MINISO is a Japanese-inspired Chinese retail brand founded by Guofu Ye and Miyake Jyunya. “A better life has nothing to do with the price” is the mission that drives MINISO to deliver well-made goods to value and quality-conscious consumers worldwide.

MINISO’s revenue exceeded 170 billion RMB (2.4 billion USD) in 2019 and it has opened more than 3,500 stores worldwide in 7 years, including one in North Korea. The Chinese retailer opened its Paris store on October 20th 2020, next to the famous Galeries Lafayette department store.

At present, MINISO has reached strategic cooperation and opened the stores in more than 40 countries and regions including the US, Canada, Russia, Singapore, UAE, South Korea, Malaysia, Hong Kong and Macau, with an average of 80-100 stores opened per month. MINISO is estimates that 6,000 stores will be opened worldwide by the end of 2020 with revenue exceeding 60 billion RMB (more than 9 billion USD).

Source: sina finance, MINISO Paris Store

Behind MINISO’s China market strategy

E-commerce and logistics overseas are often not as mature as in China. However, the performance of MINISO’s international stores is still two to three times higher than stores in China. The reason why MINISO has a huge success overseas is that MINISO only achieved the following three extremes of the most basic cores and essences of retail brand in terms of both online and offline.

Aesthetic and high-end of product designs

MINISO’s in-house design team gathered many talented Norwegian designers. The products encompass modern and trendy design, what is known in China as the combination of “Japanese style” and “Scandinavian style” (北欧风格), which are both defined by simplicity and minimalism. This design is also combined with good quality.

Chinese consumers, in general, regard perfume as luxury product. However, MINISO broke into the Chinese perfume market with an affordable option, it was announced to be “the first perfume in life” by MINISO. Thanks to MINISO, people who cannot afford luxury accessories are able to experience “luxury goods”. Compared to other perfumes on the market which cost consumers 500 RMB or more, MINISO’s perfumes sell for only 10-49 RMB and are marketed to both for men and women.

High cost-performance ratio

In China, people believe the saying 一分钱一分货, which means “you get what you pay for”. However, considering the prices, MINISO puts dis-proportionate amount of effort into product design. For example, its mineral water bottle took the product team a lot of time and energy from its development to mockup. Because mineral water bottles are prone to breaking, MINISO’s team searched for manufacturers and found no less than 100 suppliers to make mockups. It took up to a year to ensure quality and design. Finally, the elegant and high-quality bottle water has launched in the market. Surprisingly, each bottle costs only 3.5 RMB.

Excellent shopping experience

MINISO is committed to creating a good environment and shopping experience. The stores are placed in shopping malls and even the most well-known department stores such as Joy City (大悦城) or WangFuJing (王府井).

Furthermore, MINISO believes that good service means not providing too much service. In stark contrast to the shopping experience of the competitor, WATSONS, MINISO staff do not follow customers around to give recommendations. The MINISO clerks only man the check-out and display but are available if a customer needs help. With no overwhelming service, customers shop without pressure.

Source: 36kr, MINISO Interior

MINISO’s China market strategy

The target market of MISINO is 18-28 year olds. It branded itself as having a Japanese spirit, which brought it a positive image due to the general good impression of Japanese products in Chinese consumers’ minds. The Japanese-influenced store optimizes their brand value by huge volume of fans and users, also the power of word of mouth.

Product Launches

Firstly, one of MINISO’s marketing strategies in China, is it launches new products once every week to bring consumers to the shop frequently.

One of the Gen Z consumption drivers is the scarcity of products. MINISO does not only take action to frequently launch new products, but also collaborates with many brands with high-awareness such as Hello Kitty, The Pink Panther, MARVEL and KAKAO FRIENDS. This co-branding strategy leverages the IP which Gen Z loves and provides them the unique and original design of products. The Chinese retailer understands the interests and behaviors of Chinese Gen Z and responds efficiently.

Source: greatdeals, MINISO x MARVEL

Word of mouth

To spread brand awareness in China, MINISO has several word-of-mouth marketing strategies. While many brands’ social media accounts are used as bulletin boards, MINISO it makes friends with fans. They devote to having better communication with fans, being playful to invite its users to interact.

Celebrity endorsements

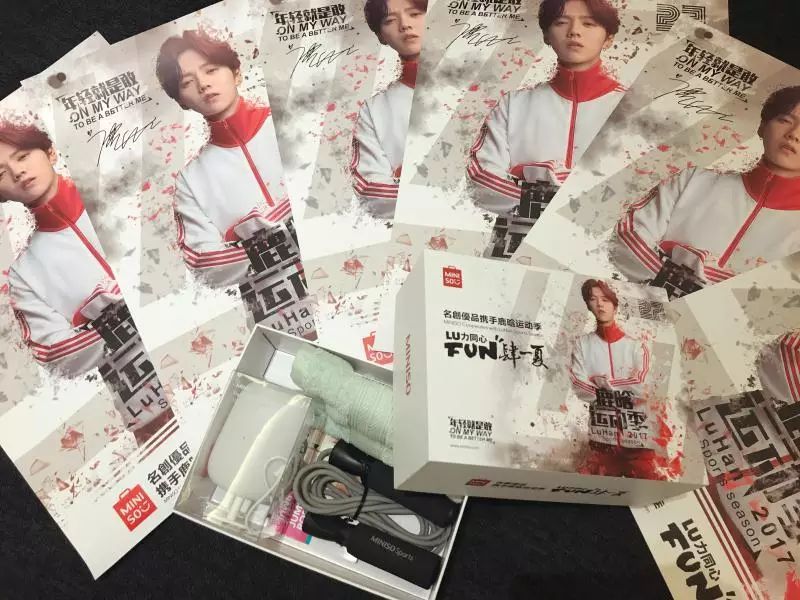

Many brands are thinking about how to find the ideal spokespersons. However, celebrity endorsements in China are anything but cheap. MINISO chooses to collaborate with celebrities on a campaign basis instead of inviting them for a formal endorsement. For example, “MINISO LuHan (鹿晗, a C-POP idol) 2017 Sports Season” collaborated with LuHan to held this campaign. It provided free limited sports gift boxes with towels, jump ropes and LuHan posters. Many LuHan fans searched for his collaborative products at the store and recognized its high-quality products during the search. Fans flocked to the pop-up stores to see Luhan, many converted from fans to MINISO’s customers.

Source: sina, celebrity endorsements is one of MINISO’s China market strategies

Viral products

MINISO perfume once reached more than 300,000 bottles a month. The partner was Givaudan Fragrance Company which also has partnerships with the luxury brands such as Dior, Chanel and Givenchy, which ensures the quality of perfume category of products.

Source: MINISO official website, MINISO perfume

MINISO’s waterproof eyeliners successfully broke into the cosmetics market and sold 100 million units a year. The waterproof eyeliners are produced in the same factory as L’Oréal’s. However, the market retail price from L’Oréal is more than 99 RMB while MINISO sells it for only 9 RMB. MINISO simply made the eyeliner into the fast consumable item. It turned out that a 99 CNY product might be lost or damaged in less than half of its use anyway, so MINISO tapped into a demand for cheaper options.

Source: MINISO official webiste, MINISO eyeliner

In terms of price, same as other brands, MINISO uses the viral product strategy. But in the era of “less is more”, MINISO believes that the viral products don’t need to be complex. Large-scale procurement and a higher quality than alternatives are the keys to viral products.

MINISO’s pain points of the future

According to the press release, MINISO (NYSE: MNSO) just went IPO on NYSE on October 15th 2020. The company sold 30.4 million American depository shares for 20 USD each, and jumped 12% in the first day of trading.

It is now developing online sales and reducing 95% of products’ price to under 29 RMB in response to the economic crisis. However, how to maintain profit after compressing the prices of already-cheap goods will be a challenge for MINISO.

Author: Shannon Yeh

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast