China’s F&B industry has dramatically evolved over the past decades, reaching 172 billion RMB market value in 2019. Due to the various types of eating habits and tastes of Chinese consumers, F&B brands need to be careful about their strategies when entering the market. In recent years, food shopping habits have drastically changed in China. Glocalization is a term that fuses the concept of global and local considerations. From the perspectives of brands, global products or services are adapted to fit the customs, laws, or preferences of a local market. What brands should do to cater to the demands of Chinese consumers remains another puzzle. Below will explain how some multicultural F&B brands have successfully entered the Chinese market.

F&B Glocalization in China is driven by consumer culture

The fast food market in China has been growing at a fast pace. For instance, KFC initially entered the Chinese market with its iconic fried chicken products. However, its continued development in China has been leveraged through the innovative menu items developed to fit into the Chinese culture. As a multinational catering brand, one of the most important factors to gain recognition in the host country market is to be able to provide products that meet the diverse and changing needs of consumers. Therefore, based on retaining the core products of the brand, KFC understands and grasps Chinese food culture and their eating habits, and continuously innovates and develops new products with higher market coverage that are similar to traditional Chinese food.

China has a vast territory and different regions have different food cultures and habits. Therefore, it is hard to satisfy them all at the same time. However, KFC has successively adapted its strategy to local tastes: launching the “Old Beijing Chicken Roll” in Beijing, which is similar to the way of eating Beijing roast duck, various kinds of porridge such as “Seafood egg porridge” in Shanghai, fried dough sticks, and soy milk for the national market. KFC also launched a Rice Bucket exclusive to the Chinese market to cater to traditional Chinese eating habits. These “Chinese-style products” have never been launched in other markets. While the core products remain unchanged, KFC integrates and innovates with domestic food products, which are highly embraced by consumers.

Spicing up the classic products with Chinese elements and leveraging local recognizable brands

Innova Market Insights’ Top Ten F&B Trends for 2020 identified “Hello Hybrids” as one of the top trends in the Chinese food industry. This trend consists in tasting unexpected combinations of flavors, which have prompted brands to experiment with unusual collaborations.

Lay’s has carefully planned its localization business strategy since its expansion to China in 1994. Not only has Lay’s addressed the tastes of Chinese consumers, but has also considered regional variations as well and launched a series of Chinese-flavored chips. For example, Lay’s introduced Peking duck-flavored chips and spicy hotpot chips, targeting China’s fiery Sichuan province. In 2020, Lay’s collaborated with a few recognizable Chinese food brands to develop innovative flavors of chips:

Lay’s x Wu Fang Zhai (五芳斋) – Salted duck egg and roast pork zongzi

Wu Fang Zhai is a time-honored zongzi brand in China, founded in 1921. Zongzi is typical food for the traditional Dragon Boat Festival. It is a bold mashup combing traditional food and chips, involving the trendy salted egg yolk flavor.

Lay’s x White Rabbit (大白兔) – White Rabbit candy

Due to its huge nostalgic value among several generations of Chinese consumers, White Rabbit has been generating a lot of buzz in the market and built successful crossovers with brands covering products of ice cream, milk tea, and even perfumes and vapes. Lay’s seized the opportunity to develop the White Rabbit candy-flavored chips to hit the market.

Lay’s x Zhou Hei Ya (周黑鸭) – Spicy duck neck

Zhou Hei Ya is a brand of braised duck snacks that is hugely popular in the Chinese market. According to CBNData, the braised market is expected to reach 220 billion RMB in 2025 with a growth rate of 13%. Duck neck flavored chips broke through the box of imagination, thus arousing curiosity among Chinese customers on this new product.

The product launch raised a huge discussion online, as consumers were curious about how these “weird” chips would taste like. It encouraged many consumers to generate content of tasting the chips and sharing their opinions on social media platforms. Acknowledging that the youth is open and willing to try innovative things, Lay’s actively presented in Gen Z’s favorite Chinese video streaming platform Bilibili followed the product launch. As of 2021, the monthly active users of Bilibili reached 267 million. Lay’s collaborated with Bilibili Macro Link (BML), which is a large-scale offline concert and gathering party of anime lovers created by Bilibili and Chaodian. Lay’s created a limited chip bundle for this crossover and invited Bilibili content creators (with over 10 million followers) to make videos on the chip tasting.

How to utilize commercials to present your brand to Chinese consumers

Dove, an American chocolate brand that entered the Chinese market back in 1989, has heavily utilized its early high-profile TV commercials. When it comes to Dove Chocolate, its advertising slogan “Dove, silky smooth” is fondly recognized in China, and the brand image of Dove Chocolate has left a deep impression on Chinese audiences.

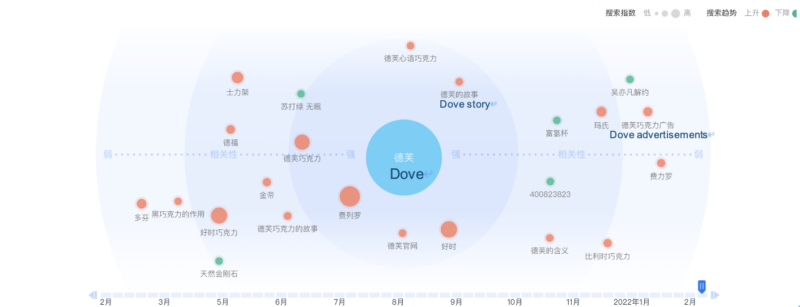

Even today, when searching for the keyword “DOVE” in Baidu index, one can find that it is related to “Dove story” and “Dove commercials”. With the rapid development of the Internet, Dove began to place advertisements on mainstream Internet media websites such as video websites, shopping websites, social portals, etc. Moreover, Dove placed chocolate products into trendy TV dramas and variety shows. The brand message reached its younger target audience was heavily involved online and high engagement.

Dove seasonally invites popular Chinese celebrities to shoot the TV advertisement, such as G.E.M., Tang Wei, Angelababy, Amber Kuo, or Sean Xiao. This is based on the attention of young consumers to the entertainment industry, extending the “halo effect” of celebrities to products through advertising, and leveraging the intangible influence of celebrities to connect consumers with the brand.

Dove has continuously updated its commercials on consumers’ preferences and followed their “Sell Dreams, Not Products” strategy to design the brand commercials. The commercials present elements of City Landmark, Fashion, Jewelry, Coffee, and other daily life elements to involve audiences in life-like scenarios. The commercials feature emotional narration, beautiful singing background music, followed by the chocolate and milk swirl to bring audiences into the silky Dove world. Dove’s commercials are very impressive in that it is well connected with the brand (see Baidu Index).

Take-aways about F&B glocalization in China

- Product Glocalization – While retaining their classic and recognizable products, F&B glocalization in China can integrate and innovate “Chinese-style” products to cater Chinese consumers’ eating habits and tastes.

- Glocalizing their marketing strategies to deliver brand message in the Chinese market – using Chinese spokespeople, tailoring their storytelling, and promoting on Chinese media channels.

- Doing crossovers with local Chinese F&B brands and create unexpected fusion F&B products to arouse consumers’ curiosity.