The size of the health food market in China grew by 18.5% to about RMB 222.7 billion in 2019. The health perceptions of Chinese consumers is increasing, positively impacting markets like organic food, vitamins and supplements and the use of plant based traditional Chinese medicine (TCM) into their daily lives.

By 2021 the health food market in China is expected to reach sales of RMB 330.7 billion. The growing sales signal a booming market and the growing shift of Chinese consumers’ health awareness and perceptions.

The health food market in China planted its roots in the 1980s. The National Food Safety Standard defines “health foods” as foods that claim to have specific health functions or vitamins, supplements and mineral intakes that aim to enhance health along with a balanced diet. Such foods are suitable for a wide range of age groups and regulates body functions but do not cure disease.

Since the opening of China’s economy, it has become the world’s biggest market in almost every product category. China’s cutting edge retail technology market in China has grown at such a staggering pace that it is now looked upon as the predictors of change in developing markets and countries.

Health food categories in China

Traditional Chinese Medicine

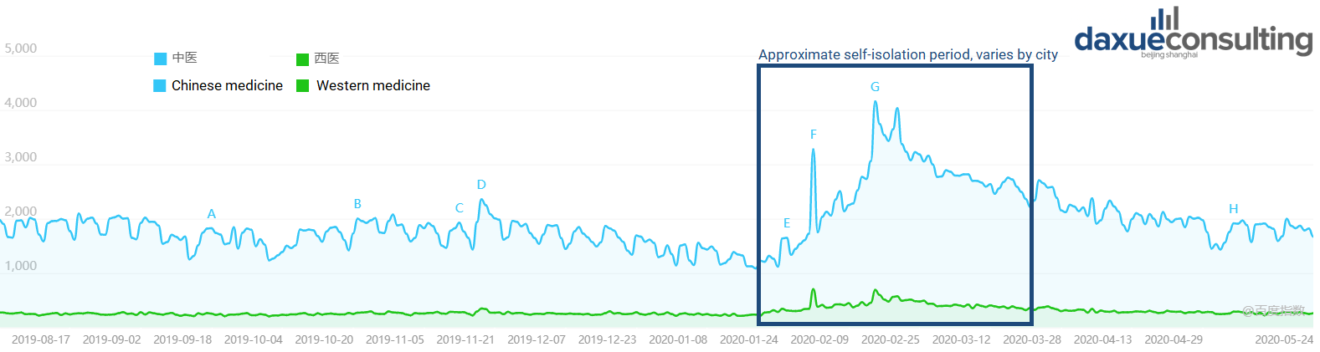

With growing economic progress and stressful lives in top tier cities, young Chinese millennials and Gen Z have been driving the growth of the health food market in China. TCM was growing in popularity before the outbreak of Covid 19, however Covid 19 simply accelerated young Chinese consumers interest and need to live a healthy lifestyle. TCM is also a national pride for the Chinese consumers amidst the Covid 19 outbreak.

Coupled with the national pride and growing health awareness, younger generation of Chinese consumers have started using TCM to help resolve lifestyle issues. Some of the top trending issues where TCM was incorporated into young Chinese consumers’ lives are the following:

Sleep issues

Chinese consumers are sleeping much lesser than the global average due to a result of high stress and anxiety. Also, as a population which relies on their mobile phones for a lot of activities, some of this has been due to long hours of playing games on mobile phones or, social media, cutting their sleep time to much less than the recommended amount.

Young Chinese millennials and new parents have been resorting to TCM and learning traditional based methods to mitigate and address sleep issues.

Obesity and diabetes

According to the statistics provided by the International Diabetes Federation, the world has approximately 425 million adults diagnosed and living with diabetes, from which 114 million cases are in China. Not only does China account for over a quarter of the world’s diabetes patients, but an estimated half of these cases are undiagnosed.

At this rate the diabetes treatment market in China is experiencing a boom but still does not fulfill national demand. The issue is so serious that the World Diabetic Organization is considering diabetes in China to be a “crisis”. This signals a market opportunity for both foreign and local brands to solve a vital issue the country faces.

Simultaneously, Chinese consumers have been looking for substitutes for sugar-based products.

Dental issues

With the rapidly growing snacks and chocolate market, the education with regard to care after consuming snacks has not kept up the same pace as the growing market. For instance, results from a research published in a Global health Journal revealed that amongst 172,425 sample residents aged between 3-74 in China, fewer than 50% of respondents brushed their teeth twice a day, resulting in a flurry of dental issues in China.

However, the Chinese government has identified this as a major public health issue and is already implementing several policies to address and raise awareness amongst Chinese consumers.

Immunity

After the Covid-19 outbreak, immunity has been of immense importance. Foreign brands selling vitamins and supplements, and TCM have gained popularity as preventive and immunity boosting foods that keep viruses at bay and the enhance the general health of the body.

Data source: Baidu Index’s search frequency for “Traditional Chinese Medicine” spiked during the COVID-19 outbreak in China

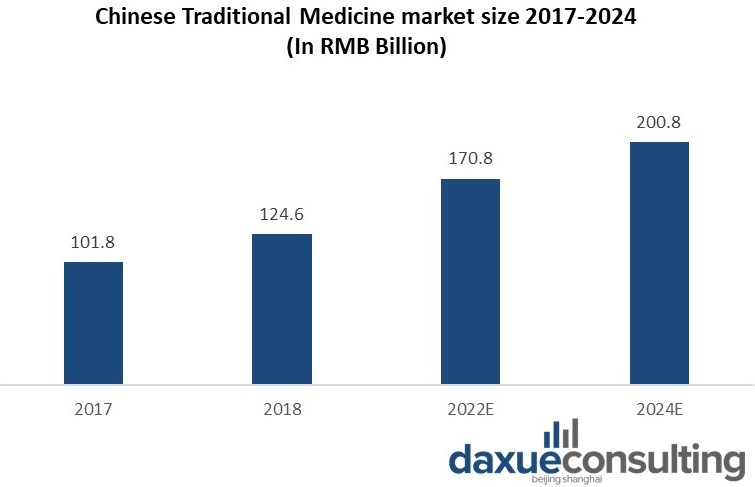

Data Source: China Pharmaceutical News “The TCM market scale in from 2020-2024 is expected to be higher after the COVID-19 outbreak.

Health supplements in China

Health supplements are a huge market in China. According to the figures from the Health supplements industry report published by TMO Group, the overall market was worth RMB 160 billion in 2018. By 2023 the market is estimated to be worth RMB 280 billion which is a CAGR of 14%.

According to a report by Euromonitor, in recent years over the counter and vitamins and supplements accrued RMB 94.8 billion and RMB 148.55 billion respectively, while weight management related products had RMB 12 million sales. Sports nutrition remained a market with massive opportunity as only RMB 2.15 billion worth of sales were recorded by the end of 2018.

Chinese health supplement consumers

Despite the positive health perceptions around health supplements in China, the consumption and penetration rates compared to other developed markets are still very low. This may be due to the growing popularity and resurgence of TCM. However, China’s massive health supplement market has room to accommodate both TCM and supplements. The awareness around these health supplement products is still very low and the growing popularity of TCM will make the market extremely competitive and foreign and local companies in the health supplement realm will have to be creative and result oriented to get young Chinese consumers attention, bearing in mind these are consumers who possess a strong buying and willingness to purchase.

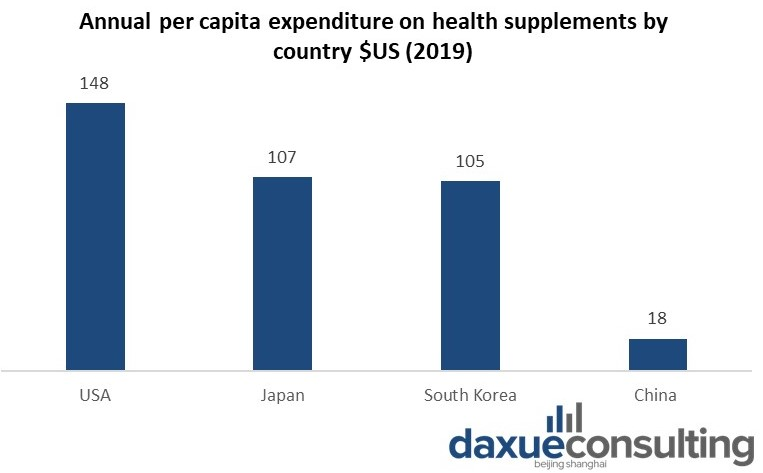

Data source: chyxx (中国产业信息院), annual per-capita expenditure on health supplements per country in USD

China’s per capita health supplement consumption in $US dollar was quite low comparing to developed markets like that of USA and Japan signaling room for growth, although the market will be fiercely competitive due to the resurgence of TCM.

Some experts in the field of health supplements have compared China’s current market to the 1970’s market in USA when the health supplement industry experienced a boom in the market. They predict a similar boom in the China market as the consumer awareness grows.

Consumer awareness for health supplements is growing

China’s is an easy target for fake products to infiltrate the market. After complaints regarding the healthcare product brand Quanjian, several scams, false advertising and pyramid schemes can give eventually effect the consumers. Sighting these issues, the Chinese government introduced its 100-Day action campaign. The campaign launched in January 2019 saw 13 government agencies carry out investigations on thousands of suspected sellers and shut down businesses selling fake nutrition products.

Following the 100-Day action campaign a public survey was conducted by iMedia Business intelligence and Data monitoring system to understand the Chinese consumers’ perceptions about healthy foods available in the market. 51% of Chinese consumers had positive perceptions towards health supplements, while 14% had negative perceptions and 36% remained neutral.

Public opinion shows that perceptions towards health supplements is still not as strong as it could, leaving a huge room for improvement in the way foreign and local brands to communicate their products to the consumers in China.

Main players in China’s health food market

Vitamins, minerals and supplements (VMS)

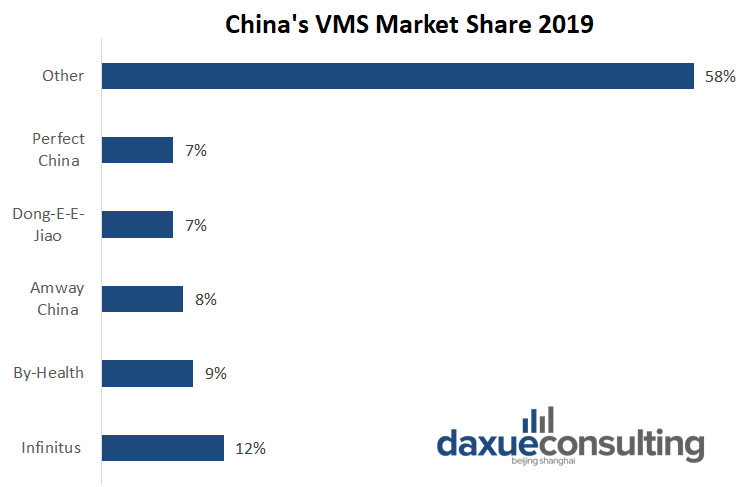

Despite a constant increase in market size year on year, the vitamins, minerals and supplements segment remains a very highly homogenized market with almost all products being identical and equivalent of each other in terms of product benefits and attributes. This means that the market is not dominated by one company and the competitive environment remains intact. According to a report published by Euromonitor, the top three VMS brands in China accounted for only 26% of the market while the remaining market was shared by 12 competing brands, all having market share of more than 1%.

Data source: Euromonitor, Northeast Securities 2019, China’s VMS market share in 2019

Consulting firm Roland Berger conducted research where it found that foreign brands in VMS market exhibited better R&D capabilities and targeted specific segments in the consumer market addressing personalized needs of the consumers. In contrast local Chinese brands did not exhibit R&D capabilities like that of their counterparts and addressed a generalized demographic segment in the market. Foreign companies can build up on their advantage whereas Chinese brands have an opportunity to better position themselves in the minds of Chinese consumers in this sector.

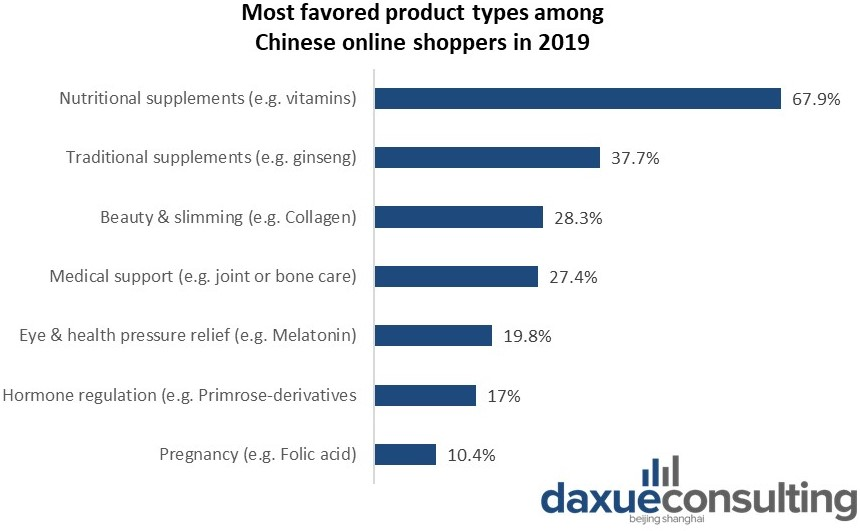

The most favored product types among Chinese online buyers were nutritional supplements mainly being vitamins followed by traditional supplements like ginseng, and beauty and slimming products.

Data source: iMedia Research February 2019, most favored health supplement products among Chinese shoppers in 2019

The weight management market in China

China’s increasing problem with obesity has made weight management related products a great potential. Despite China’s obesity rates remain low compared to western countries, it is still something of great concern as one in five children in China is overweight. However a lot of the weight management market consumption is not from obese or overweight consumers, but for consumers who are simply trying to stay in shape.

Top performing products in this sector and their prospects

Meal replacements have been growing exponentially in the Chinese health food market. As of 2018, according to Euromonitor, the market size for meal replacements in China was 6.3 billion, and it is expected to have market size worth RMB 11.3 billion by 2023.

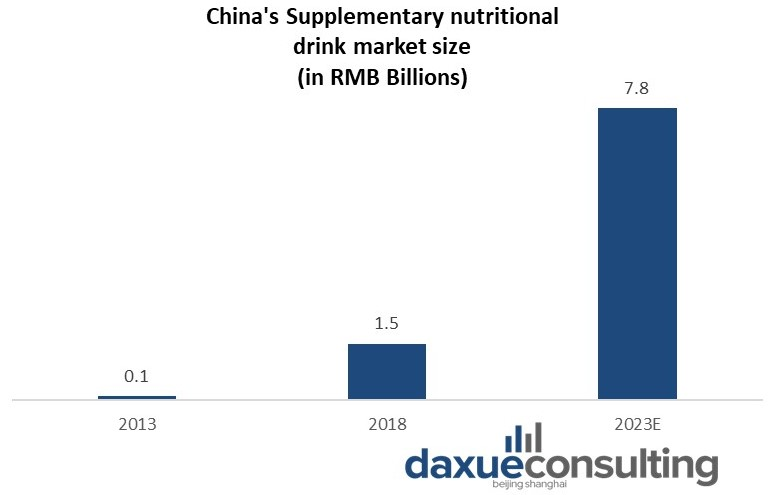

The supplementary nutritional drink market size is estimated to be worth RMB 7.8 billion by 2023E and was 1.5 billion RMB in size in 2018.

Data source: Euromonitor, Northeast Securities 2019. Market value in RMB millions

Sports nutrition market size

The sports nutrition market in China is a niche segment and though this is the smallest segment in the health food market of China, it has experienced exponential growth given the sports and fitness market in China is booming. Sports nutrition products are primarily sold through online channels accounting for 80% of the sales. According to Euromonitor, the sports nutrition products market grew to around RMB 15.1 billion.

Foreign brands were the first to introduce products in this segment and notably have been the market leader in this niche segment. Muscle tech which is now owned by Xiwang Food is among the best known and best-selling brand followed by Myprotein and Optimum Nutrition.

Local brands have been quick to respond and have caught up by surprise, presenting themselves as worthy competitors in the sports nutrition market in China. Kangbit is a domestic success story and has secured deals to be the official sports nutrition provider to national and regional sport teams.

Key takeaways about China’s health food market

China’s health supplement market is still in a very nascent stage compared to developed markets like USA, Japan and South Korea. International and local brands need to educate the Chinese consumers about their products and how they can add value to Chinese consumers busy lives. The health supplement market in China is rapidly growing and the vast complexity of consumers from different tier cities makes the market complex, yet one of the most attractive and profitable markets in the world.

As the growing health awareness in China continues to transform the nation into a health conscious country the need for health related products such as vitamins, minerals and supplements will continue to boom. As China, battles with diabetes and dental issues foreign and local brands have the opportunity to create products of sheer value by addressing a nation’s problem. However, China’s TCM is gaining popularity amongst Chinese millennials and differentiation will be the key to succeed in China’s vast market.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

Learn more about China’s vitamin and health supplement market

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast