Burberry Group Plc is a British luxury fashion house that distributes clothing, fashion accessories and licensing fragrances. Its distinctive tartan pattern has become one of its most widely copied trademarks in China. Burberry is most famous for its iconic trench coat, which was invented by founder Thomas Burberry. The company has flagship stores and franchises around the world, and also sells through concessions in third-party stores. HM Queen Elizabeth II and HRH the Prince of Wales granted the company Royal Warrants. The Chief Creative Officer is Christopher Bailey. The company is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. Sales of Burberry in China are increasing faster than any other region, so we evaluate the successful strategy of the luxury powerhouse.

Burberry’s China market entry strategy

In September 2010, Burberry bought out its first Chinese franchise partner in a £70 million deal, giving it greater control over its presence in the country. As of now, Burberry has over 57 stores in 31 cities in mainland China, including eight in Beijing, nine in Shanghai and three in Hangzhou. As China’s share of the global luxury market expands further, from 33% in 2018(when Chinese luxury consumers spent about $122 billion on high-end goods) to 41% in 2025 (when Chinese luxury consumers will spend between $173 billion and $181 billion), giving Burberry more market growth potential in China. Burberry’s strategy to enter China’s luxury market is mainly as follows.

Franchising

As a medium-cost method with rapid expansion, franchising is regarded as an increasingly critical method, which helped Burberry to enter the China’s luxury market with professional, local management. Franchising gives retailers the opportunity to build a global business in a short time. At the same time, franchising does not bring huge financial pressure on the domestic retail business.

However, the main drawback of franchising is the lack of control over the brand. Thus, it is crucial to find a right partner to eliminate possible control difficulties.

Flagship stores

Opening a flagship store is a method to enter China’s luxury market with the highest level of control and involvement, emphasizing branding rather than generating profit. Two years after seven openings of flagship globally in 2012, the “Dreams of London” was introduced in Burberry’s China flagship store in Shanghai. In the flagship store, products equipped with high-tech chips trigger multimedia content in the mirror, which displays the in the brand showroom.

Inspired by the global flagship store at 121 Regent Street in London, the space combines the best of British craftsmanship and materials. Burberry’s flagship store in China showcases the extraordinary performance of the brand, helping Chinese luxury consumers feel the multi-sensory image of the brand, aiming to increase brand awareness and achieve brand resonance.

Source: luxuo.com, Burberry Opens Flagship Store in Shanghai

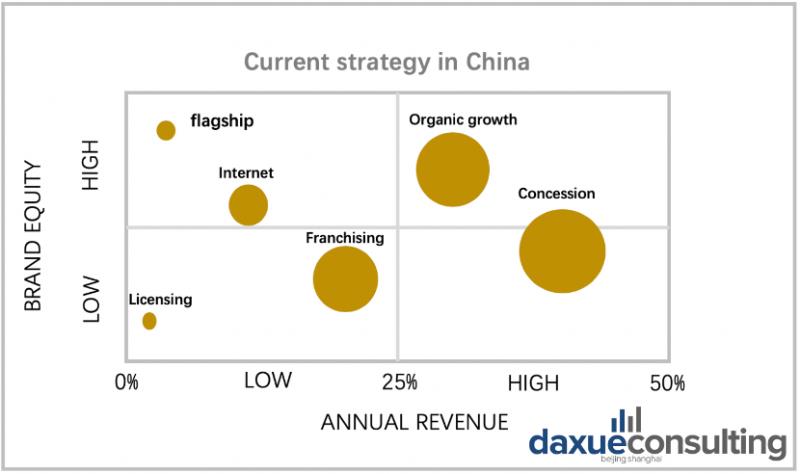

At the beginning of expansion of Burberry in China, as the market knowledge and management experience acquired in the western countries may not be appropriate, Burberry tended to conduct marketing through low-control intervention, such as wholesale, franchising, concession, etc., to test the market reaction. After a few years, when the retailer had accumulated enough local experience and knowledge, it decided to accelerate its organic growth through the use of franchises and bring operations in-house. This has allowed Burberry to tighten its grip on brand identity at different times. Thus, maintaining the global exclusivity of the brand image.

E-commerce in China

Internet sales help international retailer measure its international sales if it decides to open the physical store in a new foreign market. As a market entry method to enter China’s luxury market, internet is a form of export that enables retailers to promote their products beyond the country of origin through online platforms, mobile devices and social media and establishes a direct and mutual relationship between retailers and consumers.

Burberry in China has accumulated about 1.51 million followers on Weibo, a very popular Chinese social platform, and the number of followers on Tmall sales platform has now reached 2.16 million.

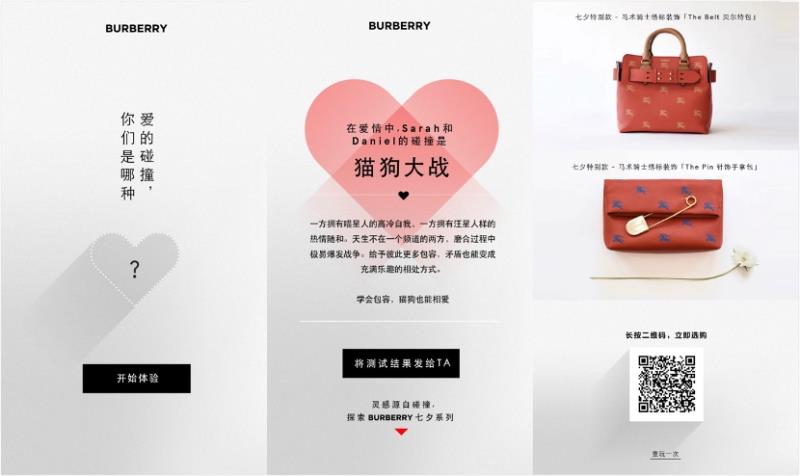

Burberry launched its Wechat Mini program on Wechat on Chinese valentine’s day (Qixi) in 2018, the mini-program campaign takes the form of a game. The campaign encourages fans to play the game with their partners. After completing the game, users will be able to get access to Burberry’s latest collection, including two Qixi bags sold exclusively in China.

Source: Jingdaily.com – Burberry Launches 2 Handbags Just for China on First WeChat Mini-Program

Late last year, Burberry and Chinese tech giant Tencent struck an exclusive partnership to develop social retailing in China. Burberry and Tencent will pioneer a concept that combines social media and retail to create digital and physical Spaces for participating communities to interact, share and shop.

Burberry’s first step will be to open a store backed by Tencent technology that offers a unique experience that connects the social and online lives of luxury customers to their physical environment. This will be a unique testing and learning space, serving as a laboratory for experimental innovation that can be extended to other parts of network of Burberry in China.

Source: Burberryplc.com – Burberry and Tencent enter into exclusive partnership to develop social retail in China

Current strategy in China

In the past, Burberry in China has tended to adopt a low involvement and control approach to enter China’s luxury market, such as franchising, licensing and concession, to maximize its market share and sales. Having accumulated a lot of resources and experience, Burberry has recently started to use overseas partnerships to further increase revenue and brand equity through stricter control of its flagship, self-owned and other wholly-owned stores.

Target customer in China

McKinsey estimates that China’s luxury spending will nearly double between 2020 and 2025.

From the perspective of age, the post-’80s (Generation Y) accounted for more than half of the consumption of luxury goods in China, making them the main force of luxury consumption in China. In addition, two-thirds of the post-’90s generation (Generation Z), who tend to be only children because of the one-child policy, said their parents (mapping as Generation X) approved of luxury purchases.

In addition to target Generation Y (the current luxury consumer main force), Burberry also sees the potential of younger consumers. From the perspective of Burberry’s entry strategy and marketing strategy in China, Burberry has been continuously entering into various popular social platforms in China and launching events with advanced technology on the social platforms for young Chinese generation, such as the events held on WeChat Mini Program, which are deeply favored by young Chinese generation.

China, the fastest-growing market for luxury goods, continues to be underpinned by a growing middle class and the latest sign that consumers remain confident.

Marketing strategy in China

Multi-channel marketing strategy in China

Burberry sells five product categories (accessories, Women’s, men’s, children’s and beauty) in three strategic regions, Asia, EMEA and the US, through both online and offline channels. Although the global revenue of Burberry in 2018 reached 2,733 billion dollars, decrease by 1% compared with last year, luxury sales in Mainland China increasing by 20% in 2018.

The revenue from offline channels is larger than that from online channels in China; however, it is a significant channel to create a seamless brand display. Burberry adopts a multi-channel marketing strategy in China combining online and offline.

Physical store

So far, Burberry has operated 57 stores in 31 different cities of China, including two pop-up stores and one flagship stores located in Shanghai. Physical stores are likely to bring about a number of functions that cannot be replaced by online channels. The purpose of in-store shopping lies not only in goods acquisition, but also in the shopping experience, the social activities, as well as the entertainment.

Burberry’s stores in China are designed to provide customers with superior customer service and experience. Also, offline stores still account for the majority of its revenue. However, for Chinese luxury consumers buying brands like Burberry, offline stores can also help solve the problem of counterfeiting.

Integration of online channels

Despite its crucial contribution, the influence of physical stores might be geographically limited. Thus, the integration of online channels helps to create a comprehensive channel to communicate products and enhance brand awareness (regardless of regional restrictions). For the Chinese market, Burberry is present on popular social platforms including Weibo, and WeChat with seamless commercial accessibility on the platforms.

The seamless integration enables Burberry to extend purchase opportunities beyond markets where it has a direct presence. For instance, Burberry partnered with social platforms to allow followers globally to experience the flagship opening event like “Dreams of London” in Shanghai.

Moreover, Burberry invited the followers on WeChat to watch the women’s wear show at London Fashion Week (AW14) on social platform. As described above, Burberry launched WeChat Mini program for fans to participate in the game and release the limited edition bags in China.

The integration of online channels expands the accessibility through the Internet, because it dilutes the exclusive brand image and value of Burberry and promotes the brand’s visibility and participation in China.

Collaborate with Chinese celebrities and KOLs

In China, choosing a popular and suitable spokesperson via celebrity endorsement is a key to success. In 2016, Burberry introduced Kris Wu (Chinese actor, singer), who is hugely popular with the young Chinese generation, as the first non-British spokesman. Burberry’s retail revenues went from declining to growing by more than 20% in two months. The following year, Burberry announced Dongyu Zhou (Chinese actress) as the brand’s first female ambassador in Asia. Zhou’s unique temperament and extraordinary acting skills have endeared her to the young Chinese generation.

Kris Wu and Dongyu Zhou were invited to Burberry’s Spring/Summer 2018 fashion show at London Fashion Week. Burberry wanted to leverage the popularity from two celebrities to appeal to China’s millennial luxury shoppers.

In 2019, Chinese actresses Wei Zhao and Dongyu Zhou have landed new roles as the faces of Burberry’s Chinese New Year campaign. As an actress, director and pop singer, Wei regards something of national treasure in China. Since she starred in a hit TV series in 1998, she has accumulated a lot of popularity in China. Unlike the new generation of stars Kris Wu and Dongyu Zhou, the Chinese customer that loves Wei is more concentrated in Generation X and Y.

Source: luxurysociety.com – Zhao Wei and Zhou Dongyu star in Burberry New Year ads as downturn fears emerge

Creating cartoon characters as brand endorsements

To celebrate the Chinese New Year in 2020, Burberry created its cartoon rat character called Ratberry. Named ‘Bobo Rat’ in Chinese, it represents the Year of the Rat, which is integrated with the Thomas Burberry Monogram for the brand’s Holiday Collection. Also, Dongyu Zhou posted Hashtag #Ratberry# on Weibo for several times, interacting with followers while receiving many likes and comments.

Source: Chinafilminsider.com – How Burberry Won Over Chinese Consumers With ‘Ratberry’ Campaign

Burberry in China collaborated with different celebrities to appeal to Chinese luxury consumers of different generations. In attracting the millennial luxury consumers, Burberry had also consolidated current main Chinese luxury consumers. From this perspective, Burberry has set up a good model for luxury brand in China.

Luxury brands are increasingly partnering with KOL on social platforms and Burberry in China is no exception. In addition to Weibo, Burberry also cooperates with many Chinese local Kols on Xiaohongshu (China’s foremost social shopping and UGC platform).

Author: Qing Zheng

Learn how brands maximize profit with a direct to consumer strategy in China

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast