After the country joined the WTO, China’s furniture market blossomed, especially due to the booming real estate industry. China is one of the world’s top manufacturers, consumers, and exporters of furniture, but local players are not able yet to compete with renowned foreign brands.

Real estate and urbanization are some of the factors influencing the growth of the Chinese furniture industry

In 2020, COVID-19 negatively impacted both the global and China’s furniture market. However, the industry is expected to bounce back and continue to grow.

The world’s furniture market’s revenue is estimated to reach US$770 billion in 2023 and grow at an annual rate of 5.31% (CAGR 2023-2027). The United States is expected to generate the most revenue in the furniture market, taking over 32.84% of the share or US$252.9 billion in 2023. In the same year, living room furniture is predicted to hold the largest market volume with US$227.7 billion or 29.57% of the revenue.

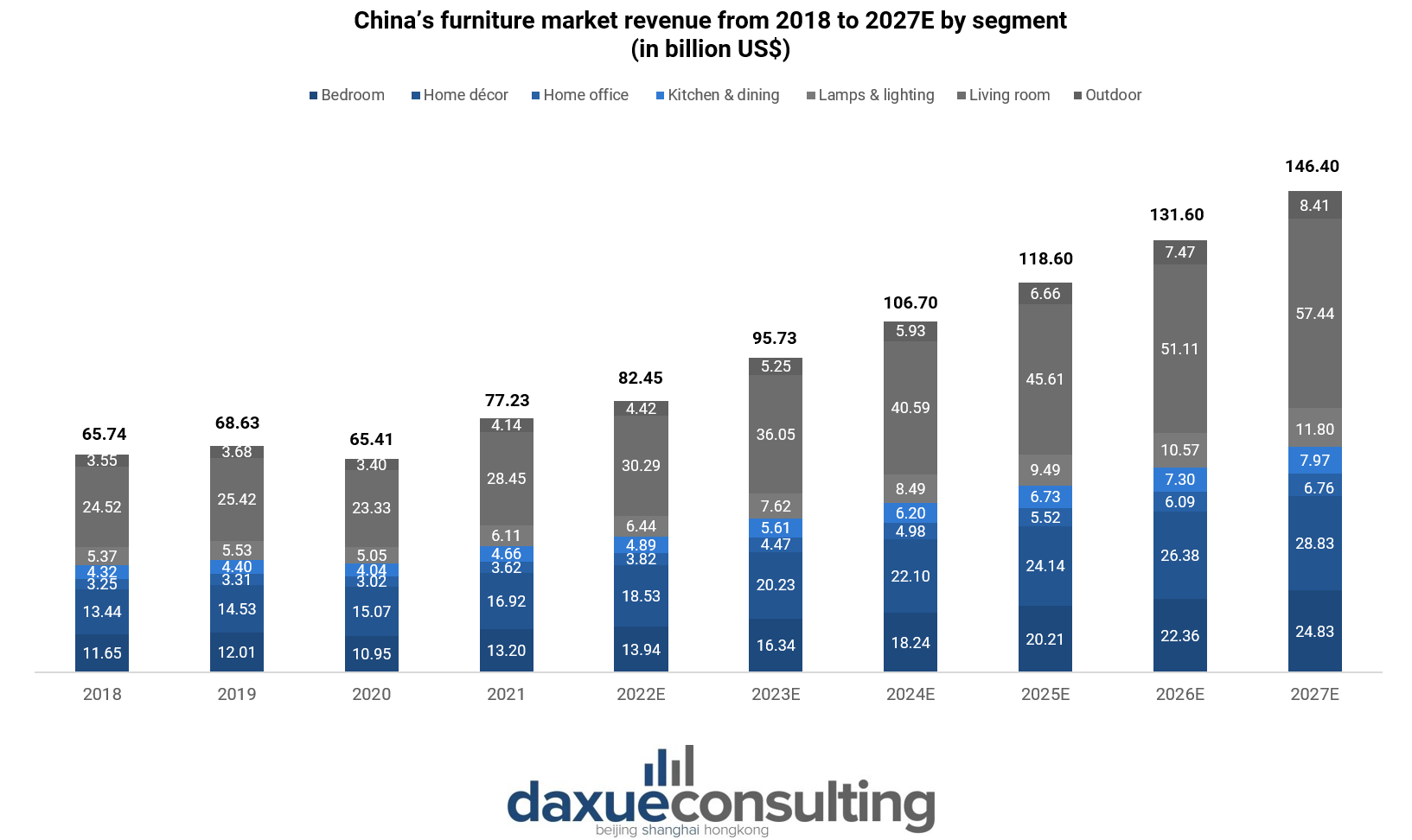

In 2023, China’s furniture industry is expected to generate around US$95.73 billion, or 12.43% of the global revenue, and grew at a CAGR of 11.20% to US$146.6 billion in 2027. Similar to the global market, the living room sector is responsible for the most revenue creation in the industry.

