The wellness industry focuses on products and services that promote health, well-being, and overall quality of life. It encompasses fitness, nutrition, personal care, mental health, alternative medicine, spa treatments, and more. The wellness industry in China is propelled by the younger generation’s emphasis on Traditional Chinese Medicine (TCM), mental health, and aesthetic spa experiences. Furthermore, digital solutions targeting wellness improvement have seen a 19.4% increase in revenue in 2024 compared to the previous year, reflecting a growing enthusiasm for accessible and innovative means of self-care.

Driving forces of the wellness industry in China

In 2022, the wellness industry in China was worth USD 683 billion, USD 550.6 billion when excluding the fitness sector.

In the coming years, several key drivers are expected to participate in the growth of China’s wellness industry. First, there is a growing health consciousness among Chinese consumers following the COVID-19 pandemic. People are increasingly prioritizing their well-being, leading to a surge in demand for wellness products and services.

Secondly, the expanding middle class, coupled with rising disposable income, has increased spending on leisure activities, including those in the wellness sector.

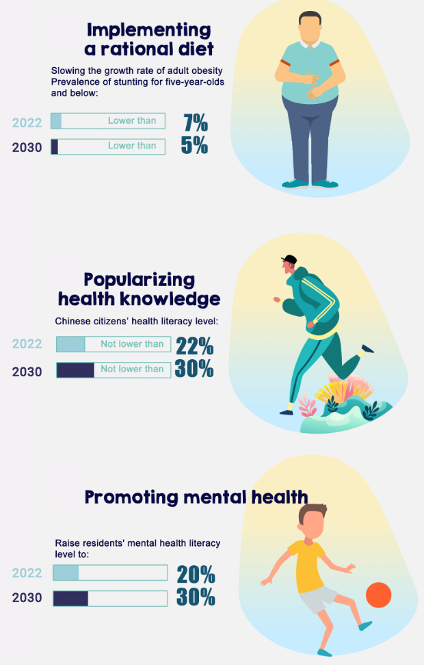

Finally, government initiatives, particularly the Healthy China 2030 agenda, have not only raised awareness but also incentivized individuals to adopt healthier lifestyles, contributing to the growth of the wellness market. The Healthy China 2030 initiative focuses on several key areas including diet, mental health, and popularizing health knowledge among the Chinese population.

