While color cosmetics were negatively impacted after COVID-19, skincare in China remained resilient. Even new groups of consumers, such as teenagers who didn’t widely use skincare much in the past, are showing greater interest. In 2023, China’s skincare market was worth USD 55 billion, and it is expected to reach USD 59 billion in 2024.

New trends emerged after COVID-19 and remain relevant today

The pandemic had varying degrees of impact on different categories in the beauty market. While it had a negative impact on color cosmetics, it benefited skincare products. In August 2022, the most-sold beauty items were facial masks, skincare sets, serums, and lotions or creams. Products with “skin repair”, “basic skincare” and “first-aid care” functions saw increasing consumer interest, especially among younger shoppers. In particular, those born after 2005 boasted a strong demand for eye essence, eye cream, and face masks compared to other age groups. Even in 2024, consumers show increased interest in skincare products.

Download our report on Chinese beauty consumer pain points

One major reason for the growing skincare demand is that Chinese consumers care more about their skin appearance. They are also more likely to be aware of their minor skin reactions, often considering themselves to have “sensitive skin”. During the pandemic, people became more conscious of how their skin looks and the damages caused by wearing face masks. This continued even after China ended its zero-COVID-19 policy in 2023.

People are becoming more aware that air quality, stress, staying up late, and other lifestyle and environmental factors can affect their skin. According to our social listening analysis on pain points in China, many consumers discuss their struggles with skin issues influenced by environmental changes. Such environmental changes include seasonal changes, air conditioners, and air pollution.

Chinese consumers have become more rational

Consumers have become more rational when purchasing skincare products. Many more are concerned with health issues, and consequently, the quality of the products they acquire. In 2021, health and family safety became the top concerns for half of Chinese consumers, and 65% of consumers expressed a heightened focus on product safety. This resulted in more careful choosing of skincare products.

Additionally, marketers have coined the term “skintellectuals” (成分党), literally meaning “ingredients party” to refer to influencers and consumers who pay great attention to ingredients. This group is interested in the so-called ingredient-based skincare, selecting skincare products based on the specific chemical elements instead of the described effects of products.

There is unmet demand for “healthy” skincare products

With growing desire to live healthier lives, Chinese consumers are interested in products that as “healthier” for their skin. By “healthy”, they refer to products that include natural and organic ingredients like plants and herbs and have minimal additives. However, based on our social media analysis on pain points in China, consumers express their frustration in finding reliable, long-lasting, and non-irritating products. For example, many brands claim to be “healthy” based on having natural or organic ingredients, yet they still contain additives. Additionally, while these healthy products exist, some either have a short shelf life or are full of preservatives.

Emotional experience also matters

After the pandemic, many young consumers suffered from negative feelings and emotions and expressed on social media. “EMO”, referring to “negative emotions”, turned into a buzzword on social networks. Many skincare brands embraced this trend, offering “anti-EMO” product lines for customers. For example, Paula’s choice and Shiseido engaged in these campaigns. Indeed, skincare was seen as an effective instrument, with users searching for “emotional healing beauty and skincare videos” and using shopping as a way to deal with negative emotions.

While not necessarily negative, consumers demand emotional experiences from skincare products and brands. For instance, they seek products that provide therapeutic benefits like traditional Chinese medicine.

Groups becoming more important in skincare: men, teenagers, and moms

In China, groups that were typically associated with skincare consumers have shown more interest in skincare.

Men are becoming much more interested in skincare, inspired by numerous Korean and Chinese male celebrities. The term “little fresh meat” (小鮮肉) is used to define this group of men, often boasting white, glowing skin and soft face features. However, a broader audience is now getting used to men skincare, with male beauty bloggers accounting for more than 20% on the three major video platforms in China (Douyin, Kuaishou, and Bilibili). Meanwhile the search volume of men’s beauty-related keywords in Xiaohongshu increased significantly in the last few years, with the keyword “Men Facial Cleanser” increasing by 732% month-on-month in 2022.

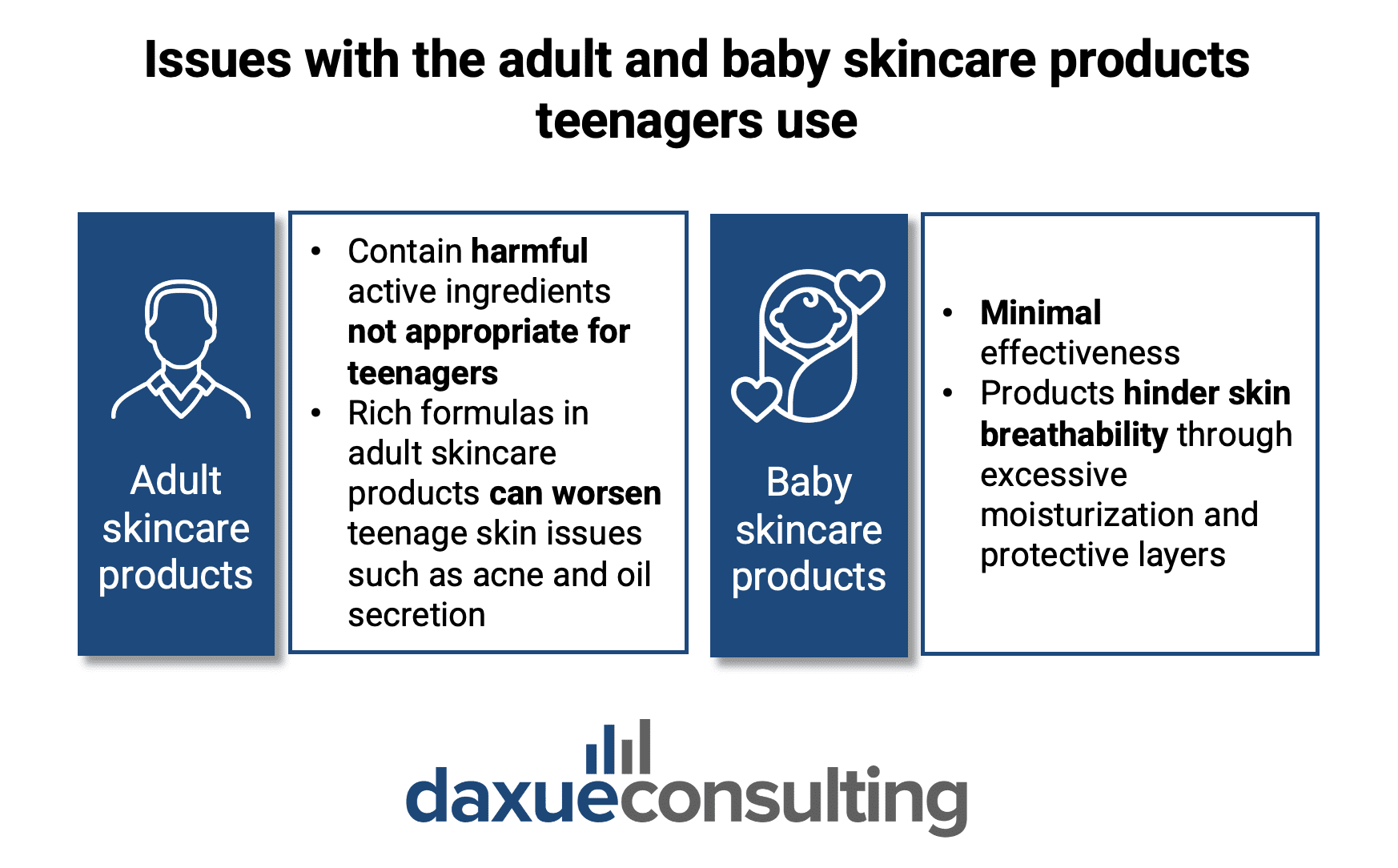

Teenagers in China are also showing greater interest in skincare products. However, many products in the market are not suitable or highly accessible. According to our social listening analysis on pain points in China, teenagers expressed that they can’t find products suitable to their skin. They use adult or baby skincare products, which are not adapted to their growing skin and end up worsening their skincare issues.

Additionally, in China’s aging population, there’s a need for products for mature skin, such as those for moms or pregnant women. Many of these women are in top-tier cities, have high spending power, and are willing to invest in themselves. They seek products that are high quality, safe, and effective.

The rise of local brands

Although top best-sold brands in the market remain predominantly foreign, Chinese brands are fighting their way through. The top four domestic companies already amount to 9% of the market share: Jala, Proya, Chicmax, Pechoin. With Guochao emerging, young consumers are buying seeking products that are of higher quality and have more cultural significance.

Apart from the market leaders, there are more niche and high-end brands in the sector. For example, Yina bases its products on the concept of “nourishing life” or “yang sheng” (养生) which embodies the spirit of traditional Chinese medicine. It was created by TCM practitioners and focuses on promoting wellness of the body and the mind. For example, their “Fortify” botanical serum is made with astragalus and peony, traditional Chinese ingredients.

Main trends in China’s skincare market

- The pandemic has boosted the skincare segment among the whole beauty market. People are showing continued interest in living a healthy lifestyle and keeping their skin healthy.

- Chinese consumers have become more rational when buying skincare products. They pay more attention to the quality and ingredients of the products. However, that doesn’t necessarily mean that emotional benefits are not valued – they are still important.

- The market is becoming more diversified, with many more male consumers, moms, and teenagers interested in skincare products.

- Although international brands are still dominating the sector, Chinese brands are attracting an increasing number of customers. The quality of these domestic brands is increasing, and they’re incorporating more Chinese elements into their products.

Download our white paper on China’s beauty industry