The luxury footwear market in China reaps the benefits of the overall luxury industry’s success

As an important category in luxury, the footwear market in China is closely associated with the performance of the overall China luxury market. Despite some slowdown in previous years, the luxury market in China still appears to be very prominent due to increasing disposable income per capita and increasing sales channels. Chinese consumers have revealed strong purchasing power in the globe when it comes to luxury purchasing. The global sales value of luxury products in 2017 amounted to 262 billion Euro, 32% of which was from Chinese consumers, making China the largest luxury consumption market. McKinsey 2017 Chinese Luxury Consumer Report estimated that the Chinese consumers’ share of the global luxury market is going to reach 44% by 2025. There is no doubt that the stronger purchasing power is a driving force for the luxury footwear consumption.

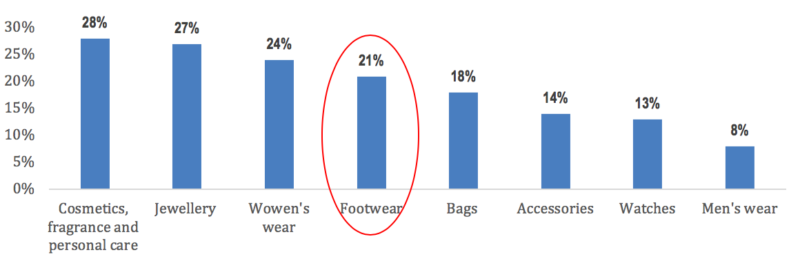

According to Bain & Company’s report on 2017 China luxury market, the total luxury market in China reached 142 billion RMB in 2017 with a YoY growth rate of 20%, which is the fastest growth in China since 2011. The top three categories contributing to the rapid growth are 1) cosmetics, fragrance and personal care, 2) jewelry, and 3) women’s wear, followed by footwear with CAGR of 21%. The growth indicates a relatively good performance for luxury footwear market in China, which is also reflected by increasing search volume of relative key words on the search engine. 2017 Baidu Luxury Industry Report reveals the daily PV (page view) of luxury footwear in last year was 364,000 with 20% YoY growth, demonstrating increasing demand for footwear.

Online sales channels are offering new opportunities for luxury footwear in China

Online share of sales is very small but increasing

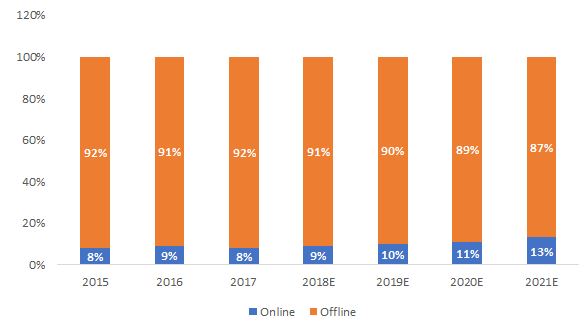

As for the sales channels of luxury brands, the traditional offline sales channel is still the mainstream, but the online share of sales has been increasing which offers new opportunities for luxury brands. In 2017, the CAGR of online sales (43%) highly exceeds that of offline sales (19%), but the proportion of online sales only accounts for 8%. However, it still indicates a significant growth for online channel development due to the change in consumer behavior and online channel building. Online consumption is an inevitable trend and is expected to keep increasing. By 2021, online sales share is expected to reach 13%.

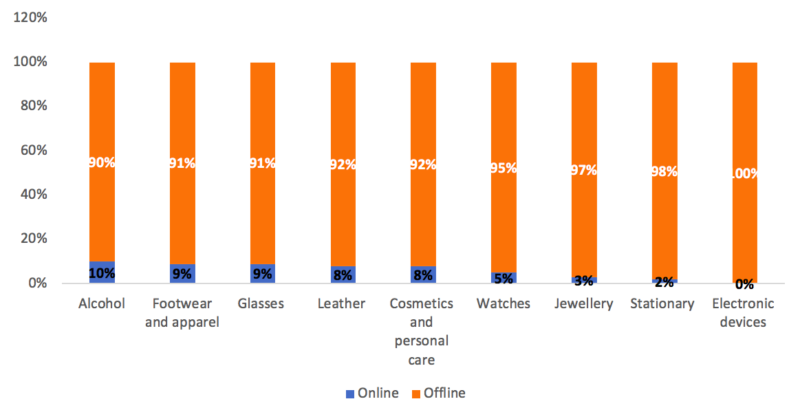

Just as other luxury products, footwear selling will also be facing new opportunities due to the development of e-commerce, especially in China where e-commerce has been rising rapidly. According to Euromonitor International, early in 2015, China became the largest e-commerce market for footwear and apparel, accounting for 21% of the total e-commerce market for apparel and footwear around the globe. Additionally, its growth was also the fastest, with a leading YoY growth rate of 41%. As for luxury footwear and apparel specifically, although the online share of sales is small, it’s the leading category in terms of consumers’ preference for online shopping. According to Secoo/Deloitte: 2017 China Luxury E-Commerce White Book, online sales of footwear and apparel takes up 9%, ranking the second place after sales of alcohol. Baidu Luxury Industry Report suggests that the mobile search on footwear accounts for 82%. The use of mobile phones is game-changing in terms of the digital strategy. Despite the large share of mobile search hasn’t successfully converted to online shopping, it suggests a large potential for luxury footwear brands.

Brands’ official websites are visited more than WeChat stores

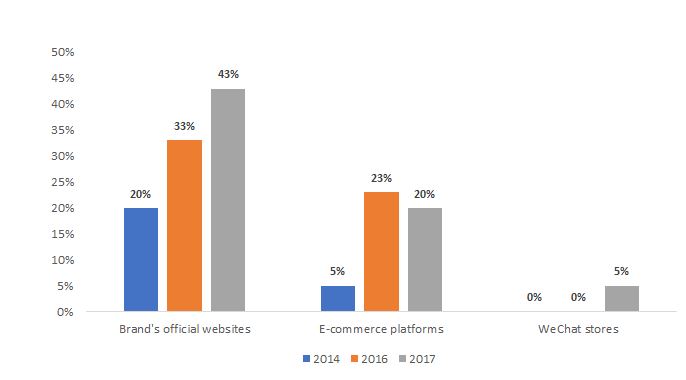

China has a unique digital landscape for international luxury brands. 2017 China Luxury E-Commerce White Book by Secoo/Deloitte suggests that sales on brand’s official websites take up the largest proportion (43%) and that sales on WeChat stores started to rise with 5% proportion in 2017. Other e-commerce platforms together contribute to 20% sales in 2017.

Online channel usage of luxury fashion brands, data gathered by Euromonitor International, graph made by Daxue ConsultingBain & Company has categorized four main online channels for luxury distribution in China, namely brand’s official websites, official flagship stores, luxury verticals, and luxury outlets. Official flagship stores are usually on Tmall and WeChat where the platforms’ large traffic can be leveraged and the stores are highly controlled by brands. Luxury verticals include Tmall Shepin (天猫奢品) and JD Toplife, which are built by e-commerce platforms that specifically target luxury brands. Luxury outlets like Vipshop (唯品会) specially provide discounted luxury products. According to the study conducted by Bain & Company, when asked about the purchasing channels, 70% respondents mentioned brands’ official websites, 42% mentioned flagship stores on WeChat and Tmall, 30% mentioned outlets and 21% mentioned luxury verticals.

The reason that brands’ official websites are used the most is high owing to product authenticity, exclusive shopping experience and post-sale service provided by the official website. Besides, it’s noticeably that WeChat stores have been rising for luxury purchasing. WeChat’s functions of WeChat stores and mini-programs have made purchasing easier by enabling seamless reading, purchasing and payment. Given the rising online shopping landscape in China, it is crucial for luxury footwear to seize the chance and capture the online market. Chinese luxury consumers show a tendency of becoming younger. Millennials and generation Z are expected to become the main luxury consumer groups in the next 10 years. Since they have higher acceptability and usage of online purchasing, online channels are inevitably becoming increasingly important for luxury brands. Therefore, luxury footwear brands in China need to leverage online channels to realize the large market potential.

Sneakerisation of the luxury footwear market in China is driven by consumers’ preference for street styles and casual wear

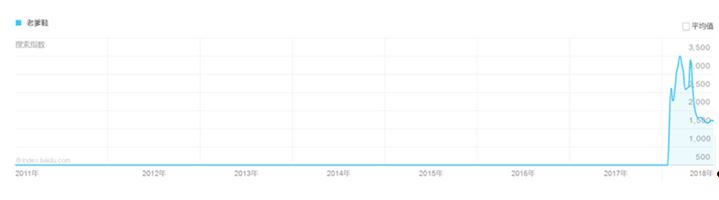

Sneakers have become a fad in luxury fashion as many luxury houses have launched sneakers in the past few seasons, including Balenciaga, Gucci, Louise Vuitton, Chanel, Prada, etc. The sneaker fever also has come to China which is driven by consumers’ increasing preference for street styles and casual wear. According to 2017 Baidu Luxury Industry Report, the top five rising shoe styles searched by users in the last year include chunky sneakers, also known as “ugly Dad shoes” (老爹鞋), socks shoes, socks boots, flat mules, and flats with pearls. The top two trends are both sneakers, suggesting a leading position for sneakers in the luxury market nowadays.

More specifically, there are several reasons leading to the sneaker trend. Firstly, street culture has become an increasingly important element that influences consumers’ dressing styles. As the boundary between traditional wearing and street styles becomes blurry, more and more consumers have developed a preference for street styles and casual wear. According to a report on China footwear market by Zhi Yan, the sneaker fever in China started in 2014. It is expected that sports style shoes and clothing will reach 246.7 billion RMB by 2020. Sales volume of sneakers will increase by 3% in 2020. Luxury brands closely follow the trend to meet the demands. Secondly, sneakers have always been playing a significant role among young consumers. Therefore, compared to traditional luxury products, sneakers can be better gateway products to luxury spending as well as a breakthrough point for luxury brands. Luxury brands are willing to build a close relationship with millennials by catering to their demands for sneakers. Thirdly, owing to the substantial change in consumption behavior subject to social media, celebrity effect has a big impact on luxury consumption. Baidu Luxury Industry Report shows the search volume of celebrities’ same style products had an explosive growth by 206% and shoes are the main category influenced by celebrities. The top rising shoe styles are very common to be witnessed being worn by celebrities in China, which strongly drives the attention and consumption of these styles.

Keeping up with Sneakerisation: luxury brands show an active digital engagement in China

According to 2017 Baidu Luxury Industry Report, 94% of search content on luxury footwear were generic words, but the search increase of brand-related words (YoY growth rate of 26%) exceeds that of generic words, which suggests a stronger awareness and desire for brands. Therefore, based on the foremost footwear trends in China and the unique Chinese digital landscape, this section will look at several leading players’ digital performance to provide insights of the luxury footwear market in China.

The case study of Balenciaga

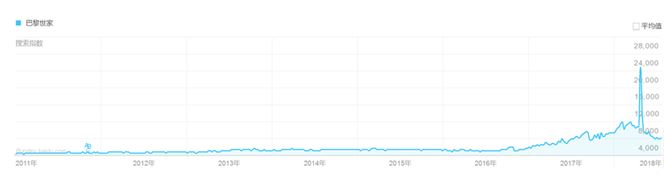

Balenciaga has successfully led the trends of chunky shoes and sock shoes

Chunky shoe trend has swept over the globe including China, led by Balenciaga Triple S. Since its debut in 2017 F/W Paris fashion week, the thick-cushioned dad shoes have caught consumers’ eye by its bold colors and maximal design. Before this, Balenciaga Speed trainer that has ribbed double-knit jersey socks and a wavy rubber sole also became a hit in the sock shoe trend since it was launched in 2016. Ugly sneakers and sock sneakers fads are joined by many players, but Balenciaga has always been able to take the trend to the extreme by its star products. Both chunky shoes and sock shoes have gone viral on the Internet in China.

|

|

Baidu index of “Balenciaga” shows that the search index was very small before 2017. But it started to increase significantly since 2017, which is positively correlated with the significant sneaker trends led by the brands. However, the peak of the index falls between 22nd to 28th of April, which is due to a negative buzz caused by an incident happened in Paris where Balenciaga was accused of discriminating Chinese people.

Balenciaga doesn’t perform very actively on China’s social media, but it was aimed at China’s e-commerce platforms

The posts of Balenciaga on Weibo and WeChat stopped on April 26th, 2018 with a statement responding to the incident that took place at a department store of Balenciaga in Paris where a few Chinee customers were involved. Balenciaga was accused of discriminating Chinese people and caused a negative buzz on social media. The statement is considered not sincere and the negative comments on Balenciaga still continue on social media. Even before the incident, Balenciaga didn’t seem to put much effort in terms of promoting its products on social media, including its signature Triple S. It has only 120,000 followers on Weibo, which is not a big number for luxury brands on China’s social media. There were only two posts regarding the Triple S, which are basic information with basic pictures about the new launch.

|

|

However, despite Balenciaga has given up the social media engagement in China, for now, it has aimed at China’s e-commerce channels. Currently, Balenciaga has established its store that sells shoes on three platforms, namely its official website, Secoo (寺库) and JD Toplife. Secoo is a leading luxury vertical that provides an integrated O2O shopping experience. JD Toplife is launched by JD, aiming to build an exclusive luxury vertical platform by providing premium service in sales, customer experience, and logistics management. Balenciaga just entered JD Toplife a few days ago, marking a significant step of Balenciaga’s e-commerce strategy in China. It’s the first time Balenciaga builds an official flagship store on a third-party retail platform. On JD Toplife, Balenciaga will provide a 24/7 service and support more local payment methods. In terms of the shipping, JD Toplife will provide a very premium service called “京尊达”. This cooperation with JD Toplife will further drive the sales of Balenciaga products, including footwear.

|

|

|

The case study of Gucci

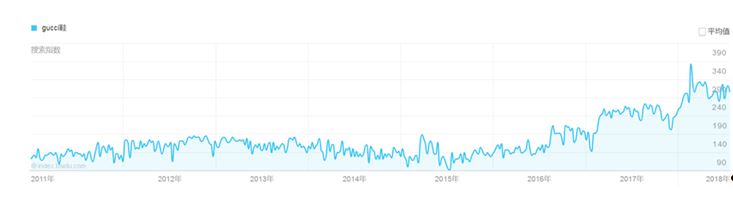

Gucci is in the lead in the white sneaker trend

With a focus on delivering teen spirit, Gucci Ace has taken the white sneaker trend to a new level because of its novel design. Gucci Ace dominated the social media feeds and celebrities’ style photos in 2017, becoming one of the most popular white sneakers. Ace shoes convey the characteristics of youth, energy and individuality by embroidering Gucci’s signature colors and animal patterns. Gucci recently also embraced the chunky sneaker trend by launching Rhyton sneakers which also features classic Gucci elements with a throwback feel. It is worth noting that Baidu index of “Gucci shoes” also suggests significant growth in recent two years.

|

|

Gucci’s social media performance is very active in terms of promoting shoes

Gucci has a very active performance on social media to promote its shoes. Gucci on Weibo has more than 1.2 million followers, which is a big number for luxury brands. Footwear is one of the main categories pushed by Gucci as it is shown on the homepage of Gucci Weibo. By clicking the picture, readers can enter the shoe category on its official website and make purchases. What’s more, Gucci promotes its shoes on Weibo by heavy use of celebrity endorsement. Gucci chooses celebrities who have similar characteristics with the shoes, and the endorsement advertises the products directly to their fans who want to act like the celebrities. While Gucci on WeChat adopts a story-telling way to promote the shoes instead of just posting a basic introduction. The articles pushing shoes focus on conveying the artistry of the products by introducing the design concepts, explaining cultural connotations and exhibiting creative works with artists. Also, plenty of pictures and videos are used to convey the message. The active performance on social media is very effective in terms of drawing readers’ attention. Comments below the article show that readers are actively expressing their support and affection toward Gucci shoes and the brand ambassador Li Yuchun (李宇春).

|

|

|

|

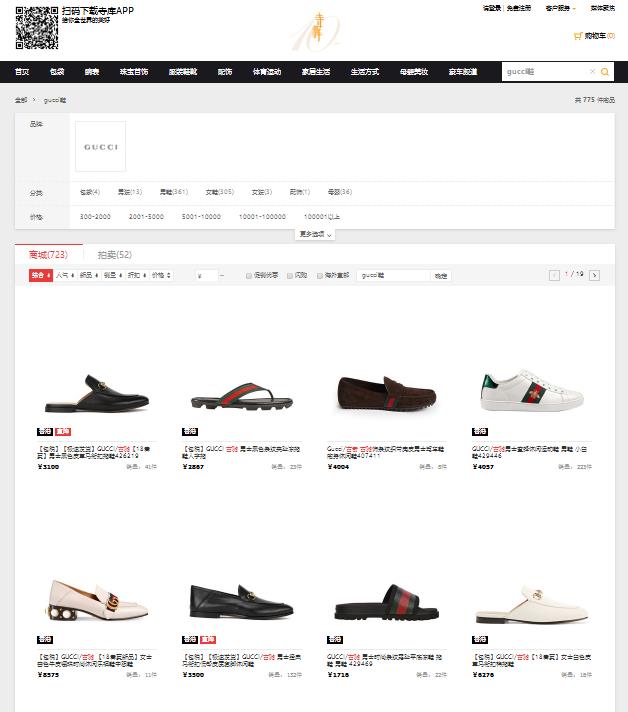

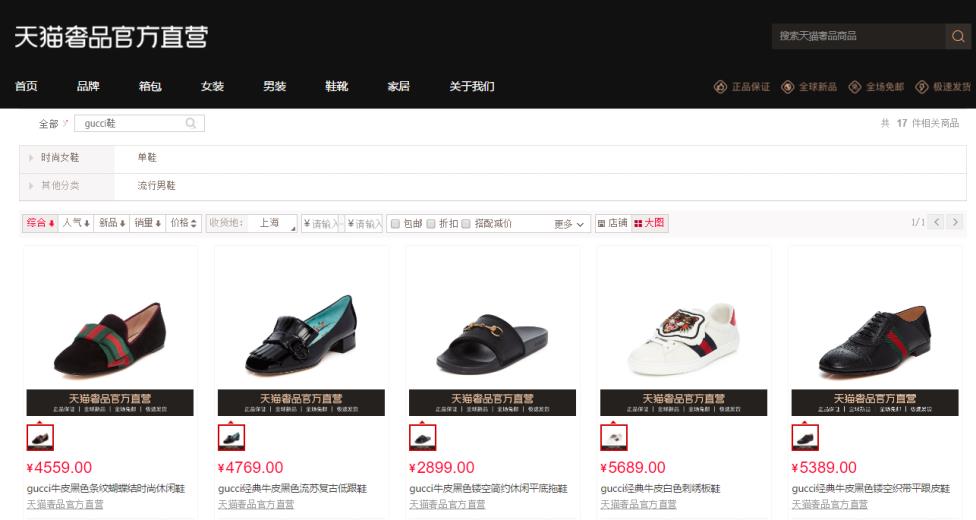

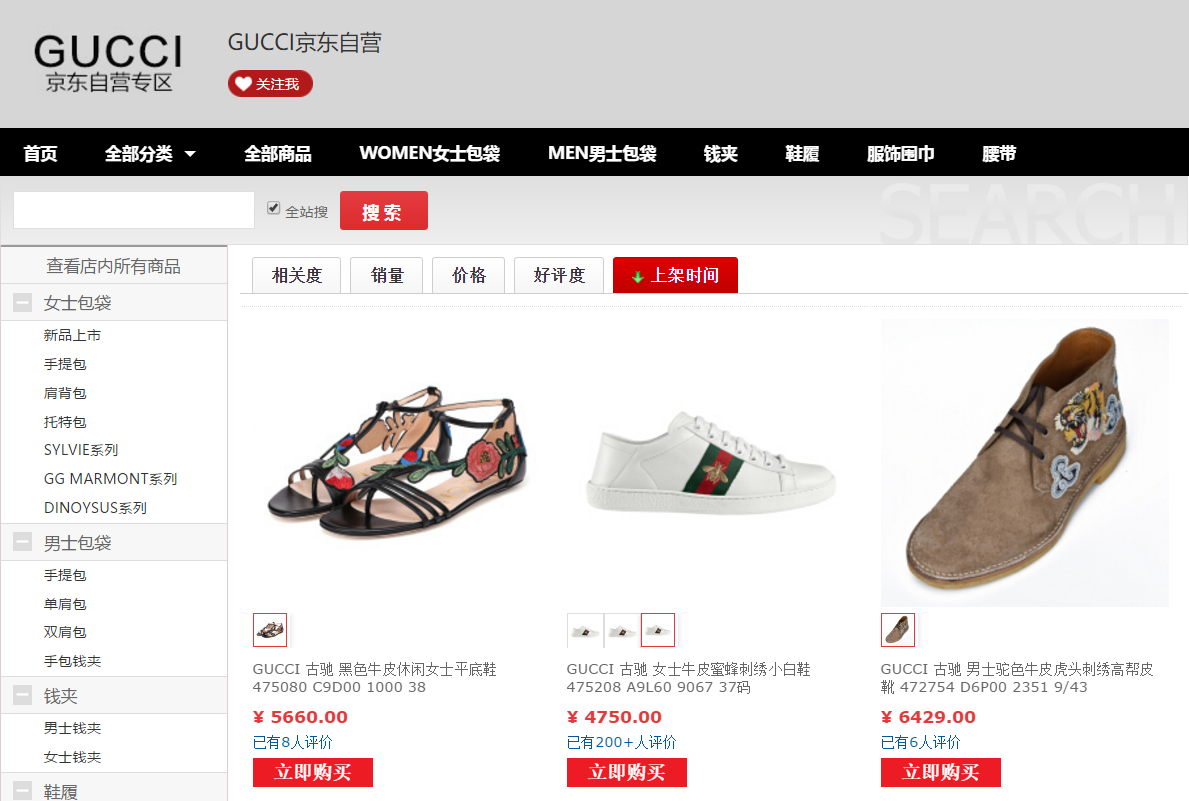

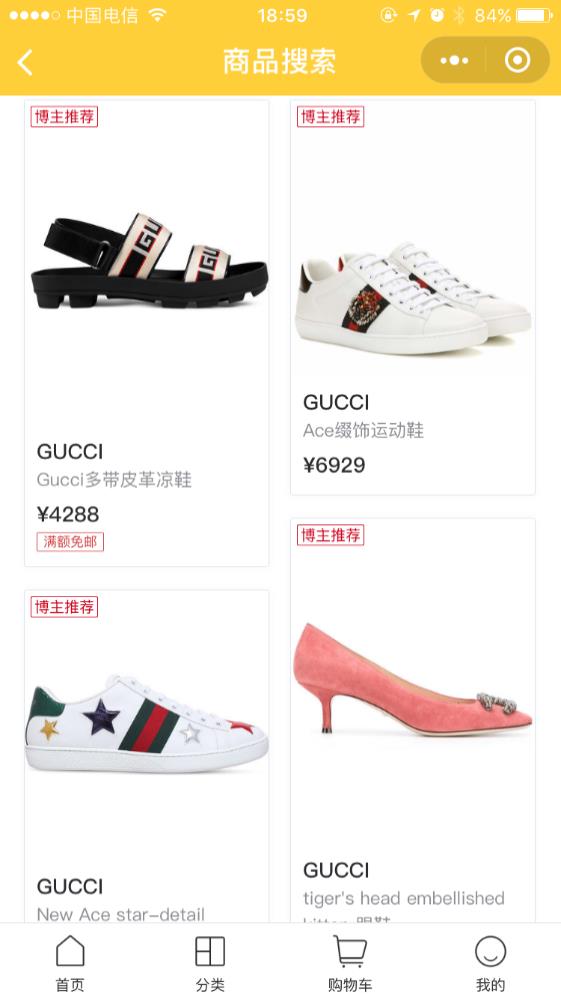

Gucci has leveraged several e-commerce platforms in China for its footwear distribution

In terms of the online sales channels, Gucci shoes can be purchased from several e-commerce platforms besides its official website, including Secoo, Tmall Shepin, and JD Self-run. Additionally, Gucci also cooperated with Gogoboi, one of the top KOLs in China’s fashion industry, to establish its presence on WeChat mini program. Bu Da Jing Xuan (不大精选) is a luxury store launched by Gogoboi and sells luxury products recommended by Gogoboi, thus the store has a strong individual character. Gucci is one of the first luxury brands that leverage the platform of WeChat which has powerful social functions as well as payment functions.

|

|

|

|

Sportswear brands are also in the luxury competition

When luxury houses are seeking the growth of footwear by creating exclusive sneakers at a high price, on the other hand, traditional sportswear brands are also in the competition by launching high-end sneakers that have a similar price with luxury brands’ sneakers. “The luxury consumers and sportswear consumers can be the same group of people. Luxury consumers can be the consumers of Nike and Adidas and vice versa.” Said Claudia D’Arpizio from Bain & Company. Therefore, luxury brands are also facing direct competition from sportswear brands in the luxury footwear market.

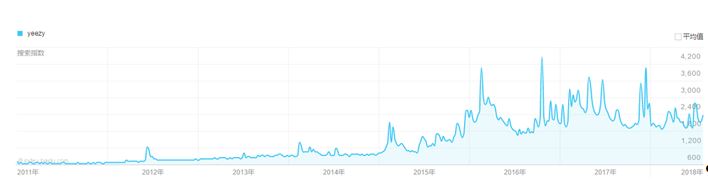

High-end sneakers by Nike and Adidas are usually around $400, but some popular styles can reach $3000 in the resale market. Limited editions and collaborations can even exceed $10,000. Footwear brands often work with celebrities or luxury brands, such as Adidas Yeezy, Air Vapormax Off White, Chanel X Adidas Originals NMD Hu, which are also sought after in the China market. For example, Adidas’ Yeezy is a kind of casual shoes with a unique look and is endorsed by Kanye Omari West, the world-famous singer. Yeezy combines Primeknite and Boost technology of Adidas which make it extremely comfortable. Yeezy also has various styles to meet the changing fashion. After it became popular aboard, celebrities and fashion icons in China soon seized this fashion and made Yeezy pursued by their followers and fans. Social media is game changing for the Yeezy hype, especially when consumers are young. Baidu index also suggests significant popularity of Yeezy by search index.

|

|

Conclusion and implications

The trends in the luxury footwear market are strongly driven by the young consumers’ preference for streetwear and the consumption behavior influenced by digital platforms, including social media and e-commerce channels. According to Bain & Company, millennials have become the main driving force for the luxury market in both China and abroad. Millennials show a preference for casual styles and street styles, which becomes increasingly important in the luxury industry. Especially for footwear, sneakers have become an important individual category for luxury brands to connect with their young consumers. Social media contribute a lot to the sneaker hype as those luxury sneaker consumers are young and closely following celebrities’ styles. When luxury brands are reaching for their sneaker consumers in China, they need to leverage the digital platforms in China, including the e-commerce platforms. Online channels share of the market is still very small in China, but it has a large potential driven by millennials who are digital savvy. More and more luxury brands have attached importance to the e-commerce channels in China. Given the unique e-commerce landscape in China, it is necessary for luxury brands to provide better service through online channels in order to cater to young consumers. Besides the official website, other verticals such as JD Toplife and WeChat are also rising to provide more localized solutions. To sum up, the footwear market has become a significant category in the China luxury market, but there’s still a large space to grow. The sneaker fad has brought new opportunities for luxury brands as well as sportswear brands to develop a digital strategy and capture the young consumer market.

Daxue Consulting can help get your luxury shoe brand into the Chinese market

Daxue Consulting has carried out projects with premium products and has experience with product launches and market entry procedures like brand naming and competitor analysis. To know more about the luxury footwear market in China, do not hesitate to contact our project managers at dx@daxueconsulting.com.