Main demographic and perceptions of wellness in China

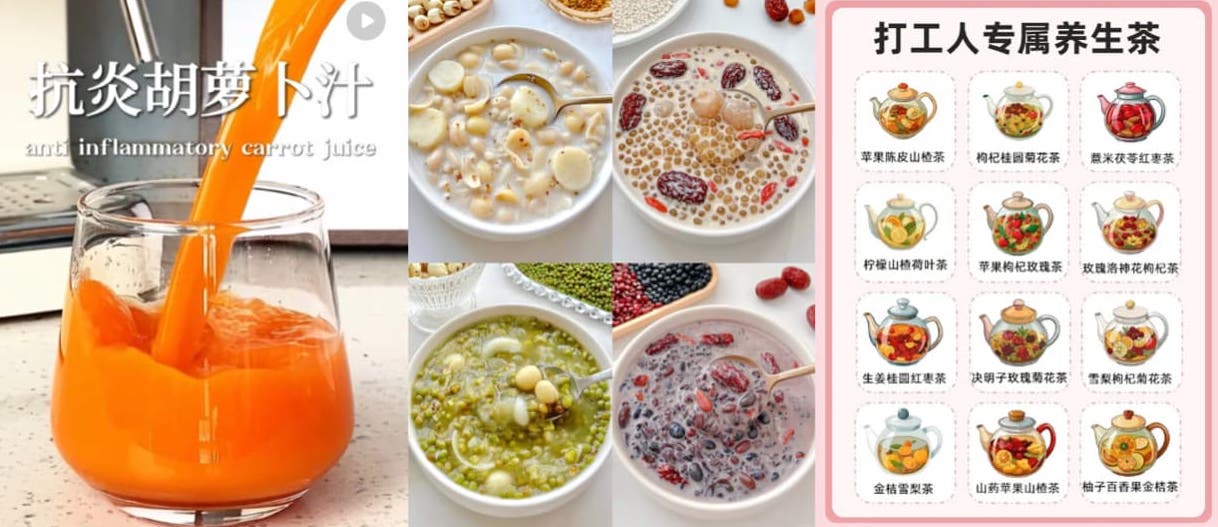

The main consumers in the wellness industry are the younger generation, comprising Millennials and Gen Zs. On Xiaohongshu, “健康养生” (healthy living) boasts 13.43 billion views, indicating widespread interest in health and wellness topics among young netizens. This group prioritizes faster and more convenient health options to fit into their busy schedules, such as health supplements and easy-to-make food with medicinal benefits.

Additionally, female consumers, residents of higher-tier cities, and white-collar professionals are key contributors to the wellness market. This demographic’s purchasing power and emphasis on well-being drive demand for a wide range of wellness offerings. Our survey conducted in 2023 (n = 1,000) revealed that high-income Millennial women residing in higher-tier cities are the primary drivers of the health supplement market in China. 51% of women reported eating supplements weekly, compared to 37% of men.

Traditional Chinese Medicine (TCM) for wellness

Young people turn toward TCM for wisdom

Traditional Chinese Medicine (TCM) plays a significant role in the wellness market. On Xiaohongshu, “中医养生” (TCM wellness) has 3.09 billion views, indicating young people’s interest in it. Interestingly, the focus is on overall lifestyle such as diet, sleep, and gentle exercise rather than acupuncture and other treatments.

Bridging ancient wisdom with modern apps

TCM’s popularity extends beyond social media, with various apps catering to TCM enthusiasts. These apps serve diverse purposes and reflect the growing demand for accessible and user-friendly platforms that promote TCM principles.

知源中医 (Wisdom of TCM) provides fundamental education about TCM with a built-in encyclopedia, videos, audiobooks, and articles. It offers users a comprehensive understanding of TCM concepts, including detailed information about different herbs shown in 3D.

中医经络穴位 (TCM Meridians and Acupoints) offers a 3D visualization of the body’s principal meridians and acupuncture points.

过日子 (Living Life) focuses on the relationship between food and health, providing insights into the benefits of various healthy foods, their suitability for specific health conditions, and preparation methods. It serves as a practical guide for incorporating TCM principles into daily dietary habits.

子午觉 (Meridian Nap) specifically targets insomnia, helping users identify the type and underlying causes of their sleep problems.

Mental wellness matters too

Transforming attitudes towards mental health in China

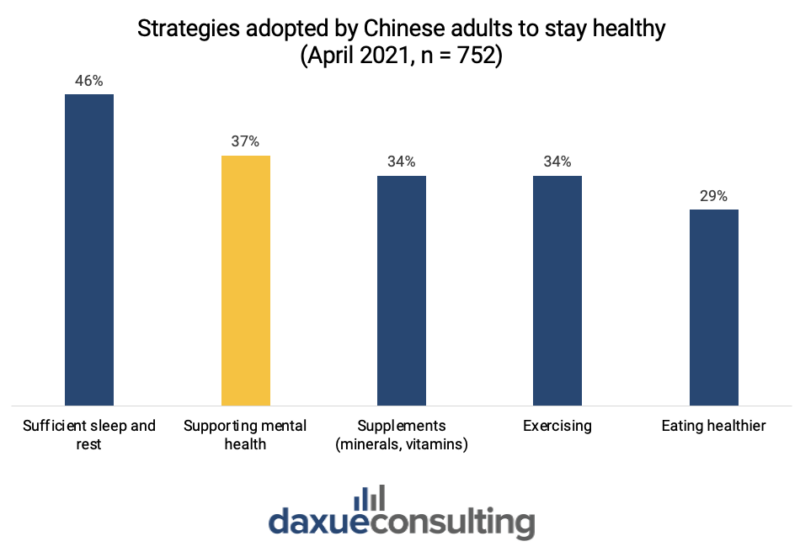

Mental health has gained significant traction in China, reflecting evolving attitudes toward holistic well-being. A survey conducted in March-April 2021 (n = 752) revealed that 37% of respondents prioritize taking steps to support their mental health as a crucial aspect of overall well-being.

Post-pandemic confidence in mental health digital solutions

After the pandemic, investors’ confidence in the mental health sector was strong, with investments reaching RMB 1.5 billion in 2021. For instance, ByteDance led a C-round financing of RMB 200 million for a digital mental health service platform. This underscores a growing recognition of the importance of mental well-being in China and the growing popularity of digital mental health solutions.

Common themes and modules embedded in Chinese mental health apps encompass love, marriage, parent-child dynamics, and emotion management. Topics like mental disorders in career development, interpersonal relationships, and personal growth are also increasingly prevalent. However, sleep-related issues are comparatively less talked about.

Exploring China’s USD 10 billion spa market

Elevating travel with China’s hotel spa offerings

In 2022, the Chinese spa market was valued at USD 10.29 billion, with a compound annual growth rate (CAGR) of 4.5% from 2017 to 2022. The hotel/resort spa segment emerged as the largest contributor, accounting for 53.1% of the market’s overall value. This highlights the importance of wellness amenities within hotels, alongside consumers’ strong inclination towards wellness-oriented travel experiences.

The increasing amount of international and local tourism in China is expected to contribute to the growing popularity of hotel/resort spas and the growth of China’s spa market.

Beyond relaxation: crafting aesthetic escapes in China’s spa scene

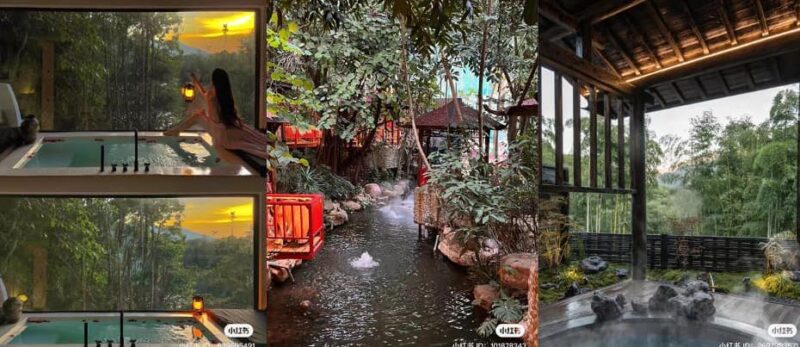

In the Chinese spa market, consumer preferences lean towards services that not only provide relaxation but are also aesthetically pleasing. Customers are drawn to spas that offer unique environments, either with outdoor pools in a natural setting or indoor facilities with Japanese-inspired aesthetics.

Online reviews on Dazhongdianping (大众点评) highlight key priorities for consumers when selecting a spa. Positive comments frequently mention the availability of various pools, the cleanliness of the amenities, and the possibility of ordering food.

Wellness industry in China: a path to holistic health

- The wellness industry in China was valued at USD 683 billion in 2022, driven by health consciousness, rising middle class, and government initiatives. Millennials and Gen Zs are the key consumers.

- Young people turn to Traditional Chinese Medicine (TCM) for wellness principles. TCM apps serve as educational and user-friendly tools to learn about TCM concepts.

- Mental health awareness is on the rise with more people prioritizing this aspect of their health. This is evidenced by increased post-pandemic investments in digital mental health solutions.

- The growth of China’s spa market is driven by the prominence of hotel/resort spas and the increasing number of travels post-pandemic. Consumers seek aesthetically pleasing experiences and amenities.