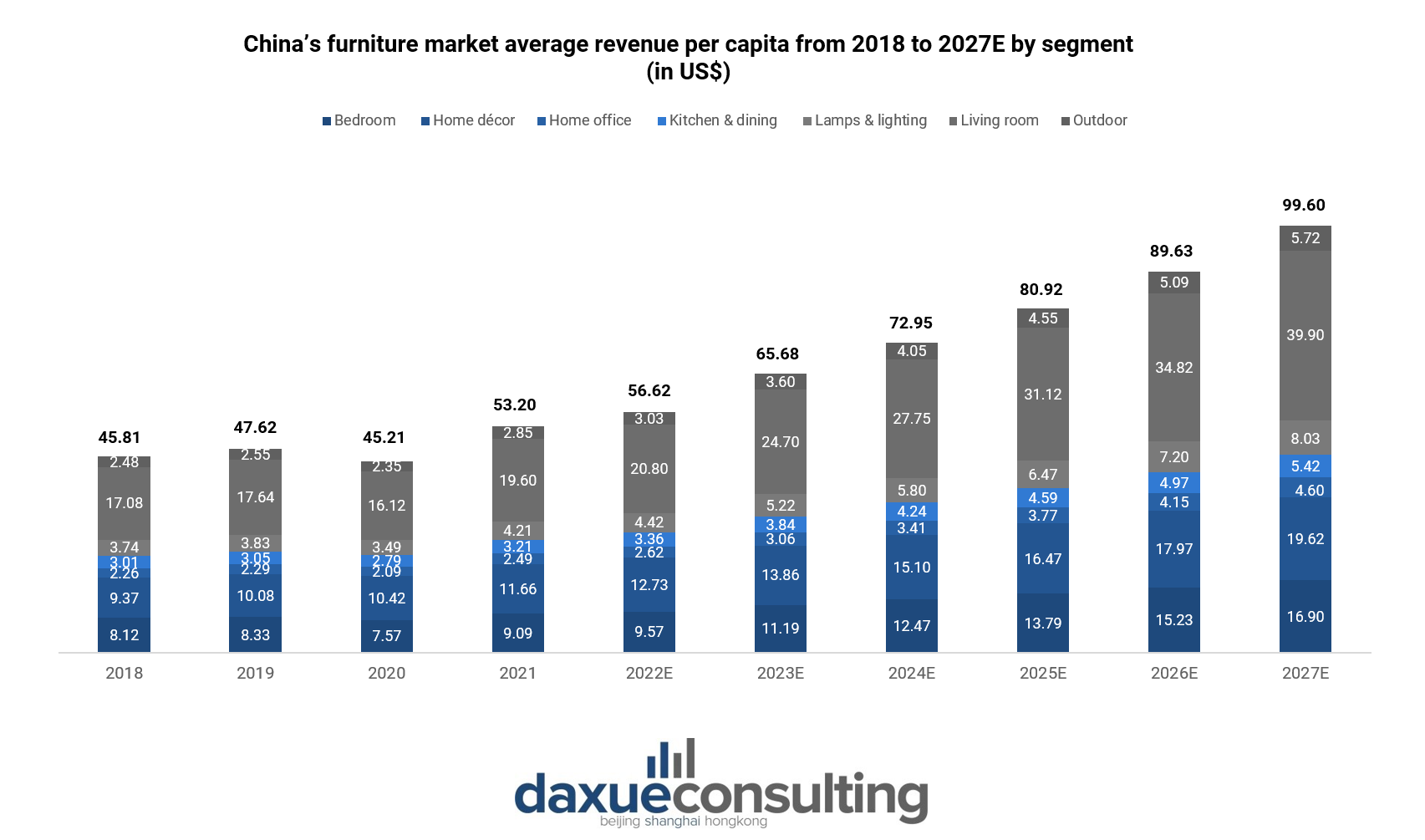

In 2023, the average revenue per capita of China’s furniture industry is estimated to be US$65.68. The living room segment will account for 43.62% of that average revenue per capita, amounting to US$24.7.

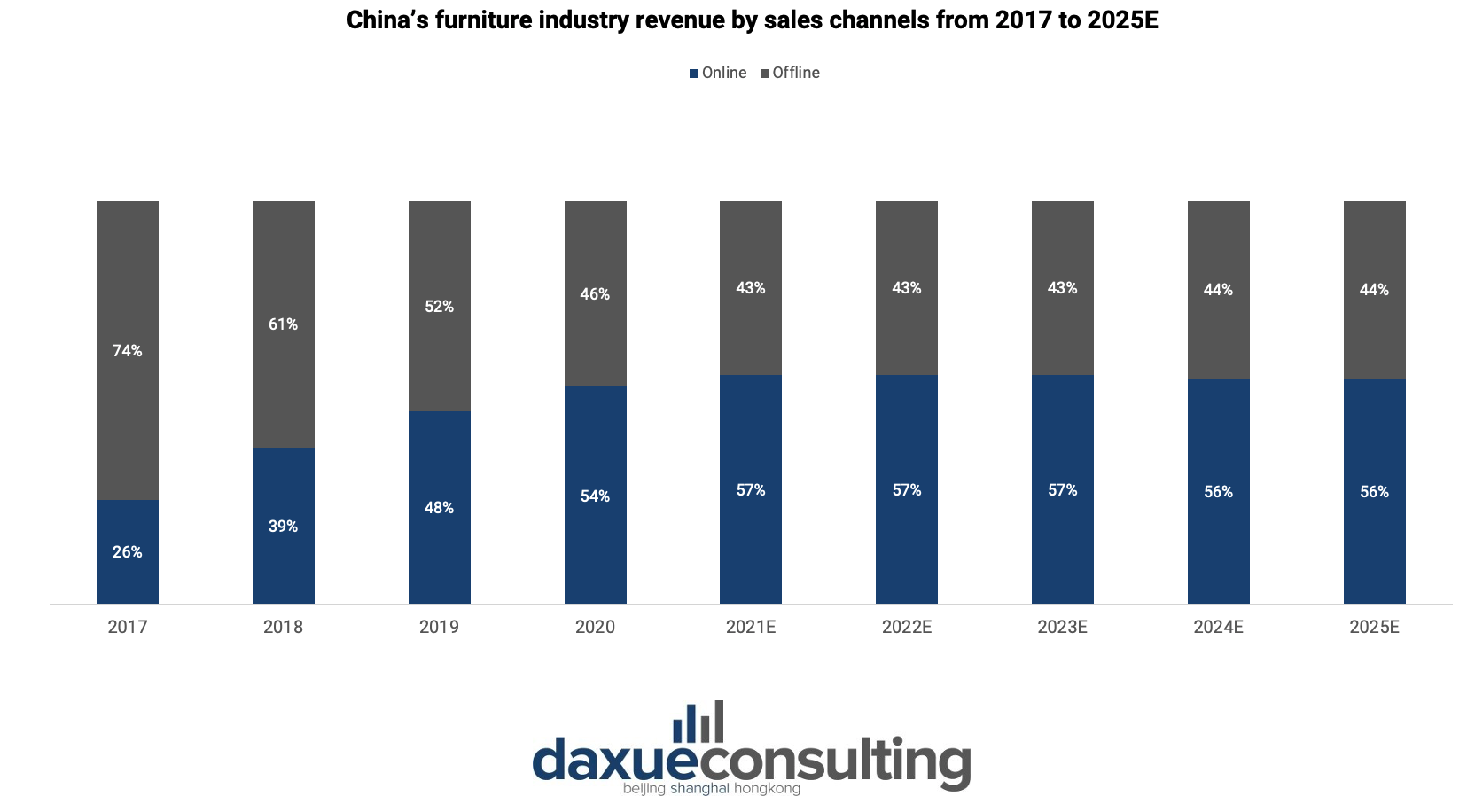

Before 2020, Chinese consumers used to prefer to purchase their furniture through offline stores. However, since 2020 such trend reversed. Offline purchases accounted for less than half of the whole generated, equaling to 46% of the revenue share while online sales took the other 54%. The sales of furniture through online channels in China are estimated to increase with a CAGR of 10.07% (2017-2025).

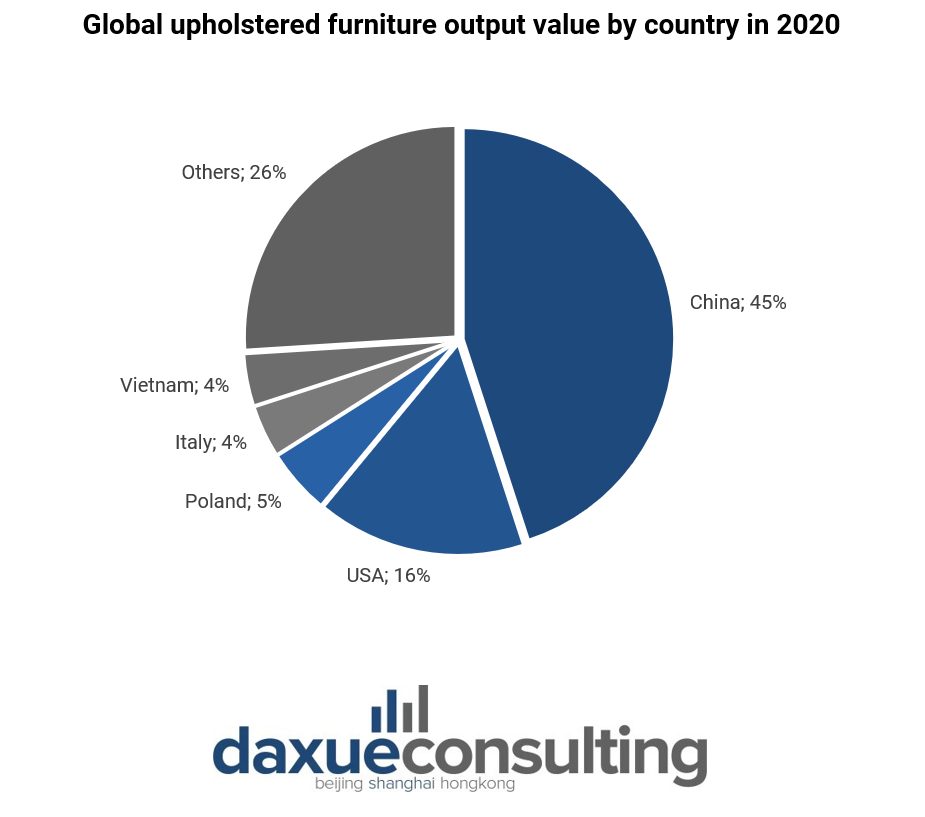

China is a net exporter of furniture

China is one of the largest furniture exporters in the world. In terms of market distribution of upholstered furniture, China is one of the largest manufacturers of upholstered furniture. In 2020, the country accounted for 45% of the global upholstered furniture output value.

Delving into the furniture trends in China

Prior to the 1990s, most furniture produced in China was built by hand one by one without large-scale retail equipment. They generally had a long production cycle, a constrained sales area, and low labor productivity. Most manufacturers were local, small businesses.

After the 1990s, finished furniture became increasingly popular and production was done on a large scale. Manufacturing efficiency increased, and there is also a multi-location production base layout and a wider transportation range. Large-scale businesses also started to appear. However, their personalized designs lacked strength and their intelligence levels were poor.

Customized furniture started to gain popularity after 2000. With the use of modern information technology and flexible production techniques, customized furniture is individualized furniture made specifically for customers. Currently, there is a notable trend of smart homes in China. Hence, there is also an increasing demand for smart furniture.

Classification of the furniture industry in China

According to the National Economic industry Classification and Code formulated by the National Bureau of Statistics, there are five sub-sectors under the furniture manufacturing industry: wooden, bamboo and rattan, metal, plastic, and others.

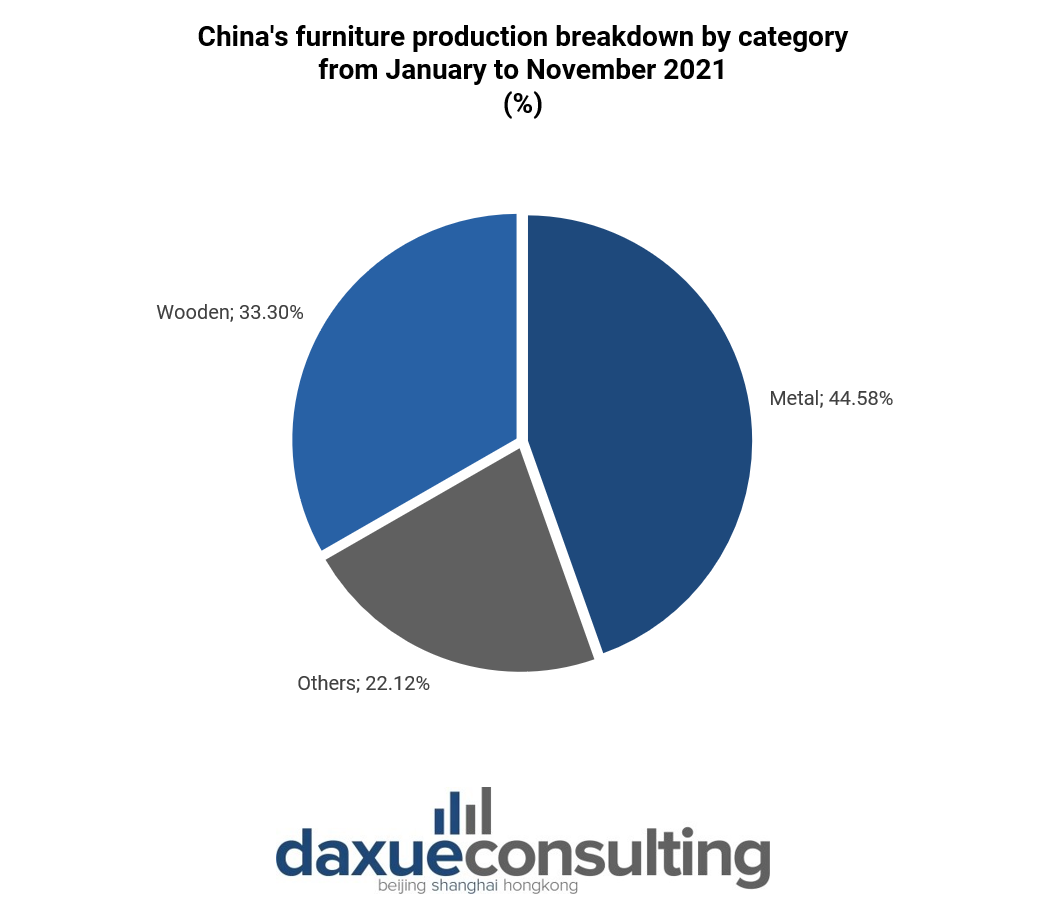

In China, metal and wooden furniture production seem to be the most popular sub-sectors. The two sectors’ production accounted for a significant share of the whole domestic furniture manufacturing between January and November 2021 with 77.88%

A closer look: Metal furniture industry in China

Metal furniture refers to furniture that has metal pipes, plates, or sticks as its main structure. According to its material, metal furniture can be categorized into ordinary steel, stainless steel, aluminum, and copper. Similarly, its coating can also be divided into five: painted, sprayed, electroplated, chrome-plated, and nickel-plated.

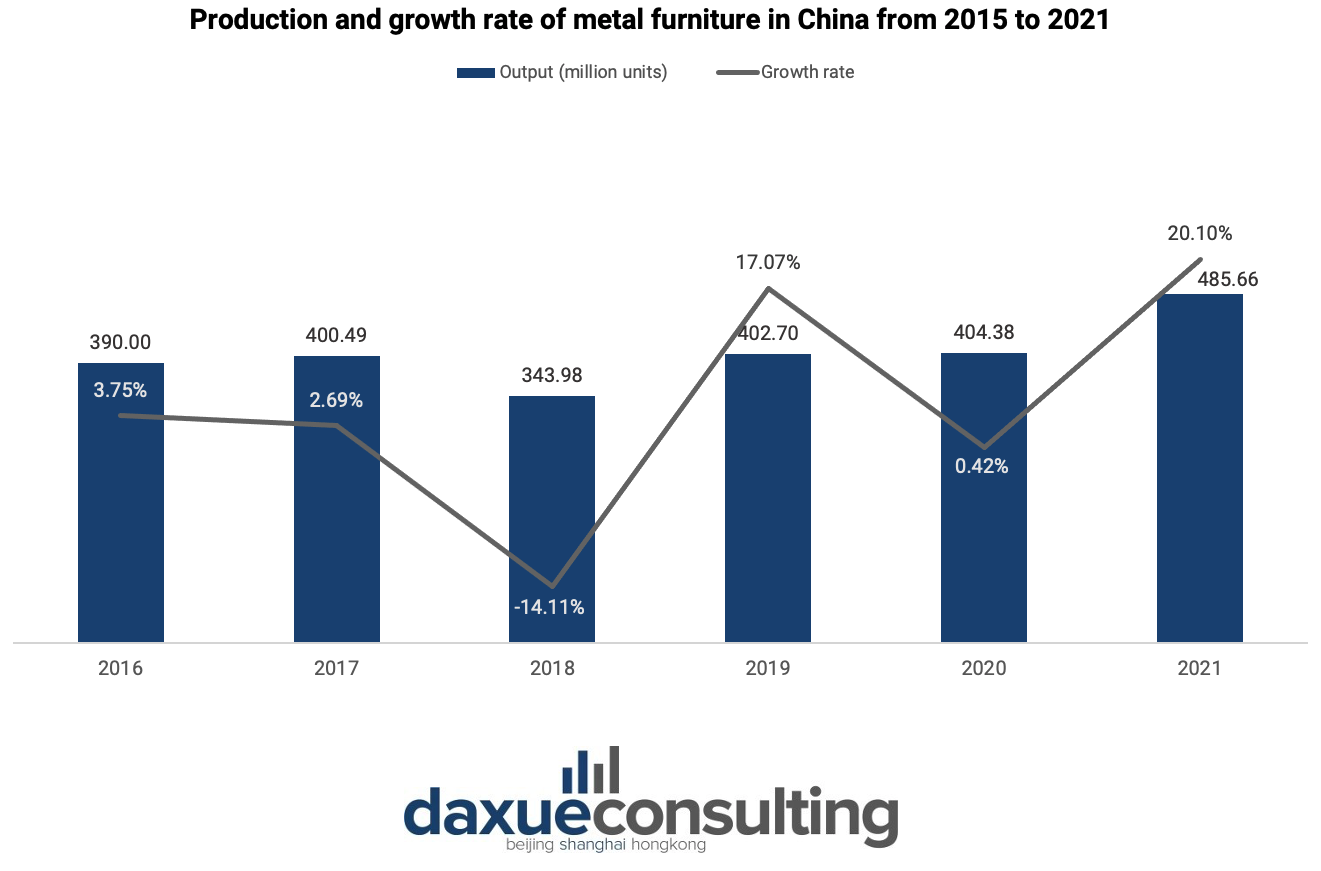

Consumers in China are becoming interested in healthy, aesthetic, and modern furniture products. The versatility of metal furniture to produce pieces that can satisfy the needs of different rooms in a house made metal furniture popular. Therefore, its production is expected to increase throughout the year. In 2021, the production of metal furniture in China had a year-on-year increase of 20.1%.

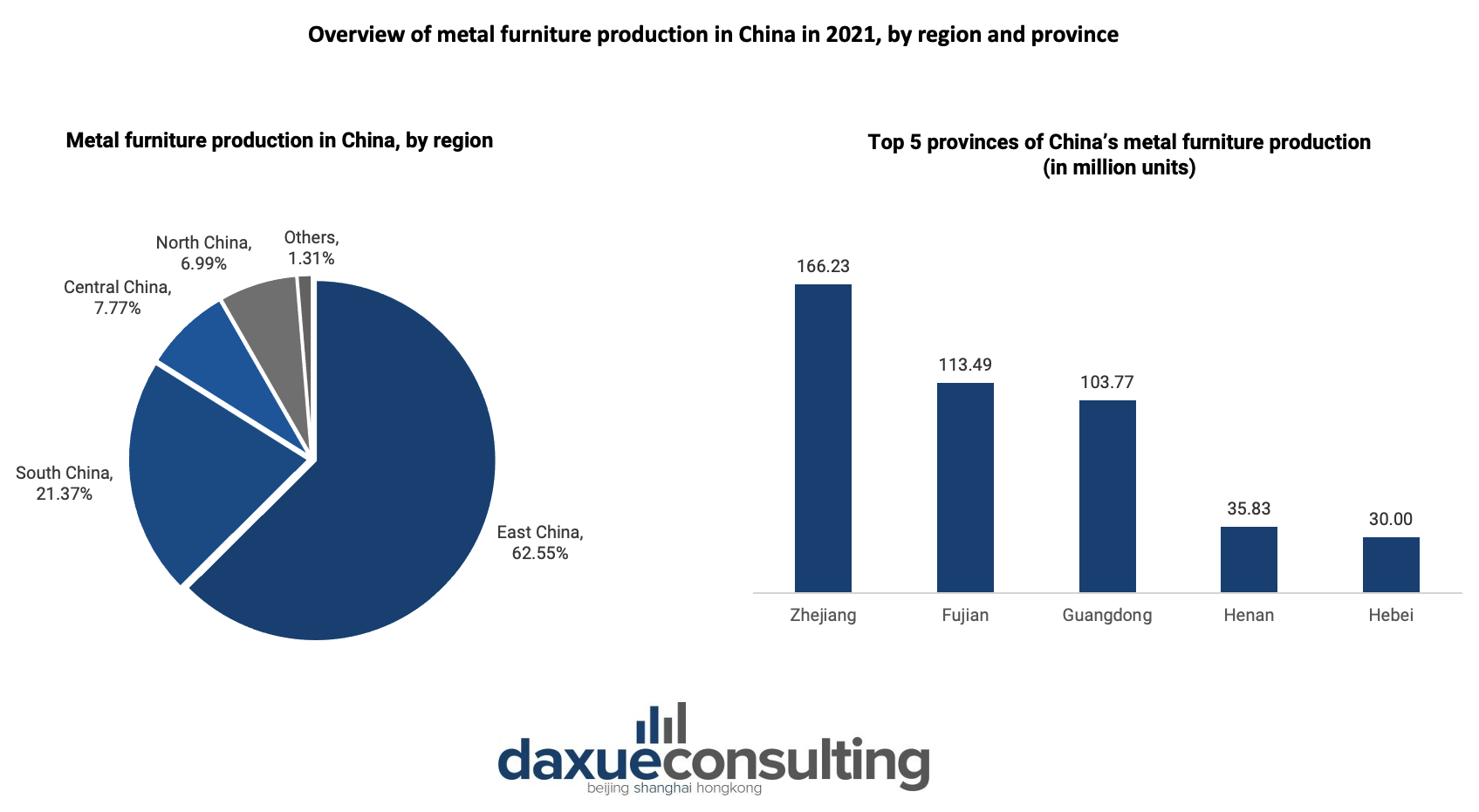

Metal furniture manufacturing is mainly concentrated in the East and South of China. In 2021, the two mentioned regions accounted for more than 80% of the total metal furniture production. Zhejiang, Fujian, and Guangdong were the top three metal furniture provinces that year.

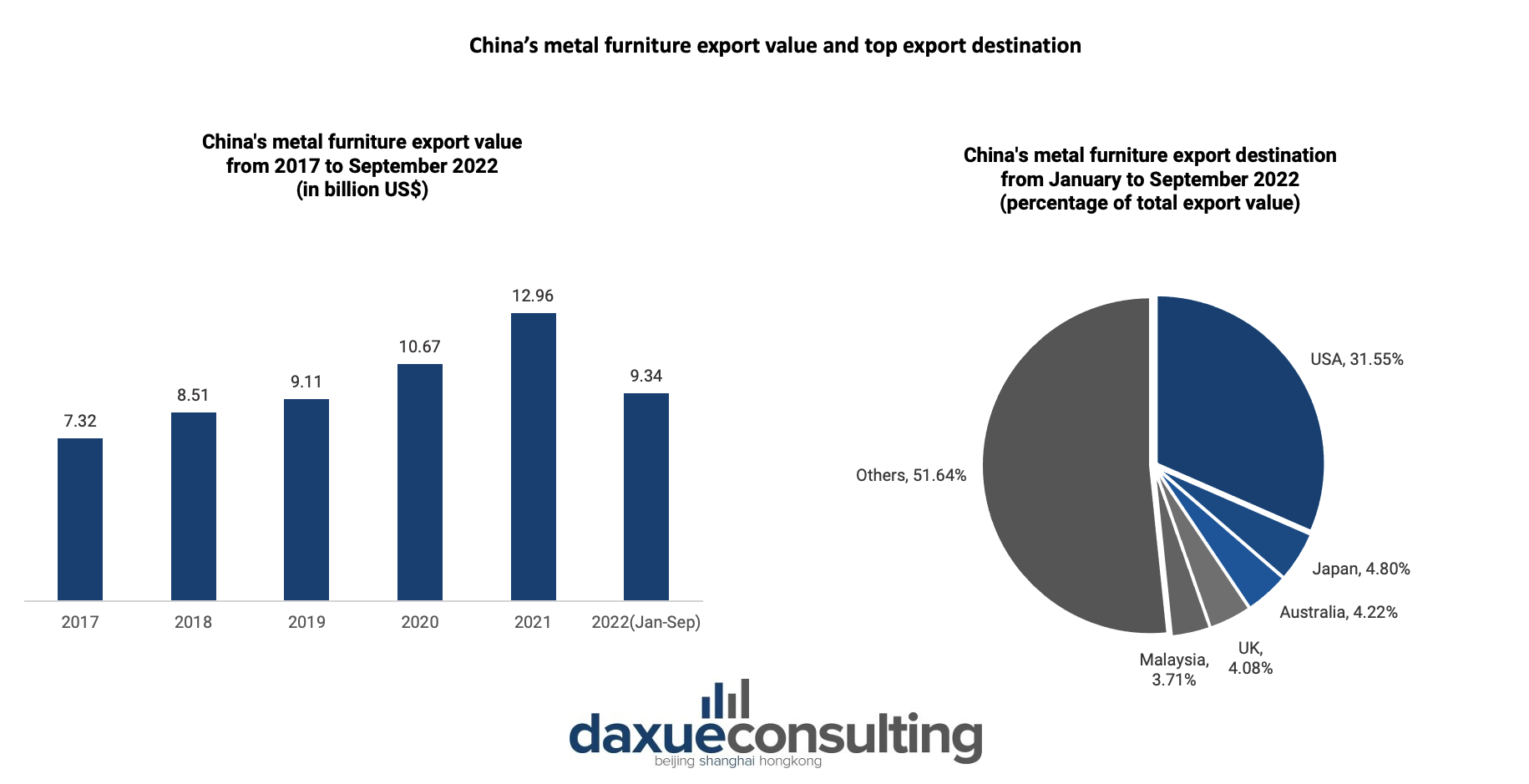

Most of the metal furniture produced in China is exported. With the continuous development of the country’s metal industry, the export value of China’s metal furniture is on a rise. The top three export destination countries for China’s metal furniture from January to September 2022 were the United States, Japan, and Australia.

