In 2023, China’s luxury market made a significant rebound, surging by 12% year-on-year after a pandemic-induced dip the previous year, Chinese luxury market is on track to become the world’s largest, with Chinese luxury consumption estimated to account for 35%-40% of the global total by 2030.

Alongside the development of the Chinese economy and its increasing international status, Chinese consumers’ national pride is growing. This trend has created a conducive ground for the emergence of Chinese luxury brands, like DUANMU (端木良锦) and Shangxia (上下), and induced international brands to incorporate Chinese elements into their products.

For foreign luxury brands to remain competitive, they cannot ignore both the strengths and weaknesses of homegrown counterparts. Failure to do so risks being outpaced by the growing momentum of Chinese luxury brands.

Deep-dive into China’s luxury market

Download our report below

1. Chinese luxury brands will come from products that are exclusively Chinese

Instead of competing head-to-head with foreign brands in segments dominated by Western names, local companies can leverage their deeper understanding of Chinese culture to cater to Chinese consumers. Indeed, although Chinese first-time consumers are more inclined to purchase foreign brands due to their longer history and higher prestige, in the long run, local luxury brands may gain more recognition by focusing on products deeply rooted in Chinese culture and habits, thereby avoiding direct competition with foreign brands.

In fact, in industries such as baijiu, tea, porcelain, and silk the quality and prestige of Chinese brands is not questioned. For instance, baijiu brands such as Maotai and Wuliangye have become synonymous with high-quality spirits deeply entrenched in Chinese culture and rituals. Similarly, tea brands like Gan De Long Xin (感德龙馨) and Long Tan Xin Yang Man Jian (龙潭信阳毛尖) are revered for their rich history and precious tea varieties, appealing to Chinese consumers’ reverence for tradition and excellent quality.

2. Homegrown luxury brands will leverage Traditional Chinese Medicine (TCM) in cosmetics and fragrances

In the cosmetics and fragrances industries, luxury brands are incorporating Traditional Chinese Medicine (TCM) into their products. More and more consumers prefer TCM cosmetics due to their association with ancient Chinese beauty practices, perceived natural and safe ingredients, and reputation for being more skin-friendly.

Between 2013 and 2022, the market size of TCM cosmetics in China increased from RMB 17.1 billion to RMB 75.0 billion. Even in 2022, when the overall performance of the cosmetics industry was lackluster, the market size of TCM cosmetics still achieved a slight increase.

Local high-end cosmetics brands such as Jadeauty (玉容初) are already seizing this opportunity by producing TCM-based skincare products. Jadeauty’s team has taken a unique approach by introducing saffron(藏红花), a natural skincare gem, into their product line. In ancient China, saffron was known as the “number one beauty regimen of ancient times,” with legends suggesting that the royal skincare secret of Empress Wu Zetian included saffron as a key ingredient.

Jadeauty’s inaugural saffron series, highlighted by its unique blend of TCM soothing and anti-aging effects along with pure herbal additions, has garnered significant favor among supporters of Chinese-made beauty products. The brand’s flagship store on Tmall boasts a satisfaction rate exceeding 99%.

3. Chinese luxury brands will leverage Chinese traditional craftsmanship to stand out

The ascending Guochao (国潮) trend, coupled with government support aimed at promoting the “craftsmanship spirit,” presents promising opportunities. Chinese consumers increasingly value brands that integrate traditional craftsmanship techniques into modern designs.

Lao Feng Xiang (老凤祥), a renowned Chinese jewelry brand, has already integrated traditional craftsmanship into its creations. This brand is the inheritor of the longest-standing gold and silver craftsmanship tradition in the Shanghai region, and its gold and silver processing craftsmanship was recognized as the second batch of national intangible cultural heritage in 2008. With over 150 years of history, its techniques include inlaying, gold and silver smelting, casting, hollowing, and engraving.

According to Deloitte’s Global Powers of Luxury Goods 2023 report, Lao Feng Xiang continues its upward trajectory, ranking eleventh and climbing one spot compared to the previous year. Based on the combined sales figures of companies during the 2022 fiscal year, this ranking evaluates the sales performance of the top 100 luxury goods companies globally.

4. The lack of a robust craftsmanship ecosystem hinders the emergence of local luxury brands

Without a solid framework for craftsmanship in China, some local luxury brands find it difficult to establish or expand their craftsmanship ecosystem. Nevertheless, Chinese luxury brands look willing to invest time and resources in incubating their own ecosystem if necessary. For example, the founder of the designer furniture brand Thru Design (素元), Wu Wei, set up his own wood training workshop to teach woodworking techniques to woodworking enthusiasts in 2012. As of 2020, over a thousand students acquired basic woodworking skills at the workshop. Many of them joined Wu Wei’s company after completing the course, while others established their own workshops to craft furniture independently.

5. The emergence of homegrown luxury brands will go hand in hand with the implementation of state policies in terms of heritage protection

Since the formulation of the Plan on Revitalizing China’s Traditional Crafts by the Ministries of Culture, Industry and Information Technology, and Finance in 2017, greater attention has been put into protecting heritage and traditional craftsmanship. This will in turn promote the appreciation of Chinese craftsmanship, conserve traditional crafts, and facilitate the emergence of luxury brands in China.

Chinese netizens show a growing interest in traditional craftsmanship and heritage, as evidenced by their active engagement in online discussions surrounding topics such as intangible cultural heritage, which has garnered 1.31 billion views as of February 28, 2024. This cultural renaissance is further highlighted by the presence of brands that related to intangible cultural heritage accounting for nearly 20% of participants in the 2021 Autumn/Winter Shanghai Fashion Week, underscoring the growing significance of traditional heritage in the contemporary luxury landscape.

6. Chinese luxury brands are well-poised to benefit from the quiet luxury trend

Stealth luxury is a prevailing trend in the luxury industry, prioritizing understated elegance, craftsmanship, and quality over ostentatious logos. Moreover, the Common Prosperity campaign in China, along with some recent fashion trends like minimalism and new vintage styles, is further boosting the emphasis on simplicity and timeless elegance over flamboyant displays of wealth. With their low brand awareness and inspiration drawn from ancient Chinese minimalism, homegrown luxury brands naturally embody inconspicuousness and low-key elegance, positioning them to thrive within this trend.

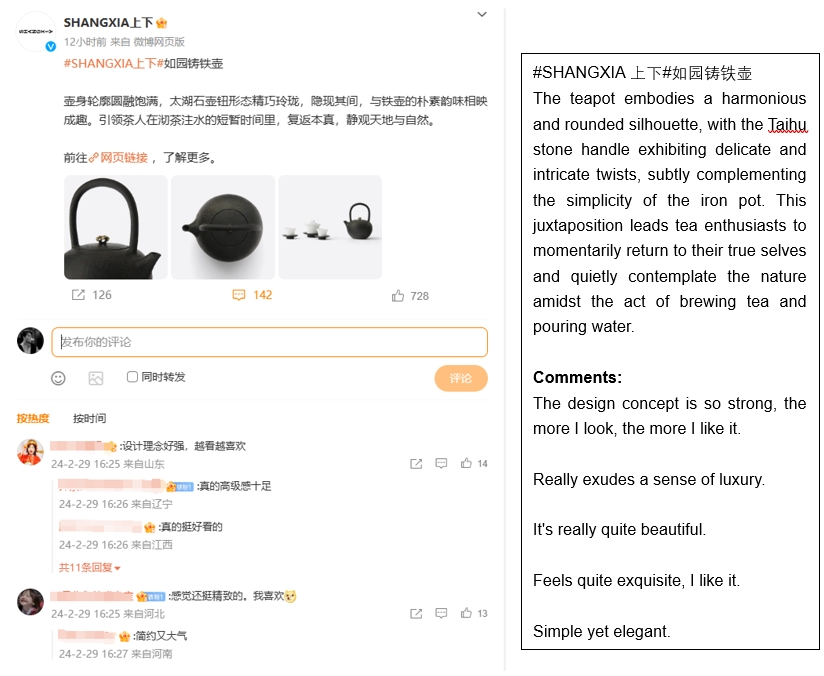

For instance, Shangxia’s products perfectly embody this minimalist and inconspicuous style, radiating an aura of exclusivity and refinement without the need for prominent logos.

Key takeaways of the future of Chinese luxury brands:

- Although foreign brands are dominating many sectors in the luxury market in China, local brands are using their knowledge of Chinese culture and traditions to appeal to their consumers.

- Industries like baijiu, tea, porcelain, and silk already boast Chinese brands with unquestionable quality and prestige, appealing to consumers’ reverence for tradition and excellence.

- Luxury brands incorporating TCM into cosmetics and fragrances tap into consumers’ preferences for natural ingredients and ancient beauty practices, driving market growth.

- Integration of traditional craftsmanship techniques into modern designs appeals to Chinese consumers valuing heritage and authenticity, creating opportunities for luxury brands like Lao Feng Xiang.

- The establishment of robust craftsmanship ecosystems is crucial for the growth of homegrown luxury brands, requiring investment in training and infrastructure.

- The Chinese government is also pushing for conserving and promoting local craftsmanship mainly as a tool of industrial upgrading, thereby facilitating the emergence of luxury brands.

- The prevailing trend of “quiet luxury,” emphasizing understated elegance and simplicity, aligns with the characteristics of Chinese luxury brands, positioning them to thrive in the market.