According to a report jointly released by Bain & Co. and the TMall Luxury Division, despite the COVID-19 pandemic, several luxury brands in China ended the year 2020 with a two- or three-digit growth rate. Considering these figures, nowadays Chinese consumers undoubtedly play a major role in the global luxury market and their importance is bound to increase exponentially in the years to come. Indeed, mainland China accounted for 20% of the world’s luxury industry last year and the report estimates that it will become the largest luxury market by 2025, thereby surpassing the regional share of the Americas and Europe. China’s luxury childrenswear market is a growing offshoot of the impressive luxury market.

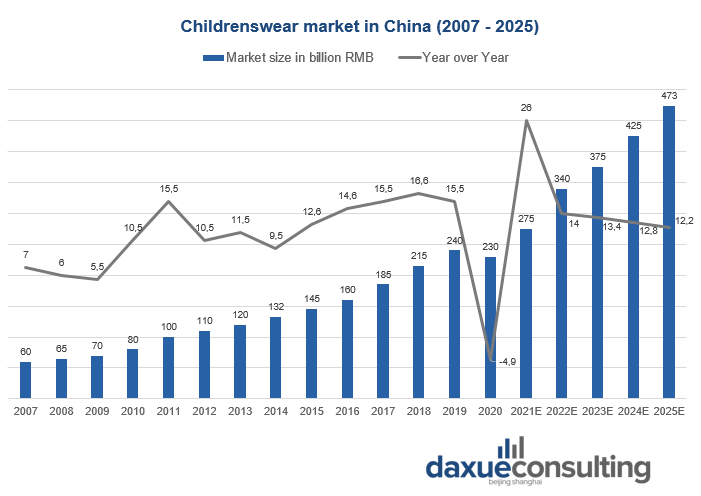

Baby apparel is emerging as an industry full of opportunities for fashion brands: the size of China’s children’s clothing market boasted a 21.34% rise in the last 5 years and it is going to generate more than 400 billion RMB by 2025, according to Euromonitor. Moreover, compared to other countries, such as the US, France, Germany, the UK and Japan, China’s childrenswear market concentration is still relatively low, providing fashion companies a big room for improving their position within the market.

Millennials living in Tier-1 and Tier-2 cities are the core consumers of high-end products in general and the same goes for luxury childrenswear in China. They mainly search for luxury goods on e-commerce platforms, paying special attention to fashionable and original children’s clothing.

Daigou agents play a major role in such quest for unique clothes. They work as a bridge between mainland China’s consumers and overseas high-end brands, allowing them to bypass PRC’s taxes on luxury goods and get their hands on the newest and most creative collections. Nevertheless, although they still have a significant impact on the luxury industry in China, several elements, such as travel restriction resulting from the current pandemic, the promulgation of the E-commerce Law and the easing of import regulations, are hindering their activities.

Chinese kidfluencers and the success of Mini Me fashion

As digital friendly Chinese Millennials settle down and start families, children spotlight on social media and sometimes they become little celebrities with thousands -or even millions- of followers and countless views to their content every day, some of them bringing big checks to their families. That’s the case of Bigqqbaby, a 4-year-old toddler with a Douyin account vaunting 12 million fans, whose funny videos are watched by hundreds of thousands of people. His account is linked to a small shop where viewers can purchase the pieces of clothing the little boy wears in the videos. Amy Baby, a little girl from Tianjin, has her own online store as well. Even if she doesn’t boast the same amount of followers as Bigqqbaby, the cute short videos she shoots with her elder brother have thousands of viewers and innumerable interactions.

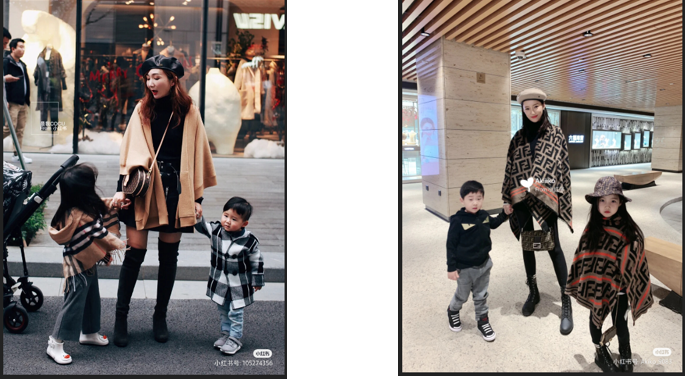

Especially significant is the success of the Mini me culture in China. Chinese Tier-1 and Tier-2 Millennial and Gen Z mothers love seeing their daughters look like them. This trend is especially evident on Chinese social media platforms. For instance, Weibo teems with mother-child influencers and bloggers, such as @佟方妤 (2.2 million of followers) and @苏格Zoe (1.4 million of fans). The former runs a vlog that goes beyond fashion and deals with a wide range of different topics, whereas the latter is much more focused on children’s and women’s apparel.

This phenomenon involves high-end clothing as well. Hundreds of people devour the pictures showing @是我COCU and her children wearing matching luxury clothes on Xiaohongshu and the same goes for @Akiiiko, whose most successful post (14 thousand likes) exhibits her daughter dressed up with the Mini me version of her elgant Fendi outfit.

Luxury brands’ strategy: Burberry and Dior

Such fever for luxury childrenswear in China did not catch fashion companies unprepared. For example, Cartier and Hermès decided to include baby accessories in the gift section of their Chinese official webpage, while many others opted for having children’s clothing independent categories on their sites and the bravest ones, like Gucci and Versace, even added a page completely dedicated to Mini me outfits. However, unlike activewear brands, such as Fila and Anta, none of the most famous luxury names opened social media accounts completely focused on children’s apparel.

One of the most interesting pioneers in luxury childrenswear is Burberry. It was one of the first high-end brands to launch a baby clothing’s line and rapidly became one of the biggest players in the market. According to its 2020/2021 report, Burberry Kids yielded 127.2 million pounds and it is going to record a 14% growth this year, jumping to 144.8 million pounds of revenues. Considering these figures, it is not surprising that the famous British brand not only offers a large luxury childrenswear collection on its Chinese website, but it also provides users with a baby apparel filter on its WeChat Miniprogram and on its TMall and JD official stores.

Dior focused many efforts on promoting its children’s line in China as well. Like Burberry, Dior has dedicated a section of its Chinese website and WeChat Miniprogram to children’s apparel. Moreover, in 2018 Dior collaborated with little celebrites such as Du Yuqi and Cui Yahan, known to the wider public for their participation in the reality show “Where are you going, dad?”, to promote its Fall Winter collection. Instead, this year it has been the time of two 10-year-old actors, Lester Lin and Pei Jiaxin, to star as Baby Dior’s Spring Summer spokespersons: the pics shared by the famous luxury brand on its official Weibo account have been reposted more than one thousand times each and received hundreds of positive reactions and comments.

5 useful takeaways from China’s luxury childrenswear market

- The children’s apparel industry is thriving and it is estimated to yield more than 400 billion RMB by 2025, thus it is going to be a highly profitable business for luxury brands.

- When buying clothes for their little emperors, Chinese consumers opt for the most fashionable and original apparel.

- Chinese social media teems with baby influencers and mother-daughter blogs. Regarding the world of luxury, the most significant phenomenon online is the one related to the Mini-me fashion, consisting of children (usually daughters) wearing the miniaturized version of their parents’ outfit.

- Fashion brands have tried to meet their consumers’ need for luxury childrenswear in China, making it easier the search for such kind of products on their Chinese official webpages and creating Mini me lines.

Burberry and Dior allocated a lot of time and resources in promoting their children’s lines. The former has widened its offer on the official website and added a children’s clothing filter in all its online stores, while Dior has repeatedly collaborated with several baby influencers and celebrities for its campaigns, getting great success on Weibo.