Market analysis of the Chinese perfume market

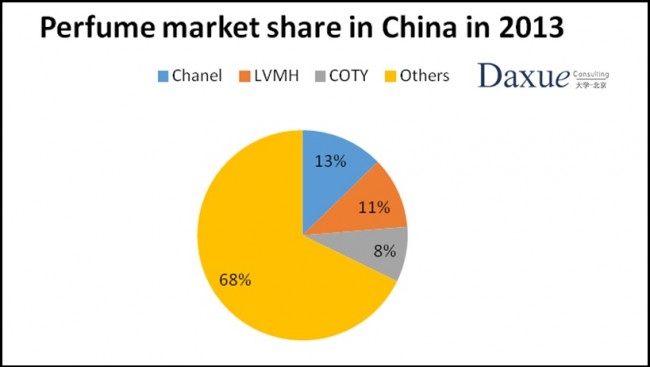

Market share

Like other skincare products and cosmetics, foreign brands have taken up the majority of the shares in Chinese perfume market. Data from market research illustrates that all the top 10 perfume sellers are foreign brands, and they take up 48.8% of Chinese perfume market. These brands are Chanel, LVMH, COTY, P&G, L’oreal, Estee Lauder, Mary Kay, Burberry, Salvatore Ferragamo, and AVON. The market share of Chanel, LVMH and COTY are 12.70%, 11.0%, and 8.5% separately.

The characteristics of Chinese consumers of perfume

Currently, according to data from market research and market analysis, conducted by many perfume brands in China, the main consuming group of perfume is made up of middle-aged females from 30 to 50 years old. Because people in this age have higher income, they can have more space to choose what they buy. But on the other hand, we could see that the perfume market in China is far away from mature. The real emerging consumer group hasn’t been established because of the consumption concept. For example, the perfume market of aiming at males is still small.

The distribution channel in China

The traditional distribution channels for perfume in China are mainly shopping malls and department stores in first-tier cities in China. But now, perfume counter becomes an important part of cosmetics franchise store in second-tier cities in China. And some local brands have already expended their market from coastal or distant cities to cosmetics franchise stores in big cities. Majority of the shopping malls and exclusive shops in second-tier cities take domestic perfume as an important replenishment for revenue.

The pricing strategy on the Chinese perfume market

The normal price of perfume like Chanel, Dior and Estee Lauder is 500 to 1000 RMB per 50 ml, which makes it luxury for most of the consumers, even for white-collars. Although perfume is the representative for taste and standard, it is still a kind of product that people use every day, so price is an important element. Finding a balance between the price and brand value to make it a high cost-efficiency product is a huge step to expand the demand and the market.

The purchasing habit

In China, one special phenomenon is that the purchasers of perfume are not usually the users. People normally buy the perfume as gifts for friends or lovers, and only 30% of the purchasers buy it for themselves. That makes the Valentine’s Day the peak season for perfume sales, which accounts for 30% of the annual sales of perfume. Among which, a large ratio of the perfume is made for lovers or boys who want to express love. So it is important to create more occasions for purchase, and increase the rate that people buy it for themselves.

The perfume itself

The smell of perfume of foreign brands is usually very heavy, but Chinese consumers have a different taste for the smell of perfume. Chinese people want the smell of the perfume to be light and simple. Females like the smell of flowers while males like even fresher one, and perfume that smell like fresh fruits and flowers gain the most popularity. So foreign brands should lighten the smell of the foreign perfume, and make the smell and package younger, while domestic perfume companies should combine the perfume with mainstream culture to make itself more competitive.

Daxue Consulting can provide you support in entering the growing market of perfumes in China. We conduct all the market research and consulting services you may need, such as potential analysis, cost analysis, implementation feasibility etc. To know more about the Chinese market, do not hesitate to contact our dedicated project managers by email at dx@daxueconsulting.com.

Follow us on Linkedin and Twitter to learn more:

Battle of the #Bakeries: How Companies Compete in the #Macaron Market: https://t.co/Sm0s7SAGSo @iammissmacaroon @LAtelierBaillet pic.twitter.com/QDRsePfCDS

— Daxue Consulting (@DaxueConsulting) November 23, 2017