Co-branding in China

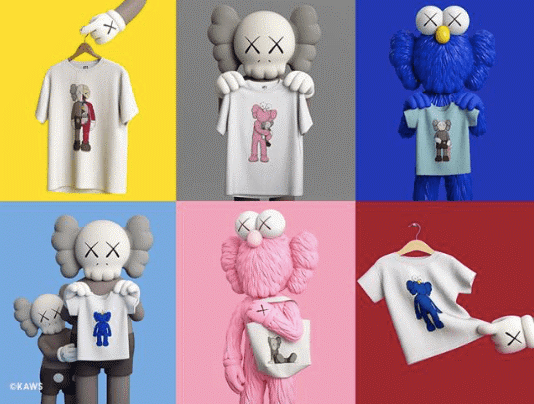

The most recent fashion collaboration in the Chinese market between Uniqlo x KAWS (UT collection) officially released in China on June 3, 2019, leading the same series in Japan for 4 days. The UT stands for Uniqlo T-shirt, this series presents the pop culture such as movies, cartoons, and art. Uniqlo’s Tmall flagship store was sold out in three seconds, which is not surprising for the new launch of trendy products in China. However, in all offline Uniqlo shops in China has been unprecedentedly snapped up and becoming hot news.

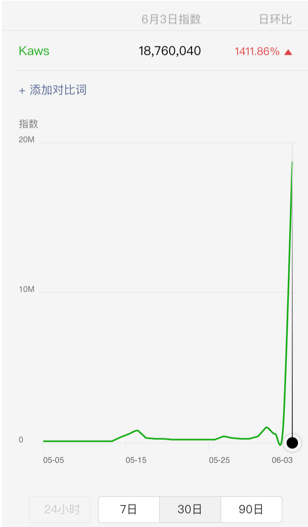

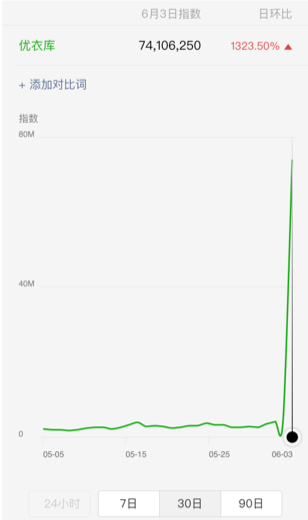

According to the result of WeChat Index, KAWS‘s search index has risen more than 180,000 times in the past month. Uniqlo’s search index, on the other hand, was exaggerated to nearly 80 million.

Interestingly, the brand collaboration in China is different from that in Korea and Japan. According to reports, Uniqlo in South Korea still has a large amount of stock left. It is undeniable that this kind of brands collaboration in China brought a hurricane in the Chinese world of fashion.

The emerging phenomenon of Co-branding in China: The fashion industry in China

In recent years, firms are actively experimenting with the strategy of Co-branding in China, and it seems the strategy is welcomed by Chinese consumers.

Win-win cooperation in China: What does it mean for consumers and brands?

Unlike in western countries, cheaper brands’ collaborations with big-name brands often have a stronger impact in China, because China’s strong fan base can help brands greatly enhance their brand awareness by word of mouth. Uniqlo chose China as the first country to release this product due to its strong follow-up effect. On the other hand, young people in China generally cannot afford luxury goods, but they are still eager to follow the trend. KAWS is famous for his unique graffiti style, and KAWS in China has worked with lots of big-name brands. It costs more than ten thousand RMB for one set of KAW’s toy. That’s the biggest reason why Uniqlo x KAWS have made such influence when consumers can’t afford KAWS’s product, and the T-shirt with Uniqlo only sold for 99RMB. As we can see, the smart Uniqlo x KAWS win-win-cooperation in China has brought great results: KAWS only needs to provide his classic elements without redesigning a new image, while Uniqlo as the fast fashion brand guarantees sales.

Fashion collaboration in the Chinese market: Exploring the success of a similar branding strategy in China

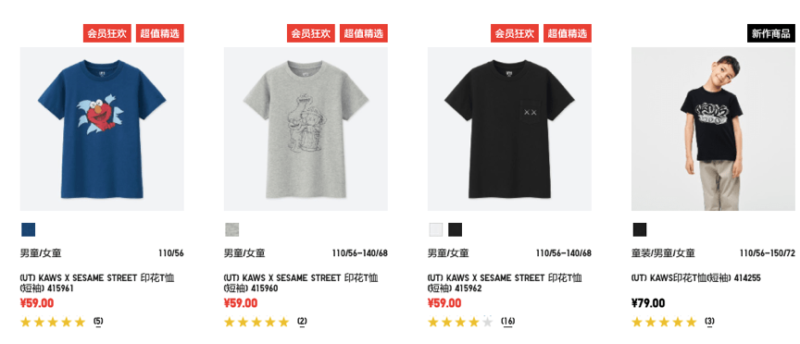

Uniqlo and KAWS launched their first collaboration in 2016 when the line sold nearly one million units a month. However, Uniqlo’s co-branding series is far more than just KAWS. Its UT collection has achieved cooperation with various IP (Intellectual Property), such as Disney,

Marvel, Sesame Street andLego. IP in the current context mostly refers to film, television literature, game animation, etc, which are in the hearts and memories of most young people in China. Uniqlo in China has established a brand image of taste, fashion, and quality. Meanwhile, what the UT collection is pursuing is that ‘More than just a T-shirt.’ The IP image help UT collection increase consumers’ sentimental value and social value. This ensures that its co-branded collections are always accessible among Chinese consumers.

Is Co-branding in China always a successful strategy?

Compared to Uniqlo, H&M’s co-branding products are increasingly difficult to attract consumers. H&M started its first collaboration in 2004; later, famous collaborations include VERSACE, Balmain, Isabel Marant, etc. The series of H&M x Moschino in 2018 received a lot of exposure and drove consumers crazy similarly to Uniqlo x KAWS. Except H&M’s cooperative products have become less attractive since the collaboration with Alexander Wang in 2014. Sales of the co-branded line have deteriorated. An increasing number of customers were getting bored and questioned the quality of the clothes. The Versace x H&M has had a large number of returns. Therefore H&M has canceled the return policy in recent joint series.

Influence of Co-branding in China

Young customers are enthusiastic about brand collaboration in China

Whenever the fashion industry in China releases the latest brand collaboration news, it becomes a talking point for young people. When thinking of co-branding, the first thing that comes to mind are ’snap up,’ ‘limit’ and ‘queuing.’ But why are they crazy about it?

Based on the analysis from OFashion, fashion brands consumption growth rate in China reached more than 50% in recent years. Young people’s pursuit of fashion has become an attitude. Based on that, fashion collaborations in China draw much attention. As mentioned earlier, one important reason is that consumers can buy ‘two brands’ at one price. The price directly leads to the difference in the influence of products in the Chinese market. At present, fast fashion cooperation with luxury brands is one of the most popular forms. In addition, the cultural factor also plays an important role. Specifically, it works in cases when brands collaborate with the cartoon, films, or even a place. Customers would prefer brands that match their feelings and values.

What do rational consumers think of Uniqlo x KAWS fashion collaborations in China?

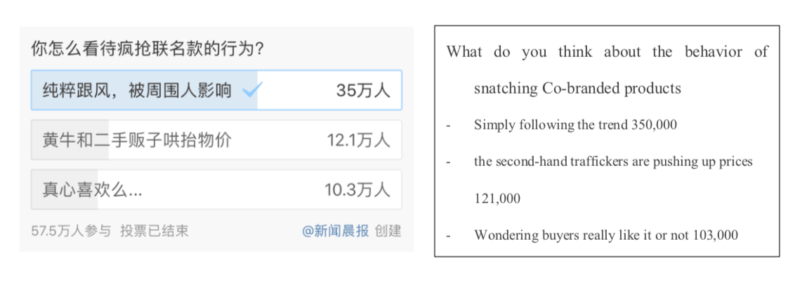

According to a survey about attitudes towards Uniqlo x KAWS fashion collaborations in China by Morning news, 350, 000 people believe that the act of snatching clothes is simply following the trend and was influenced by others; 121,000 people think that the second-hand traffickers are pushing up prices and the remaining 103,000 people were wondering if the buyers really like it.

Based on the results, more and more Chinese consumers tend to be calm and looking more critically at co-branded items.

Brands collaboration in China: What advantage can be taken?

Co-branding in China often happens in two different fields; seldom competing brands would choose to initiate collaborations. Companies relate their co-branding strategy with brand development, and their pursuit is always to maximize economic benefits. The main reason for the fashion collaborations in the Chinese market is to enhance the popularity and influence of both brands. Both brands increase a lot of exposure through their co-branding process. This can be achieved by making full use of ‘fans economy’ in China to gather fans from different fields.

Since the first co-branding Uniqlo experience in 2007, the frenzied growth has been rampant. Uniqlo’s parent company announced the first half of the performance report until February 28, 2019. According to the performance report, Uniqlo’s parent company’s sales in the first half of 2019 increased by 6.8% to 1.27 trillion yen (converted to 76.3 billion yuan). Among them, the growth rate of income and profits in the Chinese market remained at about 20%. In the 11 years since Uniqlo has never stopped exploring win-win cooperation strategy.

The Chinese world of fashion: Achieving success in branding in China

Understanding the fashion industry and brand positioning in the Chinese market should be the very first step. What do Chinese consumers need? What can the brand bring to the customers? How can companies assess consumers’ needs? Try to find resonance with the target audience and keep sensitive to the China fashion trends. Do not simply attract consumers by the design or appearance, but also consider their inner emotions. Only those brands that truly understand the Chinese consumers’ beliefs may grasp their hearts.

Before starting a co-branding project, the company must conduct a comprehensive analysis to ensure the quality of its product: Whether the brand is mature enough to scale up and enter the Chinese market. With the rise of fast fashion brands, Chinese consumers are paying more attention to the price/performance ratio of products. There is a trade-off between price and quality that managers need to consider. Cost-effectiveness has become a key factor in their choice of fast fashion brands in China. Uniqlo in China is recognized as a cost-efficient brand in the fast fashion industry.

Brands collaboration in China: Choose the right partner

Find a suitable partner for co-branding in China could be harder than finding your customers. Two brands can come from entirely different industries. Of course, consider whether one brand’s fans are willing to pay for the other brand. What truly matters is not the domain of brands, but whether the two companies share the same values and goals. For example, H&M released lots of co-branded series with brands that have exaggerated designs such as Moschino and Versace. They all want to convey an amazing image to their customers. Similarly, the UT collection of Uniqlo try to evoke the memories of the post-90s generation. Consumers value culture and feelings, especially in China. The integration of elements should be in harmony and deliver a consistent concept. In addition to the sharing value, it should be noted that the reputation of the brands will affect each other.

The formula of powerful fashion collaborations in China

When will the trend of co-branding end? Indeed, co-branding in China always has a high level of heat these years. But at the same time, consumers tend to be more rational. What companies need to consider is whether value of their fashion collaborations in China is greater than the individual parts combined. Negative public opinions were produced in the Uniqlo x KAWS incident, which caused some fans’ disatisfaction. Many people think that the sparked product snatching is not an accident, but a well-planned marketing campaign. Some say, it is likely to lose a number of fans from the generation borafter the 90s generation.

Author: Rita Fan

Make the new economic China Paradigm positive leverage for your business

Do not hesitate to reach out our project managers at dx@daxue-consulting.com to get all answers to your questions