At the turn of the millennium, the Chinese diaper market was practically inexistent. In fact, until that moment, Chinese Families had relied on the so-called split-pants —in Chinese 开裆裤Kai Dang Ku. These baby pants have a large opening right on the backside of the garment, which is specifically designed to allow the toddler to relieve him- or herself by simply squatting whenever needed. However, since the mid-2000s, the Chinese diaper market has been expanding at an unprecedented pace, thus raising the attention of major diaper brands looking for opportunities to expand their business. In particular, P&G—through its branch company Pampers—was the first to approach the Chinese diaper market with an effective research-backed strategy.

When size matters: the benefits of a large population for the Chinese diaper market

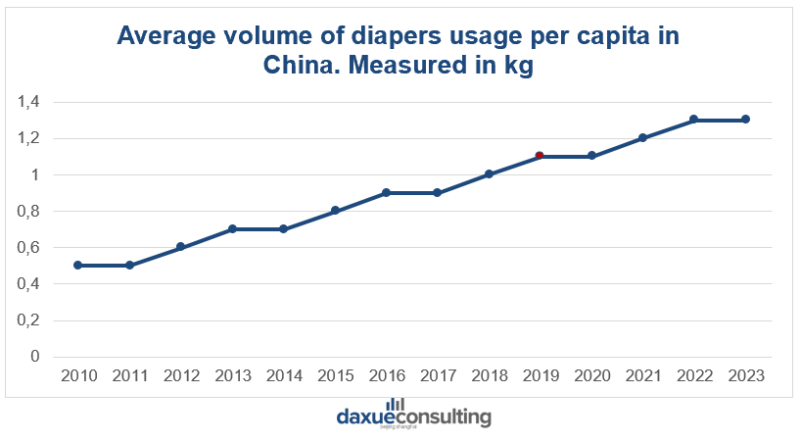

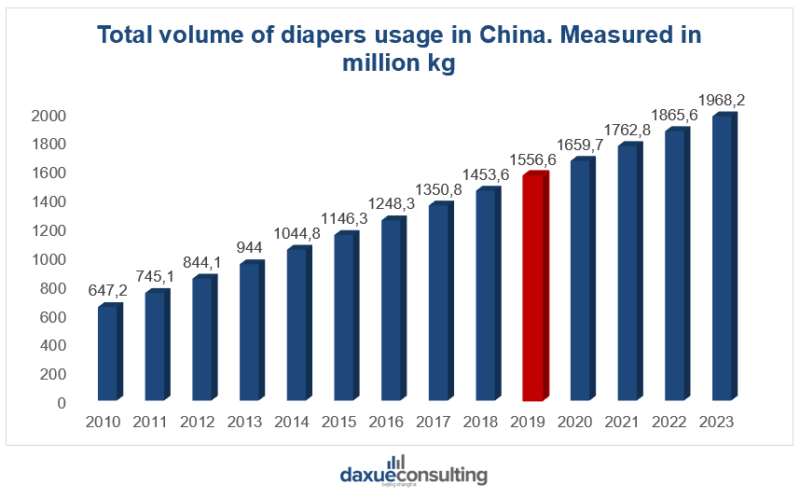

Perhaps, the single most attractive factor for every company wanting to secure a share of the diaper market in China is the country’s population. In fact, despite the effects of the recently abrogated “One child policy”, China still claims the title of the country with the most new-born babies in the world. With its 15.2 million new-born babies in 2018, China is matched only by India. In addition, the constant increase of the average household purchasing power has been followed by an increase of the number of families looking for higher quality products

The transformation of Chinese parentting habits

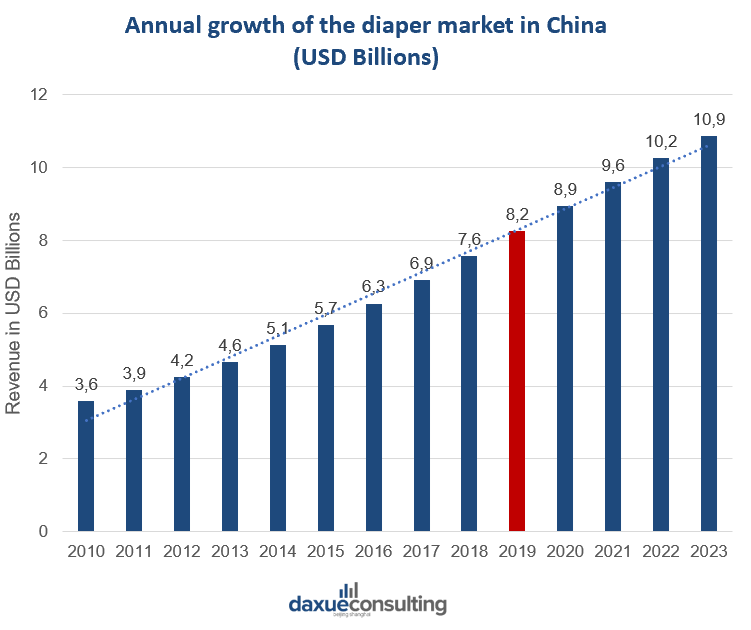

According to the latest statistics, in 2019 the total market revenue of the diaper segment in China reached the whopping figure of $8.2 billion, whereas the average revenue per capita, which is the result of the total revenue divided by the total population, was $5.7. Despite the impressive trends of the Chinese diaper market, China has not always been a profitable market for diaper brands. Pampers, which today is among the industry leaders in China, had to go through a series of failures before finding the right strategy that would penetrate the Chinese diaper market. In an interview to Bruce Brown, who was in charge of the company’s $2 billion R&D investment team tasked to find a product that would appease Chinese customers, it was revealed that the Asian giant has always been a tough market to penetrate. The researcher explained that the first time P&G tried to launch its Pampers diaper in China in 1998, the result was outright disappointing. In fact, instead of developing a unique product for the Chinese market, P&G proposed a lower-quality version of the diapers it sold in the U.S and Europe. The company wrongly assumed that Chinese parents were looking for cheap products. The very limited sales simply reminded the company that it could not be more wrong with its market strategy.

The strategy that raised the revenue of the market in China

Industry players from around the world

International diaper brands in China: Pampers

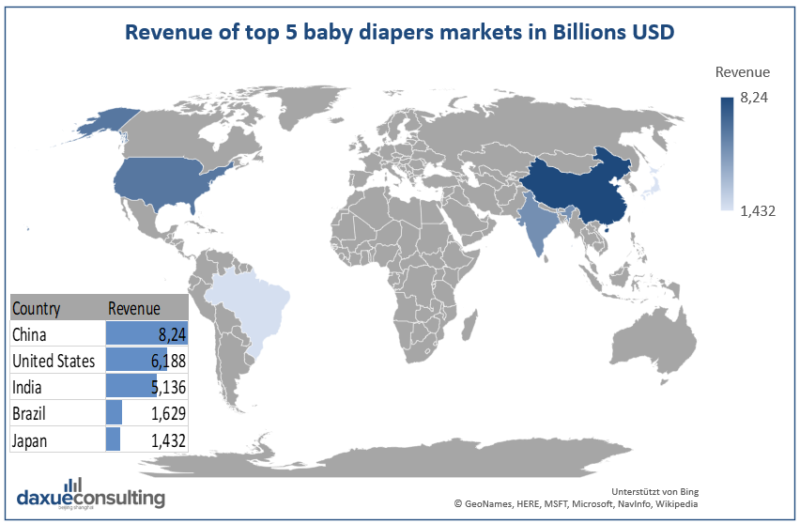

In 2017, diaper manufacturers in China produced more than 31 billion diapers. The global market size of diaper brands was valued at over $54 billion, with its leading consumer markets in North America, Western Europe and Asia. Asia alone, though, now holds more than half of the consumption of diaper globally, and this thanks to rapidly expanding Chinese market. The penetration rate is over 85% in Western Europe, Japan, and North America while on the other hand, diaper manufacturing companies in China have still significant room for improvement with a penetration rate below 55%. In addition, the diaper market in China is forcasted to maintain a two-digit annual growth rate over the next five years, especially thanks to the significant increase in disposable per capita income and the relaxing family planning policies.

US manufacturers: Pampers

Today, Pampers is among the most recognizable diaper brands in China. The company promotes its products in various ways, including billboards and television commercials. In addition to diaper and baby-wipe, Pampers offers a training pants line called “Easy Ups” and a line of disposable swimwear sold under the brand name Splashers (or Sunnies in Europe). Moreover, Pampers produces bed wetting products named Underjams for children weighing up to 85 pounds (about 39 kilograms). However, in order to reach this level of market penetration and take the lead of the diaper brands in China, Pamper had to go through multiple failed attempts, which helped the company better understand Chinese consumers.

The challenges for Pampers diapers in China

The first diaper that Pampers proposed to Chinese customers it was plastic and largely perceived as irritating, so it failed to convince customers. In 2006, a new product—the Pampers Cloth Like & Dry—despite being softer than the previous one still registered sluggish sales. In fact, after more thorough research, it was found that Pampers diapers in China were not faring well because Chinese consumers were not primarily looking for dryness or convenience. As late as 2006, the majority of the Chinese parents, when asked whether they would abandon traditional cloth diapers or split-pants, would reply stating that they simply could not see a good enough reason to start buying diapers instead of using split-pants or cloth diapers. To solve the issue, Pampers decided to adopt a more scientific approach for its market strategy. The company commissioned a study to the Beijing Children’s Hospital’s Sleep Research Center that revealed that babies wearing Pampers fell asleep 30% faster, slept an extra 30 minutes every night, and had 50% less disruption throughout the night. After the publication of these results, sales went up by 55% and, more importantly, Pampers diaper finally took off in China. Since 2006, Pampers established itself as a leading diaper brand in China.

Experts’ analysis of the success of Pampers diapers in China

In an interview on Pamper’s diaper experience in China, Karl Gerth, an Oxford professor whose main field of research is the spread of consumerism in China, pointed out that Pampers’ marketing strategies stroke the right tone. “You don’t want to come off as paternalistic,” said Gerth, who authored the book “China Made: Consumer Culture and the Creation of the Nation.” He continued stating that “The idea that Pampers brings a scientific backing and gives children an edge in their environment—that’s a brilliant way to stand out from the competition.”.

Big companies expand their market in China

After the pathbreaking campaign of Pampers, various brands found the courage to start investing in the diaper market in China. In 2013, Kimberly-Clark, a Texan company, announced the construction of a new diaper manufacturing plant in Jiangning’s Development Zone. According to China Sourcing News. The company planned to invest more than $100 million in this new manufacturing plant and product development center, with aim of integrating product manufacturing, quality control, product innovation, engineering project management and logistics management. Meanwhile, Procter & Gamble, the parent firm of Pampers and Luvs diapers, started the first stage of a three-stage investment operation in Luogang, Gaungzhou (广州) the goal of becoming one of the largest manufacturing sites in Asia. The first stage of the plan was to produce various consumer goods, including Pampers diaper for China. The initiative was part of the company’s goal of investing as much as $1 billion in China by 2015.

Japanese diaper brands

Unicharm

Beyond American companies, also Japanese companies are featured among the leading diaper brands in China. In fact, the “Made in Japan” is perceived as a reference selling point to Chinese customers, who still distrust domestic companies. In particular, the Japanese Unicharm realized this in 2016—when it changed its strategy to penetrate the diaper market in China—and began exporting from Japan instead of selling its products manufactured locally. In addition, in the first years of its activity, Unicharm operated five factories in China because the management was convinced that it would better serve the Chinese diaper market. However, the strategy did not pan out in that business was wavering. The company revealed that one fatal miscalculation was that of underestimating the customers’ preference for high quality and more expensive products. In fact, the company chose the affordable MamyPoko diapers for its main product placement strategy instead of the premium Moony brand. Moreover, the company chose large supermarkets and similar retail points as sales channels. The result war rather disappointing because after a while a large portion of the consumers turned to the on-line market to find higher-quality products.

Pigeon Co.

Another Japanese name among the leading diaper brands in China is Pigeon Corporation, which has been investing in the Chinese diaper market since 2011. The company started its operation in the Chinese market with the Changzhou-based production line, which was completed in late 2011. According to a report released by the company. In 2013, this plant produced breast pads, baby wipes and other baby items, but with a series of additional investments, the company expanded its production with the objective of producing close to 85 million diapers per year for the Chinese market. After this series of expansions, Pigeon also opened a manufacturing plant in Shanghai.

Summing up the general trend

In conclusion, we could say that China has not always been an easy market for leading diaper brands. After an initial phase of strategy assessment, though, China proved to be an extremely lucrative market. In particular, the increasing awareness of Chinese customers over quality standards and safety hazards proved to be an important factor that domestic and international leading brands have to take in consideration. For example, the 2008 baby milk scandal sparked concerns over product safety, and as a result parents were steered towards premium foreign-produced diapers. Imported premium products from the US like Pampers; and Japan like Kao’s Merries and Unicharm’s Moony diapers have gained popularity in the world’s most populous country. According to the Shanghai International Nonwovens Exibition, the rapidly increasing demand for imported diaper in China convinced many leading diaper brands at the international level to expand their production lines in China. Below it is a list of the leading diaper manufacturers in China and their location

Top 10 diaper manufacturers in China

Out of the top ten diaper manufacturers in China, seven have their headquarters in Fujian province.

- Diaborn is a leading diaper manufacturers in China and one of the top domestic diaper brands. This diaper company was founded in 2006 with the headquarter in Fujain, China. The company’s current estimated revenue is over $5 million.

- BBG Sanitary Commodity Limited was set up in 2004, and since then has emerged as a leading diaper manufacturer in China. This company is has some of the most advanced production machines, which enable diaper manufacturing companies in China to guarantee quick delivery on client’s orders while maintaining high product’s quality.

- InSoft is a leading diaper manufacturer in China, which was established in 2010 and headquartered in Fujian, China. This top disposable diaper brand employs over 500 persons and has an estimated annual revenue of $100 million.

- Chiaus is among the largest diaper manufacturers in China. This diaper company was established in 2006 and is headquartered in Quanzhou, China. The company has invested in an innovative R&D center to offer products that meet international quality standards for disposable diaper brands.

- Baron China Co Ltd is a top diaper manufacturer in China and is regularly featured among the best diaper brands. This leading diaper manufacturing company in China was founded in 2005 in Fujian, China and has an annual turnover of over $67 million.

- Yamaza is one of the larges diaper manufacturers in China and was established in 2005 in Guangzhou, China. This company is a major household name for diaper manufacturing companies in China.

- AAB China Co Ltd is another key diaper manufacturer in China with 32 production lines and a production unit covering more 80,000 square meters. This company was established in 2001 and its headquarters are located in Fujian, China. The company registers an annual revenue of $167 million.

- V Care Baby is headquartered in Quanzhou, China. This company was founded in 2007 and is a trusted diaper brand. The company has a factory covering an area of over 66,000 square meters and employs over 300 workers.

- Sun Baby Diapers differs from the other companies on the list, in that it is headquartered in Shanghai, China. The company has consistently delivered high quality disposable diaper brands in the market for diaper manufacturers in China.

- Hanhe Diaper was established in 2011 and is located at Fujian, China. It is a well-established diaper manufacturer in China, with an annual turnover of between $15 to $20 million.

Author: Abebe Gasparini

Let China Paradigm have a positive economic impact on your business!

Listen to China Paradigm on iTunes