Yakult is often mistaken for a Chinese brand, but it is actually a Japanese brand with a history dating back to 1935. After 85 years of development, it has become a world-famous manufacturer of lactic acid bacteria beverages. The brand exports its products to more than 40 countries and regions around the world. According to the official website, its daily sales volume around the world is as high as 40 million bottles.

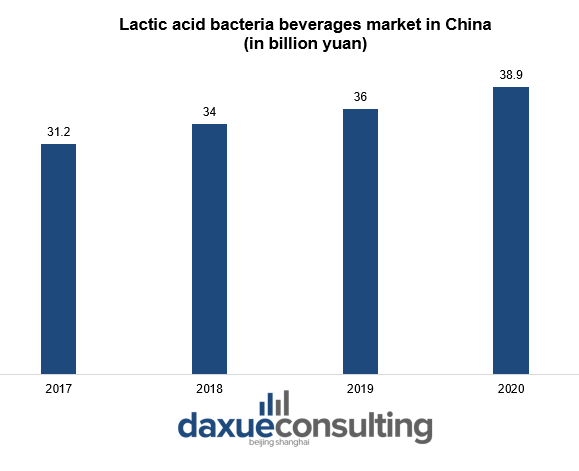

In 2020, China’s lactic acid bacteria beverage market reached 38.9 billion yuan, what proves that there are vast opportunities for Yakult in China to develop and expand its share.

Yakult: how it started

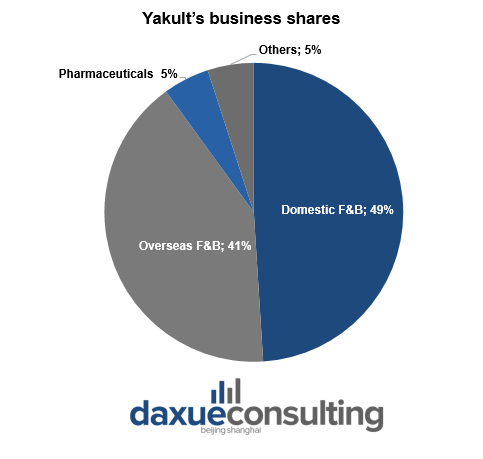

For a long time, Yakult has always adhered to the idea of the founder Minoru Daita, and aims to bring health to all mankind. Since the establishment of the first overseas office in Taiwan in 1964, the company’s sales network has spread around the world. Yakult has now become an international health food company with analytical testing, research and development, and social welfare activities. At present, the company’s business has four sectors: domestic food and beverages, overseas food and beverages, pharmaceuticals, and others (cosmetics, etc.), accounting for 49%, 41%, 5%, and 5%, respectively.

Yakult in China: spreading across main cities

In 2001, Yakult entered the Chinese mainland market and established a joint venture Guangzhou Yakult Dairy Co., Ltd. in the same year. In order to meet market needs and provide the freshest and high-quality products, Yakult Corporation established Yakult (China) Investment Co., Ltd. in Shanghai in 2005 to be responsible for the investment and management of dairy products, lactic acid bacteria beverages and related health foods in the Chinese market.

With the continuous expansion of Yakult’s business in China, it has established branches in Guangzhou, Shanghai, Beijing, and factories in Guangzhou, Shanghai and Tianjin.

Current situation of Yakult in China in numbers

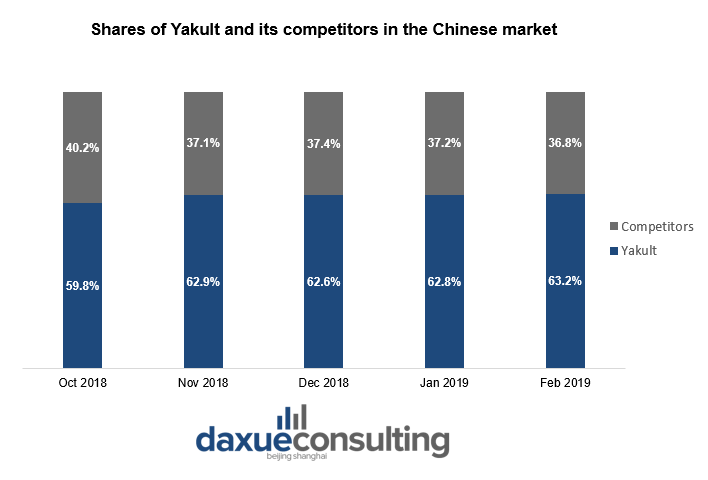

Thanks to the increasing production capacity and the gradual expansion of the market, Yakult currently covers about 730 million people in mainland China. In 2018, Yakult’s sales in China reached 2.7 billion bottles, and the average daily sales reached 7.5 million bottles. Same year, Yakult’s sales in China reached about 6.5 billion yuan. In terms of brand power index, the lactic acid bacteria beverage brand ranked first in the Chinese market in 2019 was Mengniu’s Youyi C, with Wahaha and Yakult ranked second and third. From October 2018 to March 2019, in the cold storage lactic acid bacteria beverage market in China, the market shares of Yakult were around 60%. So, Yakult is still a market leader in terms of shares, what proves its strong performance in China.

The success of Yakult in China: unique marketing method

Yakult has a unique marketing method such as “home delivery”. “Home delivery” is a service method originated from Japan’s Yakult. The delivery workers are called “Yakult mothers”. They are generally women with family difficulties and affinity. They are responsible for delivering high-quality products to everybody. At present, the Yakult mother team in Japan has about 50,000 people, and the number of people in the world has reached more than 80,000. In China, Yakult’s main sales channels are home delivery and retail. Among them, household distribution sales accounted for 10% of total sales, and sales from independent stores, hypermarkets, and supermarkets in China accounted for 35% and 50%, respectively.

Yakult’s main sales channels in mainland China are international chain stores and local large chain supermarkets, as well as some qualified small and medium-sized supermarkets. Among them, international chains and local large-scale chain stores have reached full coverage of basic goods, and some small and medium-sized supermarkets with sales conditions actively seek cooperation with Yakult, and the proportion of sales is increasing rapidly.

This distribution model started in Guangzhou in 2003, and has since stepped into developed cities such as Beijing, Shanghai, and Tianjin. This model can not only ensure that the product delivery is in a cold chain state throughout the entire process, it is in line with the consumer demand in home delivery that has been greatly stimulated after the pandemic, but it can also be used to make more consumer become regular customers.

Hurdles of Yakult in China

From the perspective of its market growth, although Yakult’s overall performance has maintained an upward trend, it seems that it has also encountered a bottleneck as the growth rate is not as good as before. The more important reason is that Yakult products need to implement cold chain management. By 2018, Yakult had sold 7.5 million bottles in China every day, and the year-on-year growth rate had dropped to 7.5%.

Pricing issues

Yakult’s pricing is rather special. When it first entered the domestic market, Yakult costed 11 yuan per row for five bottles, and did not adjust the price despite changes in the market environment. Only when the Yakult low-sugar products were launched, differentiated pricing was adopted to differentiate the original products.

Most milk beverage products on the Chinese market are engaged in activities during the New Year. Sometimes they are bundled to increase the price increase, sometimes the number of full bottles is reversed, and sometimes they are sold directly at a discount, which brings great uncertainty to the market. Yakult is different from other companies in its commodity price strategy. It has always adopted a nationally unified price, does not make any form of discounts, and has corresponding restrictions and penalties for dealers.

In the consumer environment, the visual appeal of products to consumers is driven by product design and attraction. The material used in Yakult’s packaging bottles is polystyrene resin, which is stronger and resistant to transportation issues, but the cost per piece is 0.3-0.5 yuan higher than that of similar dairy products. However, the Chinese consumers lack understanding of the reason for high prices: the brand does not clearly explain the quality and special design, and there is still a big gap between the TV advertisements in first-tier cities and second-third tier cities.

Lack of product supply

The Yakult product line lacks a multi-flavored experience and cannot meet the needs of many people. Even though Yakult has established a Shanghai factory and a Tianjin factory in mainland China, the increase in demand in inland cities in China, especially the pressure on sales to factories during peak seasons, is huge. The sales of various branches in the summer have almost always been out of stock. Even having to temporarily cancel the delivery service is undoubtedly fatal to the customer growth.

The main reason for the lack of product supply is the cautious sales strategy. The company did not expect the sales situation to be so good. At that time, Yakult only developed a few large cities in Beijing, Shanghai, Guangzhou and Shenzhen. Under the strong demands of major stores, Yakult has accelerated the development of the inland market, but the production plants have not increased production capacity accordingly.

Highly competitive market

At the same time, major companies have stepped in the prebiotic market, and market competition has become increasingly fierce. In addition to the old rival Weiquan, dairy companies including Yili, Mengniu, Guangming, and Junlebao have entered the field strongly. Therefore, although Yakult’s leading position in the industry seems to be stable, there are many hidden challenges.

Distribution costs

In some second-tier cities, local large-scale chain stores account for a very large share of sales. Since 2013, the increasing rebates and entry costs of these stores have greatly exceeded the acceptable range of Yakult in China, leading to the continuous increase of the latter’s marketing costs. Taking Wuhan as an example, its large supermarket chain system Zhongbai Convenience System has many activities. Taking advantage of its wide coverage, Yakult has to bear 10% of its activity costs. But in fact, whether it is high-price or low-price sales, it violates Yakult’s usual sales principles. In contrast, although small and medium-sized supermarkets have small sales volume, they have flexible distribution and basically settle payments in cash, reducing labor costs and the threat of accounts. In fact, all branches of Yakult are increasing their cooperation with small and medium-sized supermarkets.

Key takeaways about Yakult in China

- Yakult has strong position in China, thanks to its reputation as a healthy pre-biotic.

- Even though the sales of Yakult in China are impressive, the company seems to reach its bottleneck due to cold chain distribution issues and pricing system.

- Yakult also has to face with the growing pressure from competitors, it requires to have additional expenses on marketing.