Chinese consumer behavior is influenced by significant generational differences in the country’s vast population of over 1.4 billion people, making it a complex landscape for global brands. Retail sales in China reached a staggering 44 trillion RMB in 2021, highlighting the immense market potential. However, it is crucial to recognize that different age groups have distinct preferences and requirements, making it inappropriate to create a simplistic representation of the average Chinese consumer.

Where does the average Chinese consumer live? The rise of low-tier cities

China’s consumer landscape is marked by a significant division between urban and rural populations, as well as varying preferences across different generations. As of 2022, the urban population represented the largest consumer class, with approximately 705 million people, whereas the rural consumer base reached 196 million people. The purchasing power is concentrated in urban areas, considering that approximately 65% of the entire Chinese population lives in the cities. The attention of both international and domestic brands is shifting on low-tier cities, as the majority of urban Chinese individuals live in second-tier cities or below, accounting for roughly 70% of the country’s total population. Entering these markets requires thorough research as their needs differ significantly from larger cities.

More in detail into the Chinese generations: Gen Z, Millennials, and elderly consumers

Chinese consumer behavior reflects distinct trends across different generations. Gen Z prioritizes health and career, while millennials seek a balanced lifestyle and luxury goods. The elderly population displays a strong desire for youthfulness and indulges in jewelry and cosmetics.

Gen Z

Gen Z, born after 1997, exhibits a heightened focus on health and career, seeking less stressful jobs and opportunities for self-realization. They are avid online shoppers, comprising a significant portion of China’s consumer population, with 78% of e-commerce users belonging to this generation by the end of 2021. Young people prefer reflecting on what they are buying by doing research and finding the most convenient price. “Careful spending” does not mean they will buy an item at the lowest price possible, but they are more conscious about where their money goes.

Millennials

Millennials in China, shaped by fierce competition for education and employment, are embracing the “lying flat movement seeking a balanced lifestyle that goes beyond mere work. With a desire for self-accomplishment, they prioritize luxury goods and services, as a symbol of status and reward for their efforts, even when starting families. The rise of “spicy moms”, a strong trend in China, highlights millennial mothers’ focus on self-care and premium brands, particularly in children’s clothing. Luxury brands are responding by shifting their attention to this consumer segment, exemplified by China’s largest number of Burberry kids’ stores in the world.

Elderly consumers

Silver economy is referred to all the Chinese people aged older than 60 years old, accounting for approximatively 10% of the Chinese population as of 2023. This generation boasts strong purchasing power and has a great desire to look younger, as well as a strong willingness to spend money on jewelry and cosmetics. As they have less grandchildren to take care of, due to the one-child policy, elderly in China have now more time to spend for themselves and seek for self-actualization.

Digital consumers and affluent consumers: the intergenerational groups

Digital consumers represent a huge part of the Chinese market. In Q1 2023, there were more than 1.05 billion internet users in China, and the internet penetration was around 73%. The vast world of e-commerce platforms is extremely developed in China: consumers can choose from plenty of apps and websites to purchase products.

Thanks to this huge pool of online shoppers, which in 2022 reached almost 845 million people, e-commerce is seen as a profitable way for both domestic and foreign brands to sell their products in China. At the beginning of 2022, almost half of the world’s online retail sales took place in the “Middle Kingdom”.

Affluent consumers are another important consumer segment in China. This group includes households with an annual income of more than 6 million RMB. In 2021, 5 million families enjoyed this level of income, while 2 million families earned a net wealth of more than 10 million RMB per year. Affluent consumers belonging to the post 90s play a key role in the luxury market as they vaunt a strong willingness to spend and tend to shape the luxury market with their needs.

Brands are finding more ways to engage with young and old consumers: the case of Gen Z and the Silver Economy

Key Opinion Leaders or “KOLs” are one of the most powerful tools for brands to enhance their sales. KOLs are social media influencers who are often experts in the category of products they are promoting. They are extremely popular among the young consumers. Indeed, it is estimated that, in 2021, 48% of Gen Z shoppers were influenced by KOLs during their online purchase process.

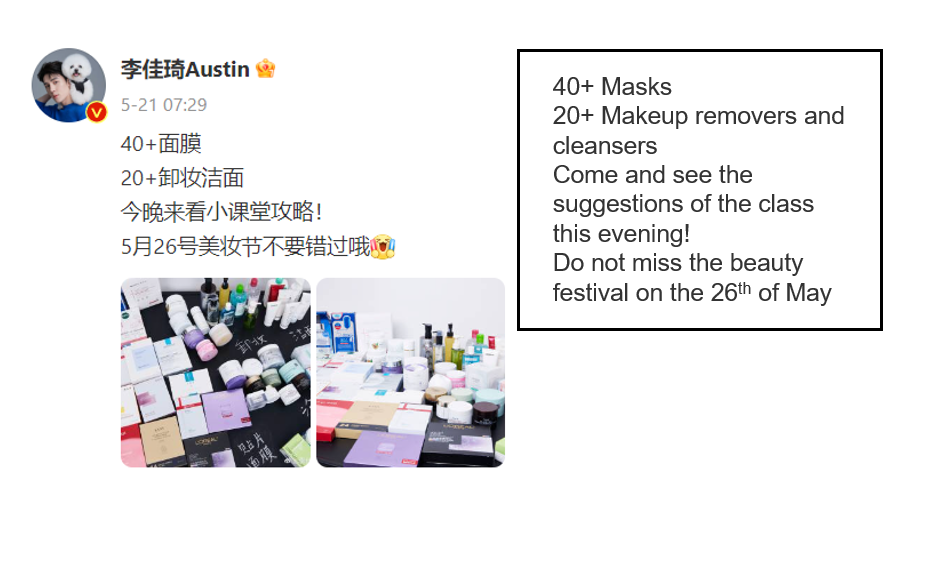

KOLs in China enjoy great success on social media platforms such as Weibo. For example, Li Jiaqi (李佳琦) is one of the most famous KOLs in China at the moment, even after having disappeared on the internet for a short period of time. He has firstly become famous for his beauty products reviews, but then his domain has expanded, and now also includes kitchenware and fashion items. The popularity he has built over time granted him more than 30 million followers on Weibo.

The rise of the silver economy

In 2021, the silver economy in China generated around 5.9 trillion RMB. As Chinese population ages, especially due to the one-child policy, both domestic and foreign brands are shifting their attention towards the elderly generation. The Chinese government has taken steps to create a more conducive environment for the silver economy, as evidenced by the initiatives outlined in the 14th five-year plan.

One of the significant trends shaping the consumption patterns within the silver economy is the increasing emphasis on looking younger. This need is concerning more and more people older than 60 years old, resulting in a rising demand for anti-aging products.

To address the concerns and anxieties related to aging and cater to the growing population of seniors on the internet, the e-commerce platform Taobao has launched a campaign with the motto “aging is cool” (我们老有意思了). As part of this initiative, a live stream event took place on March 9th 2023, featuring three 60-year-old women. During the three-hours shopping show, the three anchorwomen promoted a wide range of makeup products, gadget, and healthcare items. The official hashtag of the campaign (#我们老有意思了#) was launched on the same day of the live stream and immediately gained a lot of popularity, reaching almost 3 million views.

A glimpse into Chinese consumer behavior

- With a population of more than 1.4 billion people and a consumer pool of roughly 900 million customers, China is one of the biggest economies in the world.

- Lower-tier cities in China are gaining increasing importance for brands as they hold the majority of the urban population and have distinct consumer needs, prompting a shift in focus from international and domestic brands to capture the potential of these markets.

- China’s Gen Z, born after 1997, prioritizes health, career, and self-realization, showing a strong preference for online shopping and careful spending.

- Millennials in China pursue a balanced lifestyle beyond work, embracing luxury goods as symbols of accomplishment. The rise of “spicy moms” highlights their focus on self-care and premium brands, prompting luxury brands to cater to this consumer segment.

- The silver economy in China represents approximately 10% of the population aged 60 and above, who possess significant purchasing power and a strong desire to look younger. With fewer grandchildren to care for, they now have more time for themselves and seek personal fulfillment.

- KOLs wield significant influence over Chinese consumers, with 48% of Gen Z shoppers being influenced by them. China’s silver economy, generating 5.9 trillion RMB in 2021, has prompted brands to prioritize the aging population.

Author: Lorenzo Linguerri

Learn about Chinese young consumer habits