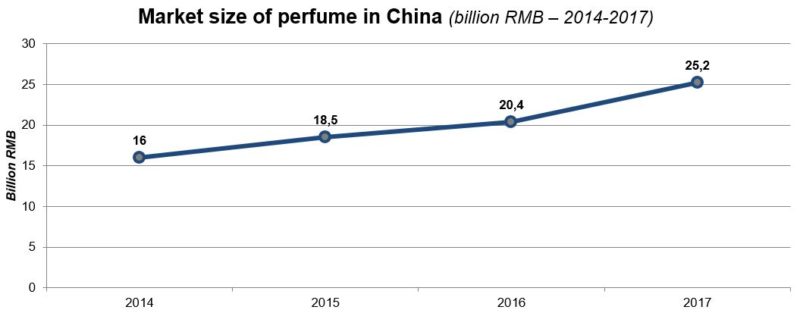

Chinese perfume market shows fast growth, the market size reached RMB 15.2 billion (USD 2.2 thousand million) in 2017. Yet the Chinese perfume market is far from mature and therefore holds great potential.

The history of perfume in China

Many people believe that perfume is a new thing in China, however, this is far from the truth. As a matter of fact, the Chinese have a long history of using incense and fragrance herbs in China. Ancient Chinese not only burnt incense, but they also mastered the distillation skill to produce “perfume”. Yet it had mainly be used by imperial and noble families. In the 20s and 30s, perfume was also very present in China, especially in the city like Shanghai, many perfumes are even produced locally. Perfume had always been a symbol of elegance, wealth and mystery in China. However, the arrival of communism stopped the trend. Products like fancy clothes, cosmetics and perfume were a symbol of capitalism and illegal in China at that time. After the Chinese economic reform and open-up (starting in 1978), Chinese consumers are holding increasingly stronger disposable income and an opener attitude towards global lifestyle trends. Using perfume in China has become popular once again, even a part of the daily life for many young Chinese consumers.

Foreign perfume brands should approach Chinese consumers differently

P&G notices a real potential concerning the perfume market of young Chinese consumers. Back 2014, less than 1% of the Chinese population used perfumes while 60% in Occidental Europe or in the US were doing so. Compare to their parents, Chinese millennials (born from the early 1980s to early 2000s) get to know about perfume in their early stage of life. On the other hand, the Chinese young generation is more appearance conscious and have a stronger desire to show their personal taste in comparison with their more conservative parents. Hence, they have become the main force of consuming perfume in China.

For a very long time, China had no culture of using perfume until recent years. In other countries, consumers might choose one particular perfume because of its name, shape of bottle or scent that may trigger fond memories from their life experiences. Yet Chinese millennials have grown up with parents and grandparents wearing no perfume. As a result, the attachment factor will not have an impact on the consumers’ perfume purchasing behavior. For the younger generation who starts to explore the world of perfume, they tend to make a safer choice by picking those from well-known brands and products with higher reputation. Moreover, since wearing perfume shows a high social status in China, Chinese consumers want their friends and acquaintances to recognize the one they are wearing.

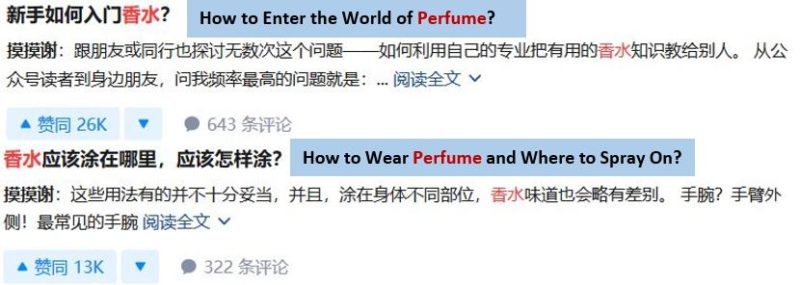

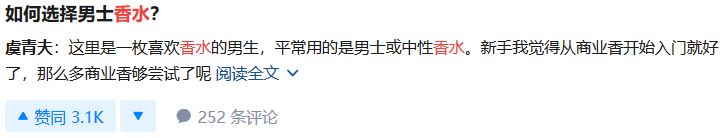

On the biggest Chinese question-answer platform Zhihu (知乎), the top 2 posts regarding perfume/cologne are: How to Enter the World of Perfume (with 26K agreed and 643 comments till December 20th 2018) and The Complete Guide to Perfume (with 14K agreed and 232 comments till December 20th 2018), in which the author explains the basic knowledge about perfume, for example: What is top notes, heart notes and base notes; as well as the basic types of fragrances. The author also offers perfume novices suggestions about how to pick the first perfume and recommends certain perfumes for them to try out. The 4th hottest answer on Zhihu regarding perfume is to answer the question: How to Wear Perfume and Where to Spray On? (with 13K agreed and 322 comments till December 20th2018).

As mentioned before, Chinese perfume market is still in the initial phase. International perfume brands should approach Chinese consumers differently as consumers from other countries. Besides the role of a seller, western companies should also play the role of an introducer of perfume in the Chinese market. Brands should help Chinese consumers developing the knowledge of how to choose the right perfume, as well as how to use it. As a result, it could be very advantageous for foreign brands by the time they successfully transmit the habit and tradition of using perfume. Once more and more young consumers in China obtain knowledge and culture, wearing perfume will become a part of many Chinese consumers’ daily life.

Perfume and cologne market in China: Sephora Beauty Class

Sephora provides an online page where they sell perfume a so-called “Sephora Beauty Class”, which shows the perfume or cologne classification according to the percentage of perfume, and from which category is the current product on that page. This helps Chinese consumers learn the right description of the product and how long they can expect the scent to last.

Male consumers are becoming more interested in cologne

Young Chinese men are becoming more beauty conscious and confident to take care of their appearance. In VIP.com’s (唯品会Chinese e-commerce platform, focus on cosmetics and clothing) report, from 2015 to 2017, post 95s increased year by year, from 16.7% of the 2016 men’s beauty purchase rate in 2016 to 42.9% in 2017. Although according to Forward-the Economist, over 70% of Chinese perfume market share came from women in 2017, young male consumers nowadays are getting rid of the traditional image of a Chinese man and becoming more and more interested in cologne. International brands should approach Chinese male consumers in the early phase of their cologne exploration journey.

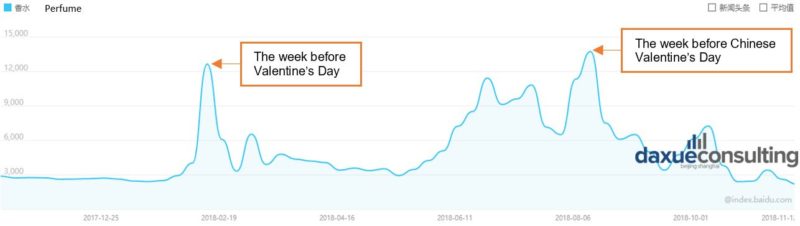

The best period for selling perfume and cologne in Mainland China

Good timing to engage with the Chinese male consumers is a holiday. From Daxue Consulting observation, Chinese consumers like to purchase perfume as a present for their significant others, since perfume as a gift is considered personalized and intimate. As we can see from the search frequency of the term “perfume or cologne” (香水) in the last 12 months, peaks have been reached in the week before Valentine’s day and the week before Chinese Valentine’s day (七夕 Qixi, mostly in August, depending on the lunar calendar). Many Chinese male consumers might not purchase their first bottle of perfume on their own but receive it from their girlfriend or wife. As a matter of fact, consumers in China almost only choose perfume from international brands as gifts, since these are considered more decent. Chinese not only gift perfumes on Valentine’s day but also on other occasions like birthday, Christmas and anniversaries. Compared to other luxury goods, perfume from a high-end brand is more affordable, yet still wins the gift-giver a good “face” because of the brand reputation and the favorable design.

Design and brand reputation might be more important than perfume itself in the Chinese market

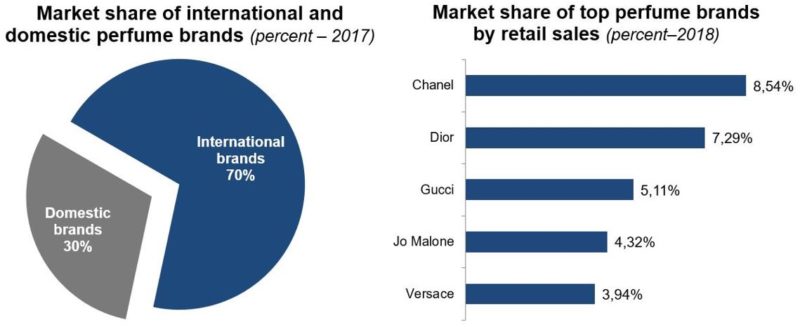

Social status is very important in China, the average Chinese consumer prefers using perfume from luxury brands to show their status. Compare to a Chanel handbag or a pair of Gucci shoes, perfume from luxury brands is much more affordable. It is a good starting point for many Chinese consumers to get in touch with an international premium brand. On the other hand, due to the concern of Chinese consumers about food and cosmetic scandals, they have more trust in perfume from international brands. Although there are plenty of Chinese local perfume brands, they mainly appear on the low-end market. According to data from Euromonitor International report on the Perfume Market in China, sales of international premium fragrance brand in the Chinese market grew by 2.2% during 2016 while the market of domestic fragrance brands dropped by 3.6%. In general, international brands have a good reputation in China, it is even so when it comes to products like perfume. It endows the bottle of fragrance with an exclusive and elegant ambient, especially when it is coming from counties like France or Italy.

70% of the Chinese perfume market share comes from world known brands. Since Chinese consumers consider perfume as a luxury product, they tend to purchase perfume from high-end brands, which are exclusive from overseas. The top 5 brands by retail sales in the Chinese perfume market are Chanel (FRA.), Dior (FRA.), Gucci (IT), Jo Malone (ENG) and Versace (IT).

This is a post from a Weibo KOL 孙尚香Scent specialized on content about scents, lifestyle and art, who has 843K followers:

I just got interviewed by a European market research institute, they asked me: “In the Chinese perfume market, what matters the most for a brand-new perfume to Chinese female consumers? I answered: as a matter of fact, the appearance of it… Am I being too honest?” The top comments under this post mentioned what also matters a lot is the cooperated celebrities for the product and name of the product. This post might not completely right, however, it implies that the design and celebrities’ endorsement can strongly impact the Chinese consumers’ perfume purchasing decisions.

The penetration of the Chinese perfume market: Diverse distribution channels

The offline store is still a significant distribution channel for selling perfumes in China. In the offline stores, consumers have the chance to smell different kinds of scents and obtain professional consultation. The most relevant channels are shopping malls as well as personal care and beauty stores like Sephora. Although shopping malls normally have a better presentation of the products and offer more exclusive service, young Chinese beauty consumers increasingly tend to purchase beauty products including perfumes from stores like Sephora, in which perfumes are placed on open shelves and organized by different brands. Products are better accessible and the shopping experience more relaxed.

Due to the high internet and smartphone penetration in China and the convenience of online shopping, Chinese online retailing has been booming since many years and it is still on an upward climb. A few international brands (e.g. Chanel) have their Chinese official website selling diverse products incl. perfume. Besides that, several foreign brands have built their official flagship stores selling cosmetics and beauty products incl. perfume on Tmall (Chinese B2C e-commerce platform from Alibaba Group), e.g. Estee Lauder, Lancôme, Givenchy, Jo Malone, Guerlain. Another option for brands to distribute perfume in China is via Tmall Global (天猫国际官方直营), as CK, Gucci, ANNA SUI, Burberry, Versace and Davidoff are doing. Tmall Global offers discounts very frequently and has a strong price advantage. On Dec. 20th2018, the best sellers on Tmall Global are from the following international brands: CK, Burberry, Versace and Ferragamo. These products have relatively low prices, for every 50 ml, the average price is approximately 175 RMB (25 USD).

The second option for international perfume brand on Tmall is to distribute through the Tmall Sephora flagship Store, which is used by e.g. Gucci, Kenzo, LOEWE, GIVENCHY, Bvlgari, Chloe, miu miu etc. As we can see from the prices of over-all best sellers, the average price is much higher than which on Tmall Global – 805 RMB (117 USD) for every 50 ml. The over-all best sellers on Tmall Sephora flagship Store are from the following international brands: LOEWE, Tiffany and miu miu.

There are no official flagship stores from international brands on Jingdong (京东, China’s second-biggest B2C e-commerce platform). However, brands can distribute perfumes on the Jingdong Ziying Store (京东自营店, direct sales of Jingdong). Moreover, same as on Tmall, international perfumes can be sold on Jingdong Sephora flagship store.

Last but not least, the emerging social media and e-commerce platform Xiaohongshu (小红书, also known as RED) is providing the opportunity for Chinese consumers to purchase perfume online. What makes Xiaohongshu special is its social and life-sharing character, the platform works closely with Chinese KOLs and celebrities. The following example is KOL’s article recommending nine different kinds of perfumes from international brands and shared her experience. At the bottom, readers can purchase directly the buyable products mentioned in the post, which in this case, all nine perfumes mentioned. This post got 12K likes and 988 comments. It also has been saved as a favorite for 53,8K times, which means many readers would view this post again in the future and take this KOL’s recommendation and user experience as a reference.

What kind of perfume do Chinese people prefer: Be aware of the different preference for the scent of Chinese consumers

Chinese consumers prefer more delicate and floral scents. Chinese people do not feel a strong need to cover the body smell with perfume. Secondly, China has a very introverted culture and social environment, as a result, Chinese people don’t want to “stand out” from the crowd. Wearing too strong perfume might be considered indecent in China. Finally, China has a long history of using herbs and another kind of plants for pharmaceutical usage. Chinese consumers believe in the medical effect of ingredients making of perfume. Some consumers like perfume carrying an earthy or herby note rather than a heavy fragrant which could be considered as “smelly chemical”.

Takeaways for international perfume and cologne brands from Daxue Consulting

Unlike other counties, for the last decades, Mainland China had no tradition and culture of using perfume. Yet as the Chinese young generation holding stronger disposable income and more open attitudes towards global lifestyle trends, the perfume market size in China is increasingly growing.

How can international companies approach Chinese consumers and get a piece of the pie before it is too late?

One thing is sure, Chinese consumers are different. For example, the attachment factor of perfume won’t work in China since a young generation has grown up with their parents and grandparents wearing no perfume. International brands should not only play the role of seller, but also the role of an introducer of perfume culture. As we can see from the behavior on Chinese social media, Chinese consumers are very interested in Perfume, yet lack enough knowledge about it.

Chinese male consumers are becoming more active in the beauty product market including the cologne market as the traditional image of perfect Chinese male changes; they are now more appearance conscious and more confident to purchase goods like perfume.

Moreover, Chinese consumers have a different preference for scent, fresh and floral fragrances are more acceptable than strong ones. Also, woody and herby scents are liked by many Chinese consumers.

Personal care and beauty products stores like Sephora are the first choice for Chinese millennials to purchase perfume offline, as the shopping experience is more relaxed and the products more easily accessible. For online-retail, the two massive Chinese e-commerce platforms, Tmall and Jingdong, are good choices for international brands. The social media app Xiaohongshu is also becoming an unneglectable platform to leverage, not only by working with KOLs and celebrities to promote but also as a distribution channel.

Author: Chencen Zhu

Daxue Consulting considers each project as a unique and new challenge. With our services including store checks, Focus groups, Mystery shopping, Market analysis, In-depth and quantitative interviews, Daxue will provide you will the cutting-edge market analysis of the industry and product in China. Based on the data and report, we will offer you the Chinese market tailor-made business plan and go to market strategy with a ‘think out of the box’ Blue Ocean Strategy for your perfume brand.