It is no secret that China’s population is aging: in 2050, the Chinese elderly over 60 will make up 39% of the population compared to 15% now. Nonetheless, China has not reached the level of prosperity of its developed counterparts such as Japan or European countries and has specificities that could make this issue more complex and pressing than elsewhere.

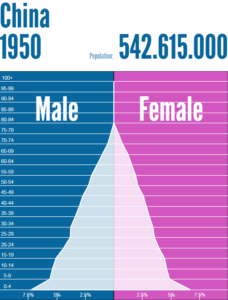

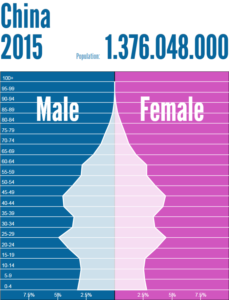

Chinese Elderly: The age pyramid turns upside down in China

Pictures source: Population Pyramid

China’s population is one of the fastest aging in the world. When it took 60 years to the US seniors over 65 to constitute more than 14% of the population, the Chinese population met this criterion within 23 years. On the other hand, China goes short of young citizens as the fertility rate equal to 1.5 in 2015 is still below the replacement level of 2.1. Comparing 1950 and 2015 age pyramids, one worrisome phenomenon shows up: there will be more seniors in China than working-age adults. Today, there are 7.6 workers for one retiree in China, but according to the United Nation’s demographic forecast, each retiree will be supported by 2.1 workers by 2050.

The Chinese working-age adults will bear the burden

The new China Health And Retirement Longitudinal Study (CHARLS) realized in 2015 by Peking University found that the average number of surviving children for people in their 60s has declined to 2.5, while those in their 80s have more than four children on average. It means that those in their 60s now will hardly be able to rely solely on family for care in their later years, a conclusion that did not appear in the 2011 CHARLS. It illustrates the 4-2-1 system that the Chinese adopted because of the one-child policy. The unique child takes care of his two parents who look after four grandparents. With Confucius principle of filial piety at the center of the Chinese culture, taking care of parents is the norm.

What does it mean if such a norm becomes law? In 2013, the “Protection of the Rights and Interests of Elderly People” law was enforced. Children have the duty to tend to the “spiritual needs of the elderly” and if they fail, they can me sued by their parents over 60. Better still, since May 2016, the Chinese who don’t comply with this law can see their social credit scores lowered as punishment. If the Chinese government legislate on the elderly care, this is for sure a major social issue. Thus, the working-age adults have legitimate reasons to worry: “I pay my pension money every month, but I don’t know how much I will get after I retire,” says a middle-aged employee of an international company.

Is it too late for the Chinese government to fix it?

Talking about retirement, one solution for the government would be to delay the retirement age. Beijing has already raised it for some women in the civil service, but more can be done. About 87% of men between 60 and 64 and 86% of women in their 50s don’t have health conditions limiting work, which means they are physically able to work after their legal retirement age.

The government also relaxed the one-child policy at the end of 2015 to allow Chinese couples to have two children, hoping it would help to cope with a weakening traditional family support. They expect the labor force to rise by 30 million by 2050. However, socio-economic reasons dissuade most couples from having more than one child. The policy change comes too late and will be insufficient to reverse the rapid aging of the population according to experts.

The fundamental problem is the pension system that started too late, and that is already using the money of younger people to pay current pensioners. It will become a burden on the country’s finances, as it is predicted to have a financial gap of RMB 86 trillion according to Hu Jiye, a professor at China University of Political Science.

Undoubtedly, China “needs to do much more to be prepared for an aged society” as Jiang Baoquan, a demographer with Xi’an Jiaotong University puts it.

How does Daxue Consulting help its clients

A leading provider of nursing homes in Europe contacted Daxue Consulting to prepare its entry into the Chinese market. The client required a benchmark of already existing competitors in China and assessment of the size and the potential of the market for high-end nursing homes. Daxue’s team conducted an extensive desk research, carried out a benchmark of competitors and a mapping of supply of nursing homes across China to meet the client’s demand.

See also our service: Naming in China