Investigating what movie preferences say about Chinese consumers

As of August 11, 2019, Nezha, a movie re-adapted from an ancient Chinese mythology, has grossed over ¥3.5 billion ($700 million) in China, becoming the most popular movie of the summer. However, recent sales are not too optimistic for other players. Because of strict censorship, four highly-anticipated movies were pulled from cinemas in one month during the past summer. Shanghai Fortress, a big-budget movie on showing, is suffering a complete box-office smash. What does the changes in movie success say about Chinese consumer preferences?

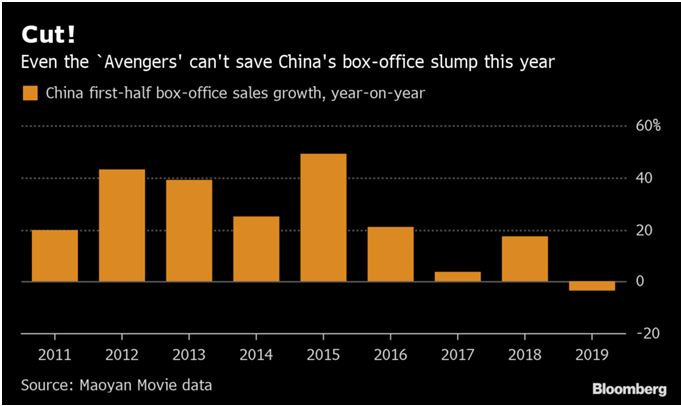

In the first half of this year, China’s box-office sales fell 3.6%, which has not happened for several years, according to the data from Maoyan Movie and Box Office Mojo. As a key overseas market for most major movie studios around the world, China’s movie industry is brewing a big demand-driven re-shuffling.

[Source: Maoyan Movie data & Bloomberg; Chinese consumer preferences are changing]

Reasons behind this steep drop

On June 23, the overall movie ticket sales in China reached ¥30 billion, which was 7 days later than last year. The drop has been partly attributed to a rise in the average movie ticket prices from 35.56 RMB to 38.6 RMB, according to Alibaba’s Lighthouse data app.

[The expensive movie ticket price of the Avengers: Endgame premier in China]

Nevertheless, the construction of movie theaters is not intimidated by the drop of movie ticket sales in China. This year so far, 4,585 new screens have been built, adding the total national number to 64,085. The growth rate of new screens dropped 15% compared to the same period last year, which suggests the inability of China’s film industry to absorb the weakening economics and the changing moviegoers.

Shanghai Fortress: One of the biggest failures in the recent history of Chinese movies

The highly-anticipated sci-fi movie Shanghai Fortress, with a total production budget of 360 million RMB and massive pre-heat on social medial, was released on August 9. With the appearance of famous actress Shu Qi and ex K-pop star Lu Han, who is dubbed by foreign media as the “Chinese Justin Bieber,” Shanghai Fortress was supposed to win the hearts of Chinese audience this summer. Following the success of another sci-fi film, The Wandering Earth, earlier this year, the market placed huge hope on Shanghai Fortress with a film row piece rate up to 33.5% on its first day of showing.

However, any hope for the film’s success is deteriorating. On August 11, the forecast figure of overall box office by Maoyan was reduced from 366 million RMB to only 138 million RMB. Moreover, it only took three days for the rating of this movie on Douban, Chinese No.1 film rating website to sink to 3.3 out of 10. The failure of Shanghai Fortress is perhaps a symptom of changes in Chinese consumer preferences.

[Source: Douban. Shanghai Fortress with a 3.2 rating, 61% give it 1/5 stars]

The huge box-office smash and overwhelming criticism have showed warning signs to the investors and creators in China’s movie industry. For many years, China’s box office has relied heavily on the celebrity effects and hot IP topics. In 2013, Tiny Times 1.0, directed by Guo Jingming and adapted from his novels, opened the golden age of Chinese celebrities to make money in the film industry. This hot film series earned more than 1.72 billion in total at national box office with a rate of return up to 250%. Compared to the average movie rating of 4.68 on Douban, the successful movie ticket sales of Tiny Times series proved that celebrities used to have a huge effect on China’s film industry.

[Source: Douban & Big Data Group, Tiny Times series in China proves stardom still affects Chinese consumer preferences]

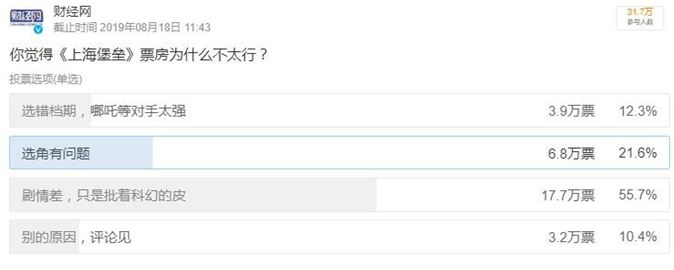

Six years after Tiny Times 1.0 released, this old pattern of attracting audience no longer works in the current landscape, especially among Chinese young people. A user on Douban wrote, “If The Wandering Earth showed up hope for Chinese science fiction, Shanghai Fortress showed us the desire for money.” According to an online survey conducted by Caijing, 55.7% of the participants believed that the biggest reason behind the failure of Shanghai Fortress is that it is “a fake science fiction with an awful plot”.

[Source: Caijing.com.cn, reasons why Shanghai Fortress’s poor sales]

Reasons why Shanghai Fortress is experiencing low sales are: a fake science fiction with an awful plot (55.7%), bad casting decisions (21.6%), poor timing and strong competition (12.3%) and other (10.4%)

Chinese consumers see through poor movie plots

From Wolf Warriors II in 2017, to Dying to Survive in 2018, to The Wandering Earth in 2019, none of these successful movies leveraged massively famous celebrities to gain movie ticket sales. More and more audience sees through the plot of movie investors and producers, who are merely trying to make money from enthusiastic fans of celebrities. While choosing films to spend their leisure time, audiences are looking for deep and interesting plots, and movies that are highly rated by critics. In other words, movies are one area that show the increasing sophistication of Chinese consumer preferences.

Investors start to adapt their strategies to this changing scenario. Earlier this year, immediately after Green Book won Oscar, Alibaba brought the movie into the Chinese market. Jack Ma even promoted this film as a personal mission ahead of its national release by inviting his celebrity friends to screenings. Despite its deep American societal theme and a story that seems un-relatable for a Chinese audience; Green Book astonishingly earned 122 million RMB during the first three days of its opening.

The collapse of Shanghai Fortress is a nightmare for its investors and movie studio, but it opens a bright future for China’s film industry. At the same time, the success of Green Book proves that Chinese audience is much more open-minded than originally thought. Most popular movie topics around the global are acceptable to their increasingly sophisticated appetite. As long as the films demonstrate their sincerity and creativity, the audience will embrace them with a warm welcome.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes