Relying on China’s robust economic advancements and Chinese people’s increasing health awareness, China’s fitness industry has boomed. In 2019, China has become the largest fitness market in the world with approximately 49,860 fitness clubs and 68.1 million members.

An optimistic estimation is that China’s fitness industry total out-put value, including gym memberships and equipment purchases will surpass 185 billion RMB at the end of 2020. Nevertheless, as of 2019, only 4.9% of the Chinese population was gym goers, which is far behind western counterparts. Hence, the future of China’s fitness market is sure to be even more prosperous than now.

Gyms in China are on the decline, due to inflexible year-based membership and mismanagement of finances. However, the fall of traditional gym is a birth of a new, innovative fitness ecosystem. China’s fitness and sports market is heading online, represented by mobile fitness apps like Keep, and flexible class options like SuperMonkey.

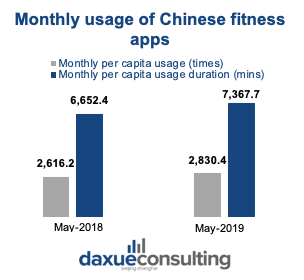

In May 2019, the monthly active user of China’s fitness apps reached 64.2 million, which is only 4 million fewer than the number gym members in the country.

On top of this, the outbreak of COVID-19 in China compelled Chinese people to stay at home, promoting more online fitness apps usage.

Source: QuestMobile, China’s fitness apps usage duration and frequency changes.

How Keep takes the leading role in China’s online fitness industry

As the leading fitness app in China, Keep is provides users with exercise monitoring and guidance, instagram-like social networking, sports equipment sales and nutrition advising. After launching in February 2015, the Chinese fitness app has accelerated the industrial transformation of online fitness. In the beginning of 2020, Keep raised 80 million dollars in its series E financing, totally obtained 254 million dollars investment in its series A, B, C, D and E financing. Keep became China’s first tech-sport company having obtained 5 turns investment.

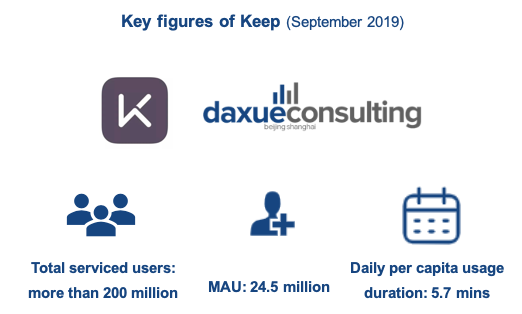

Keep’s MAU reached 24.5 million in September 2019, dominating China’s online fitness market. Keep’s initial product positioning was to create an online playground that was more than just a gym. Here, users can participate in any form of exercise, and bond with fitness partners through social networking. Now its business is covering online sports app, sports products sales and Keepland offline fitness club.

Source: Quest Mobile, Zhihu, Key figures of Keep in September 2019.

Who are “Keepers”

Keep’s target user group

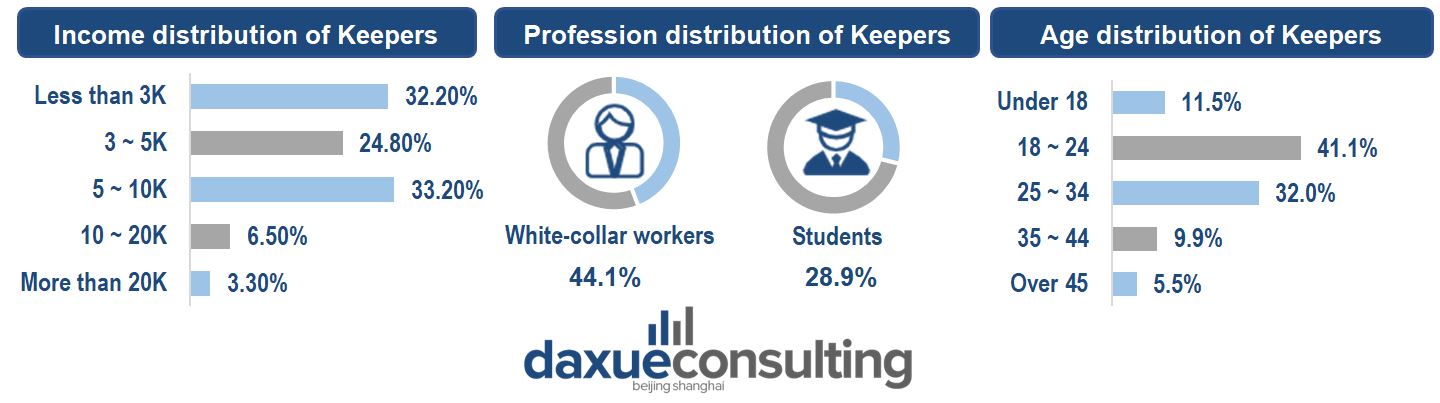

Keep’s target users are fitness newcomers, who may be urban white-collar workers and college students. Geographically, the Chinese fitness app has a clear focus on young people in tier 1 and tier 2 cities. They are more susceptible to have a strong willingness to work out because of their stressful daily work and irregular lifestyle. As for gender distribution, Keep has more female users than male users: 51.2% female users, 48.8% male users. Keepers are generally young, with more than half of them are under 25. In terms of income, keepers are concentrated in the low-income range of 5,000 to 10,000 RMB per month. And 37.4% of keepers have bachelor’s or master’s degrees and above.

Source: Zcool, Age distribution, profession distribution and income distribution of Keepers

Keepers’ first demand is weight loss and muscle gain. But in the shadows of their fitness goal is the very human need for social gratification, which they achieve through showing off their fitness gains and receiving praise from peers. Hence, by capturing the psychological journey of most users, the Chinese fitness APP is upgrading to a fitness-focused social app. Keepers can leverage fragmented time to choose appropriate training courses and share their outcomes in the community.

Exercise behavior analysis of Keepers

In January 2020, Keep released the National Sports Life Report, and Keepers have shown amazing enthusiasm and engagement. The report analyzed the exercise behavior preferences of the over 200 million Keep users. Keepers have accumulated a total of 22.4 billion minutes of exercise. On average, they work out 4.6 times per week, with each workout lasting 20 minutes. 62.2% of Keepers like exercising from 8 to 11PM after work.

There are also geographical differences. Users from tier 1 cities like Beijing, Shanghai, Guangzhou, Chengdu and Shenzhen significantly exercise more than those in other cities. As for fitness spending, keepers spend an average of $126 per month. 90s and 00s are more willing to invest in themselves, and women spend more than men.

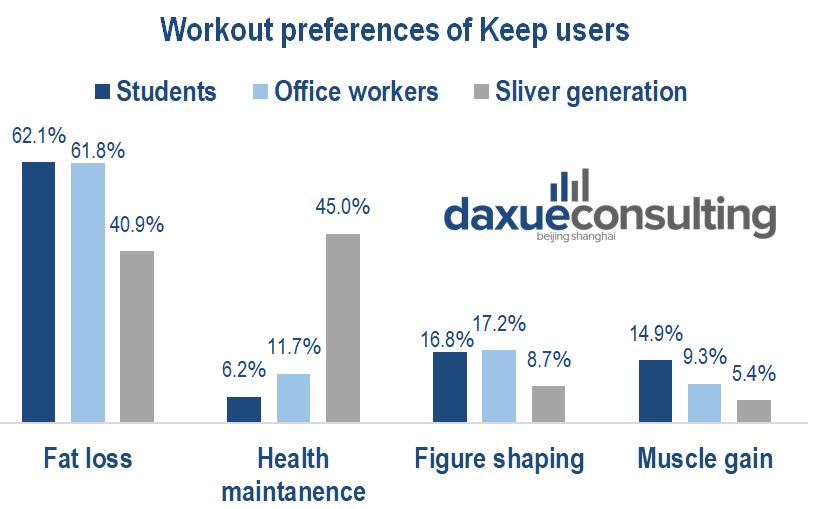

Age groups is also a factor in exercise preferences. For instance, while students and office workers aim for to lose weight and get in shape, the silver-generation lays emphasis on simply maintaining health.

Users of different age groups like different workouts. Students like squats, office workers like planks, and silver generation likes wall squats. But for the majority of keepers, abdominal muscles are the most popular muscle group to train.

Source: Keep, workout preferences across generations in Keep

Feedbacks of Keepers

Feedback on the app is relatively positive, which reflects users’ satisfaction with the experience. People are happy to show off what their improvements, especially pictures of abs and slim waists. Also, healthy food and new sports equipment photos also frequently appear in posts. Beyond its fitness classes, Keep ultimately brings users a healthy lifestyle and an expanded social network. On the other hand, criticisms like “Movements are too hard”, “It doesn’t work well” and “Inserting ads in instructional videos is annoying” exist as well.

Source: Zhihu, Keep and Weibo, What Keepers say on social media

Keep’s market strategies

Product function analysis of Keep

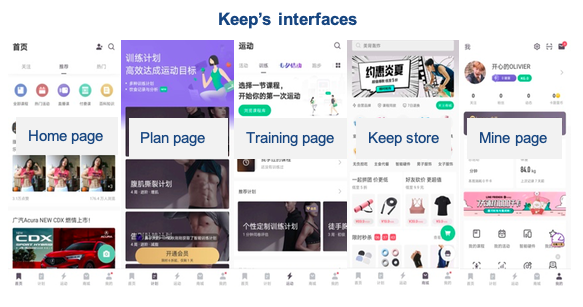

The app has five navigation bars to organize its functional matrix. The overall design of Keep is very simple, with a white background and a purple theme color. Keep’s slogan “Self-discipline gives me freedom” when you enter the page conveys the concept of Keep and is very inspiring for Keepers.

Source: Keep, user interfaces

Home page – sports socialization

The “Home page” displays information centered on fitness courses. It shows content posted by other users and popular activities and topics to mobilize users’ interests of the courses. Keep’s sports socialization app attributes are demonstrated in its home page. Through showing off fitspiration, it inspires newcomers, as well as encouragement to Keepers. The photo feature in the bottom right corner allows users to record and share their workout status at any time.

Plan page – customized personal workout plan

The “Plan page” has “My Training Plan”, which can customize workout plans according to user needs. As Keep has entered the profitability phrase, this function is not available until you become a member. For the same purpose, Keep has launched a new paid service – “Professional Diet Advice”. This section can provide optimal daily diet depending on the metabolism and workout frequency of user.

Training page – comprehensive fitness trainer

The “Training page” includes various workouts like running, yoga, walking and biking. Keep also recommends workouts based on the users profile and previous activity.

Keep store – pay for the ideal

The “Keep store” focuses on three classifications: food, smart devices and sports equipment. The advantages of Keep store’s merchandises are same model with the trainers, self-branding, and seven-day free return. “Shopping cart” and “my mall” buttons are set at the bottom right corner, simplifying user’s purchasing experience.

My page

The “My page” is a management interface for user’s information, preferences setting, training and shopping data.

How Keep encourages users to stay active

Keep relies on three means of activating users: characteristic services, diversified activities and incentive system. Undoubtably, Keep’s comprehensive services cater to users’ different requirements from fitness to healthy eating and shopping.

Moreover, the Chinese fitness app regularly organizes online and offline activities to engage users. Keep’s activities basically include three types: holiday activity, like ‘Keep summer marathon’; hotspot activity, like ‘fat loss challenge’ after Chinese New Year; and cooperation activity with other brands, like ‘share a work out achievement to win a Volvo’.

Fitness is definitely beneficial while many Keepers are suffering from the process and give up halfway. Keep has released a statistic suggesting only 13% Chinese who have weight losing plans actually achieve their goals. Thus, departing from increasing user activity, Keep has set up an incentive system. Keepers can get one emblem after achieving one day’s fitness goal. With certain numbers of emblems, Keepers can exchange some special awards.

Keep leverages multi-engagement driving systems to attract and retain users

Keep’s marketing strategies are very effective and have great lessons for other brands landing in China. Keep’s four strategies of expanding product awareness are social media, KOL promotions, co-branding and App store optimization strategy.

Source: Keep, Keep’s business collaborations

Keep’s social media activity

As a sport social app, Keep always has high social media activity. In the beginning of its launching, Keep intensively posted advertisements on China’s blog and forum sites to draw initial users. Now Keep’s online playing field has expanded to all China’s top social media platforms like WeChat, Weibo and Xiaohongshu. Keep has acquired over 4 million followers on Weibo and opened official account on WeChat and Xiaohongshu. Moreover, Keep targets WeChat mini-programs’ powerful user base and set up its own to provide quick experience for users. Frequently pushing news and creating hot topics on social media has largely increased the exposure of Keep.

Source: Xiaohongshu, WeChat and Weibo, Keep’s social media activity

KOLs promotions

KOLs are a very effective marketing strategy in China. It is normal to see Keep invite many Chinese stars as its brand promoter. Chinese actor Li Xian became Keep’s first celebrity participant and launched a ‘Li Xian HIIT fat burning challenge’. Li Xian is a post-90s Chinese actor who became popular from starring in dramas. With more than 22 million Weibo followers, Li Xian’s amazing influence has undoubtedly brought huge traffic to Keep.

Co-branding

In the partnership with other influential brands in China, Keep has succeeded in attracting more potential users. Leveraging Victoria’s Secret supermodel’s charming figure as the gimmick, Keep has released a waist and abdominal training course. Supermodel Karlie Kloss has starred in the course, having attracted over 2.25 million participants.

In addition, Keep has opened a discussion forum for Victoria’s Secret Angels. Users can participate in the course, record their training and share in the community to win prizes. Moreover, after discovering that everyone has a dream of being a superhero, has associated with Marvel. Creating several corresponding training courses for Marvel’s superheroes, Keep has drawn mass of Marvel superheroes’ loyal fans.

Keep’s App store optimization promoting

In terms of app store optimization (ASO), Keep also has an impressive performance.

Through optimizing its icon, creating keywords and titles, Keep quickly improves its ranking in app stores. By creating related keywords, Keep succeeded in increasing user searches and its exposure. There are 18,704 ‘Keep’ related keywords in iOS 14, with 7,021 search results in the top three. In other words, when searching any health or fitness related apps on Chinese app stores, it’s hard not to come across Keep.

Keep is the top fitness app, and ranks 75th among all apps. Even better, Keep has been named to the Apple Store’s list of top apps of the year multiple times.

Source: Qimai, Keep’s ASO strategy

Keep’s business model for turning user traffic into profit

Keep gets monetary return in four ways: e-commerce, paid courses, memberships, and advertising.

Keep launched the e-commerce function in version 3.0 released in April 2016. Currently, the Keep store has four self-branding categories, food, sports equipment, sports apparel and sports commodities. Keep’s courses are geared towards different needs, with prices focused on ¥16.90 to ¥99.

By sharing professional fitness knowledge and inviting celebrities to participate, Keep’s paid classes are well received by users. Keep adopts nudge marketing to promote their long-term memberships, by reducing membership price as duration goes, and the lowest price for one month is ¥19. After opening the membership, users can enjoy customized courses and exclusive training plans. With advertising partnerships with famous brands such as Volvo, SKECHERS and Adidas, Keep can also generate a significant amount of profit.

Selling fitness equipment is Keep’s largest revenue generator. Aimed at the urban and family users, Keep has developed smart sports equipment. Its star product is the Keep treadmill, which is networked to Keep’s cloud and uploads data in real time. Around its user demographic, Keep developed many products, including smart body-fat scale, sports apparel, equipment, and supplies. Now Keep’s products have covered users’ four scenarios of eating, wearing, using and practicing.

Takeaways of Keep’s successful marketing strategy and its prospects

Keep’s functional matrix and marketing strategy are always evolving. From a simple sports app to a dominating fitness brand, Keep has undoubtedly undergone a revolutionary product upgrade. Its viral expansion gives the credit not only to perfectly catering to user’s needs, but also to its insightful marketing strategy.

Apart from self-marketing in its own app, Keep has taken advantages of social fission to draw private traffic. Keep’s strategic footprint extends far beyond the online fitness industry. Its self-developed smart fitness equipment has achieved the synchronization and sharing of data in the Keep cloud. On top of all this, Keep also constituted offline fitness gym Keepland to round out user’s fitness experience.

Learn the branding techniques to succeed in China

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast