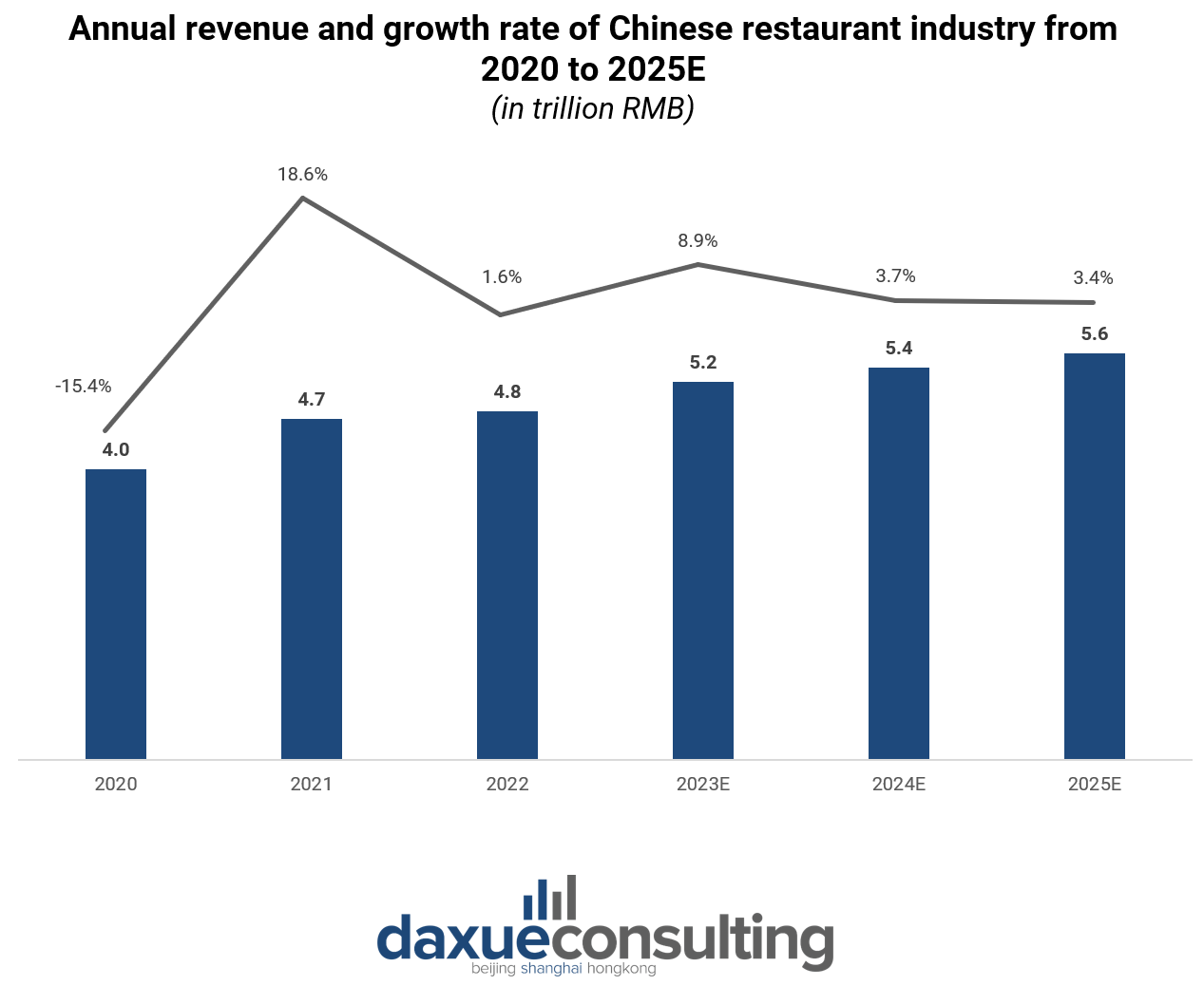

The restaurant market in China has witnessed a significant rebound following the pandemic. In 2023, the Chinese food service market reached RMB 5.2 trillion (USD 717.6 billion), marking a 20.6% year-on-year increase, and essentially returning the market scale of the catering industry to pre-pandemic levels. In the near future, the growth rate of the catering industry in China is expected to stabilize, with a projected market size of RMB 5.6 trillion (USD 772.8 billion) by the year 2025.

Technology also has a large impact on this market, as with the increasing digitalization in the country, people are more willing to order takeaways and eat by themselves. Indeed, Chinese food delivery services’ user base is the biggest worldwide and reached more than 540 million users as of 2023.

Digital appeal and high-end cuisine shake the Chinese food service market

Contrary to most countries, dining out in China is seen as a normal everyday activity rather than an occasion to “treat yourself”. A survey published by Statista.com in December 2022, in which 7,000 individuals aged more than 16 years old were interviewed, showed that around 50% of the respondents dine out several times a week. They usually go to quick-service restaurants serving traditional Chinese dishes, leaving full-service restaurants for special occasions.

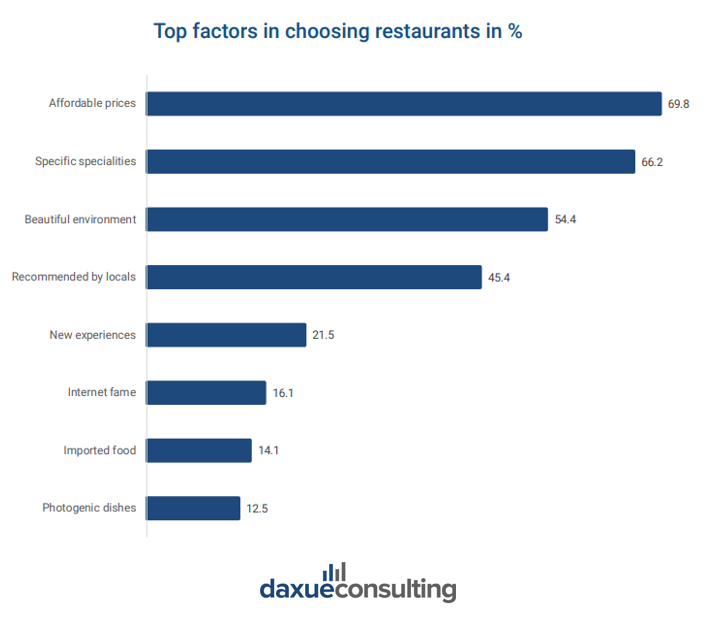

In 2024, Daxue Consulting published a market report about the Chinese food industry, in which 1,000 people were interviewed about their preferences while choosing a restaurant. The survey showed that, in selecting a restaurant, the participants prioritize affordability (32.6%) as their primary criterion, followed by the availability of specific dishes (26.6%), and the overall environment (13.5%).

This trend remains relatively consistent across both genders. However, as age increases, the importance of dishes becomes more prominent, while the emphasis on factors such as internet popularity, seeking new experiences, and the visual appeal of dishes in photographs decreases. This underscores the rising importance of factors like the visual allure of the environment and dishes, the experiential aspect, and the restaurant’s social media virality in attracting younger consumers who prioritize digital experiences and social validation when dining out.

Source: Daxue Consulting F&B industry white paper, most common factors consumers take in consideration while choosing a restaurant

Moreover, dining out has also become a way to affirm the individual’s social status. Consumers, especially in high-tier cities like Beijing and Shanghai, would rather eat at high-end restaurants and spend more money on refined ingredients, even spending more than RMB 6,000 (USD 828) per person. In particular, consumers in Shanghai are particularly passionate about French cuisine. The reasons behind this popularity are numerous, starting off with its exotic nature and the research of refined ingredients. French restaurants and cafes have chosen the Chinese city because of its deep roots in French culture, especially because the first French cafe and restaurant brands were opened in Shanghai in the early 1920s, allowing Chinese consumers to discover this cuisine.

Globalization and urbanization are reshaping consumers’ interests

The tradition of dining out is carried on differently in numerous areas of China. Eating outside is particularly popular for young, single urbanites in higher-tier cities. This shows big potential for the Chinese foodservice market, which is undergoing a notable transformation, shifting from traditional in-person dining to a mix of online and offline options.

However, full-service restaurants are still the most preferred option among Chinese consumers, especially because of the rapid urbanization, their research of high-quality dining experience, and the demand for healthier food options. With the globalization process, foreign cuisine in China is also becoming very popular. In June 2020, Shanghai had more than 12,000 restaurants specializing in foreign cuisine, almost 20% of the city’s total restaurants.

Despite a growing market demand for healthier options among health-conscious consumers, fast food restaurants are witnessing a fast development in the country. In 2023, American Chains such as McDonalds and KFC further extended their influence in China, bringing the number of restaurants respectively to 5,900 and 12,000, adding around 900 and 1,200 stores compared to the previous year.

Source: Tastien, burgers with Chinese-style flavors

Social media platforms play a key role in the Chinese restaurant market

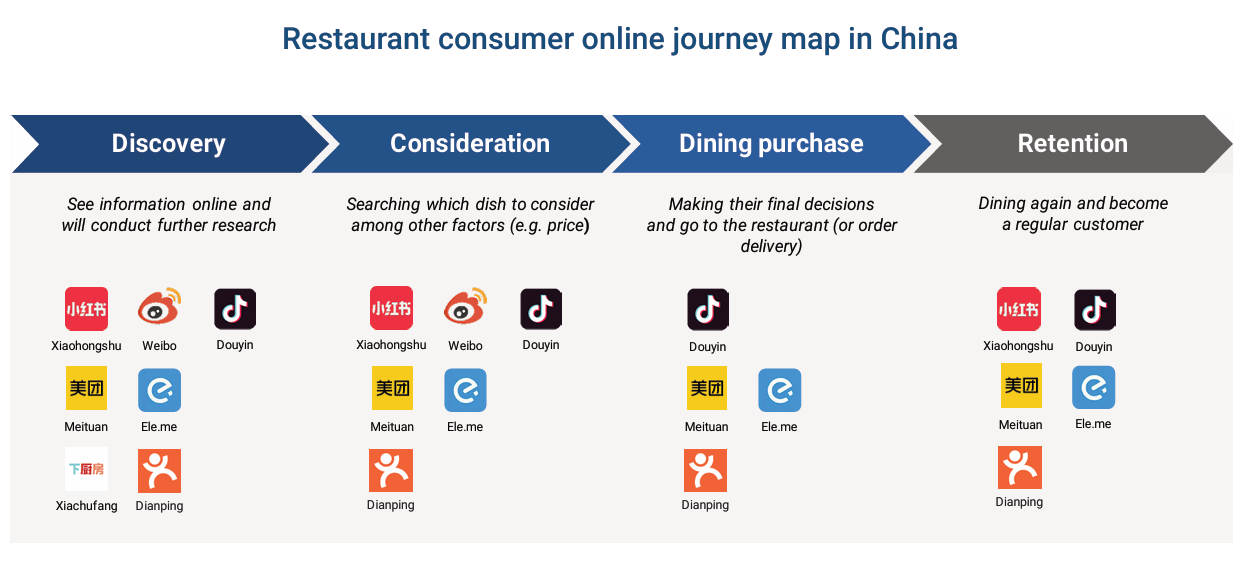

In China’s restaurant market, Generation Z and Millennials have emerged as dominant consumer groups, constituting more than 35% of the total consumers as of 2023, with an increase of 9% compared to the previous year. This digitally-savvy generation relies heavily on social media platforms like Douyin, Xiaohongshu, and Weibo for obtaining information and influencing how people discover restaurants.

There are countless posts and vlogs with hashtags such as #探店# (explore shops) #打卡# (punch-in) on these platforms, allowing people to evaluate and choose restaurants based on their preferences. Indeed, these two hashtags have respectively more than 3.18 billion views and 1.45 billion views on Weibo as of April 2024.

Apart from social media, many food-centered apps are flourishing in China, such as the delivery platforms Meituan (美团) and Dianping (大众点评). In 2023, the two apps had a revenue of respectively RMB 276.7 billion (USD 38.1 billion) and RMB 2.3 billion (USD 317 million).

Source: Daxue Consulting F&B industry white paper, the most common process of choosing a restaurant through social media

As a result, many restaurants actively engage with review apps and social media platforms, encouraging customers to leave positive feedback and rewarding them with discounts or free meals. Furthermore, large-scale social media organize marketing events which play a key role in creating buzz and driving traffic to offline stores. From 17th of July 2023 till the end of the year, Xiaohongshu launched the project “100 stores exploration plan” (100家探店计划) in Shanghai. The initiative consisted of selecting 100 restaurants and cafés for users to explore and collect stamps. Users could exchange merchandise with the stamps they collected and participate in giveaways if they posted on the platform with relevant hashtags. The project was a success, as of April 2024, the official hashtag (#100家探店计划#) has more than 2.5 million views on Weibo.

From robotization to private cuisines: emerging trends in China’s restaurant market

Robotic innovations elevate China’s restaurant scene

The Chinese restaurant market has experienced a rise in the adoption of technology, transforming the way businesses operate and enhancing the dining experience. The market of service robots in China reached RMB 51.6 billion (USD 7.1 billion) in 2022, and food delivery robots have already been adopted on a large scale in restaurants in high-tier cities like Beijing. The pandemic helped this sector to skyrocket.

Since February 2020, many tech giants such as Alibaba and Meituan have already been testing robot delivery food services. As of 2023, the number of food delivery robots reached 70,000 units. These robots are being fine-tuned continuously, such as including glass covers to the trays to ensure food safety. In short, the robotics and automation technologies can reduce labor costs and provide unique dining experiences for customers in China.

Source: PUDU, Haidilao employs robot waiters

Cartoons and anime-themed restaurants are the new trending places to go

As the restaurant market becomes increasingly competitive, more and more themed restaurants are opening as owners find new ways of differentiation. The trend of themed restaurants became popular in 2010s, when many 80s-themed and nostalgic-themed have opened in Beijing and Shanghai. Some of the most common themes include movies, TV, anime, or big IP themes.

In January 2024, the animation company and IP retail store IPSTAR (潮玩星球) posted on Weibo an updated list of must-see themed restaurants all across China, including cartoon, movies and anime-themed restaurants. Furthermore, the company makes regular posts on its Weibo page about the next opening themed restaurants and what they are about; as of April 2024, the page counts more than 340,000 followers.

Source: Weibo.com, the interiors of the Sherlock Holmes-themed restaurant in Shanghai

Enjoying an intimate moment with the loved ones: private kitchen cuisine in China

In recent years, private kitchen cuisine (私房菜) has become more popular in the Chinese restaurant market. Private kitchen cuisine usually refers to small restaurants with unique and creative dishes served in a cozy and intimate dining space. In bigger cities where the lifestyle is more fast-paced, private kitchen cuisine provides a comfortable dining space that can satisfy people’s desire for more private and intimate social interaction with their friends and families. As of April 2024, the hashtag #私房菜# (#private kitchen#) has more than 1.5 billion views and almost 200,000 posts in which people like to discuss their experiences and recommend remarkable private restaurants.

Source: Weibo.com, an example of the interiors of one private kitchen cuisine restaurant in Beijing

Furthermore, since the end of the Zero Covid policy, the trend of private Karaoke restaurants regained popularity after the negative records of less than 2500 karaoke bars as of 2022. Restaurants started to offer private dining rooms with Karaoke, in order to transform an intimate meeting with family or friends in a party, enhancing the customers’ experience.

Consumers’ trend of dining alone is encouraged by many restaurant chains

As society changes, restaurants in China also evolve and adapt to meet the changing needs of their customers. In order to respond to the rising trend of solo diners, they are now offering menu options tailored for individuals. This represents a radical change in Chinese cuisine because, according to tradition, food portions are usually big to be shared with the other diners. Therefore, these options for a single person allow solo diners to enjoy a full meal without having to order large portions meant for groups. Furthermore, some restaurants in China are providing comfortable seating arrangements for single guests. For instance, since 2017, the Haidilao hot pot restaurant (海底捞) staff places a stuffed toy on the opposite side of the table if a person is dining alone.

Source: Weibo.com, stuffed toy given by Haidilao hotpot if the person is dining alone

Delivery and takeaway are flourishing among young users

In the past, restaurants mainly relied on customers dining in as their revenue stream. Digitalization has profoundly transformed the restaurant market. Nowadays, offline, and online stores are the two main battlefields for restaurant operators. Not only do they have to attract customers offline but also online. According the survey published by Daxue Consulting in the F&B market report, 17% of respondents order takeout for more than 30% of their meals. This proportion is higher for Gen Zs (25%) and Millennials (21%).

The pandemic accelerated this transformation as eating at restaurants was not allowed in many cities. Meituan Group’s revenue in 2022 reached 220 billion RMB, a 22.8% increase from 2021’s 180 billion RMB. In addition to traditional food delivery apps, many restaurant groups joined Douyin since 2022. Haidilao, the popular hotpot chain restaurant, launched a group purchase on the Douyin platform, generating a revenue of approximately 300 million RMB from the three products offered.

With over 743 million monthly active users as of October 2023, Douyin provides an excellent platform for restaurants to do livestreams, launch group purchases, and partner with Douyin takeaways to attract customers. Many restaurants have gradually transitioned from a dual-channel strategy of dine-in and take-out to an omnichannel strategy of dine-in, take-out, and Douyin.

This transformation reshapes the customer journey by integrating digital platforms into their dining experience. Customers can seamlessly discover, engage, and purchase from restaurants through the aforementioned features, creating a more interactive and convenient dining ecosystem.

The restaurant market in China is a non-stop innovation process

- Following the pandemic’s challenges, the Chinese restaurant market is experiencing a revival. As of 2023, it’s a thriving industry valued at over RMB 5.2 trillion.

- Consumer preferences in the Chinese restaurant market are evolving, shifting focus from affordability to experiential dining. There’s also a growing interest in luxury cuisines, particularly French food.

- Urbanization and globalization have facilitated the growth of foreign restaurant chains in China, despite consumers’ pursuit of healthier food options.

- Social media significantly boosts the Chinese restaurant market’s success. Sharing photos, videos, and reviews on these platforms has become so widespread that Xiaohongshu initiated the “100 stores exploration plan” to encourage dining out.

- Technology is increasingly prominent in China’s restaurant market. Consumers are drawn to robot delivery services and robotized restaurants.

- In recent years, themed restaurants have gained immense popularity in China. To stand out from competitors, many eateries offer anime, movie, or nostalgia-themed dining experiences.

- The trend toward private kitchen cuisine reflects consumers’ desire for intimate dining settings, allowing them to enjoy meals with family or friends away from the hustle and bustle of traditional restaurants.

- Dining alone is becoming more common among Chinese consumers. Many restaurant chains cater to this trend by providing stuffed toys for solo diners.

- In recent years, many Chinese restaurants have adopted an omnichannel approach. They leverage apps like Douyin for live-streaming, online ordering, and brand promotion.

Download our China’s F&B industry white paper

In our recent white paper, in addition to extensive research on the restaurant market, we unveil our findings on changing eating and cooking habits among Chinese consumers, emerging coffee culture trend, and explanations of F&B consumer tribes, including healthy food, coffee, and alcohol consumer tribes.

We offer consulting services for China’s F&B industry

China’s restaurant market is a dynamic sector, influenced by shifting consumer preferences, technological advancements, and evolving dining habits. Daxue Consulting offers expert market research in China, providing in-depth insights into the trends and challenges shaping the restaurant industry.

Our comprehensive consumer understanding helps businesses refine their offerings and craft effective marketing strategies to resonate with local diners. Through our consulting services, we guide you to leverage emerging opportunities and navigate the competitive landscape. Reach out to us today to discover how our expertise can drive your restaurant business’s success in China.