A few years ago, the perception of beauty market was that it was a market primarily, if not strictly, for women. However, in recent years, the tides in China’s beauty market have begun to turn. Chinese men have become more aware of their appearance and have an increased need for beauty products. While beauty brands are well-equipped with the knowledge of how to reach women, now the question is, how can brands reach Chinese male beauty consumers?

“Before, men would never spend 26 dollars on an eye cream. But now it is totally acceptable.” says David Beckham, the brand global ambassador of Biotherm Homme. To this extent, a variety of beauty brands, from global corporations like L’Oréal to local mass brands, are putting more effort in their marketing strategies targeting Chinese male beauty consumers.

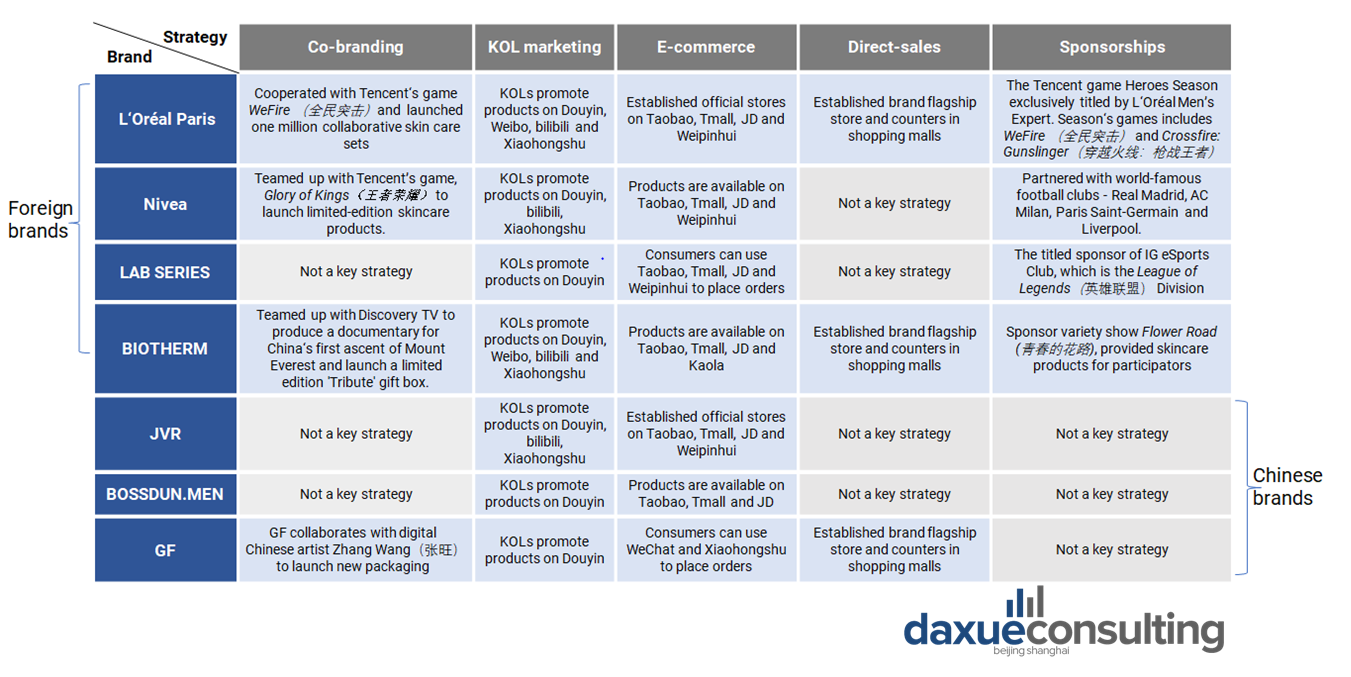

Comparing men’s beauty brands’ marketing strategies to target Chinese male beauty consumers

Both foreign and domestic beauty brands in the Chinese market can be compared along the spectrum of high-end vs. affordable.

In terms of marketing strategies targeting male consumers, domestic and foreign brands share some common grounds, such as making an effort to spread through multiple activities and platforms. However, the difference is that foreign brands use more co-branding and sponsorship than Chinese beauty brands.

Source: brand official websites, designed by daxue consulting, comparison of how Chinese domestic and foreign cosmetics brands reach Chinese male consumers

KOL marketing and e-commerce are the two common strategies used by all six brands on the above list. However, three foreign brands, L’Oréal, Nivea and LAB SERIES, are all involved in co-branding and/or sponsorships with popular video games, such as WeFire, Glory of Kings and League of Legends, while GF is the only Chinese brand that has a similar sponsorship strategy.

L’Oréal Men Expert (foreign & affordable): Diverse products, young celebrities and multiple sales channels

L’Oréal Men Expert’s advantages are its popularity and diversified product line. With a good understanding of young Chinese lifestyles, the brand has won the trust of many Chinese consumers. First, the brand provides a wide range of products, from skincare to hair styling. Its products have well-recognized effects according to consumers’ posts on social media platform Weibo and Red (Xiaohongshu). Second, it also tries to attract consumers by advanced design and packaging.

Moreover, L’Oréal has constantly been working with a number of Chinese millennial and gen-z celebrities to create their brand image among Chinese male beauty consumers since 2009. In 2009, L’Oréal Men Expert announced its first Chinese spokesperson Daniel Wu. The product “Hydra Energetic” that he endorsed quickly became the annual best seller of the brand. Since then, L’Oréal Men Expert has been collaborating with a number of young Chinese celebrities (Ethan Juan in 2012, Jing Boran in 2015, Kris Wu in 2017, Lu Han in 2018 and Zhu Yilong in 2019). On February 2020, L’Oréal Men Expert announce Jackson Wang as its newest global spokesperson. His fans warmly responded to this news and the announcement received 100,000 likes on Weibo.

Source: Sample of Weibo & Red Posts, 2020, CN, Chinese men’s perceptions of L’Oreal

L’Oréal is one of the first foreign cosmetic brands to target Chinese male consumers. As a result, it has already developed a solid network of franchised stores both online and offline. The brand is also actively engaged in online and offline promotions. For instance, it has posters in a large number of shopping malls and frequently holds offline events. It also collaborates with KOL Jiaqi Li on live-stream and with celebrities on TV advertisements.

LAB SERIES (foreign & high-end): Focusing on the network influence

LAB SERIES is a sub-brand of Estee Lauder with a good reputation, high quality and simple design. Unlike L’Oréal, LAB SERIES has not been collaborating with many Chinese celebrities. As one of the representative high-end skincare brands in male beauty with a 33-year history, LAB SERIES is more demanding in choosing online and offline agents and business activity locations.

Source: Sample of Weibo and Red Posts, 2020, CN, Chinese men’s perceptions of Lab Series

One of its most famous online + offline events was the LAB SERIES CITY SHOW in 2017. In the offline part, the brand held a five-day pop-up Café in Shanghai’s Xintiandi and a pop-up store in Joy City Shanghai mall. As for online, it specially designed five kinds of gift boxes that aligned with five iconic Chinese cities: Beijing, Shanghai, Guangzhou, Hangzhou and Chengdu, and interacted with consumers online by inviting them to share their stories in those cities. This marketing event won a prize in ROI awards 2017 and the brand’s sales in November had a YOY (year-on-year) growth of 104%.

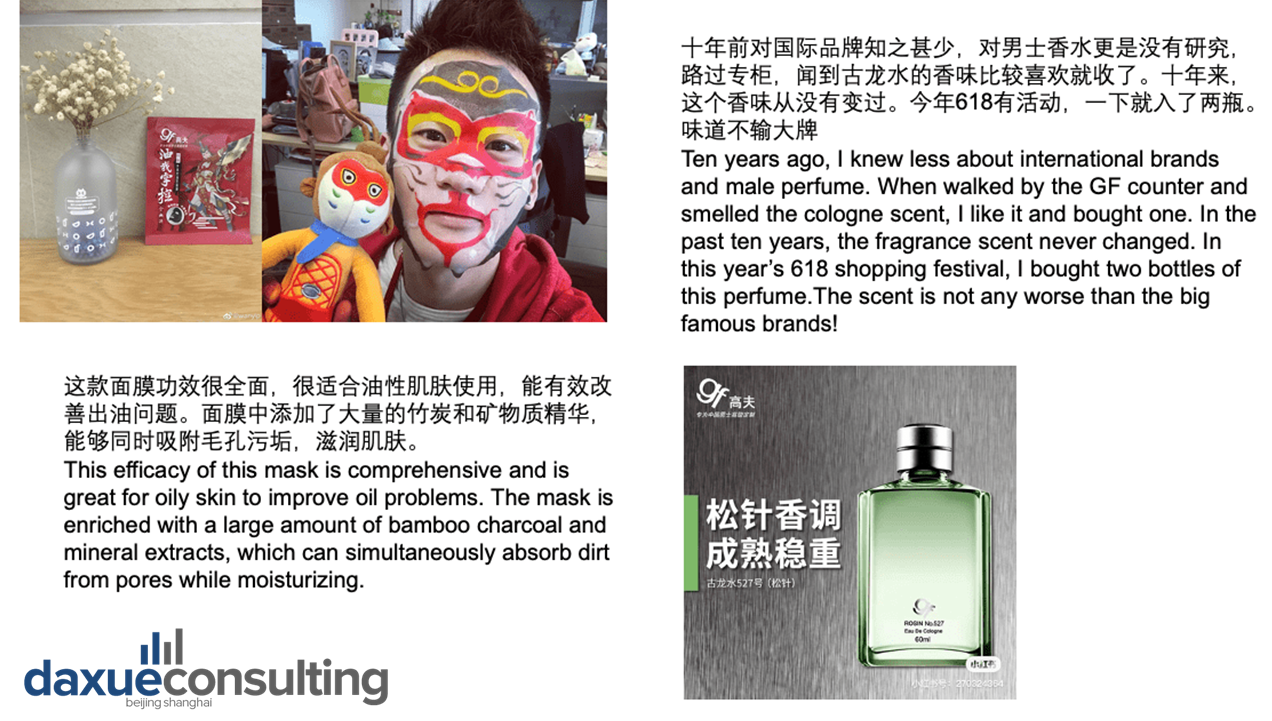

GF (domestic & affordable): Targeting young Chinese men through diverse interests and hobbies

Founded in 1992, GF is the first Chinese men’s beauty brand in the market. Products with comprehensive effects are the main sales point for GF.

Source: Sample of Weibo and Red Posts, 2020, CN, Chinese men’s perceptions of GF

GF communicates to young Chinese men through their interests, such as literary & art fans and sports enthusiasts. The brand reaches their target consumers, who are men between the age of 18-29, through different culture zones. For example, it released an online advertising video “They said, I am a literary youth”. The video targeted young Chinese men who love literature and art, and the video received millions of views within a day.

GF also focuses on Chinese traditional culture. In 2017, the brand co-created a product line with a hit Chinese animation Monkey King: Hero is back and the product’s single-day sales exceed 410,000 on the “Double 11” shopping festival. In 2018, it collaborated with Chinese artist Zhang Wang to launch a new packaging with Chinese traditional paintings.

Three main marketing strategies commonly used by men’s beauty brands in China

A multi-channel approach to reach consumers

With the fast development of information technology in China, various sales channels have appeared and have provided brands with plenty of ways to reach their target consumers. According to JD.com’s report, online beauty sales grew at a Compound Annual Growth Rate of 29.47% and will likely power the growth of the beauty industry in the future. Therefore, most of the brands are building both online and offline distribution channels, including self-operated stores and third-party platforms.

Men’s beauty brands also frequently use product placements on Chinese TV shows and internet dramas to quickly interact with audience. Although this approach may not convert audience members to consumers as fast or as directly as common e-commerce promotions, it is able to increase exposure and discussion of the brands. In this way it increases brand awareness in China.

Marketing to young consumers with a variety of hobbies

Young consumers’ preference is one of the key drivers of Chinese beauty market. Chinese men between 20-30 years old have been the main consumers of male beauty products. Consequently, many men’s beauty brands try to adapt to their needs, such as young men who likes to stay up late, who are sports fans or literary youth. For instance, the group of young men who likes to stay up late are often willing to spend more money on beauty products for healthy skins. Hence beauty brands would create a specific product line that is aimed to deal with skin problem from staying up late.

Leverage social media to get Chinese consumers’ insights

Chinese consumers are very used to consulting opinions from social media before making a purchase, and also to leaving comments after a purchase. In turn, social media platforms become crucial for brands to collect consumers’ insights. Beauty brands have started to pay more attention on their social media influence, in order to enhance communication with consumers based on their comments and to gain a good understanding of consumers’ characteristics, the consumption level and the SKU preference.

Approaches to influence Chinese male beauty consumers

According to Air Paris’s report on Chinese male beauty consumers, a survey on Weibo in 2015 showed that 31% of the male consumers were “strongly opposed” the use of beauty products and only 29% said they “strongly agreed”. However, after three years, the percentage of “strongly agreed” rose to 69% and the percentage of “strongly opposed” was less that 10%. Since the social attributes and shareable characters make social e-commerce friendlier for beauty brands, men’s beauty brands have a chance to make good use of their influence on Chinese male beauty consumers.

Leveraging different culture zones among Chinese men

In order to reach Chinese male beauty consumers more efficiently, brands can benefit from a good understanding of male consumers’ interest and their culture zones. Sponsorships in cultural zones such as sports, e-sports and literary youth can increase brands’ engagement with target consumers and therefore increase brand awareness.

Source: You Xi Tuo Lu (游戏陀螺) (WeChat official account: shouyoushouce)

Here is an example of how L’Oréal Men Expert engaged with male consumers through Tencent mobile games WeFire and Crossfire: Gunslinger. In May 2016, L’Oréal Men Expert and Tencent Game co-created an online and offline event named Hero Season. This deep cooperation included offline game events, specially designed skincare products and game-related derivative products. Both brands share a common group of young Chinese male consumers, and this collaboration was historical and successful.

Romantic topics drive Chinese women to buy men’s beauty products as gifts

Besides Chinese male beauty consumers, Chinese women should not be neglected as another group of potential consumers. “Gifts for boyfriends” is always a hot discussion point online, and beauty products are a popular category for the gifts. Among all the beauty products, women usually consider high-end brand gift box or products with fine packaging as a good choice for their male partners.

Source: Sample of Red and Douyin Posts, and Tmall, 2020, CN

Men, as the gift receiver, often consider skin care product sets to be good gifts, because many say they do not know how to buy those products by themselves. On T-mall, male skin care sets always have excellent sales performance.

The keys to reach Chinese male beauty consumers

- Reach men’s ‘tribes’, whether it is athletes, e-sports fans, or literary youth. Brands have been able to increase brand awareness through co-branding and partnerships based on interest groups.

- Men like to purchase skincare sets rather than individual items. Additionally, skincare sets are a popular gift for women to buy for Chinese men.

- Like most consumer markets in China, cosmetics and skincare needs to have a strong O2O (online to offline) strategy to survive. E-commerce and offline retail are both important sales channels. Online, brands should monitor what men are saying about their products to understand their desires. Offline, brands should be interactive, being present at events, having pop-up shops, and selling in stores like Sephora.

See our full report on the male beauty market in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast