In 2014, despite making up 20% of the world’s population, Chinese consumers accounted for only 1% of global fragrance value sales. This striking disparity is shaped by their relative unfamiliarity with perfume and its politically charged past. Indeed, in recent history, fragrance was seen as a symbol of elitism and was even prohibited during the Cultural Revolution. Many Chinese consumers preferred a “no-scent” approach, considering strong or artificial fragrances potentially intrusive or even disrespectful in shared spaces.

Read our white paper on China’s beauty industry

Yet China once had a rich history of scent. Any account of the Imperial Court reveals the integral role of fragrant oils, sandalwood, blossoms, and spices, some brought from the ancient Silk Road. Empress Cixi, the infamous “Dragon Empress”, was known for her love of scented products. Today, as fragrance slowly reclaims its place in domestic culture, Chinese perfume brands are beginning to reinterpret scent through a distinctly Chinese lens, drawing from traditional aesthetics and olfactory heritage. As perfume gradually gains popularity, especially among younger urban consumers, there is a clear preference for soft, natural, and clean scents that reflect restraint and harmony, values deeply embedded in Chinese aesthetics.

How Chinese perfume brands tap into cultural heritage to claim a foreign brand dominated market

Historically, the fragrance and perfume market in China was dominated by foreign luxury houses such as Chanel, Dior, and Jo Malone. These brands benefited from their long-standing prestige and the aspirational value associated with Western luxury. For many Chinese consumers, wearing these international fragrances was a symbol of sophistication and status. The dominance of imported brands shaped the market and delayed the emergence of local innovation for years.

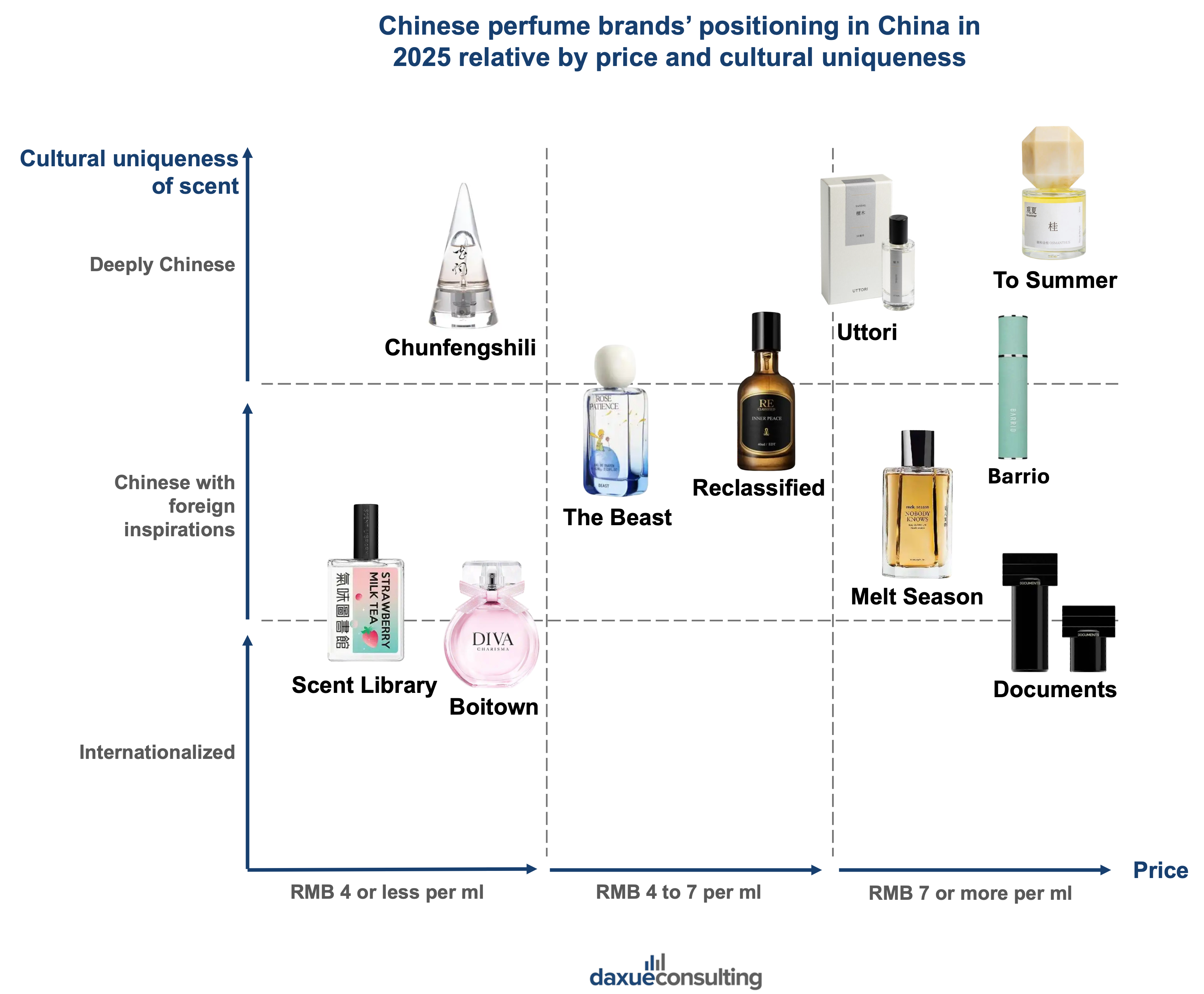

Premium segments are leveraging Chinese identity and heritage, leaving imitation behind

In recent years, a significant transition has taken place. Chinese luxury brands are moving from imitating Western luxury to building a distinctly local identity. Top-tier brands like To Summer (观夏), Uttori (五朵里), and Barrio (巴莉奥) embrace strong cultural uniqueness, following the Guochao (国潮) trend. These brands use Chinese symbols and storytelling as core brand assets. To Summer, for example, incorporates ingredients like osmanthus, lotus and bamboo, and offers an immersive flagship experience that blurs art and retail. Uttori and Barrio similarly build on minimalism and nature to project refined, culturally grounded luxury. Their strategy targets affluent, culturally confident consumers looking for sophistication with a Chinese soul.

New affordable brands follow the same trend, as the mass market’s interest in Chinese culture is rising

At the same time, culturally inspired affordable brands are rising. Chunfengshili (春风十里), positioned as both deeply Chinese and low in price, adopts a poetic and artistic approach. Fragrance names reference ancient poetry, and marketing mimics classical literati culture. Scent Library (气味图书馆), while more international in tone with scents not specific to China—like marshmallow, blueberries, and even cannabis—taps into everything. The brand also uses nostalgic cues like White Rabbit candy to connect emotionally with younger consumers. Their lower price points make them collectible and social-media friendly, fueling online buzz and experimentation. These brands democratize Chinese identity in perfumery, making it accessible while still emotionally rich.

Chinese perfume brands marketing strategies

To Summer: Shopping as an immersive experience

To Summer’s flagship store in Shanghai redefines the perfume retail experience. More than just a boutique, the space feels like a scent museum, with carefully curated interiors and an art gallery on the second floor. The brand offers perfumes, diffusers, candles, and hand creams, inviting visitors to spend up to an hour exploring and testing the collection at their own pace. Products often sell out quickly, adding an aura of exclusivity.

Flagship stores in China are powerful branding tools, acting as experiential destinations rather than transactional spaces. To Summer’s store has become a “must-visit” location in Shanghai, not only for perfume lovers but also for cultural consumers seeking aesthetic and sensory experiences. In a market where social media and word-of-mouth are crucial, creating such immersive spaces allows brands to become part of lifestyle narratives.

Scent Library: Nostalgia and diversity to create online hype

Scent Library taps into collective memory and online buzz through a mix of nostalgia and sensory experimentation. Its famous White Rabbit candy perfume revives a beloved childhood treat, sparking emotional connections with Chinese consumers. The brand continues to release playful, candy-inspired fragrances that resonate with younger audiences.

Beyond nostalgia, Scent Library’s appeal lies in its wide range of unconventional scents and low prices. This encourages customers to buy, compare, and share their opinions online. The result is a self-sustaining “hype loop”, where social media users generate buzz through scent reviews, favorites, and collection posts, making the brand a mainstay in fragrance discussions on platforms like Xiaohongshu and Douyin.

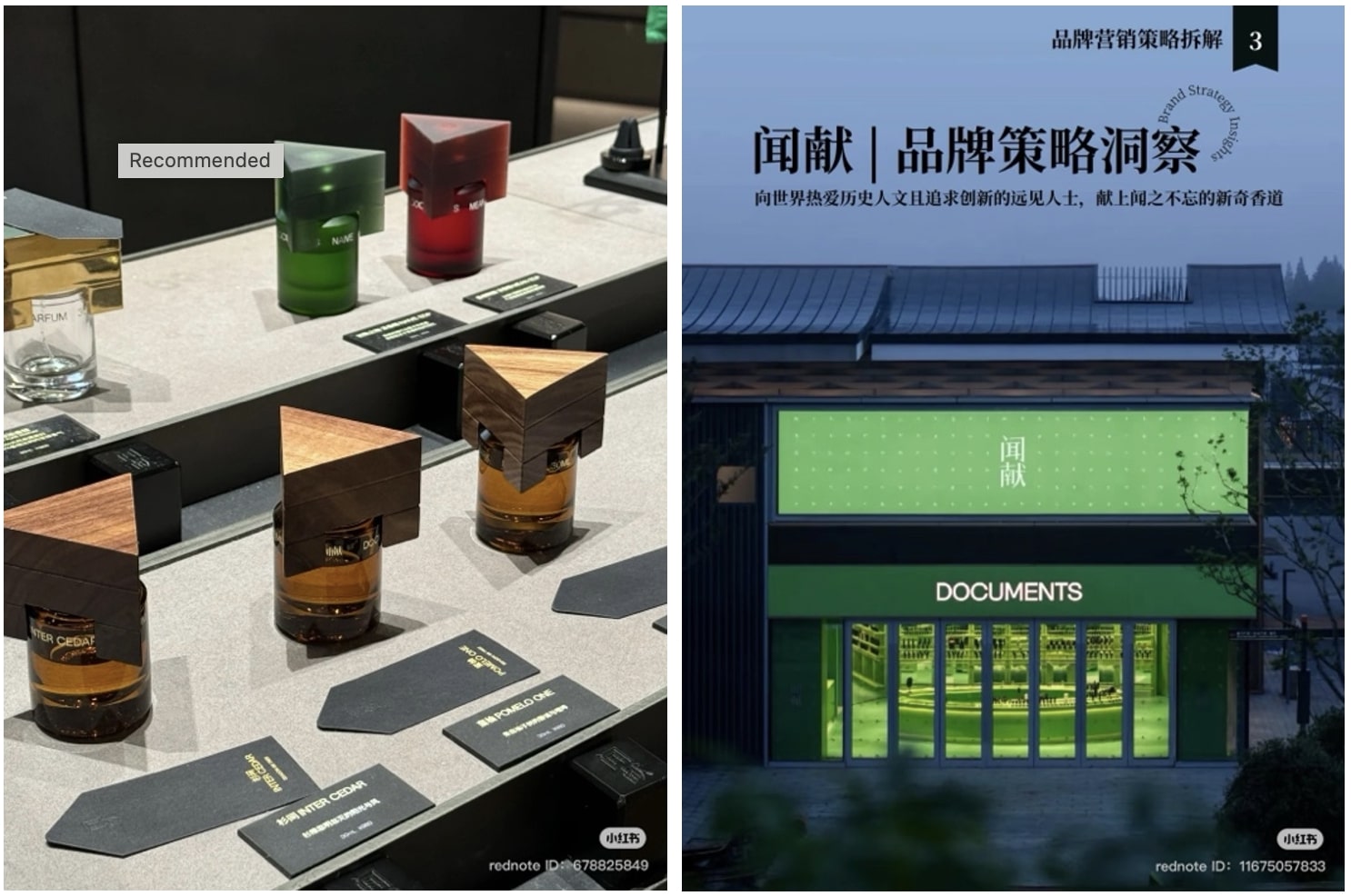

Documents targets young generation seeking a “niche identity”

Documents (闻献) stands out for its “anti-mainstream” marketing and commitment to cultivating a niche, “Zen and cool” identity. The brand avoids typical e-commerce channels and livestream sales, focusing instead on offline “ritual spaces” like its Night Temple concept store on Huaihai Road, Shanghai. Indeed, more than half of all perfume products are being sold outside of e-commerce platforms. These all-black minimalist environments are designed to evoke spiritual calm and exclusivity.

This aligns perfectly with the preferences of China’s Gen Z consumers, who seek individuality and differentiation in their brand choices. By merging immersive physical experiences with symbolic storytelling, DOCUMENTS builds a loyal, culturally curious fanbase and encourages organic user-generated content online. The brand recently gained traction after L’Oréal took a minority stake in the brand, investing more than USD 1.4 billion.

Melt Season is building its brand’s identity through collaboration

Melt Season’s perfumes aim for a natural, wild-life and nomadic aesthetic. One key example is its partnership with the popular Chinese TV series “To the Wonder” (我的阿勒泰), which coincided with the launch of the prairie-inspired perfume “Roaming Wind”. This collaboration was driven by founder Ni Lishi’s intuitive response to the series’ visuals, which matched the brand’s creative direction. The campaign generated significant buzz and visibility on Chinese social media, highlighting Melt Season’s ability to capitalize on cultural relevance and emotional resonance.

The rise of Chinese perfume brands

- Perfume is a relatively recent lifestyle category in China, shaped by traditional values that favored subtlety and natural scents over bold or artificial fragrances.

- The market was long dominated by Western luxury brands, which symbolized status but left little room for domestic innovation.

- Today, Chinese premium perfume brands like To Summer, Uttori, and Barrio are defining a new, culturally rich luxury by integrating heritage symbols and immersive retail experiences.

- Affordable brands such as Chunfengshili and Scent Library are also embracing local identity through poetic narratives and nostalgia-driven products.

- With experiential flagship stores, unique scent profiles, and storytelling that resonates with younger generations, Chinese perfume brands are transforming fragrance into an expression of modern cultural confidence.

Contact us for in-depth beauty market research in China

The cosmetics market in China is a rapidly evolving landscape, driven by the rising demand for high-quality products, innovative ingredients, and sustainable practices. Daxue Consulting offers specialized market research in China, providing a comprehensive understanding of the preferences, behaviors, and emerging trends shaping the cosmetics market.

Our Chinese consumer insights empower businesses to tailor their products and marketing strategies to resonate with local tastes and expectations. We offer consulting services that help you stay ahead of industry developments and achieve sustainable growth. Connect with us today to discover how our expertise can support your brand’s success in China’s thriving cosmetics market.