Monitoring the Chinese millennials behavior will only become more important due to increases in spending power. This key group of technology savvy, Internet-connected and educated consumers alone represents nearly a third of the Chinese population and is larger than the whole working population in the United States. In total, there are around 400 million Chinese millennials, aged between 15 and 34 years old and born between the introduction of the one-child policy in 1980 and the year 2000.

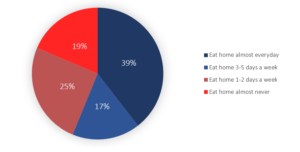

One trend in this group is the decrease in time spent cooking for themselves in favour of ordering food and eating out. Online research performed by the Xinhua News Agency (reproduced below) shows that 44% of millennials eat at home just two days a week or less. While a Global Consumer Survey by the Australian research authority for Livestock and Meat reported similar results, finding that 43% of Chinese consumers eat lunch out at least five times a week, and 78% eat dinner out at least once a week. In addition to this, the Chinese food delivery service market is strong with customers spending upwards of USD 1.8 billion (RMB 12 billion) in the first half of 2015.

Weekly frequency of young people eating at home: 44% eat outside of the home at least five times a week. Reproduced by Daxue Consulting from the Xinhua News Agency.

Chinese Millennials Behavior: Workplace Exhaustion

The high growth of China’s GDP (averaging 10% since the 1980s) has led to urbanization (a shift in populations from rural to urban areas). This flux of people within cities has made the housing and job markets more competitive. The former has resulted in people opting to live outside of central areas, while the latter can raise expectations on people to work harder and longer. In 2013, the numbers of hours annually worked by the average Chinese worker in a year was over 2,000 hours, some of the highest in the world.

This means it is not uncommon for entry and mid-level workers to become overworked, and this has even been described as an epidemic. Compounded by living a long distance from the workplace especially in economically developed cities such as Shanghai and Beijing, eating out or ordering food is a viable and convenient substitution to cooking for many people who simply do not have the time or energy.

Priorities of the Modern Chinese Consumer

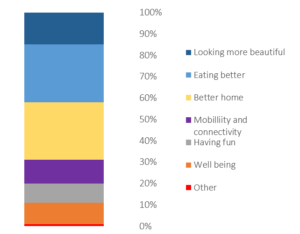

Additionally, the spending priorities of consumers are changing. Along with appearance and having a better home, eating ‘better’ is a significant priority for consumers with the largest expenditure in this area – around 25%.

Eating better is a high priority for Chinese consumers; it is the largest category for consumer expenditures at around 25%. Reproduced by Daxue Consulting from Goldman Sachs

Many millennials live alone and far from their families in different provinces or different cities, and simply don’t know how to cook like their parents. Individuals are becoming more and more specialized to the point where individual daily tasks are now outsourced. The Chinese rarely cook just for one; a minimum amount of rice in a rice cooker or various vegetables must be prepared. It can easily be considered it as more expensive than eating out or ordering delivery due to food wastage and energy usage.

The increase in quality of life for many people thanks to rising incomes (China has lifted more than 800 million of its people out of poverty since the ‘80s, according to The World Bank, meeting all of its U.N. Millennium Development Goals by 2015) has meant that technology, travel, and a global awareness have become a larger part of normal life. A more international outlook from this has lead Chinese millennials to desire the taste of international cuisines. This has been demonstrated by the surge in popularity of foreign cuisines. Japanese and Korean food, as well as Australian steak, are especially popular in China. Additionally, foreign alcoholic beverages such as wines and whiskeys over baijiu 白酒 (traditional rice spirit) have seen big increases in popularity within China. Chinese consumers are also increasingly choosing western food, and western restaurants originally targeted at expats now enjoy a strong Chinese clientele.

A desire to eat better and different cuisines but an inability to cook may be pushing the trend for eating out and ordering food more.

Xintiandi, Shanghai, is a popular and upscale shopping area where foreign restaurants are a common sight. Western restaurants originally targeted towards expatriates are seeing a strong presence of Chinese customers.

Xintiandi, Shanghai, is a popular and upscale shopping area where foreign restaurants are a common sight. Western restaurants originally targeted towards expatriates are seeing a strong presence of Chinese customers.

Chinese Millennials Behavior: The Eating Out Experience

Food holds a central and special place in Chinese culture. Dining etiquette is said to have originated in the Zhou Dynasty (1045 – 256 BC) and Chinese gastronomy, the way the ingredients are selected and prepared, the utensils used, the method of cooking, and the manner of display, extends the purpose of eating beyond sustenance. Dining with others is one of the prime ways to socialise, do business, deepen relationships, and honour guests.

This is reflected in various aspects of Chinese society through. Go to any mall in a developed city, and it will be packed with both shoppers and diners alike – a by-product of traditional culture blended with a modern lifestyle. This central place of dining in the culture encourages people to eat out.

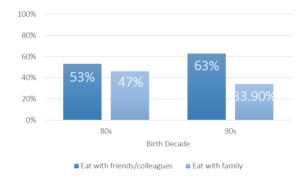

For millennials specifically, as a result of the one-child policy, there is a greater desire for a bigger social life than people born in previous generations. Rather than accompanying their families for dining experiences, millennials are dining out with their friends, and for millennial couples, dining together occupies more than 80% of all social activities. The worldwide foodie phenomenon is also sizable in China. Named Chihuo (吃货), this refers to the culture of people who like to try different foods. It is a big hobby for some people and social media forms an integral part of sharing their experiences. Around 60% of Chinese mobile users share food on social media and it is rewarding for foodies to find the best restaurants.

Who do Millennials eat out with: Millennials eat out more with friends than their families. Data reproduced from Horizon China

‘Eating In’

In just sixth months, online food ordering users have grown by 32% from 114 million to 150 million between December 2015 and June 2016. For comparison, in the same period mobile phone users grew by 41% from 104 million to 146 million.The industry is dominated by three big players: Ele.me, MeituanWaimai, and Baidu Waimai, with 36.5%, 30.5%, and 15% of total market share respectively.

McDonald’s delivery scooter in China: Foreign firms such as McDonalds and KFC use delivery services as important tools to increase brand reach. Customers pay a flat fee of around $1 (7 RMB) for delivery.

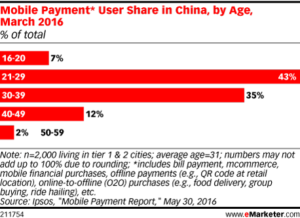

Millennials are discovering the joys of deliveries to their homes and workplaces, 176 million orders were fulfilled in the first quarter of 2015, up by a whopping 340%. Even coffee can be delivered home for 10 RMB from the closest convenience store. With the popularity of these services soaring Ele.me managed to rise over USD 600 million at a USD 3 billion valuation in 2015. Helping to fuel this is one unique trait of Chinese millennials behavior is the zhai宅 culture, a culture of staying in the home with comforts such as the internet and video gaming. For millennials, eating through other means than cooking has never been easier, and it is no surprise delivery services are capitalising on millennial’s desires for convenience. In addition to the range of services, there is significant ease of paying for food through mobile payment systems such as Alipay (by Alibaba) and WeChat Wallet. These services are extremely popular as methods of payment for millennial age groups.

Users ages 21 to 29 in tier-1 and tier-2 cities in China account for more than two-fifths of all mobile payment users in the country, and along with users in their 30s make up the vast majority of the mobile payment user base. Source:eMarketer

Decreasing Price Sensitivity

The older generation China (over the age of 55) experienced the harsh reality of the Cultural Revolution of the 1960s to early-1970s. For the older demographic spending frugally has been ingrained since a time when food security was much lower. This is shown 55 to 65-year-olds in tier-1 cities allocate much of their spending on food and food ingredients and little on discretionary categories that include eating out. In contrast, in total dining out is expected to grow by 10.2% a year in the next decade, compared with 7.2 % for basic food ingredients.

This is driven by decreasing price sensitivity in millennials scaling as a function of increasing disposable incomes. Millennials will eat out (or in) not only because it is convenient, social, and provides variety but because they can increasingly afford to eat out/in more often and from better places. However, for now, price remains one of the key considerations to those choosing to eat out; research by Goldman Sachs has shown that most people look to spend just 10 to 40 RMB on for a meal eaten out.

Final Remarks

Lifestyle factors that include a more international outlook, inability to cook, and long working days are some of the main drivers causing millennials to cook less. Technology holds a key position as an enabler of this trend in providing a high degree of convenience and accessibility to food through delivery services. However, arguably the largest driver is the increases in disposable incomes seen by millennials. Various trends are colliding. The search for better food and a healthier lifestyle may change the situation and convince some millennials to cook again either as a hobby or a habit. The future is still to be written in the cooking industry in China.

See also our expertises: Online market research China

Stay Updated! Follow Us on Facebook: