The global market for perfumes has been increasing, and among it is South Korea’s perfume market, whose growth has been largely driven by the young consumers. In 2019, the market was worth about KRW 603.4 billion (or USD 423.0 million), and it predicted to reach to about KRW 980 billion (or USD 686.9 million) by 2025. In addition to using more perfumes, Korean consumers are redefining “perfume” and interacting it with it differently.

In the era of “korgasm” (코르가즘), people are seeking for a new kind of pleasure

Among the trending keywords during the Covid-19 pandemic is “korgasm” (nose + orgasm, 코르가즘), which describes the emotional pleasure felt through smell. People have been mainly looking for perfumes – not only to “decorate” oneself and to express their individuality but also to get “emotional support”. While time spent at home has increased, causing many to feel fatigued, Korean coined the term Coronablue (코로나블루), to describe the feelings of depression during Covid-19. To emotionally recharge, Korean consumers have used perfumes and other well-scented products like essential oils to feel different, positive emotions. Among the top luxury perfumes in South Korea’s perfume market are French Chanel (샤넬), British Jo Malone (조말론), and French Diptyque (딥티크).

Perfumes, a “small luxury” are less of a financial burden

Consumers are more willing to spend money on themselves today, which explains why many are looking for small luxuries (스몰 럭셔리). Small luxuries refer to those in the low-price range such as perfumes, AirPods cases, masks, and lipsticks. They are more affordable than luxury cars, and clothing and can serve as a “gift for myself”.

Niche brands, major driver of the perfume market, are more expensive but worthwhile

Although niche brands are usually double or triple the amount of the mainstream perfume products, they are considered a worthy investment. Korean consumers are turning to niche perfumes as a way to express themselves and their personal tastes. An official from the perfume industry said that niche perfumes are favored because they contain natural and rare ingredients that blend well with the individual human natural scent and are only produced in small quantities, creating a one-and-only fragrance for an individual.

The MZ Generation, a major pillar of the South Korea’s niche perfume market

The MZ Generation (MZ세대), collectively referring to those who are from the Millennials (born in early 1980s to early 1990s) and Generation Z (born in the mid-1990s to early 2000s), are significantly contributing to the growth of niche perfume brands. Their increasing purchasing power and desire to actively express themselves have encouraged companies to focus on perfumes amid the decreasing overall cosmetics market in the early periods of the pandemic. According to Hyundai Department Store (현대백화점), one of the major department stores in South Korea, the sales of their niche perfumes increased by 89.1% from 2020 to 2021. In the case of both Diptyque (딥티트) and BYREDO (바이레도), 70% of their customers are in their 20s and 30s.

Fashion companies joining the niche market are competing over foreign brands

As niche perfumes become more trendy, large fashion companies like LOTTE (롯데), Shinsegae (신세계), and Hyundai Department Store (현대백화점), are competing fiercely to import foreign perfume brands. Shinsegae International has acquired the sales rights for well-renowned brands like BYREDO (바이레도), Diptyque Paris (딥티크), and Santa Maria Novella (산타마리아노벨라).

Leading department store Lotte Department Store (롯데 백화점) also announced that it will be more than double the area of the perfume zone and introduce over ten luxury perfumes – some that even perfume aficionados may not be aware of like French candlemaker TRUDON (트루동) and PARFUMS DE MARLY (퍼퓸드말리). Hyundai Department Store’s Handsome (한섬) plans to strengthen its perfume its position by opening its first flagship store. In May 2022, it opened French Liquides Parfums Bar in Gangnam, known as one of South Korea’s affluent neighborhoods.

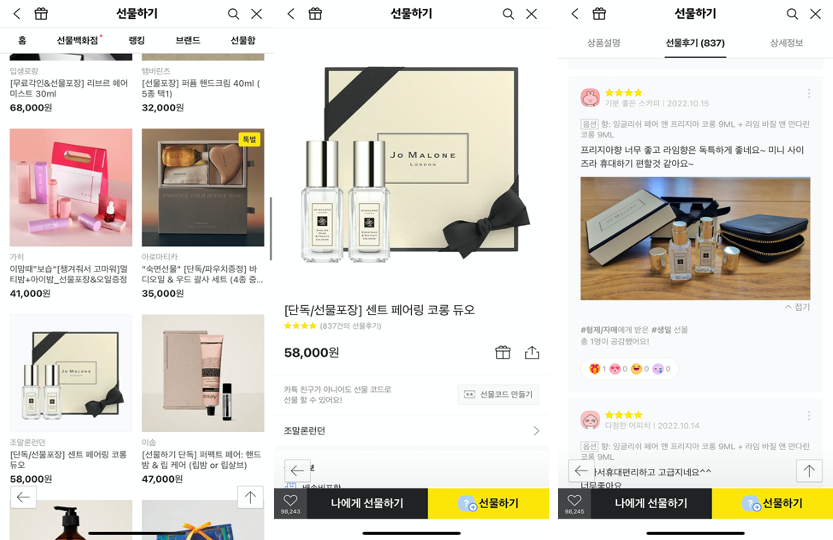

How the messaging app KakaoTalk (카카오톡) is used for selling perfumes

Besides their offline and online websites, perfume brands including Jo Malone (조말론), Diptyque (딥티크), NONFICTION (논틱션) have official stores in KakaoTalk Gifts (카카오톡 선물하기), a feature of the messaging and most frequently used app KakaoTalk (카카오톡). The gifting feature allows users to buy, send/receive gifts for special occasions like birthdays, Valentine’s Day, and graduations. Perfume brands don’t only use it to sell their products but also allow their customers to share their opinions and experiences using them.

South Korean brand TAMBURINS (탬버린즈) starts off with a luxurious experience

Launched in 2017, sunglasses brand Gentle Monster’s TAMBURINS (탬버린즈) has stepped up its marketing efforts as part of its strategy to win in the highly competitive niche perfume market. In September 2022, it launched its first campaign to introduce its first perfume collection. In collaboration with Jennie from Kpop group Blackpink, it produced a short video, receiving positive response from both local and international viewers, and opened a temporary exhibition, where it could provide an experience as many companies in South Korea’s beauty market, Korean F&B market, and South Korea’s luxury goods market do.

Key takeaways of South Korea’s perfume market

- The perfume market continued to grow during the pandemic in South Korea. Brands are mainly targeting the MZ Generation (MZ세대), who are wearing perfumes as a fashion statement, want to feel a “korgasm”, and are willing to invest in themselves.

- Perfumes are “small luxuries” (스몰 럭셔리) that are more affordable than luxury bags and cars. They can be gifted to oneself and to others through platforms like KakaoTalk Gifts (카카오톡 선물하기).

- Niche perfume brands like Jo Malone (조말론), Diptyque (딥티크), and Byredo (바이레도) are particularly receiving most attention in South Korea’s perfume market. Their natural and original ingredients that blend well to create a unique smell for each person are a major success factor.

- Large fashion companies like Shinsegae International and LOTTE (롯데) are joining the competition in niche perfume market. Efforts include increasing the number of perfume stores and bringing in lesser-known luxury perfume brands.

- New players like TAMBURINS (탬버린즈) are trying to win in South Korea’s perfume market by providing an immersive experience and communicating their brand identity. They have launched their first campaign in collaboration with Jennie from Blackpink and opened an artistic exhibition.