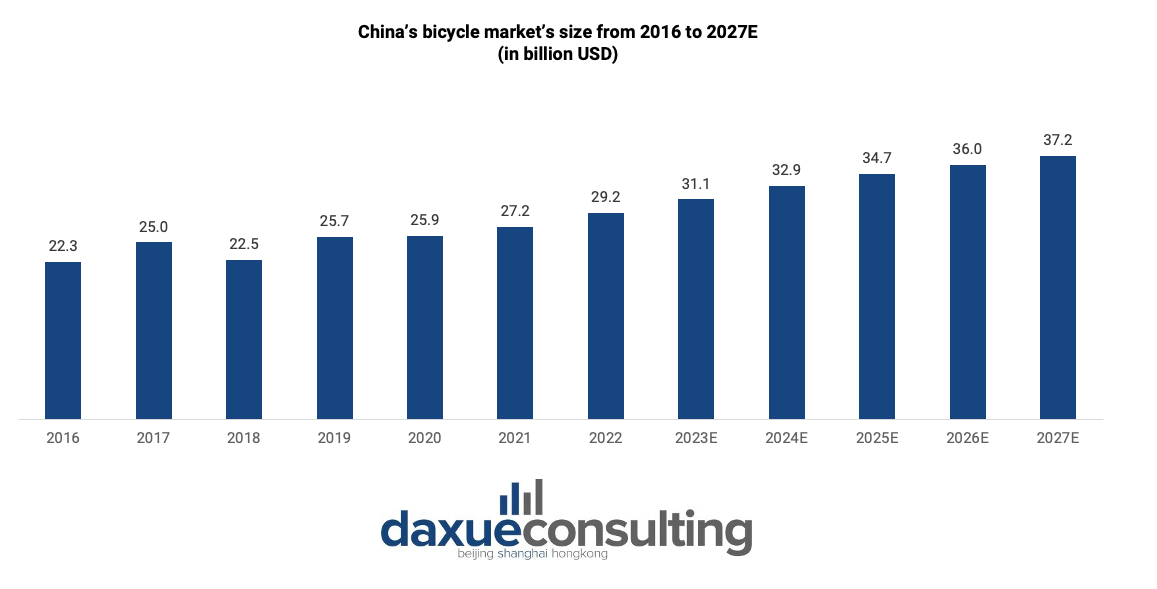

Explosive growth: China’s bicycle market expected to surpass USD 37 billion by 2027

According to iiMedia’s report, the bicycle market in China is projected to reach RMB 222 billion (approximately USD 31.1 billion) in 2023. This value is anticipated to experience consistent growth over the coming years, with a CAGR of 4.9%, reaching RMB 265.7 billion (USD 37.19 billion) in 2027.

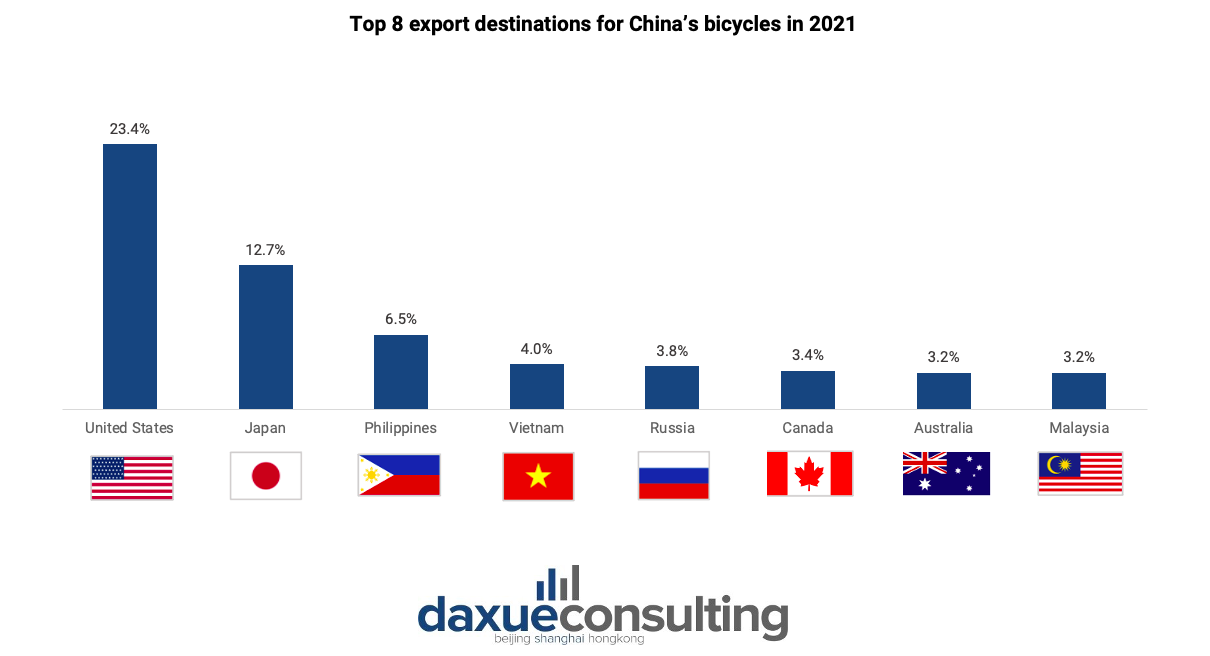

China has also solidified the country’s status as the world’s largest bicycle production and export hub. The COVID-19 pandemic has driven a surge in bicycle demand both domestically and internationally, propelling China’s bicycle industry to new heights. During the largest bicycle industry expo in Shanghai in 2021, the China Bicycle Association and industry representatives estimated that the nation currently accounts for a substantial 60% share of the global international trade in bicycles despite pandemic challenges. In the first quarter of 2021 alone, bicycle exports surged by 73.4% year-over-year with a total value of USD 1.06 billion. Based on the Observatory of Economic Complexity data, China exported USD 5.06 billion bicycles during that period, with the United States as the largest export destination.

Cycling boom in China fuels surge in insurance interest

The surge of interest in cycling in China is not only impacting the bicycle industry but also creating ripples in the insurance sector. China Ping An General Insurance has witnessed a significant uptick in non-motorized insurance sales, experiencing a remarkable 91% year-over-year increase in 2021, followed by an even more impressive growth of 254% in 2022.

Cycling insurance in China covers injuries, medical expenses, and bicycle damage across various scenarios. Despite cycling’s growing popularity, many haven’t adopted such coverage, highlighting safety awareness gaps. Furthermore, China’s commercial insurance sector is facing a gap in coverage, particularly when it comes to providing comprehensive insurance tailored for sports activities like cycling. Yet, the recently updated “Sports Law of the People’s Republic of China” underscores the importance of sports insurance, opening doors for insurers to expand into this burgeoning market.

China’s bicycle industry: Unveiling the demographic and multi-faceted appeal of cycling in China

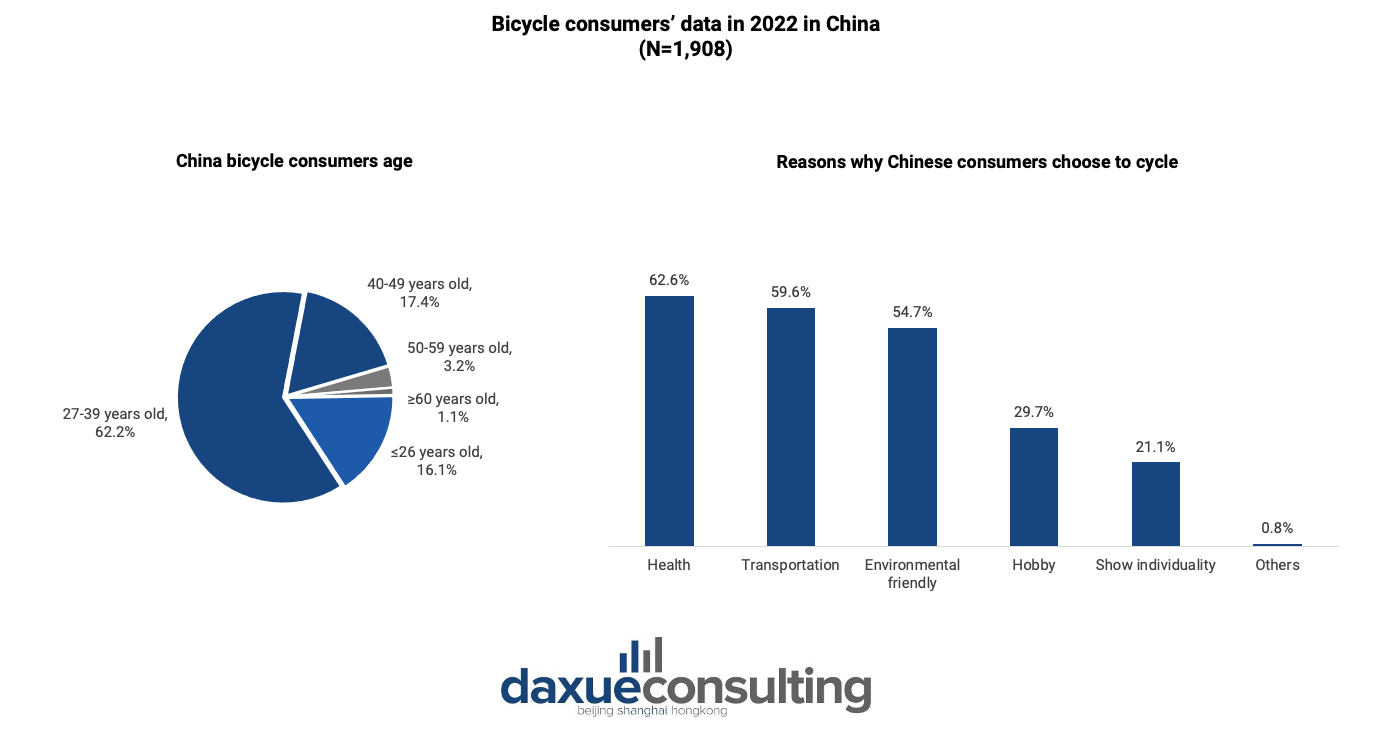

In 2022, the majority of bicycle users in China fell within the age bracket of 27 to 39 years old, making up a remarkable 62.2% of the entire cycling consumer demographic in the country. When inquired about the motivations driving Chinese consumers to embrace cycling, three primary purposes surfaced prominently: fitness, transportation, and environmental protection.

More than just transportation and health, bicycles are also a community and lifestyles

Bicycles have gained popularity in China for various reasons. The COVID-19 pandemic led to the closure of indoor fitness facilities and gyms, prompting people to explore outdoor alternatives that could be enjoyed individually or in small groups while adhering to restrictions. Consequently, many individuals turned to cycling as a health-conscious and socially distant activity with fitness enthusiasts being drawn to mid- to high-end bikes, valuing cycling as an effective full-body workout beneficial for joints and overall cardiovascular health.

Bicycles also provide a practical commuting option, especially in crowded cities where subways and taxis can be costly and congested. With gasoline prices surging from 8 RMB (USD 1.1) per liter in 2021 to over 10 RMB (USD 1.4) per liter by June 2022, many individuals are opting for a more cost-effective means of commuting, turning to cycling as their preferred mode of transportation. In contrast to many other countries, urban Chinese residents show a preference for bike-sharing over bike ownership, with 44% using bike-sharing services and 41% owning bikes according to a survey in December 2022.

Additionally, cycling has become a social activity and a means for social identification, as seen in the demand for eye-catching cycling apparel. Brands such as PNS, Rapha, and MAAP, with their distinctive cycling apparel, have cultivated a strong and expansive social identity.

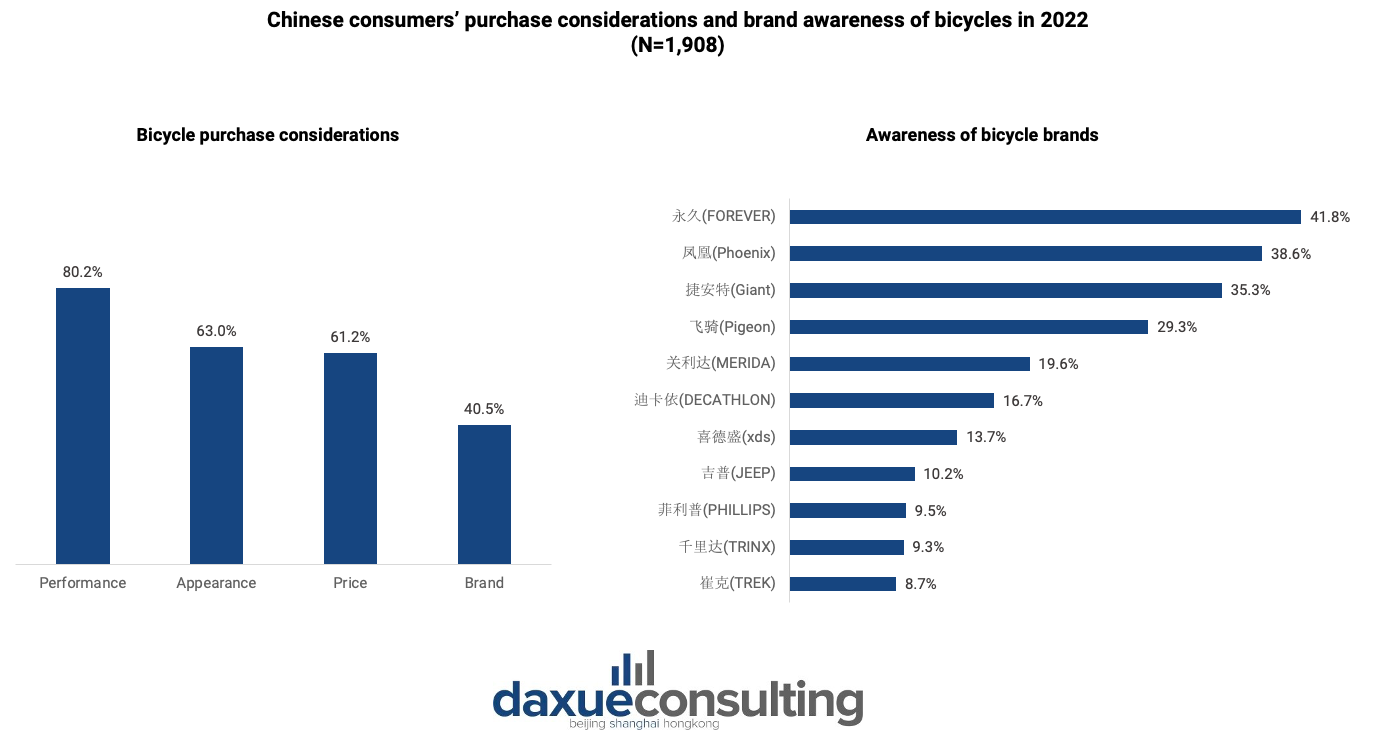

Bicycle market in China: Performance tops consumers priorities

When it comes to making bicycle purchases, more than 80% of Chinese consumers prioritize product performance in 2022. Following this, 63.3% of consumers consider product appearance, and 61.2% take price into account. In terms of brand consideration, 40.5% of consumers factor it in.

Regarding well-known bicycle brands, Forever, Phoenix, Giant, and Pigeon garnered significant consumer awareness at 41.8%, 38.6%, 35.3%, and 29.3%, respectively, signaling a strong market reputation. Within the bicycle market in China, consumer awareness and recognition of a brand stem from the product itself and the alignment between corporate promotional information and the product. The higher the product quality and the better the fit between promotional information and the product’s attributes, the greater the consumer awareness and recognition.

Road cycling in China is booming, causing a surge in sales of road bikes

Bicycles in China span various types, tailored to different riding needs and environments. These include road bikes, mountain bikes, folding bikes, gravel bikes, city bikes, fixed-gear bikes, and electric assist bikes. Among them, road bikes are the top sellers. JD.com reported that between July 1st and August 10th of 2023, there was a significant uptick in sales for road bikes priced between RMB 1,000 to RMB 2,000 (USD 136.8 to USD 273.7) compared to the previous year, with an impressive 180% year-over-year increase. High-end road bikes priced above RMB 5,000 (USD 684) saw an even more substantial growth, with transactions increasing by 530%. Furthermore, there was an 11-fold increase in transactions for cycling apparel priced higher than RMB 2,000 (USD 273.7). Additionally, children’s bicycles and folding bicycles witnessed a notable surge in sales, with over a 50% increase during the “5.20” promotion period on Taobao in 2022.

Cycling craze fuels demand for high-end bicycles in China

China is witnessing a remarkable upswing in the demand for premium bicycles as cycling gains traction among enthusiasts. Premium bicycles from brands like Brompton, Giant, and Specialized are resonating with Chinese consumers, with prices ranging from over RMB 13,000 (USD 1,790) for inner-city foldable bikes to RMB 10,000 (USD 1,380) for high-performance road bikes.

Chinese consumers, unlike their foreign counterparts, favor pricier sports-grade bikes, seeking both fitness benefits and social status. Fitness awareness, coupled with bicycle-friendly urban developments, is further bolstering this trend. However, the surge in demand has strained the global supply chain, causing supply shortages and delays. Despite these challenges, the phenomenon offers a lucrative opportunity for both foreign and domestic bicycle manufacturers to tap into China’s flourishing market by prioritizing design, quality, and innovative strategies.

E-bike boom in China and its safety concerns

Electric bicycles are poised for significant growth within the bicycle market in China with rising output and impressive sales figures from major bicycle companies in recent years. Electric bicycles offer higher technical standards and selling prices, making them valuable options for consumers. As per a 2021 Bloomberg report, approximately 300 million electric bicycles are currently in use across China, and this figure is expected to significantly increase due to growing demand and government policy support. The e-bike market in China was valued at USD 15.9 billion in 2022. It’s projected to reach USD 22.8 billion by 2028, with a 6.1% CAGR from 2023 to 2028.

The industry is also driven by advancements in lithium-ion battery technology, which enhances electric capacity, and the environmentally friendly nature of electric bicycles contributes to their widespread applications. E-bikes in China are also increasingly equipped with high-tech features, making them more than just a means of transportation but also serving as communication and entertainment hubs.

Shared bikes are reshaping the traditional bicycle market in China

The bike-sharing trend has disrupted China’s traditional bicycle industry as more people opt for shared bikes rather than buying their own. The bike-sharing industry is growing rapidly, with the China Bicycle Association predicting 20 million shared bikes by the end of 2023.

China’s bike-sharing craze began with competitors Mobike and Ofo, introducing smartphone-enabled bike sharing. Ofo, founded in 2014, focused on solving the last-mile problem for students while Mobike, founded a year later in 2015, aimed for the high-end market. In 2019, Ofo filed for bankruptcy while Mobike became Meituan Bike after its acquisition in 2018. In 2023, key players are Meituan Bike, Hello Bike (Alibaba-owned), and Qingju Bike (Didi-owned). Meituan Bike, based in Beijing, leads globally. Hello Bike, known for Alipay-blue branding, expanded to first-tier cities. Qingju Bike, with light green branding, operates mainly outside first-tier cities, offering e-bike sharing.

Cycling in China: A brief look at the market growth and projection

- In 2022, bicycles accounted for 44.3% of commuting options in China, surpassing metro, bus, taxi, and cars. The bicycle market in China is projected to reach USD 31.08 billion in 2023.

- China has become the world’s largest bicycle production and export hub, contributing to 60% of global bicycle trade.

- The cycling boom in China has led to increased interest in cycling insurance, with substantial growth in non-motorized insurance sales.

- Cycling appeals to a wide demographic in China, with motivations ranging from fitness and transportation to environmental concerns and social connections.

- Road bikes, premium bikes, and e-bikes are experiencing significant growth driven by various factors, presenting opportunities.

- Bike-sharing is reshaping China’s bicycle industry with a predicted 20 million shared bikes by 2023. Major players are Meituan Bike, Hello Bike, and Qingju Bike, with Meituan Bike leading globally.