As Li Jiaqi and Viya win the titles “king” and “queen” of this year’s Singles’ Day and fashion brands keep on collaborating with the same handful of Key Opinion Leaders (KOLs), China’s KOL economy is in flux. Gen-Z consumers looking for more authentic and deeper tastemakers are the main driver of change. KOLs’ standardized format and lack of genuine opinion are paving the way to a new generation of influencers in China labeled as Cultural Opinion Leaders (COLs).

Gen-Z consumers: a digitally savvy, culturally proud, and individualistic crew

The concept of COLs in China is inseperable from understanding Gen-Z. The so-called Generation Z includes people born between 1996 and 2010. They are digitally savvy, individualistic, and like finding innovative ways to express themselves. According to CNBData, in 2020 the number of Gen-Z people in China exceeded 226, accounting for 16% of the total population. They boast a high purchasing power and a greater propensity to consume than previous generations: Chinese Gen-Z consumption in fashion vaunts a sustained growth rate of around 3.5% and 4.5%.

Although having higher income, elder generations tend to be more reluctant to spend money for purchasing consumer goods, luxury clothing, and accessories. Akin to their Western counterpart, Chinese Gen-Z consumers are digital natives who keep updated about global trends. Nevertheless, they were born in a world were “Made in China” is no longer synonym of low quality, thus they are more willing to promote and exalt domestic brands. Due to their cultural confidence, they tend to reward foreign brands which are successfully incorporate cultural Chinese elements in their products through a non-stereotypical lens.

Moreover, as part of a collectivist society, their individualism does not result in desiring to shine by themselves, but rather in expressing their originality and uniqueness within a community of kindred spirits, fueling the growth of subcultures and niche markets. Last but not least, Chinese Gen-Z consumers pay great attention to corporate values and choose those brands whose principles and behavior better fit their beliefs.

The importance of subcultures and niche communities in China

Subcultures play a major role in fulfilling Chinese young consumers’ need to express their real selves and in facilitating their quest for a place in the world. Some of these realities can even spread and become mainstream among the general public. This is the case of streetwear in China: in 2018 streetwear brands boasted a higher growth rate than non-streetwear ones, thus inducing several big fashion names to add urban features to their collections.

The Anime, Comics and Games (ACG) is currently one of the most successful subcultures. According to a report jointly published by AdMaster and Mining Lamp, ACG-related content is especially popular among Chinese Gen-Z because it allows young people to cheer themselves up, it stimulates their own imagination, and it helps them to better express their personality. Aware of the great potential of subcultures, brands are attempting to tap into niche communities but unless well-designed, this operation may easily look far-fetched and inappropriate. Indeed, niche communities require genuine commitment and a deep understanding of their subculture and do not admit any superficial interest-driven approach.

The twilight of KOLs is the dawn of a new generation of influencers in China

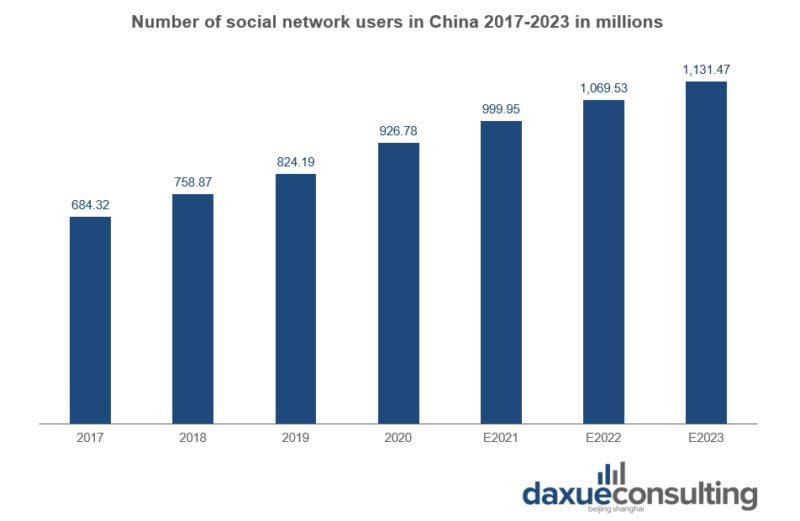

In 2020, China vaunted about 989 million Internet users, of which 357 million people shopped at least once through social media generating about 242 billion USD in revenue, accounting for 11.5% of total online sales. Word of mouth is extremely significant in Chinese consumer journey, and it is behind 20% to 50% of all purchasing decisions. According to Highsnobiety report, China’s huge market, its high internet penetration, the ubiquity of social media platforms, the importance of word of mouth as well as the absence of eminent traditional fashion media made KOL economy thrive in the latest years.

Nevertheless, now the mechanism has stalled, engagement rates of the most popular KOLs are stagnating and several insiders mention “KOL fatigue” as a real issue. Meanwhile, Chinese young audience’s engagement on emerging platforms is on the rise, indicating that Chinese Gen-Z has not lost interest in influencers, but rather that a new class of tastemakers is budding: the so-called Cultural Opinion Leaders, or COLs.

COLs will give mainstream influencers a run for their money

The main features of this new category of KOLs are inherent in Chinese Gen-Z. Indeed, the typical COL was born after the 90s and has grown up in a world where Chinese products are just as good as imported ones. Western observers tend to see China as a closed ecosystem, instead COLs usually studied abroad or are part of the Chinese diaspora and they represent a link with the global creative community. Unlike traditional KOLs, COLs do not emulate and adapt global trends to the local environment, but they rather contribute to shape and settle those trends. Furthermore, COLs do not focus just on fashion, but fashion is just one of their fields of interest. Generally, they are part of a tight-knit community of kindred spirits, thus although they have a shorter reach, the engagement rate of their audience is higher than average.

Another important feature of this next generation of influencers is authenticity. KOLs are in such high demand in China that they only advertise products they got paid to promote. Even if they were willing to post about a brand they genuinely love, their manager or their multi-channel network would not allow them to do it. COLs, instead, adopt more authentic and genuine approach, without being afraid to show a more human and less showy side of their lives.

New KOLs, new platforms

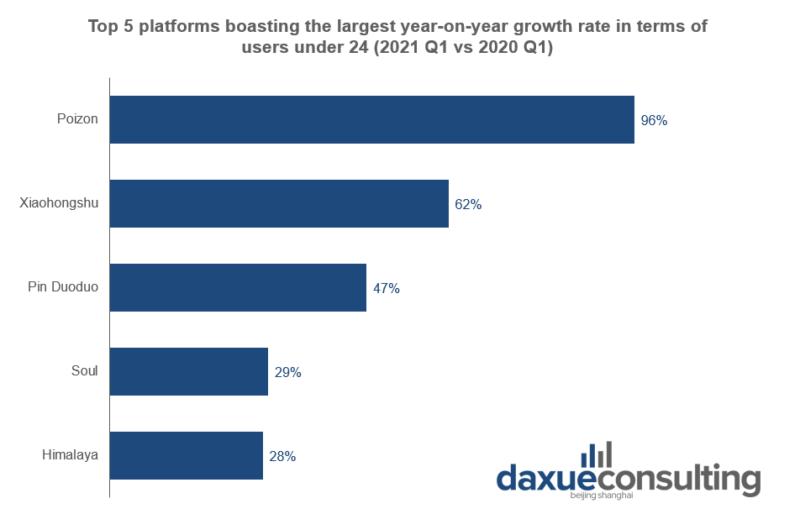

Beyond paving the way to the emergence of COLs, Chinese Gen-Z are boosting the growth of a different set of platforms. Although WeChat and Weibo keep on playing a major role in the daily life of Chinese young people, it is not where young consumers go to seek for like-minded communities. Instead, platforms such as Dewu, Xiaohongshu, Pin Duoduo, Soul and Himalaya are booming, especially in terms of active users under 24.

Also known as Poizon, Dewu is a marketplace renowned for its anticounterfeiting efforts and authentication measures. The app allows shoppers to share pictures and impressions on their purchases, and fostered the development of a strong community of sneaker lovers, mostly composed by Gen-Z male consumers. According to TD Reply, this resale platform vaunted a year-on-year growth of 96% in Gen-Z members during 2021 Q1 and 59% of its user base is younger than 30.

Douyin is going to be less relevant in the rise of COLs, since in China the platform has a more diverse user base than its Western version Tiktok. Moreover, the number of new users aged between 30 and 35 is growing, while the amount of people under 30 is gradually shrinking.

Next generation of influencers is about to be born

- As Chinese Gen-Z consumers impose as an important driver of growth for fashion brands, they disrupt the way influencer marketing takes place and foster the emergence of a new category of KOLs labeled as Cultural Opinion Leaders.

- What makes Chinese Gen-Z consumers different from previous generations is their familiarity with digital devices, their confidence in Chinese culture, and their quest for individuality leading to the mushrooming of niche communities and subcultural groups.

- COLs reflect the same features of the generation which is boosting their growth. They are part of the global creative community and give their own contribution to shape global trends. Moreover, fashion is not COLs’ main field of interest: they usually maintain a small circle of like-minded people marked by high engagement and a strong sense of community. Unlike traditional KOLs, they adopt a more genuine approach enhancing trust among fellow members.

- Such new generation of influencers in China will probably flourish on Gen-Z consumers’ favorite platforms, such as Dewu, Xiaohongshu and Soul.

Is a COL marketing strategy in China fit for your brand?

- Is your target consumer group Gen-Z?

- Are the products you’re selling empowering to Chinese culture?

- Do your products contribute to Chinese Gen-Z’s journey of finding their identity?

- Does your brand have a strong digital presence?

- Are your products authentic?