Founded in 2014, the SUPERMONKEY gym chain started out as a 24-hour self-served gym box in Shenzhen. Within a year, it offered group class studios and expanded to Shanghai and Beijing in 2016 and 2018, respectively. To date, SUPERMONKEY owns more than 100 physical stores in prime areas of nine major cities across China, including Guangzhou, Nanjing, Hangzhou, and Wuhan, and it has accumulated more than 300,000 paid users.

SUPERMONKEY strives to not merely be a fitness gym but also one that is part of a modern lifestyle. This “new-style” gym in China with pay-per-use and WeChat booking system as its core characteristics has increasingly been the more attractive gym option for urban white-collar workers who seek convenience, efficiency, and fun in a group setting. In China’s fitness industry, traditional gyms with long-term gym memberships are failing due to inflexibility and poor financial management (learn more about the downfall of China’s traditional fitness centers).

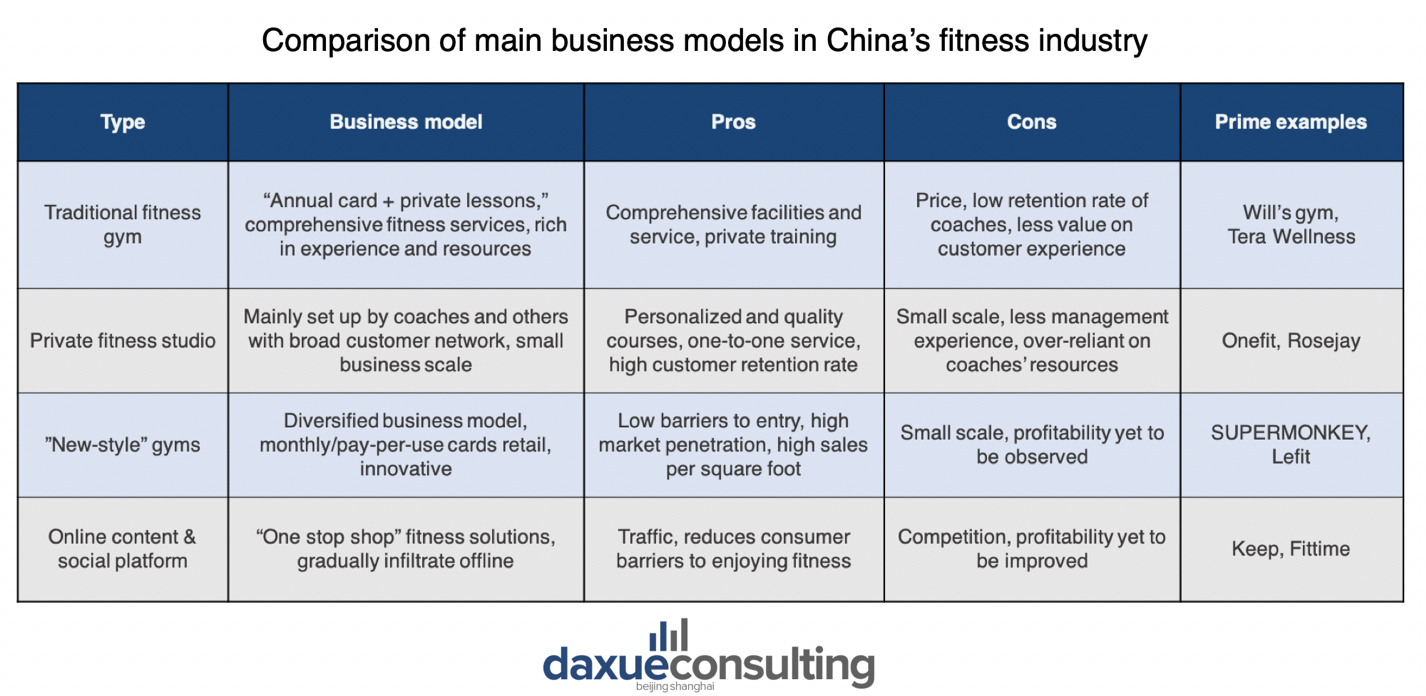

Source: Guotai Junan Securities, daxue consulting analysis, comparison of main business models in China’s fitness industry

SUPERMONKEY gym received its Series D funding round of 360 million CNY, or USD $54 million, in early 2019. It is one of the few enterprises in China’s fitness industry under “Hurun China Cheetahs 2020,” a survey done by Hurun Research Institute that compiles high-growth startups mostly likely to reach USD$1 billion valuation within five years in China.

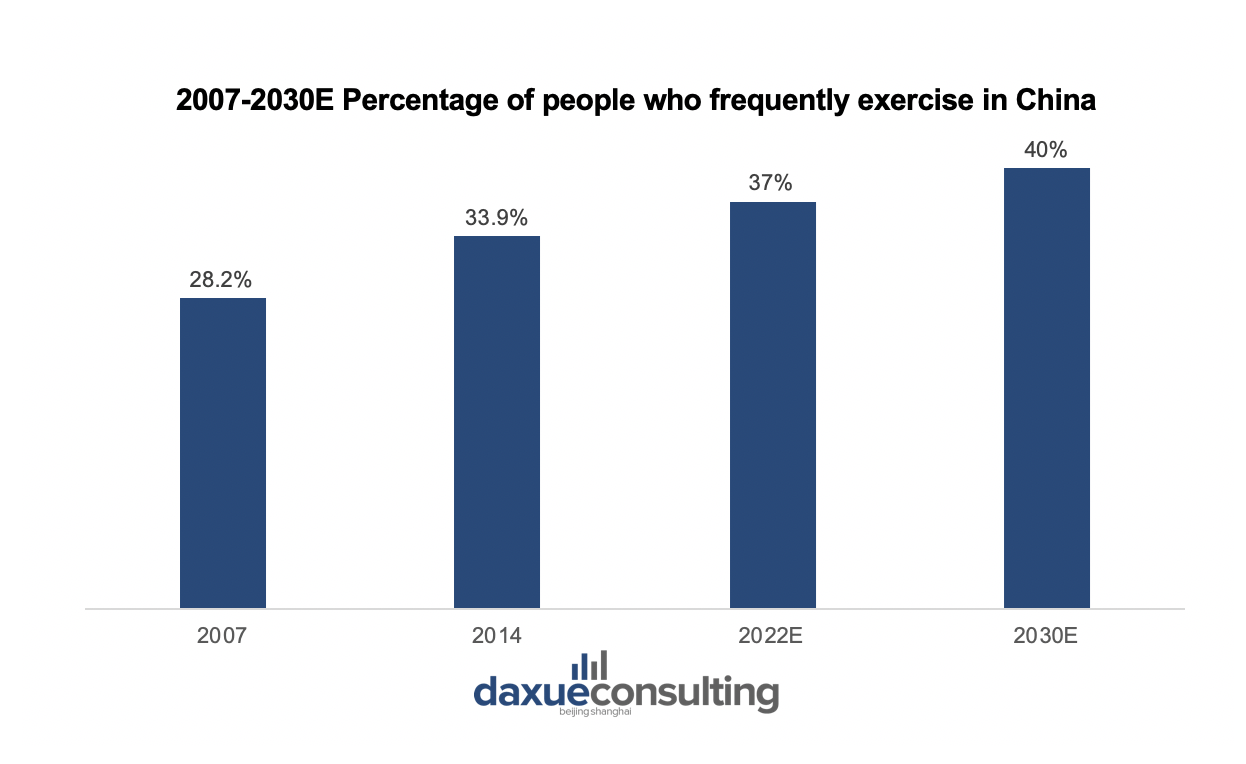

More and more Chinese are exercising regularly

The Chinese government plans for the percentage of people who frequently exercises to reach 37% by 2022. From 2007 to 2014, this figure has increased from 28.2% to 33.9%, which means that Chinese consumers are increasingly valuing personal health and fitness. The fitness industry, particularly brands with a new retail model like SUPERMONKEY, have a proven success track in the future.

Source: General Administration of Sport of China, daxue consulting analysis, 2007-2030E Percentage of people who frequently exercise in China

With group studios as their main stream of business, SUPERMONKEY gym also has other main lines of business and continues to develop: (1) SUPERMONKEY mini, which are private coaching gyms; (2) gym boxes, self-served gyms resembling shipment containers; and (3) brand merchandise and retail.

SUPERMONKEY as a “new-style” gym: Building a lifestyle brand

Since its incorporation, SUPERMONKEY gym has increasingly become a “web celebrity” (wanghong 网红) in China’s fitness industry. Their motto “Super Life, Super Me” serves as a powerful branding strategy which has resonated with young, white-collar Chinese consumers living in top-tier cities. Using its WeChat mini program as the primary digital platform for membership management, SUPERMONKEY gym emphasizes “no annual card, no salesperson, pay by class.”

Source: Daxue Consulting, SUPERMONKEY group class studio in Super Brand Mall in Shanghai

Clear motto defines the goal and identity of the brand

“Super Life, Super Me” is the motto of the brand, and this clear vision can be seen in almost any social media page next to SUPERMONKEY’s brand name. It effectively tells consumers what the brand is about and can allow them to easily recall the brand.

No commitment: Pay-per-use model for a selection of 100+ courses

Unlike traditional gyms with annual membership fees, SUPERMONKEY gym brands itself as a low commitment fitness center that is easily accessible through their WeChat mini program and convenient locations. It offers over 100 high-quality group classes divided into six main categories: slimming and shaping, boxing and dance, yoga and Pilates, regeneration, performance enhancement, and children’s development.

Moreover, SUPERMONKEY bought the rights to Les Mills, which has already existing fitness class curriculums and equipment. SUPERMONKEY instructors get certified in Les Mills to teach those classes.

Coherent store design and prime locations in urban districts

One of the most important contributing factors to SUPERMONKEY’s strong brand identity is its distinguishable and coherent store design. The theme of bright yellow and black evokes feelings of vitality, energy, and cheer, which are all suitable for the fitness industry.

Branding the fitness gym as an integral part of lifestyle: “Urban Spot in Motion”

In 2018, SUPERMONKEY rolled out the concept of “Urban Spot In Motion” (城市运动橱窗计划) for its offline stores, which envisions to integrate sports with lifestyle in urban areas. The floor-to-ceiling glass windows of their stores in urban areas allow those passing by to witness the energy and joy of the people at the gym, thus serving as a natural source of consumer traffic to the brand.

Source: Sohu, SUPERMONKEY’s premier themed gym in Shanghai Raffles City mall

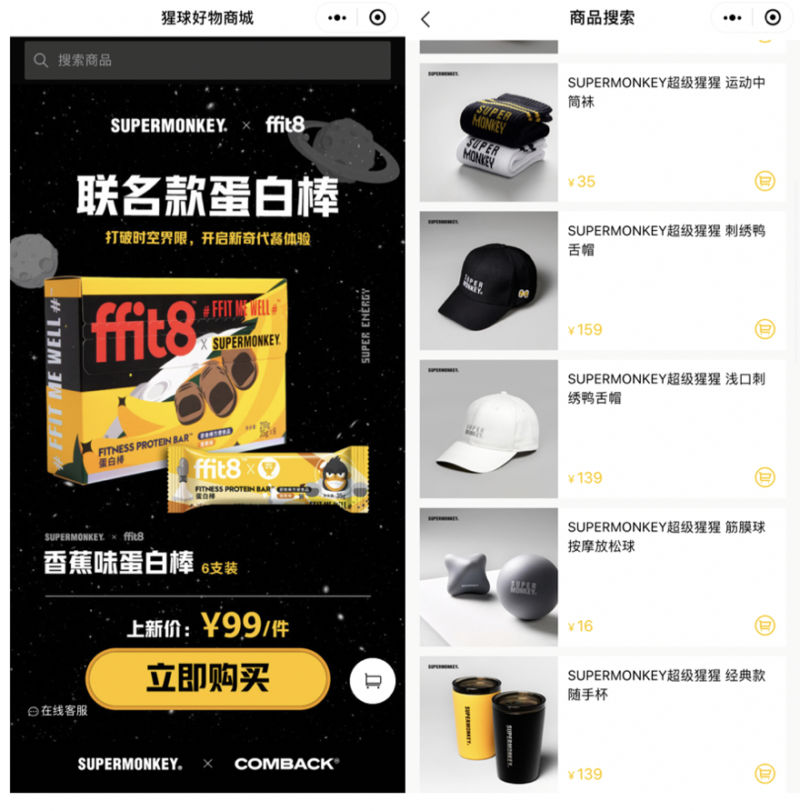

Building a lifestyle brand with merchandise and other products

To further foster brand awareness, SUPERMONKEY aims to create a lifestyle brand as a fitness gym. Once its operations have been more stable along with the expansion of offline stores, SUPERMONKEY’s revenue allows for alternate ways of building a lifestyle brand. In 2017, the gym explored brand products such as sports clothing, water bottles, and accessories that surrounds the concept of “lifestyle.”

Source: SUPERMONKEY WeChat mini program, SUPERMONKEY’s store

Reshaping the fitness industry in China with WeChat mini-programs and a retail model

WeChat mini-programs as the primary platform for class bookings

In 2018, among all social media platforms in China, WeChat had the highest number of monthly active users (MAU) at over 1 billion. WeChat mini programs are effective for SUPERMONKEY as it offers a user-friendly experience and has an easier registration process for members. Users are able to book a class instantly without membership commitment, and this shift towards a more retail model in the fitness industry in China focuses on customers’ freedom and breaks away from traditional fitness centers where annual cards are common.

Source: SUPERMONKEY WeChat, User interfaces of SUPERMONKEY WeChat mini program

SUPERMONKEY’s WeChat mini program is conveniently integrated with the brand’s WeChat official account. Any WeChat user is able to access the mini program within a few clicks without any registration process. It displays the available group classes that range from 69 RMB to 159 RMB.

The mini program serves the brand well for its automation and self-serve processes. It notifies gym-goers two hours in advance and a 6-digit access code to the gym is sent ten minutes prior to the class. Users scan a QR code provided by the trainer to sign in to the class.

WeChat in-app marketing is effective for capturing user interest post-workout

After a class is finished, SUPERMONKEY pushes mini program notifications to users and further engages with them, such as a feedback survey rating the class and the trainer, user ranking of time spent on exercising, and a link to class picture that easily allows users to share on WeChat moments. Thus, for brands, WeChat mini programs have an advantage over separate APPs as development costs and user downloads can be avoided and marketing activities can be conducted easily.

All within WeChat, the brand can push new coupons and classes to users. WeChat not only is a powerful tool in terms of fulfilling the gym’s automation processes, but it is easy for the brand to get their name out through word-of-mouth strategy, which constitutes 80% of their user origin.

A retail model to sell a fitness service

SUPERMONKEY’s studios have no front desk or admins, meaning it is completely self-served except for the courses led by trainers. Also with no lockerrooms, the brand is able to make use of its real estate on what really makes it profitable: classes.

Each SUPERMONKEY studio runs from 6AM to 11PM typically, and the average daily classes is around 10-12, with each lasting about an hour. Their group classes range from 20-50 people. According to the founder, the company uses different prices to distinguish user needs at different time periods.

SUPERMONKEY develops strong co-branding marketing to tackle young consumers

SUPERMONKEY x LELECHA

In August 2020, SUPERMONKEY and popular new-style tea brand LELECHA collaborated to promote new avocado beverages. Their marketing campaign adopts a fun and entertaining approach and offers an innovative way in tea consumption while staying fit as a lifestyle. It catches the attention of young consumers as the campaign combines two seemingly unrelated trendy brands and highlights the core values of each brand (read our top picks on China’s co-branding marketing campaigns).

SUPERMONKEY x Neiwai Active

Neiwai Active, a Chinese lingerie brand that values women empowerment and positive body image, co-launched an innovative underwear product with SUPERMONKEY in May 2020. The fitness brand’s marketing focuses on the product attributes, including high quality fabric and comfort, while the lingerie brand’s marketing primarily focuses on exercising. The appeal of this co-branding combines the market strength and brand awareness in order to bring benefits for both brands.

Source: Wechat, SUPERMONKEY’s recent co-branding marketing campaigns with LELECHA and NEIWAI ACTIVE

How SUPERMONKEY adapted to COVID-19

In the face of fitness competitors like the app Keep and to in response to the stay-at-home lifestyle, SUPERMONKEY offered an online 14-day training camp in February when their offline stores were shut down. It also took advantage of free live-streamed lessons on Weibo’s Yizhibo.

As a business reliant on offline store profit, SUPERMONKEY has been affected heavily by the pandemic. Its retail model has transformed the industry’s perception of the profit model of gyms, yet this model has seen many difficulties. These include how to expand the market to open more stores outside of tier 1-2 cities, how to maintain profitability, and how to prevent sacrificing high-quality coaches with quantity. As SUPERMONKEY is one of the pioneers of this retail model, its success remains to be tested by the market.

What brands can learn from SUPERMONKEY’s market strategy

More young people in China are willing to pay a premium for new experiences, which include shaping their bodies and obtaining better health. SUPERMONKEY as a “new-style” gym in China responds well to changing consumer demands and aims to be a brand that combines fitness and lifestyle. With their convenient store locations and a quick booking system, SUPERMONKEY’s retail model allows for high capacity of the flow of people. Such “new-style” gyms in China have deemed to be popular amongst consumers, but there are challenges to overcome with this new model and it is yet to be explored in China. However, one thing is clear: Chinese people are paying more attention to their health than ever before.

Learn the China branding strategies behind SUPERMONKEY and other brnds

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast