China plays a leading role in the global e-commerce market. According to Statista, in 2021 almost half of the world’s e-commerce retail sales took place in China, with a sales value estimated to be more than US and Europe combined. These record-braker figures are possible due to the immense number of Chinese internet users, which in 2022 has exceeded one billion. Two of the largest contenders in Chinese e-commerce market are Alibaba and Pinduoduo, which are competing to gain the trust of Chinese lower-tier cities. In order to achieve this goal, in 2010 Alibaba launched Juhuasuan: its flash-sales and group-buying e-commerce platform.

What is Juhuasuan and why is it useful

Founded in 2010 as a branch of the e-commerce marketplace Taobao, to which was separated in 2011, becoming an independent subsidiary of Alibaba, Juhuasuan is a group-buying app, offering very low-priced products in bulk. It’s an innovative way of selling unwanted products from warehouses because they are cheaper if more people buy them. In fact, Alibaba tends to get rid of unsold inventory through such affiliate. However, there were episodes in the past in which the platform sold products which weren’t necessarily from Alibaba’s warehouses. In 2015, the app collaborated with an American fishing company and sold more than 767,000 USD worth of carps in just a two-days promotion.

Flash-sales and lower-tier cities

Indeed, another strength of Alibaba’s group-buying platform is flash sales. Some products get heavily discounted for a short period of time, so the users of the app can purchase them at bargain prices. In this way, Juhuasuan improves the results of merchants which are selling their products through Tmall and Taobao. However, flash sales aren’t its only objective of such platform. In fact, one of the main scopes of this platform is to promote goods and products in lower-tier cities. More than 68% of Chinese people live in lower-tier cities, whose residents account for the biggest part of e-commerce users, has extremely increased. Young people in lower-tier cities are very interested in videogames and group-shopping. Their time spent on e-commerce sites increased by 40 minutes per month in 2022, so they represent a huge opportunity for platforms who want to sell their products through group-buying.

Juhuasuan vs Pinduoduo: the dispute to conquer lower-tier cities

The contenders for the market of lower-tier cities are numerous, there is also another platform that is rapidly growing and is gaining its space among the big platforms: Pinduoduo. The platform was created in 2015 in Shanghai, and its core business is the group-shopping. In 2022, the startup gained more than 784 million users, overtaking the e-commerce giant Alibaba by just 7 million units. Despite this enormous growth, Alibaba still detains the biggest net worth between the 2 platforms, which on November 23 2022, reached 201.3 billion USD, while Pinduoduo has just a net worth of 82.7 billion USD.

Pinduoduo: the “new entry” of Chinese e-commerce

Pinduoduo is a group-buying app, it’s not focused on what the consumer prefers, but at selling in bulk at lower prices. Their motto is “together, more saving, more fun”, which highlights their tendency to the collective purchase. Both Juhuasuan and Pinduoduo are aiming to conquer the lower-tier cities, but unlike Alibaba’s affiliate, it is more interested in agri-food products. This is due to the fact that lower-tier cities are often located in rural areas of China and purchases are often difficult without e-commerce platforms.

Pinduoduo’s marketing technique is simple: it’s based on the business model “consumer to manufacturer”, which means that the platform creates a direct link between the farmer and the consumer. It also offers two prices for the same good: the former is the higher one, while the latter is the cheaper one, because the first price is placed when a consumer decides to buy a product on his own, whereas the cheaper one is set when a certain amount of people buys the same product. Thanks to its innovations, Pinduoduo rapidly became one of the “main players” in the Chinese e-commerce market, competing with other platforms that were created long before it was born. However, Taobao’s sister company didn’t stand still and tried to counter Pinduoduo’s ever-increasing influence in lower-tier cities. In December 2019, Alibaba announced a 1.4 billion USD (10 billion RMB) subsidy to cut prices and increase sales, boosting the search volume of the site up to 3,000 times per day on Baidu. This competition becomes more intense especially during shopping festivals: 618 and the Singles day, also known as Double 11.

Juhuasuan vs Pinduoduo: 618, Singles day and beyond

618 and Singles day are the most important periods of the year for e-commerce purchases. The former was initially created to celebrate the “birthday” of the e-commerce titan JD.com and occurs every June 18. It was first launched in 2010, but rapidly gained popularity and now it’s the second largest e-commerce festival in China in terms of money spent by shoppers.

Singles day or Double 11 is another famous Chinese shopping festival. Initially created in 1993 as an anti-Valentine’s Day to celebrate the pride of unmarried people, Double 11 soon became the largest annual shopping event. Tech companies did not release the actual sales revenue during Singles day 2022, but the total GMV of all traditional e-commerce platforms and livestreaming e-commerce platforms was estimated to be around USD 157 billion (or 1,115.4 billion RMB).

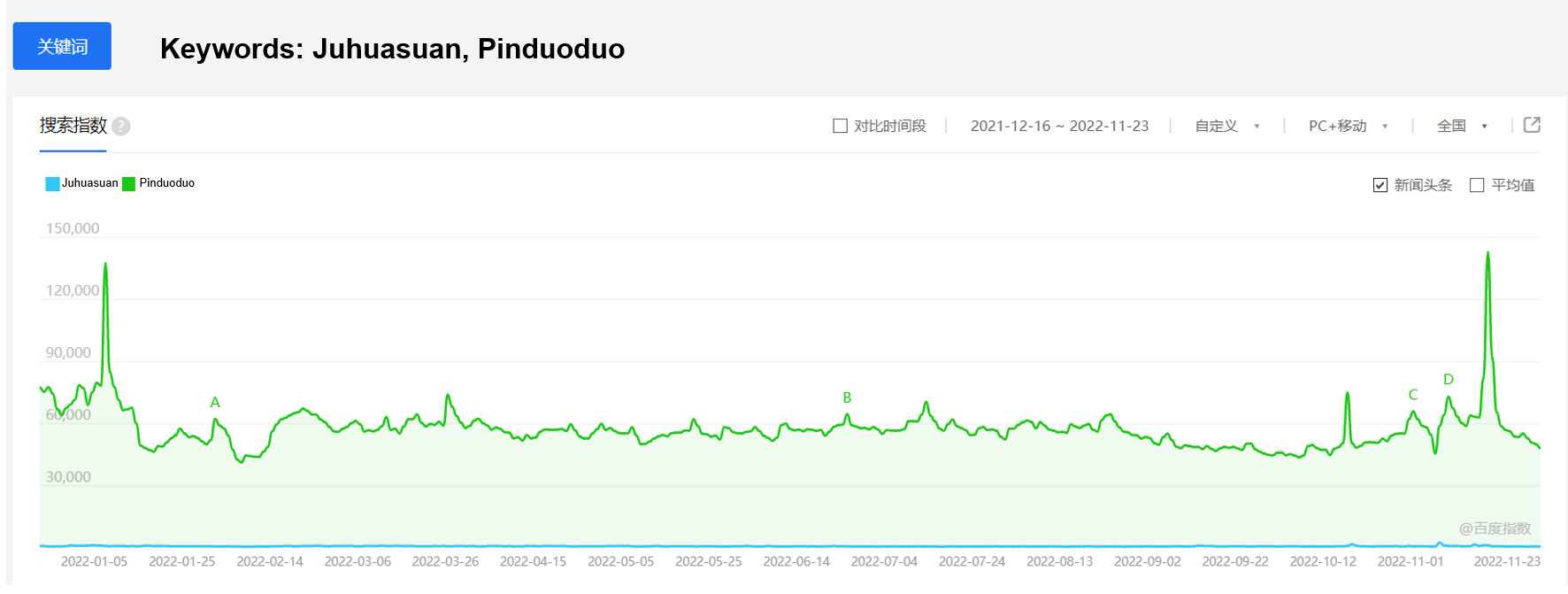

At the beginning of 2022, Alibaba’s affiliate gained a lot of buzz among Chinese internet users. Indeed, it was the official e-commerce partner of Beijing Winter Olympic Games and launched the campaign “when I think of skiing, I think of you”, whose video received more than 20 million views. Other than the winter Olympics video, the platform also released some Olympic-themed games on the Taobao app, which increased by 17% the visits to the platform. However, it was not enough to compete with Pinduoduo’s figures on “Singles day”, especially because two years earlier together with the national research institute signed a cooperation agreement in smart agriculture. The plan was to use artificial intelligence, advanced equipment, and the 5G to improve agriculture and mix it with technology. During the years after the cooperation, Pinduoduo increased its revenue by 7% per year. The real gap between Juhuasuan and Pinduoduo has been shown during this year’s “Singles day”. On Baidu, Pinduoduo registered a peak of more than 142,000 research per day, whereas its competitor struggled to reach 1,000 in 2022.

Baidu: search frequency for “Juhuasuan” and “Pinduoduo” in 2022

Juhuasuan: the best is yet to come

- Juhuasuan is a group-buying platform with a great and innovative potential, which, unfortunately, is not enough to scare large group-buying competitors, especially Pinduoduo.

- After receiving a “10 billion RMB subsidy”, the app experienced an enormous growth over the years, increasing its year-on-year transactions by 41%.

- Such growth was evident at the beginning of 2022, when the app became the main e-commerce platform to sponsor the winter Olympic games in Beijing.

- These are signals of a development that can bring Alibaba’s group buying app to compete with its rival platforms in the future.