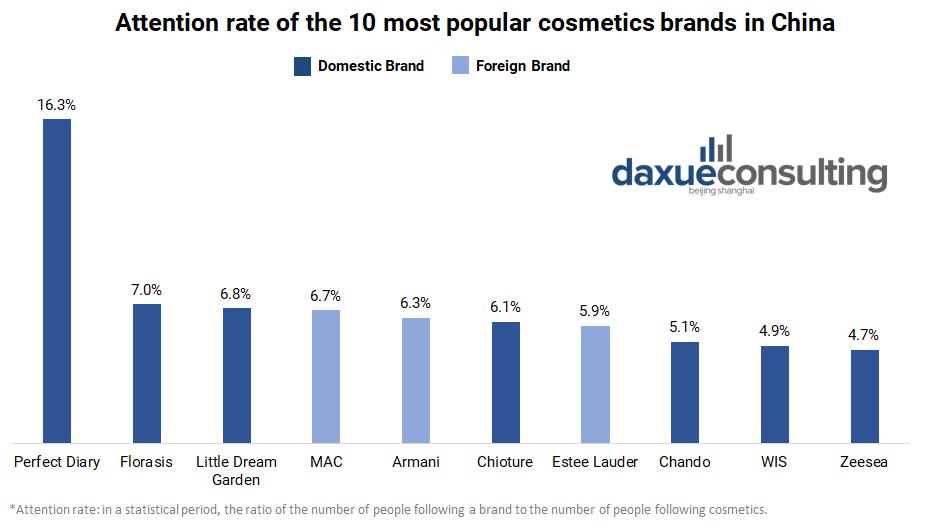

Foreign cosmetics brands have historically taken a larger market share in China; in 2018 they took 70% of the cosmetics market. However in 2020, Chinese domestic cosmetic brands are giving foreign brands a run for their money. In fact, when it comes to amount of attention received from cosmetics fans, seven of the ten top brands in China are domestic. So what can foreign brands learn from domestic brands when it comes to cosmetics marketing in China?

Data source: QuestMobile New Media, Which Chinese domestic makeup brands are the most popular

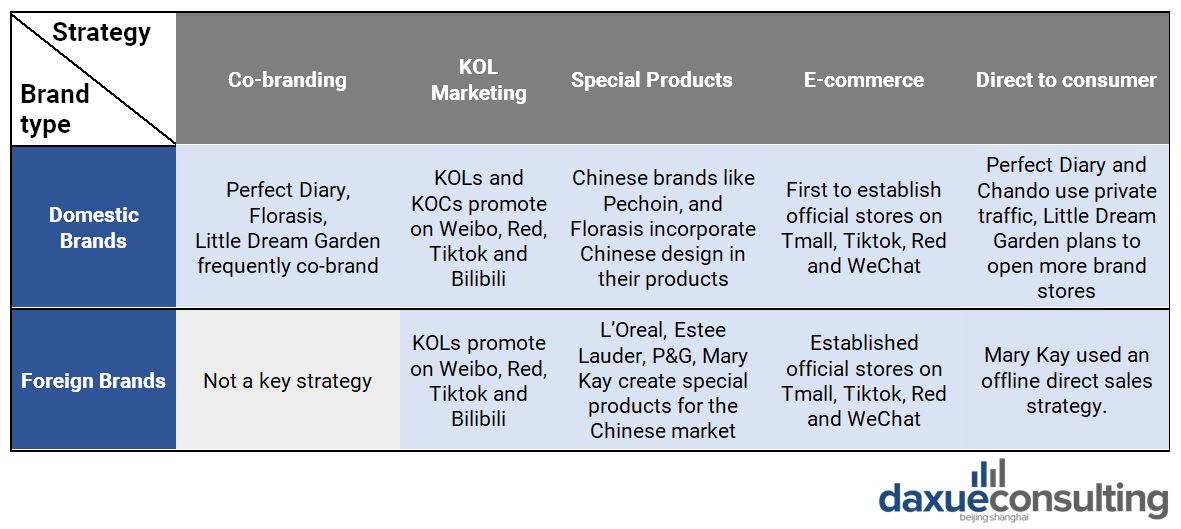

Since we have observed a strong shift from foreign brands to domestic brands in China’s cosmetics industry; we looked into the marketing strategies of both groups.

So, what is behind the rise of domestic cosmetics brands?

In the next section we evaluate some of the similarities and differences in cosmetics marketing in China.

Co-Branding

Foreign brands are not as pro-active at partnering up

Not many foreign cosmetics brands use co-branding as a key strategy. Co-branding helps brands “exchange” customers, and effectively expand their consumer base. As competition in the Chinese cosmetics market is fierce, such giants as L’Oreal or P&G have not involved other brands for cooperation.

Domestic brands reach across industries to co-brand

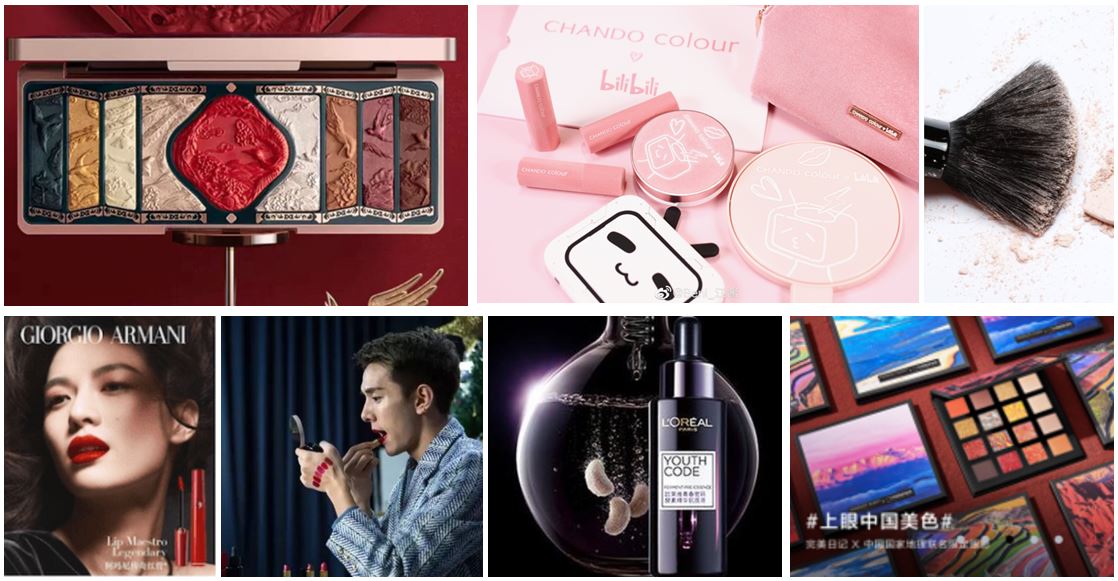

Domestic cosmetic brands, on the other hand, actively use co-branding to expand their consumer base. For instance, Chando’s cooperation with Bilibili reaches across industries to find a common consumer base. As a platform that attracts mostly gen Z, Bilibili provides a platform for Chando to increase consumers base. Perfect Diary alone has already co-branded with British Museum, National Geographic, Discovery and Oreo.

Source: 2kantoutiao.com, Chando X Bilibili

Daxue’s insights on co-branding

Chinese brands are certainly bolder when it comes to co-branding. They find partners in seemingly irrelevant industries, such as video, food and beverage and even museums. In western academic articles, when co-branding comes up, ‘sacrifice’ follows. Hence, western brands may be less opportunistic to collaboration as they keep in mind what there is to lose. For those who are unfamiliar with the peculiarities of the Chinese market, co-branding can be a risky endeavor. If done poorly, co-branding can damage a brand’s image.

“One key reason foreign brands have done less co-branding is the cultural gap between the Global HQ and the Chinese HQ, that Chinese brands don’t have. Many China HQs of Western brands still lack of freedom for taking such initiatives.”

Remi Blanchard, Branding Project Leader at daxue consulting

KOL marketing

Foreign cosmetic brands have a good grip on KOL marketing

L’Oreal and Estee Lauder chose this cosmetics marketing strategy in China to gain new consumers and increase sales. In 2019’s double 11 presales, Chinese beauty influencer Li Jiaqi sold over 0.4 million Estee Lauder’s Advanced Night Repair in a short time.

Domestic cosmetic brands have a good grip on KOL and KOC marketing

The rise of most Chinese domestic cosmetics brands attributes to social seeding through KOL marketing and cooperation. It is common to market on Douyin, Kuaishou, Weibo, Wechat and Red, but each social platform has its own marketing strategy. For example, Little Dream Garden leverages KOLs to post product testing videos on Red, guiding users to join in the discussion. Florasis also involves KOLs to promote their products. On 3rd March 2019, search word ‘花西子’ peaked because Li Jiaqi promoted Florasis’ loose powder. Another peak on 18th May 2019 is because Florasis announce Ju Jingyi (famous Chinese singer) as spokesman.

Data source: Baidu index, What increased the search of ‘Florasis’

On top of KOL marketing, Chinese brands have nailed the art of KOC marketing. KOCs are micro-influencers, who are more likely to be loyal to a brand, but have a smaller following than KOLs, but most importantly, KOCs are genuine consumers. Perfect Diary was one of the first brands to work with KOCs, and as a result has obtained the highest attention rate among cosmetics brands in China.

Daxue’s insights on KOL and KOC marketing

While KOL marketing is certainly effective on the large scale, demonstrated by the fluctuations on Baidu searches with Florasis’ KOL promotions, Chinese consumers are aware that KOL promotions are paid promotions. To really take cosmetics marketing to the next level, it is important to leverage KOCs, and turn casual mentions of your brand to intentional mentions.

“KOL remains to be the influencers – their messages today can build both emotional and beneficial connections in China. KOCs are more effective for word-of-mouth, and focus more on the product itself, instead of the brand.”

Yuwan Hu, COO at daxue consulting

Special products

Foreign cosmetic brands start to release products designed for Asians

Foreign brands focus on a special approach to the Chinese market. They create products and sub-brands oriented on the Asian audience. It could be skincare products created specifically for Asian skin or inspired by the Chinese traditional medicine. For example, in 2019 Procter & Gamble (P&G) brought a premium skincare brand called Oriental Therapy to the Chinese market. Chinese herbal medicine inspired the company to create this cosmetic line.

Source: Weibo, Premium skin-care brand Oriental Therapy for China

Domestic cosmetic brand products are already developed with Asian consumers in mind, so their specialization goes to the next level

Domestic cosmetic brands try to create special products focused on Chinese traditions and culture to attract customers. For example, Florasis created a chinoiserie cosmetics. The idea behind Florasis brand is ‘the Oriental makeup, using flowers to nourish the makeup look’. It includes everything from product ingredients to package design. For example, Florasis’s carved lipstick replicates the ancient Chinese carving technique and carved flowers on the lipstick, creating a precedent for the three-dimensional texture lipstick in China.

Source: Taobao, Florasis’s classical relievo

Daxue’s insights on specialized products

We are currently experiencing an uptick in nationalism in China. Whereas 15 years ago, a western brand could leverage its ‘foreignness’ to attract consumers, now the opposite is true. Chinese brands have especially been returning to national Chinese roots in beauty and aesthetics.

“In the past two years we have seen an increase in successful marketing strategies which celebrate traditional Chinese culture among both foreign and domestic brands. Including products sold in Majiang packaging, collaborations with Chinese museums such as the Forbidden Palace, and using traditional Chinese art in marketing campaigns. Brands are realizing the value and importance of the Chinese identity.”

Allison Malmsten, Marketing Manager at daxue consulting

E-commerce

Foreign cosmetic brands e-commerce sales are climbing rapidly

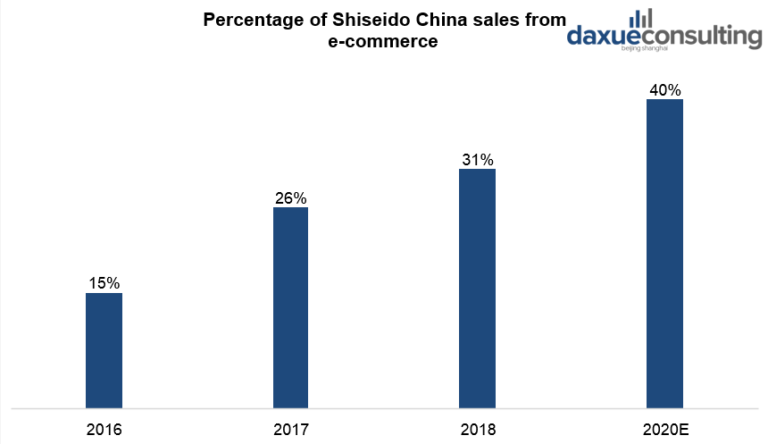

When it comes to whether to use e-commerce, there really isn’t an option. All foreign brands widely use e-commerce to expand their influence in the Chinese cosmetics market. E-commerce is only getting more important. Shiseido claimed it expects e-commerce to generate 40% of its China sales by 2020.

Data Source: Shiseido Annual Reports, Percentage of Shiseido China sales from e-commerce

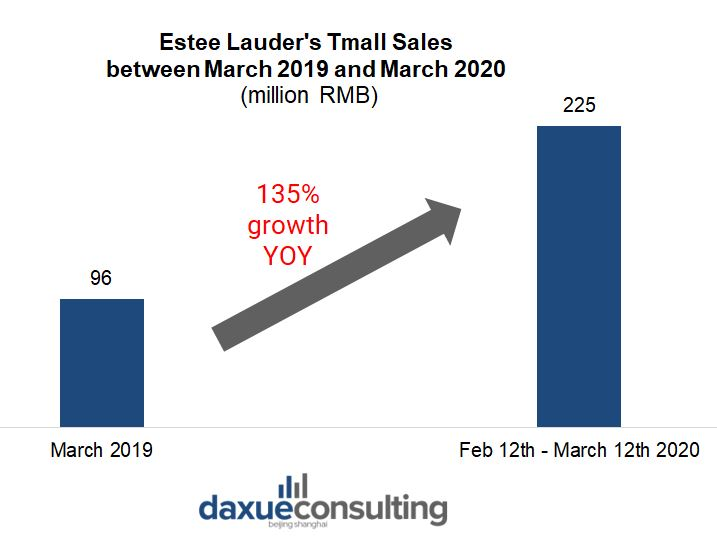

Sheiseido’s incredible e-commerce growth is by no means unique. In March 2020 sales of Estee Lauder China on Tmall grew 135% year-on-year.

Data Source: WalkTheChat Analysis, Evolution of Tmall flagship sales between March 2019 and March 2020

Domestic cosmetic brands

Domestic brands especially aware of the importance of e-commerce in China. Florasis opened its Tmall flagship store in August 2018. Although the sales for 2018 were only 43.19 million RMB, Florasis’ sales reached 1.1 billion RMB in 2019, rising nearly 25-fold. Chinese brands have been the first to hope on Douyin, WeChat, and Xiaohongshu. For example, the rising Chinese brand Marie Dalgar uses WeChat mini-programs to drive offline traffic online (via scanning a QR code), then the brand leverages WeChat’s data base to analyze user portraits, which it takes into consideration for product development.

Daxue’s insights on e-commerce

While many foreign brands stick to the e-commerce giants like Tmall and JD.com, the way Chinese brands turn digital opportunities into assets is worth studying.

“It is much harder for cosmetics brands to do e-commerce in China as they need to create a web of signals coming from everywhere to reach their audience, social media, PR, e-commerce, when at the end of the day the final purchase will 99% of the time be done on e-commerce platforms. The need to be multi-platform can therefore be tricky as it is hard to directly see the results and calculate the ROI.”

Steffi Noel, Project Leader at daxue consulting

Direct to consumer strategy (brand independence)

Direct to consumer (DTC), also known as brand independence, is when brands do not use third party platforms like Taobao, JD.com, or offline distributors to sell their products. This puts the brand in full control of consumer data, costs, marketing, and separates their products from counterfeits.

Foreign cosmetic brands have yet to take full advantage of direct to consumer

Direct to consumer is the strategy that Mary Kay utilized to become popular in tier-2 and 3 cities. The brand trained ambassadors to run beauty classes in their homes. However, other than Mary Kay’s China entry strategy, a substantial amount of foreign cosmetics brands have not used direct to consumer strategies.

Domestic cosmetic brands have mastered DTC through private traffic

Perfect Diary’s rise to fame by reaching consumers directly with loyal ambassadors is not so different than Mary Kay’s, but the key difference is Perfect Diary’s strategy is entirely online, it is known as private traffic. Perfect Diary maintains WeChat groups with its consumers, where consumers can directly interact with a virtual KOC, who has a friendly personality and a wealth of cosmetics knowledge. The Chinese brand has hundreds of these WeChat groups, and each one is managed by one personal account.

Daxue’s insights on direct to consumer strategy

Brands may find it easier to create a unique value proposition with a direct to consumer strategy. A successful brand independence strategy will allow a brand to create a strong link with customers, in which they will prefer to shop from the brand’s platform directly over visiting different online marketplace platforms.

“We noticed that some brands have been leaving the marketplace when they’ve been selling there for many many years. One reason is because when you’re selling on the marketplaces, everything is very sales driven, but not so focused on branding.”

Min Chun, Project Leader at daxue consulting

Takeaways for cosmetics marketing in China

- Chinese cosmetics brands are putting their eggs in more baskets. Not only are they using more marketing tactics, but they are using a wider variety of digital platforms, and co-branding with more partners.

- The marketing tactics embraced by Chinese brands require closer interaction with consumers, and a closer understanding of Chinese consumers. KOCs for example may be a bit harder to nail down, so it takes a deep understanding of how consumers are talking about your brand online to figure out how to turn it into your favor.

- Localizing has never been more important. This isn’t to say that foreign brands have to ditch their western brand image, this can be done through creating products that cater to Asian skin, or designing packaging that celebrates traditional culture.

See our report on branding in China

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast