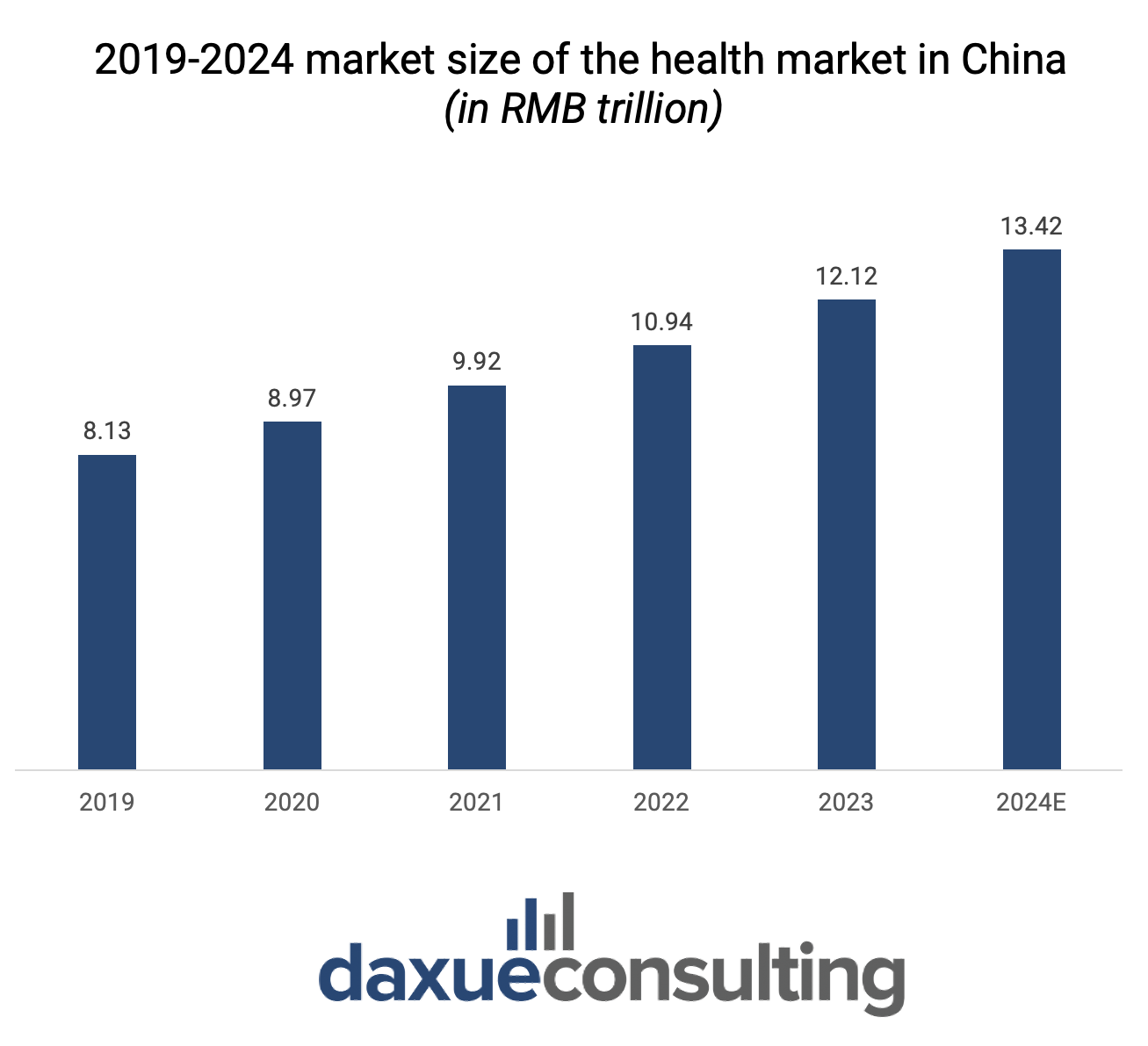

Following the COVID-19 pandemic, the health market in China has experienced notable transformations, adapting to new consumer behaviors and healthcare priorities. With a burgeoning emphasis on wellness and preventive care, coupled with advancements in technology and a growing aging population, the Chinese healthcare market has demonstrated resilience and sustained growth. By 2030, it is projected to reach approximately RMB 16 trillion, underscoring its significance within the broader economy and its potential for further expansion.

Source: finance.sina, designed by Daxue Consulting, 2019-2024 market size of the health market in China

Diverse demands: how different generations shape the health market in China

The main consumers of the Chinese health market span a diverse range of demographics, primarily including Gen Z and the aging silver economy.

Youthful vigilance: rising health awareness among the youth

Gen Z, comprising young adults and teenagers, are increasingly health-conscious and proactive about their well-being. They show a strong preference for preventive health measures, opting for nutritious foods, dietary supplements, and fitness programs.

This generation is tech-savvy, often utilizing digital health platforms and fitness apps such as Keep App and Huawei Sports Health to track their health metrics and engage in virtual fitness communities. Social media also plays a significant role in shaping their health choices, as they are influenced by wellness trends and health influencers online.

Source: Xiaohongshu, there are over 28.2 million posts under the subject of health on Xiaohongshu as of May 19, 2024

According to iiMedia Research in 2021, over 80% of consumers of health products are middle-aged and young adults, with those under 40 years old constituting 83.3% of the consumer base. Among them, individuals aged 31-40 represent 34.0% of consumers.

Among the young consumer group, 50% reside in economically developed regions such as East and South China. Moreover, over 80% of consumers hold higher education degrees, with 55.0% being college graduates or above. This underscores the correlation between access to health information and higher education levels, as well as the financial capability to invest in health products and services.

Interestingly, within the demographic of young consumers of health products and healthcare infrastructure, those living in second-tier cities constitute the highest proportion at 37.3%, surpassing the 29.3% in first-tier cities. This suggests that health consumption not only requires awareness and financial resources but also leisure time. Compared to the high-pressure work culture in first-tier cities, young people in second-tier cities may experience less stress, allowing them more energy to focus on health and wellness activities.

Silver economy’s purchasing power: strong consumer spending among the elderly

On the other end of the spectrum, the aging population, often referred to as the silver economy, represents a significant segment of China’s healthcare industry. According to the National Bureau of Statistics, as of the end of 2023, there were 296.97 million people aged 60 and above in China, accounting for 21.1% of the total population.

With the rapid aging of China’s population, there is a growing demand for products and services tailored to the elderly. This includes chronic disease management, rehabilitation care, and elder-friendly health products. From 2018 to 2022, the market size for elderly health services in China has shown a year-on-year growth trend, reaching approximately RMB 3.2 trillion in 2022.

Health issues are a critical necessity for the elderly, so compared to younger generations, they are more willing to spend significantly on health products. They account for a substantial 60% of the market share. The silver economy also shows a strong interest in traditional Chinese medicine, reflecting a preference for holistic and culturally familiar healthcare options.

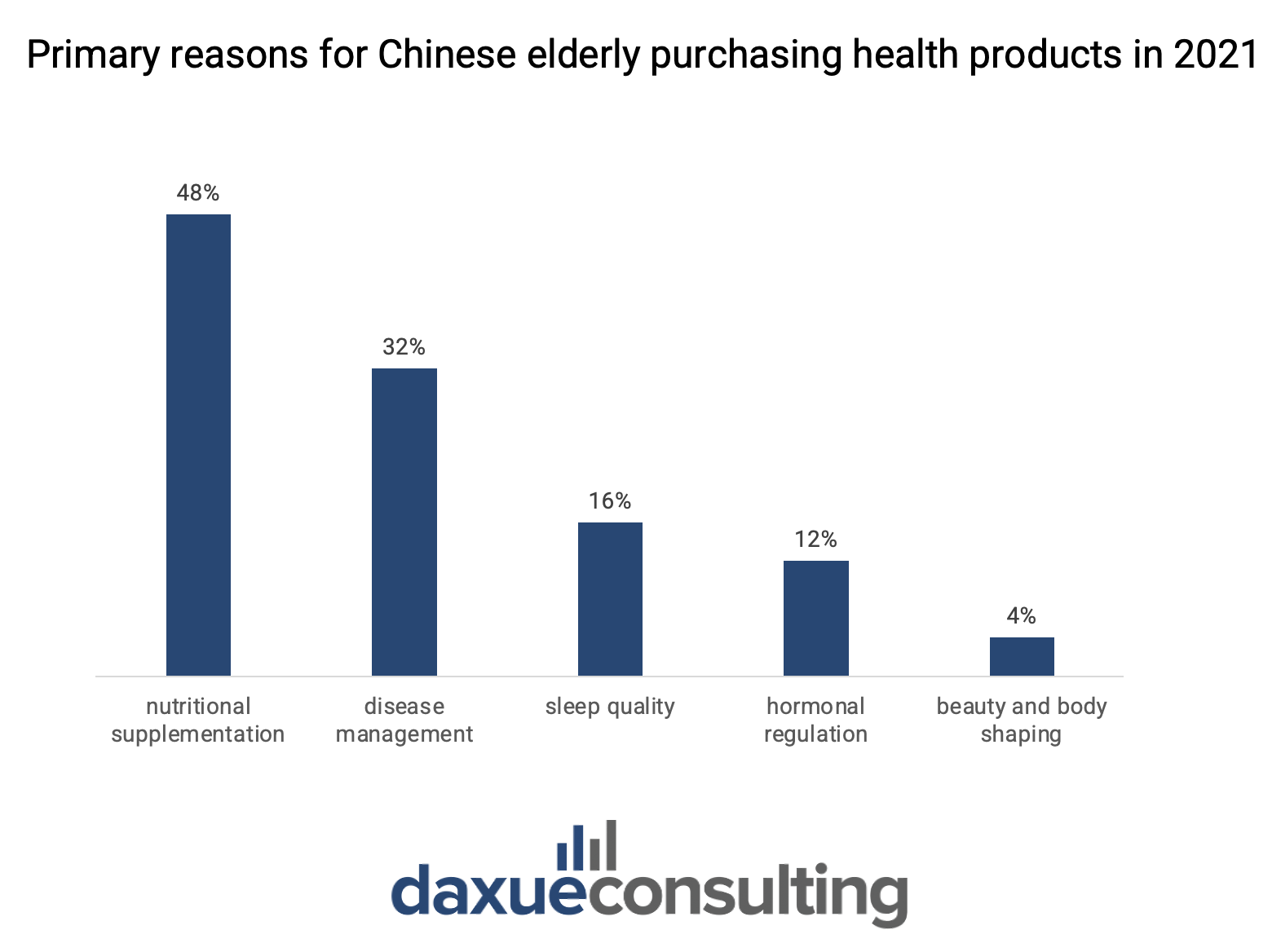

Graph Source: iiMedia Research, designed by Daxue Consulting, primary reasons for Chinese elderly purchasing health products in 2021

Regarding reasons for purchasing health products among the elderly, 48% cite nutritional supplementation, 32% mention disease management, and 4% are interested in beauty and body shaping. Despite constituting a small portion, the interest in beauty and body shaping among the elderly reflects an increasing demand for a high quality of life in the modern era. Notably, the number of elderly individuals, including males, undergoing cosmetic procedures is on the rise, indicating a shift in beauty standards across generations.

Key sectors driving the health market in China

The Chinese health market is a complex ecosystem, driven by several key sectors including healthcare services and facilities, the medical device market, and the medicine market.

Each of these sectors plays a crucial role in addressing the diverse health needs of the population, from advanced medical treatments and cutting-edge technology to pharmaceutical advancements and traditional remedies.

Healthcare services and facilities in China

China’s healthcare services and facilities sector is experiencing rapid evolution, driven by both Chinese government investments and increasing consumer spending stimulated by stable growth in national income. In the first half of 2022, per capita healthcare expenditure in China reached RMB 1041, marking a 2.6% increase and constituting 8.9% of total per capita expenditure.

The landscape of healthcare service providers in China comprises hospitals, primary healthcare institutions, and specialized public health facilities. Hospitals serve as the primary providers of medical services, with 46% of medical visits occurring in hospitals in 2021. These hospitals can be categorized into public and private entities, with public hospitals dominating the domestic landscape, accounting for 39% of medical visits, while private hospitals only make up 7%.

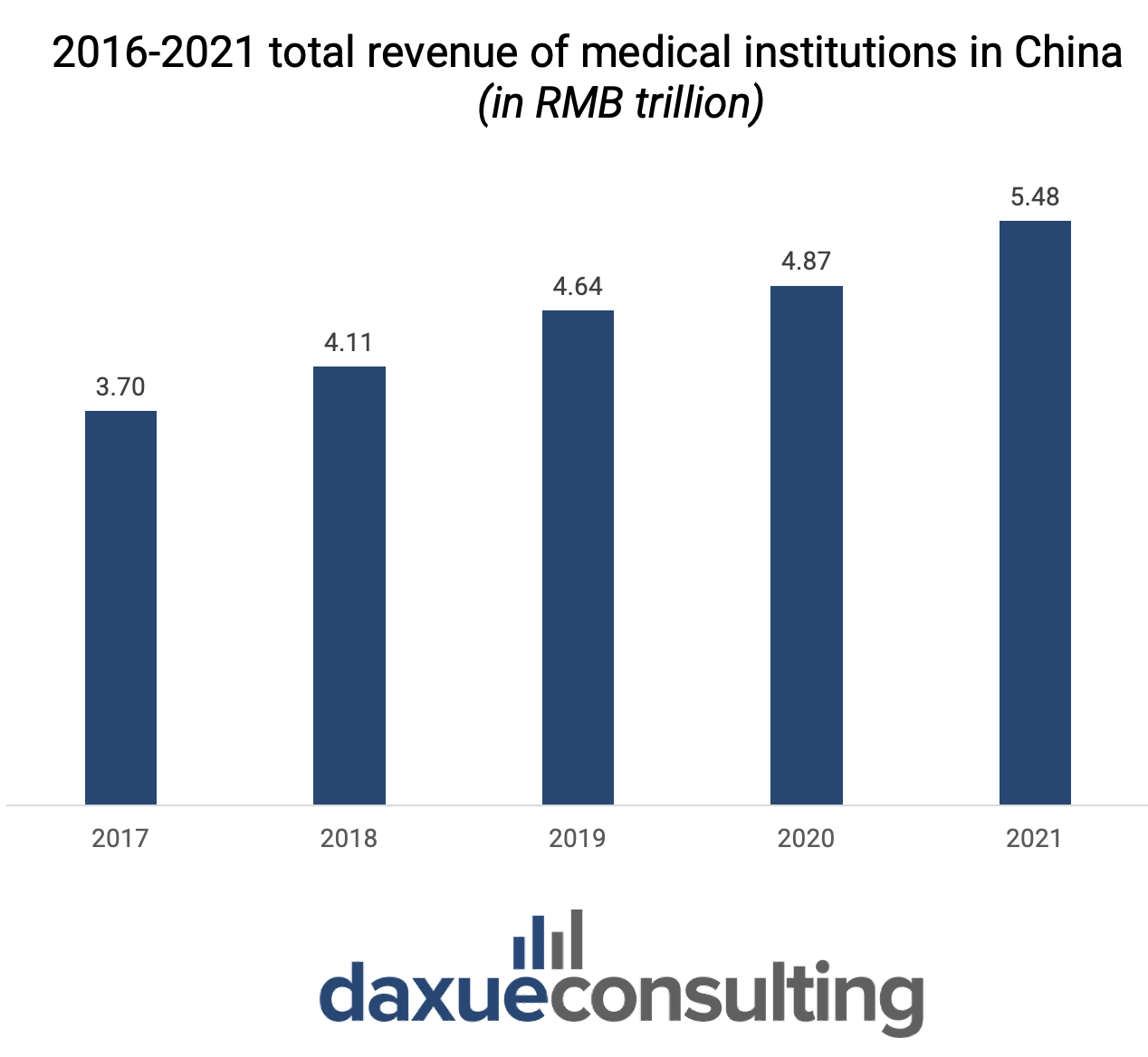

Graph Source: health statistics yearbook, designed by Daxue Consulting, 2016-2021 total revenue of medical institutions in China

From the supply side, there exists considerable room for improvement in the efficiency of domestic healthcare resources in China. In 2021, tertiary hospitals accounted for only 0.3% of the total number of hospitals, yet they handled 27.4% of medical visits and utilized 31.2% of physician resources.

Conversely, primary healthcare institutions, which primarily serve common illnesses and a broader demographic, comprised a staggering 96.4% of the total number of hospitals. However, they only accounted for 52.3% of medical visits and utilized 40.3% of physician resources. This data suggests a disparity in resource allocation, with tertiary hospitals shouldering a disproportionate burden compared to their primary counterparts.

The medical device market in China

The medical device market in China has seen significant growth, driven by technological advancements and increasing healthcare expenditures. This sector encompasses a wide range of products, from diagnostic equipment and surgical instruments to wearable health tech and homecare devices, all essential for modernizing China’s healthcare system and improving patient outcomes.

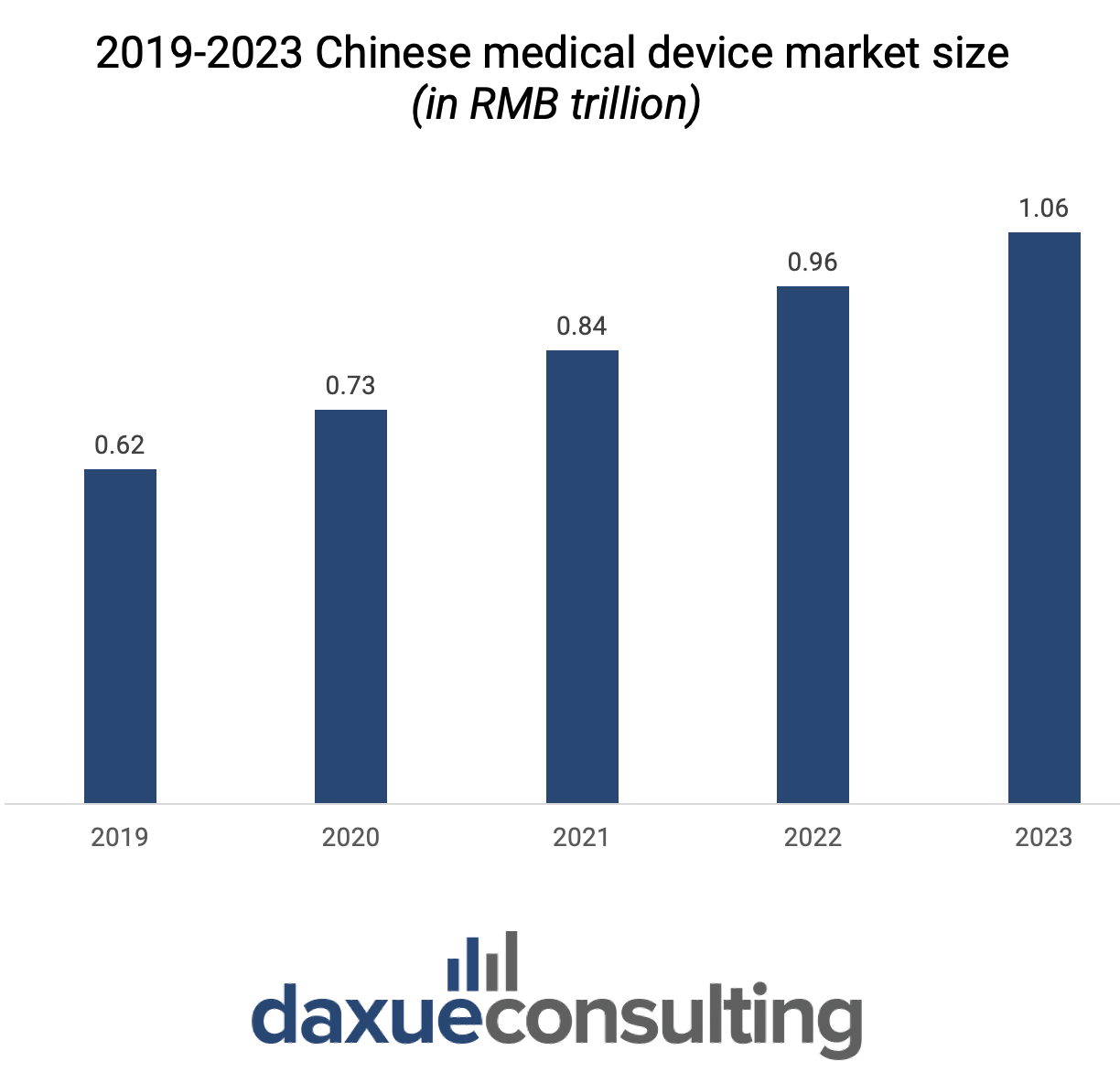

According to consultancy firm Roland Berger, the scale of the medical device market in China surged from RMB 843.8 billion in 2021 to RMB 958.2 billion in 2022, achieving a compound annual growth rate of approximately 17.5% over the past seven years. In contrast, the global market witnessed a drastic decline in growth rates due to the COVID-19 pandemic.

Graph Source: 36kr, designed by Daxue Consulting, 2019-2023 Chinese medical device market size

Within the Chinese medical device market in 2023, medical equipment accounted for RMB 381.6 billion, representing 39% of the total market, followed by homecare devices at RMB 208.6 billion, constituting 21%. Among the companies listed for high-end medical devices, Mindray Medical(迈瑞医疗) secured the top position with a revenue of USD 4.51 billion in 2022.

Looking ahead, the future of China’s medical device market presents both challenges and opportunities. In 2023, 80% to 90% of high-end medical devices in China, such as radiotherapy equipment and MRI machines, are dependent on imports. This heavy reliance on imports highlights a critical need for further localization and innovation within the industry.

Pharmaceutical industry in China

The medicine market in China is a robust and dynamic sector, featuring both traditional Chinese medicine (TCM) and modern pharmaceuticals. As the world’s second-largest pharmaceutical market, China presents a complex landscape that the impacts of the COVID-19 pandemic have further complicated. The pandemic has significantly disrupted the support and information flow needed by healthcare professionals and patients for treatments and medications.

According to Huaon Research, the market size of the Chinese pharmaceutical market reached approximately RMB 1.448 trillion in 2020, marking an 11.33% year-on-year decline. This downturn was primarily driven by the pandemic’s immediate impacts.

However, the long-term outlook remains positive for the pharmaceutical companies due to the increasing aging population and ongoing growth in healthcare expenditure and growing demand in commercial health insurance. Over the next five years, the market is expected to grow at a CAGR of 9.6%, reaching RMB 2.2873 trillion by 2025.

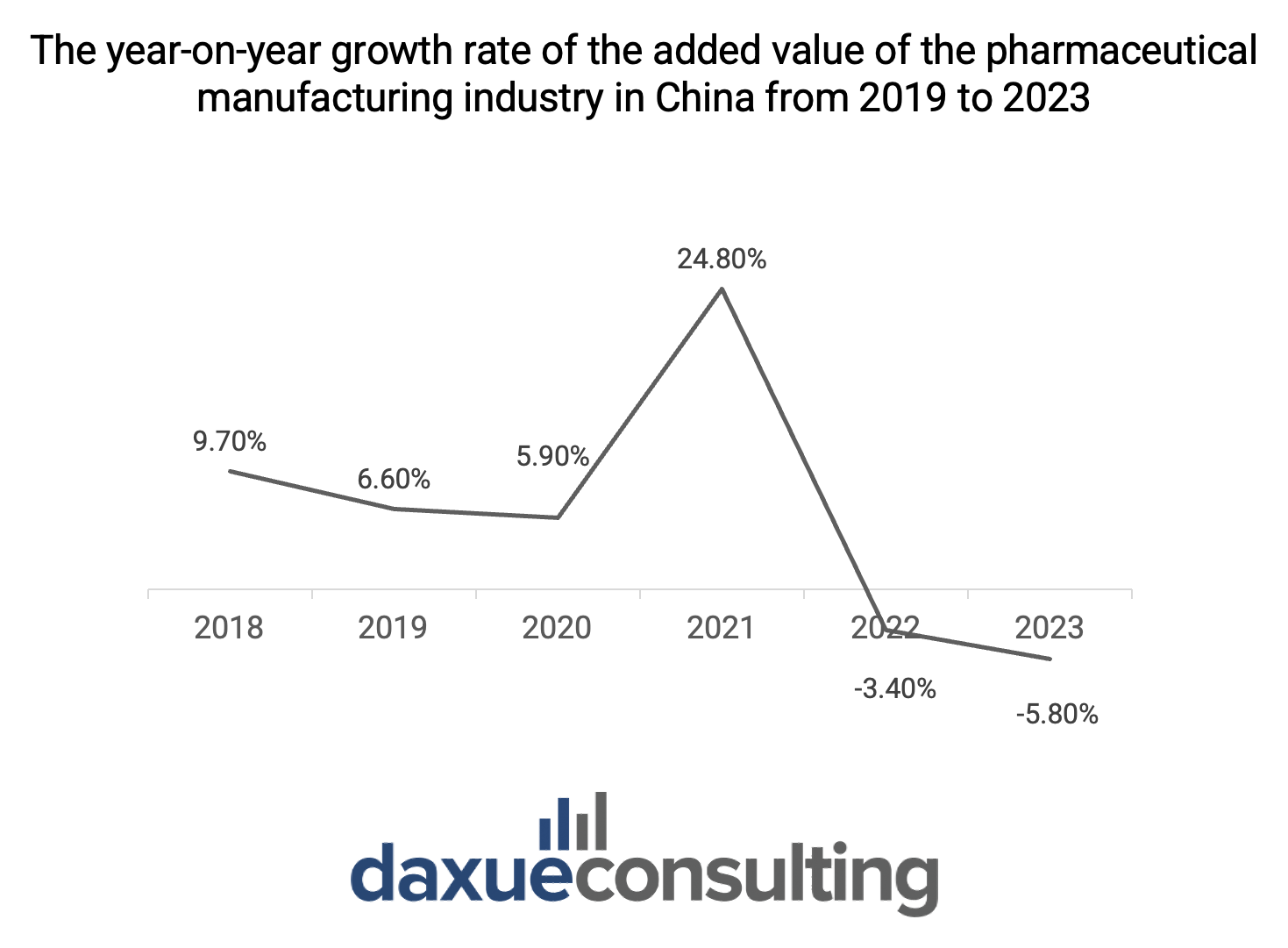

Graph Source: China Health Media Group, designed by Daxue Consulting, the year-on-year growth rate of the added value of the pharmaceutical manufacturing industry in the Chinese market from 2019 to 2023

Revolutionizing healthcare: key trends and innovations in China’s health market

The rise of AI

One of the most notable trends in China’s health market is the extensive application of artificial intelligence (AI). In the context of an aging population and a shortage of healthcare professionals, AI emerges as a crucial solution to bridge the gap between the supply and demand of medical resources. AI technology enhances existing Chinese healthcare systems by streamlining processes, increasing efficiency, reducing the workload of medical staff, and accelerating the development of drugs and vaccines.

Since 2018, China has seen progressive development in the AI healthcare sector, with regulatory policies becoming more comprehensive and certain segments developing viable commercial models. Major companies in this sector include Tencent(腾讯), Baidu(百度), iFlytek(科大讯飞) and BGI Genomics(华大基因), with most still exploring sustainable business models.

The AI healthcare market is on a rapid growth trajectory, fueled by the gradual improvement of data interoperability and advancements in cognitive intelligence technology. In 2021, the market size of China’s AI healthcare industry was approximately RMB 9.5 billion and is projected to reach RMB 38.5 billion by 2025, reflecting a CAGR of 46% from 2020 to 2025.

Source: Visual China Group, Chinese elderly individuals experience AI-powered medical devices at the Second Digital China Summit

The emergence of online healthcare in China

Another key trend in China’s health market is the rapid digitalization of healthcare services. Online healthcare, including telemedicine, digital consultations, and e-pharmacies, has seen significant growth. This shift towards online platforms addresses the challenges of accessibility and convenience, allowing patients to receive medical advice, consultations, and even prescriptions from the comfort of their homes.

On the demand side, the COVID-19 pandemic has acted as a catalyst for the transition of user healthcare habits towards online platforms, establishing a significant user base. By December 2021, China’s online healthcare user base had reached a staggering 298 million, accounting for 28.9% of the overall internet population.

Major tech companies and startups have entered the online healthcare space, offering a variety of services ranging from virtual doctor visits to remote monitoring and digital health management. For instance, platforms like Ping An Good Doctor(平安好医生), WeDoctor(微医生), and AliHealth (阿里健康)have become household names, providing comprehensive online healthcare solutions.

What do you need to know about the health market in China?

- Post-pandemic, China’s health market adapts to new behaviors, emphasizing wellness, tech advancements, and an aging population, projecting RMB 16 trillion growth by 2030.

- Diverse generations shape China’s health market, with Gen Z embracing preventive measures and tech-savvy habits, driving consumption.

- On the other end of the spectrum, China’s aging population, 21.1% of the total, drives demand for elder-focused services, including traditional medicine, with a substantial market share.

- China’s health market thrives with sectors like healthcare, medical devices, and pharmaceuticals, addressing diverse health needs amid rapid evolution.

- China’s evolving healthcare sector is driven by government investments and rising consumer spending, with hospitals dominating services, though resource efficiency requires improvement.

- China’s medical device market surges with technological advancements, reaching RMB 958.2 billion in 2022. Challenges include heavy import reliance.

- China’s medicine market, encompassing traditional Chinese medicine and modern pharmaceuticals, faces challenges and growth opportunities post-COVID, expecting steady expansion.

- In China’s health market, AI usage is prominent, bridging supply-demand gaps, enhancing efficiency, and driving growth since 2018.

- Key trends in the health market in China include the rise of online healthcare, addressing accessibility challenges, and accommodating changing user habits post-COVID.

We can guide you in navigating China’s healthcare market

At Daxue Consulting, we specialize in understanding China’s healthcare market. Leveraging our deep insights into this dynamic market, we offer tailored solutions to optimize your strategies for engaging China’s healthcare market effectively.

Whether you’re a global brand expanding into China or a local startup seeking to scale your operations, we have the expertise and resources to support your goals. Contact us today to initiate or review your strategies focused on China’s healthcare market and unlock growth potential.