Chinese furniture market’s players, industry chain, and business models

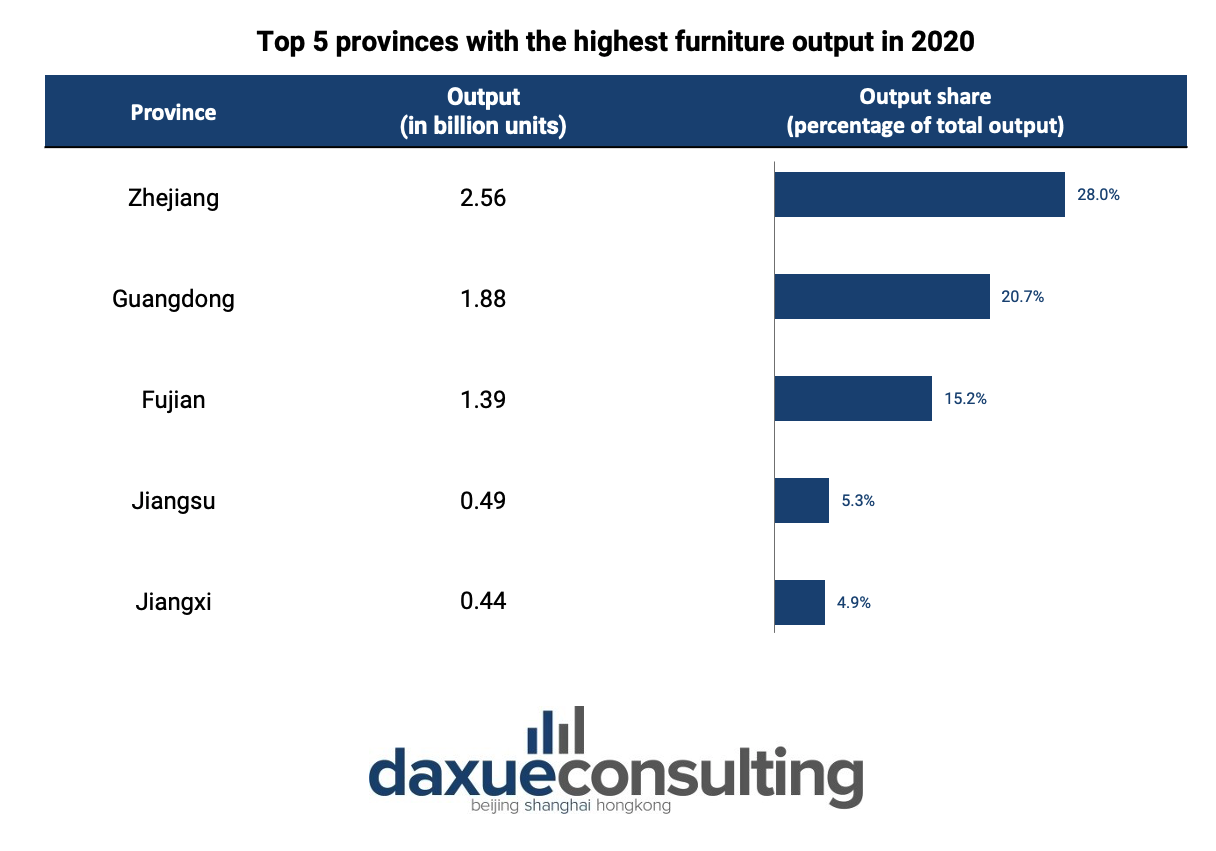

From the perspective of regional distribution, China’s furniture production is mainly concentrated in coastal provinces such as Zhejiang, Guangdong, Fujian, Jiangsu, and Jiangxi. These 5 provinces were responsible for 74.1% of the furniture output in 2020.

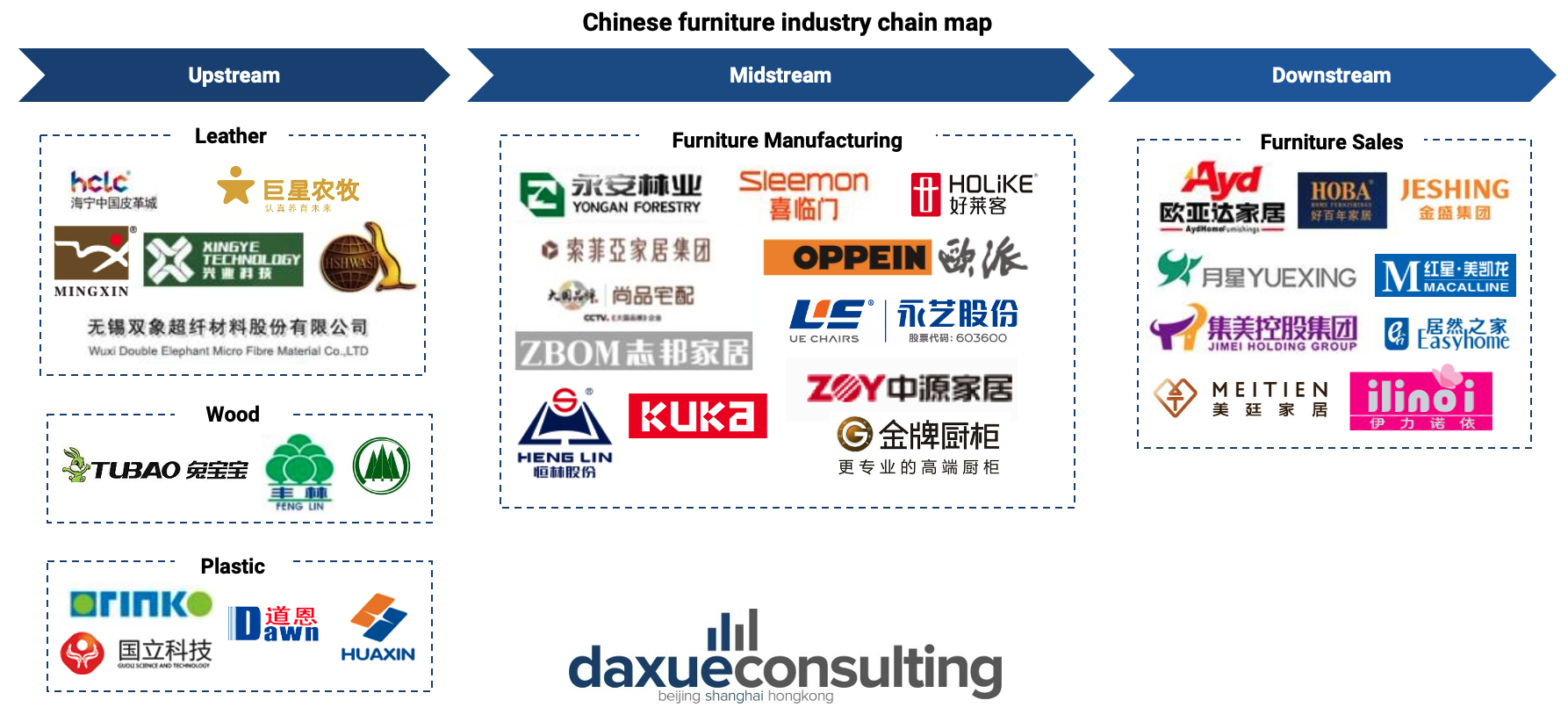

Chinese furniture industry chain

The upstream of China’s furniture industrial chain consists of raw materials supply links. The raw materials include wood, leather, metal, plastic, glass, sponge, and so on. The midstream companies are responsible for manufacturing all types of furniture. The downstream is the furniture sales link. The sales channels include supermarkets, department stores, furniture shopping malls, online retail, furniture specialty stores, etc.

At the present, China’s furniture market is relatively fragmented and the market share of leading brands is generally relatively low. The nation’s furniture manufacturing industry also has a relatively high degree of marketization and its profit margin is greatly influenced by the cost price of upstream raw materials.

In China, the majority of small businesses in this sector focus on producing low-end goods with small profit margins. Meanwhile, leading companies rely on comprehensive advantages such as R&D, design, brand channel, and scale. Therefore, they can benefit from a larger profit margin.

Business models of the furniture industry in China

Within the furniture manufacturing industry, there are mainly 3 business models adopted by the players:

Original Equipment Manufacturer (OEM)

Under this business model, brand owners provide the trademark and design for the OEM company. The manufacturer (the OEM) accepts the brand owner’s commission to produce the products. Therefore, a manufacturer adopting this model or an OEM factory has little influence over any aspect of the brand’s manufacturing process.

Original Design Manufacturer (ODM)

With the ODM model, the manufacturer participates in developing and manufacturing some parts or the whole product depending on the technical specifications of the brand owners. The main distinction between the ODM and OEM business models is that in the ODM model, the manufacturer has certain R&D and design capabilities as well as a certain authority, and can even offer a range of pre-formed products for brand owners to pick from.

Original Brand Manufacturer (OBM)

Businesses that use this model create their own brands, file their own trademark applications, and develop their markets. The enterprise conducts independent research and development, product design, manufacturing, and sales. Thus, the business has full independence and control, and decision-making authority over the financial gains generated by its own brand.

The first-mover advantage enjoyed by foreign brand owners in both brand and channel construction makes it more challenging for Chinese manufacturers to compete in the global market through the OBM model at the moment. Consequently, most domestic manufacturers engage in OEM and ODM partnerships with mature global brand owners.

Through time, leading businesses in the sector have developed specific R&D and design capabilities, as well as a solid reputation in the market. As a result, China will have the chance to establish a well-known local brand in the future as its businesses strengthen their capacity to understand consumer demand.

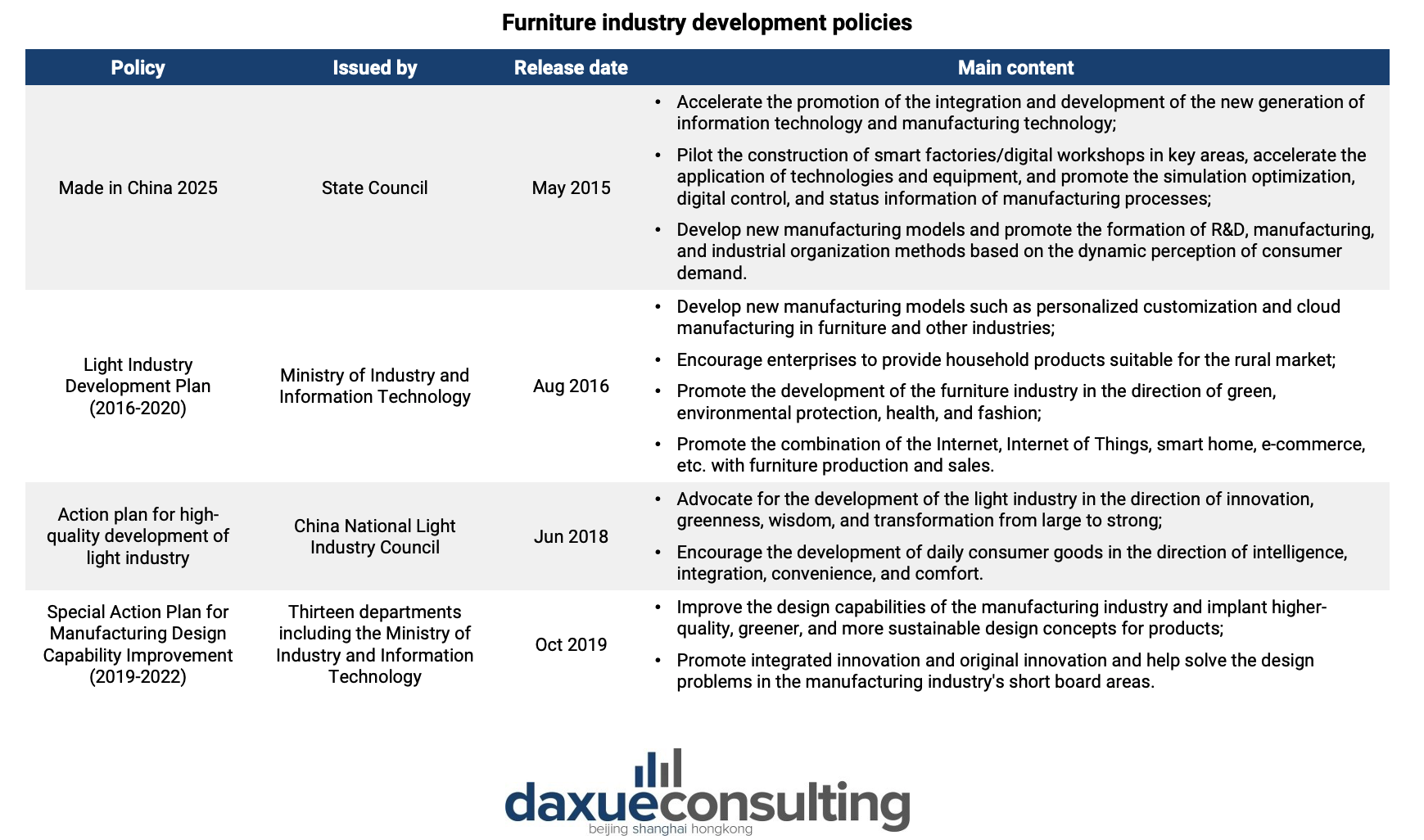

China’s furniture industry policy

Several government policies such as the Light Industry Development Plan for 2016 to 2020 encourage the manufacturing industry (including furniture manufacturing) to go greener and to incorporate technological advancements.

What to know about China’s furniture market:

- The pandemic had a negative impact on the furniture industry in China in 2020. However, the market bounced back and is expected to increase at a CAGR of 11.20% (2023-2027). The living room segment is anticipated to generate the largest revenue.

- Customized furniture became a trend in China during the early 2000s. With the increasing popularity of smart home appliances, there is also an increased demand for smart furniture.

- Regarding the material classification, metal and wood are the most produced type of furniture in China.

- The majority of furniture in China is produced in coastal provinces such as Zhejiang, Guangdong, and Fujian.

- As foreign brand benefits from first-mover advantage, local manufacturers face challenges in the ODM model. Instead, Chinese manufacturers engage in OEM and ODM partnerships with mature international brands.

Author: Regina Sukwanto