Introduction of Calvin Klein

Calvin Klein (abbreviation: CK), is an American fashion brand, founded in 1968. It was named after the founder, designer Calvin Klein. Calvin Klein is one of the largest designer brands in the United States. Its new product designs are endless, and the momentum of Calvin Klein in China is strong. Their products adhere to perfectionism, and every piece of Calvin Klein fashion is aimed to be perfect. As it reflects the full New York lifestyle, Calvin Klein’s clothing has become the favorite of the new generation.

Calvin Klein has three major brands: “Calvin Klein Collection” (high-end fashion), “CK Calvin Klein” (high-end ready-to-wear), and “CKJ” (denim). It Also operates casual wear, socks, underwear, nightwear, swimwear, perfume, and glasses, furniture and etc.

[Source: Weibo, CK is prominent in China’s underwear market]

Calvin Klein Initial Stages in China

Calvin Klein Jeans, launched in Beijing in 2001, was a landmark for the brand. CK held its debut Fall/Winter 2010 line in Shanghai. It marked as its first time to show the entire line in the same show and reflected Calvin Klein’s emphasis on the Chinese market.

In 2006, President and chief operating officer of Calvin Klein, Tom Murry, gave an analysis of Calvin Klein in China, “Our core client here (Calvin Klein consumers in China) is middle class, aged 25 to 35. Ours is a segmented business, and in China we are focusing on the middle range. In March, we’ll open our first Collection store in Beijing, hopefully following with additional locations. There is a growing affluence in China. It can support luxury, but so far, no one is making money yet in luxury goods.”. Calvin Klein made up for a unique blank market of middle-class consumers in China. CK China positioned itself as a midprice brand with global prestige.

Calvin Klein Facing Challenges in China

Thanks to the steady double-digit growth in Europe in 2019, Calvin Klein’s third-quarter revenue repaired the second-quarter decline. A slight increase of 0.5% year-on-year to 968.9 million US dollars, a fixed exchange rate increase of 3%, a 10% increase in Europe, and the additional revenue of acquisition of Australia business offset the decline in China and North American home market. Same-store sales in international and North America respectively decreased by 2% and 4% year-on-year.

Chairman and CEO, Emanuel Chirico said in the 2019 financial report that the current holiday season needed to continue to face the fiercely competitive and widely promoted retail environment. It was expected that global macroeconomic and geopolitical turmoil would continue to bring headwinds. He pointed out on the analyst conference that same-store sales and profit margins were disappointing in the third quarter, and he expected the trend to continue.

Calvin Klein sales declined in Hong Kong

Emanuel Chirico also revealed that the lucrative Hong Kong market, which accounted for more than 1% of the group’s revenue, plunged 40% in the third quarter, showing a decrease trend of Calvin Klein’s business in Hong Kong. Calvin Klein penetrated Hong Kong far more than its competitors before. Therefore, Calvin Klein’s parent company continued to put pressure on the performance of CK China. During the period, the Group did additional branding work on the tension between China and the United States. A small survey of about 1,000 shoppers showed that their acceptance of Calvin Klein and Tommy Hilfiger brands remained unchanged. “We have not seen any potential negative reactions from Chinese consumers to American brands,” he said in response to analyst questions.

Calvin Klein’s decline in Mainland China

As for Calvin Klein’s decline in the mainland, Emanuel Chirico explained that as the first local high-end brand, Calvin Klein’s positioning of midprice non-luxury brands and a huge sales network had put pressure on consumer flow, and physical same-store sales had not been able to reverse the decline. The strong growth of the online platform was not enough to offset the decline of the entity.

[Source: Tuxi, CK store in China]

Calvin Klein’s Humiliating China Incident

In 2019, Calvin Klein listed Hong Kong and Taiwan as separated regions from China on its English page and Hong Kong was separately labelled on its Chinese page. Calvin Klein consumers in China were furious about its implication about Taiwan and Hong Kong were independent countries, so they boycotted the brand. Zhang Yixing, a Chinese pop star and a Calvin Klein ambassador, warned the brand to respect the “one China” policy. Before the explosion of CK, many well-known international brands were collectively boycotted by Chinese netizens because of the politically incorrect division of countries and regions.

[Source: RETAILINASIA, Zhang Yixing]

According to the operator’s financial network, in 2018, the first quarter of CK parent company PVH Corp.’s group revenue was 2.314 billion US dollars, an increase of 16.4% year-on-year, net profit reached 179.4 million US dollars, and digital business achieved a 20% increase.

Emanuel Chirico, Chairman and CEO of its group, stated that “CK has continued to outperform the rest of Asia in all categories in China, despite its strong international business momentum.”

In response, many netizens have said: “To run business in the Chinese market, you must obey Chinese laws”, “China’s territorial integrity cannot be violated”, “leave none behind”.

Calvin Klein China apologized on Weibo and corrected the mistake on its websites. “We respect and support China’s sovereignty and territorial integrity,” the company stated.

How COVID-19 Affected Calvin Klein in China

Calvin Klein’s parent company is PVH Group. On February 12, 2020, PVH Group disclosed the impact of the COVID-19 epidemic and revealed that most of its Calvin Klein outlets and authorized stores in China were closed, and other stores needed to close early even if they were still in operation. Sales had dropped sharply.

PVH Group expected that CK China would contribute 7% of the Group’s revenue in 2019. The Asia-Pacific region accounting for approximately 16%. On the other hand, China would account for 20% of the group’s global procurement. About 10% were exported to the United States.

Emanuel Chirico, CEO of the PVH Group, believed that the epidemic would only have a “short-term” impact on Asian business. He emphasized that the local major development opportunities would continue to increase in the long run.

Calvin Klein First Test On “Cloud Pop-up Shop” with Tmall

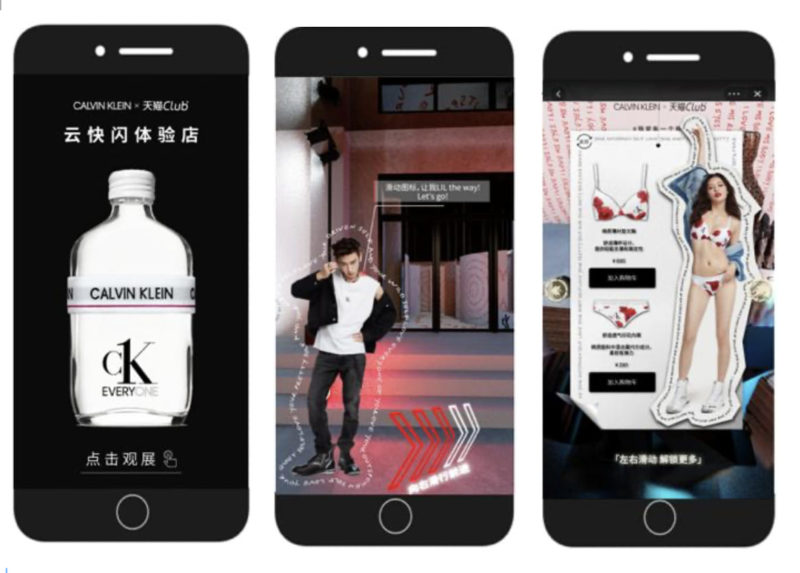

On March 16, 2020, Calvin Klein China and Tmall Club joined forces with the official flagship store of Tmall. This collaboration was the launch of the CK ONE “Cloud Pop-up Shop“. The shop integrated the interactive 3D virtual experience exhibition, and simultaneously released a limited time limited edition of CK ONE series of clothing and CK EVERYONE Eau de toilette.

The opening of the “cloud pop-up shop” was a test for Calvin Klein and Tmall Club to combine the online shopping experience with cutting-edge technology. Public information shows that as a new-experience marketing of Tmall, the Tmall Club co-brand, reaches a wide range of people. Through online and offline linkage, it is possible to create online groups that suitable for different groups. Innovation would be important in the future marketing of Calvin Klein in China.

[Source: Baijiabao, Calvin Klein First Test On “Cloud Pop-up Shop” with Tmall]

What we can learn from Calvin Klein’s China strategy

Calvin Klein has targeted a more middle class consumer than other luxury brands in China. The brand has also navigated through internal crisis management during the Hong Kong incidents. Additionally, having employed Coronavirus crisis management. The brand can continue to expand through digital marketing and KOL marketing.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes